Cross-border payments has seen surging interest in stablecoins over the past few months, but how have public companies responded? We review the earnings calls of key players from across the industry to find out.

Once a fringe technology for cross-border payments, stablecoins have seen a transformation in interest over the past few months.

As we discussed in our landmark report, The state of stablecoins in cross-border payments: The 2025 industry primer, Stripe’s acquisition of Bridge for $1.1bn was a critical moment for the industry in terms of taking the technology seriously. However, the July passing of the US’s GENIUS Act was arguably the most important moment for the space, providing a legitimising regulatory framework that served as a greenlight for the traditional finance industry to engage with the technology.

For many across the industry, the last few months have seen a host of new announcements around stablecoins, from partnerships to products and beyond, but how much of an impact has the world of stablecoins had on publicly traded companies serving the cross-border payments industry?

In this report, we look into the recent earnings calls of 25 companies from across the industry, from banks and payment service providers to B2B payments providers and money transfers operators. We look at how mentions of stablecoins in earnings calls have changed across different companies over the past quarters, as well as where key publicly traded players are in terms of market-ready stablecoin products.

Discussion of stablecoins in earnings calls: A jump for payments companies

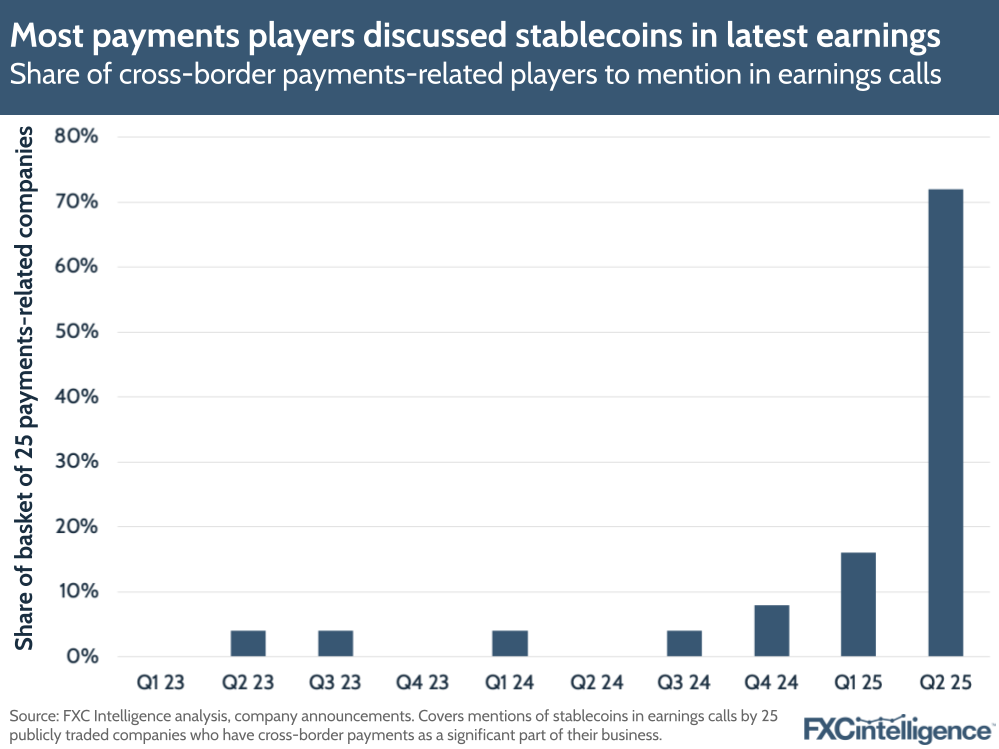

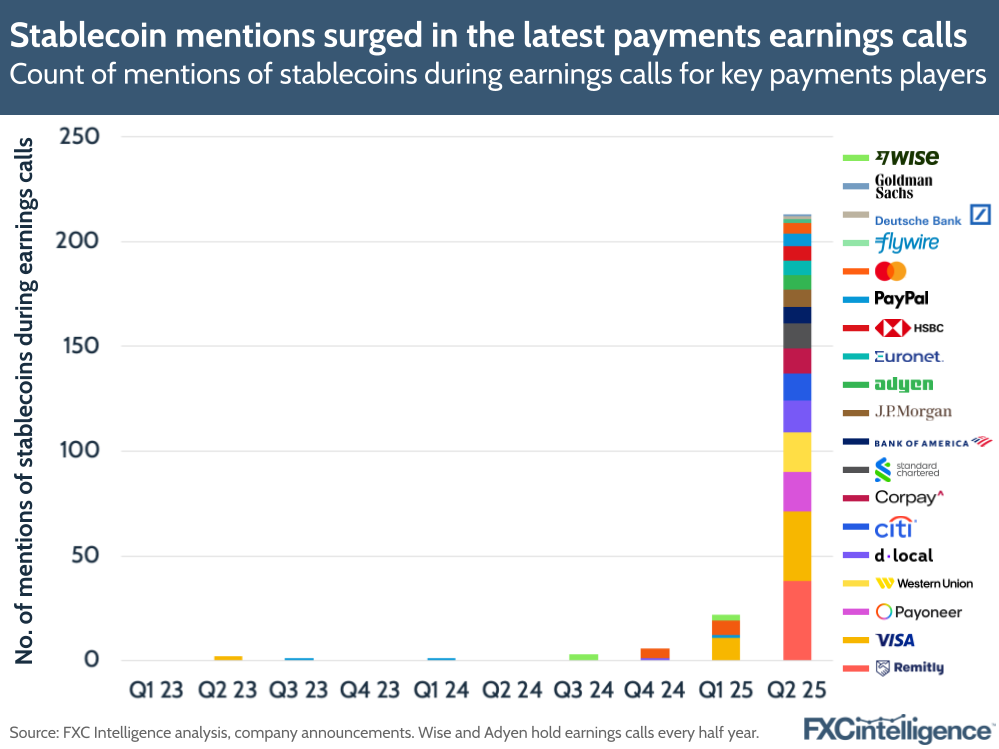

For this report, we reviewed the number of mentions of the word ‘stablecoin’ and its variants in every earnings call held by the 25 companies we reviewed between Q1 2023 and Q2 2025. In doing so, we gained a view not only of how common stablecoin discussion is at present, but how much this state of affairs has changed over the last few quarters.

We’ve previously taken this approach for a variety of topics in the past, including subjects of increased hype such as artificial intelligence, but never before have we seen such a marked jump in discussion of a topic in a single quarter.

In Q2 2025, 18 out of the 25 companies reviewed, or 72%, saw at least one mention of stablecoins during their earnings call, up from four, or 16%, in Q1 2025. Prior to this, most quarters in the preceding two-year period saw either just one or no companies discussing the technology.

Not only has this latest quarter seen an increase in the number of companies related to cross-border payments who are discussing stablecoins, but the rate of mentions has also markedly increased. Q2 2025 saw 213 mentions of stablecoins across the earnings calls of all 25 companies, up from just 22 in Q1 25.

This puts the average number of mentions per company who discussed the technology at 12 for Q2 versus 6 for Q1, while no prior quarter in the period covered saw an average above three mentions.

Who is discussing stablecoins the most?

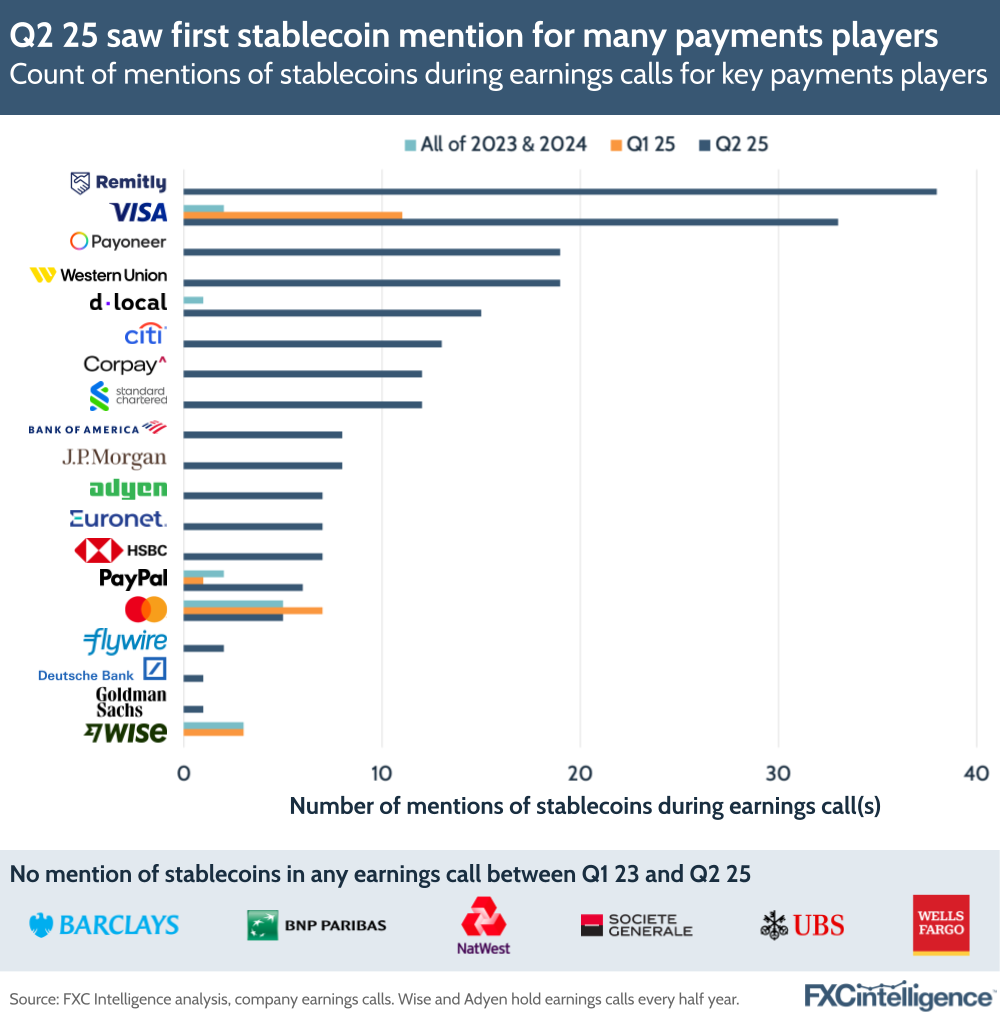

In Q2 2025, Remitly saw the highest number of stablecoin mentions among the companies reviewed, with 38 mentions across its earnings call. However, the company had not mentioned the technology in any previous earnings call across the period reviewed. This was common for many companies in the group, with 56% of the 25 companies having mentioned stablecoins for the first time in their Q2 earnings; when assessing only the companies that discussed stablecoins in the latest quarter, this share rises to 78%.

Visa saw the second-highest mentions in Q2, having had the highest number of mentions in Q1 and being one of only a handful of players to have mentioned stablecoins during their earnings calls before 2025.

Western Union and Payoneer had the next highest number of mentions in Q2, with both having not previously mentioned the technology, followed by dLocal, Citi, Corpay and Standard Chartered.

Meanwhile, although PayPal and Mastercard’s rate of mentions were lower in this latest quarter, they have mentioned the technology in more earnings calls across the two and a half-year period than any player in the group other than Visa.

While the vast majority of the companies in the latest quarter mentioned stablecoins without prompting, Wise was a notable exception, having seen mentions in its two most recent earnings calls, which are held half-yearly, only because it was asked about the technology by analysts.

Interestingly, among those in the 25 who saw no mention of the technology across the period, all were banks and the majority are based in Europe, where regulation exists but has not been as attention-grabbing as in the US. With the overwhelming majority of the current supply of stablecoins pegged to the US dollar, there has so far been more interest from the US banking industry than the European one, while the space as a whole remains more cautious about the technology than among non-bank players.

How much is discussion related to market-ready products?

Increased hype and interest in any technology often prompts a rise in discussion in earnings, but to what extent does this link to tangible products and features for the companies we reviewed?

While not every company was able to point to a live or soon-to-be live product or feature related to stablecoins, more than half of those discussing the technology were at an advanced stage in the process, with some building on well-established products, such as PayPal’s stablecoin PYUSD, while others highlighted products or features launched in the last few months.

Others pointed to features that already exist in their products, including Euronet, which previously added stablecoin support to its enterprise payment platform Ren and has already processed some limited blockchain-native transactions, while dLocal highlighted its ability to settle in stablecoin and its recent joining of Circle Payments Network to provide on and off-ramp services.

There were also those, namely Flywire, Circle and Remitly, who detailed newly announced stablecoin-based solutions that are set to roll out within the next few months. Meanwhile, Western Union went into detail about the areas where it was actively developing stablecoin solutions without going so far as announcing specific products. These include actively testing the use of on-chain settlement for its own in-house treasury, something that private rival MoneyGram is already doing, as well as exploring making its own rails available for on and off-ramping and enabling its customers to buy, sell and hold cryptocurrencies including stablecoins.

Payoneer, meanwhile, reported that it was exploring adding stablecoin send and receive capabilities to its wider AP/AR product suite, as well as using its last-mile infrastructure for on and off-ramping, although did not indicate that it was yet performing any active tests in this area.

Among the remaining banks who discussed the technology, namely Goldman Sachs and Bank of America, there was a sense that US players are waiting to see the exact form the regulatory framework from the GENIUS Act takes, which is expected to be clarified by the end of February 2026, before they commit to any particular product development.

Meanwhile, Adyen has said it was not currently considering a product in the space, but would if customers requested it. Wise CEO Kristo Kaarmann described the technology as “interesting to watch” but said that it was “hard to see the general use cases” for the technology in its most recent earnings call for FY 2025 (which took place in June), and the company has not specified any move to develop a product.

Having said this, Steve Naudé, Global Managing Director at Wise Platform, said in a recent interview with us that Wise remains “interested” in stablecoins, a fact also shown by the agenda for the company’s San Francisco conference next month, which will feature a conversation between Wise CTO Harsh Sinha and Zach Abrams, CEO and Co-Founder of Bridge.

Key stablecoin-related products from public payments companies

Where products and features related to stablecoins have been launched or are in development, there is significant variation, but there are also some relatively consistent trends in terms of the types of products that companies are producing in the space.

A number have focused on their own stablecoins, with PayPal joined by Standard Chartered and Deutsche Bank, both of whom are addressing the shortage of non USD-pegged stablecoins with one pegged to the Hong Kong dollar and another to the euro.

Beyond issuing stablecoins, many of the banks also pointed to blockchain-based tokenised deposit services as part of discussion of their stablecoin approach. While typically not fitting the GENIUS Act’s narrow definition of stablecoins, these solutions bring blockchain technology to transaction banking and in-house treasury by providing a tokenised version of a bank’s deposits. J.P. Morgan has been offering this in some form for several years via its Kinexys platform, although its recently announced J.P. Morgan Deposit Token has taken this further. Meanwhile, Citi and HSBC have also launched similar solutions.

While their core offering is a potential competitor to stablecoins for some applications, Visa and Mastercard have also both launched several solutions, including stablecoin infrastructure for other players as well as solutions to enable cards to be used to pay with stablecoins.

Finally, there are those who have largely added capabilities via partnerships with key players, with Corpay’s Circle partnership seeing the company add a host of solutions around USDC, including embedded wallets in customer accounts; 24/7 global FX using Circle’s stablecoins; and enabling its commercial cards to draw directly from USDC balances.

By contrast, Remitly is also adding digital wallets for customers who join its soon-to-be-launched membership programme Remitly One, allowing them to hold both stablecoins and fiat currencies, as well as allowing stablecoin pay-outs via a partnership with Bridge.

Stablecoin adoption among publicly traded companies: A promising start

With so much activity in the stablecoin space, we are likely to see far more movement from both public and private cross-border payments players in the future. However, the maturity of so many of the players’ plans at this early stage of interest is telling.

While technologies that attract considerable hype are often followed by a surge in earnings call discussion, this is often abstract in nature and can take some time to translate into meaningful products. By contrast, not only are the range of cross-border payments-related companies discussing stablecoins in earnings call broad in nature, but the general maturity of how they mention the technology is high.

While many are pointing to existing or recently launched or announced products or features, those that are still only referring to in-development solutions have a clear sense of where they see the technology’s potential, and a clear road to product development ahead.

How much stablecoins ultimately become a part of the wider cross-border payments space remains to be seen, but it’s clear that many in the industry are working hard to embrace the technology.