Citi has announced its Q2 2025 results, in which the bank saw overall revenue rise 8% to $21.7bn, while cross-border transaction value grew slightly faster at 9%. During the earnings call, CEO Jane Fraser highlighted Citi’s stablecoins strategy, which we’ve discussed in more detail below.

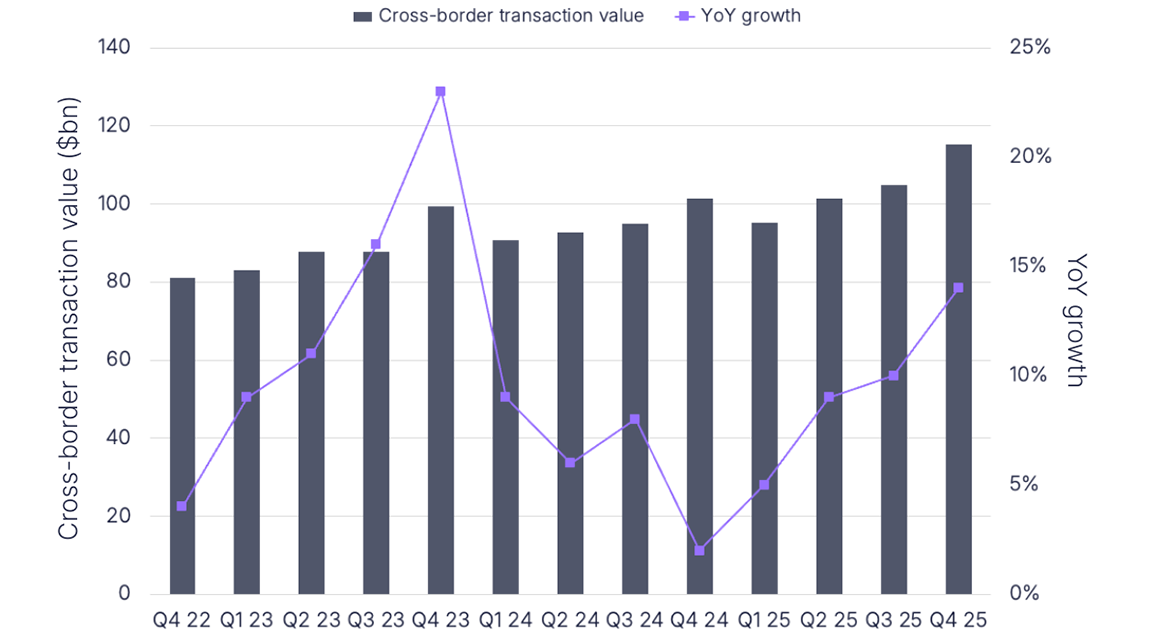

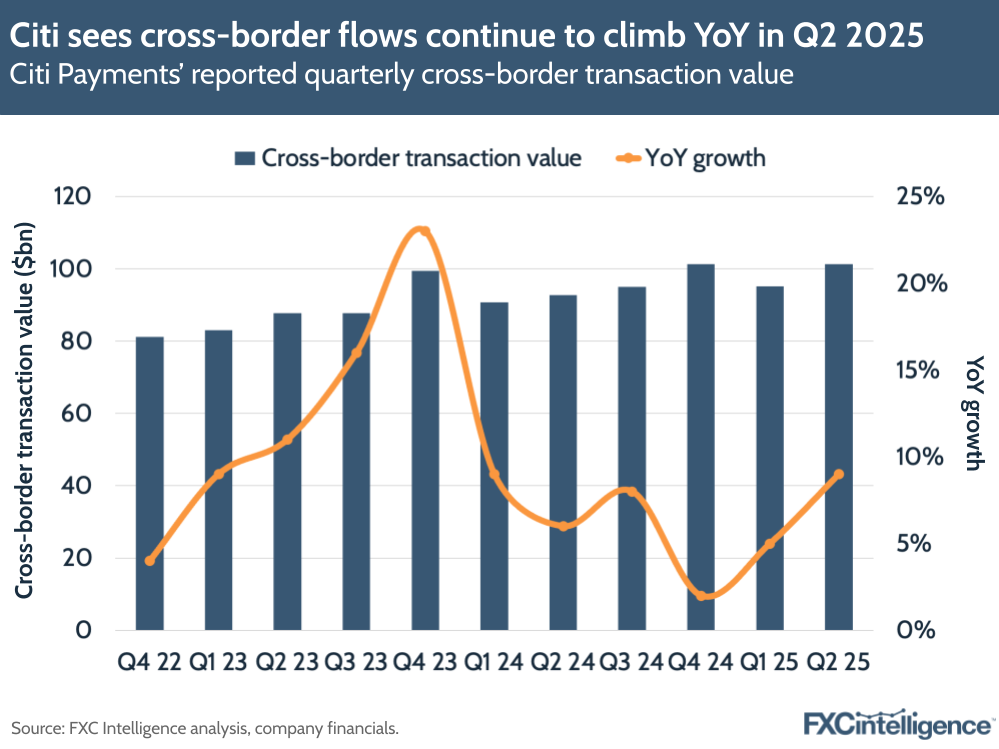

Cross-border transactions continue to be a key driver for Citi’s Payments segment, which is part of its Treasury and Trade Solutions (TTS) arm under the bank’s Services division. Though the company doesn’t report cross-border revenues directly, cross-border transaction values rose by 9% to $101.3bn, marking the bank’s second quarter surpassing $100bn in this metric and its fastest growth since Q1 2024. Fraser said that the bank had been proactively helping clients navigate “macro and geopolitical uncertainty”, which had driven strong growth this quarter.

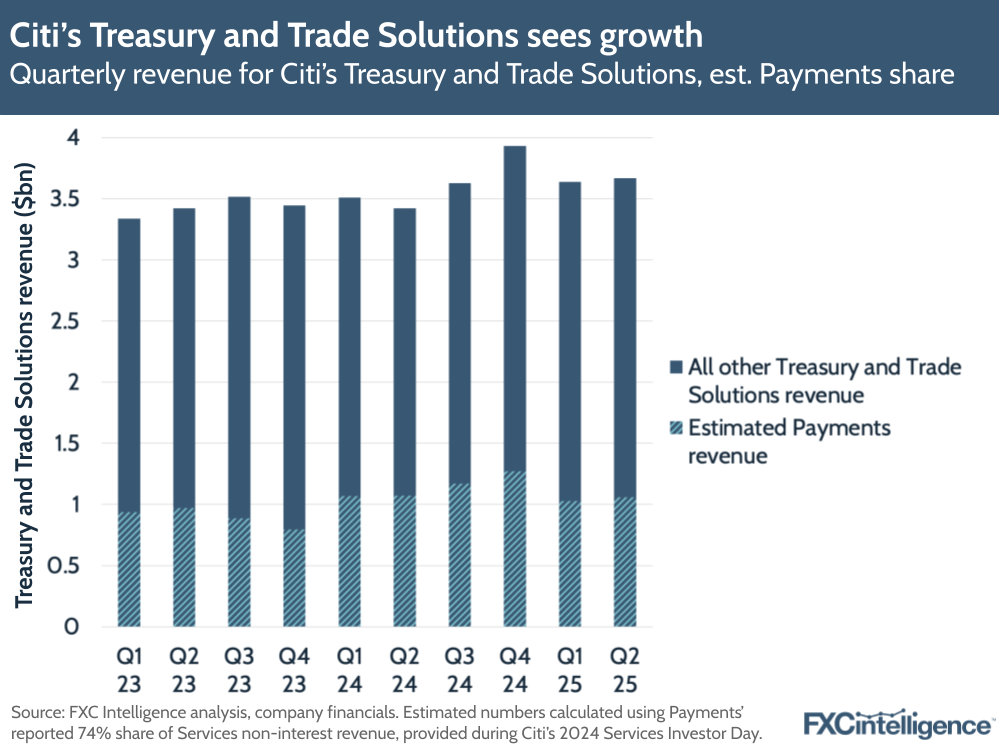

Citi’s Services revenues rose by 8% in Q2 2025 to $5.1bn, accounting for 23% of its overall revenue (the same as in Q2 2024). This was spurred by TTS revenue growing 7%, with a 12% increase in net interest income as average TTS deposits grew 5% to $713bn. Cross-border transaction value made up the equivalent of 14% of this total – slightly higher than Q2 2024.

However, TTS non-interest revenue – which accounts for the majority of Payments revenue – declined by -9%, compared to 14% growth in Q2 2024. The bank said the decline was the result of lending taking a higher revenue share, but was somewhat offset by a rise in cross-border transaction value, as well as an increase in US dollar clearing volume of 6%.

At last year’s Services Investor Day, Citi said that Payments had a 74% share of the bank’s non-interest Services revenue. If this share was still the same in Q2 2025, the company would have continued to see over $1bn from payments in Q2, though its share of TTS revenue would have dipped slightly from 30% in Q2 2024 to 29% in Q2 2025.

Stablecoins emerged as a key theme for cross-border payments in the earnings call. Fraser called out Citi Token Services, the bank’s in-house digital asset platform that is live in four markets and has already processed “billions of dollars” in transactions since its launch in 2023. She highlighted three other areas the bank is exploring – reserve management, on/off ramps and the potential issuance of a Citi-branded stablecoin – and mentioned recent moves in the US to regulate stablecoins could help give banks a “level playing field” in the space.

“Digital assets are the next evolution in the broader digitisation of payments, financing and liquidity,” Fraser said. “What our clients want is multi-asset, multi-bank, cross-border, always-on solutions provided in a safe and sound manner with as many of the complexities solved for them, and that’s what we do.”

“We are the global leader in enabling clients to move money cross-border and digital asset solutions complement our existing product suite. So, we’re well advanced in developing our digital asset capabilities.”