Last week, FXC revealed its Cross-Border Payments 100 for 2025. We’ve broken down some of the main data points about the companies included to give key insights about the industry.

The seventh edition of FXC Intelligence’s Cross-Border Payments 100 for 2025 once again highlighted some of the key movers and shakers in the cross-border payments space. If you missed it, we published a comprehensive report on our 2025 Cross-Border Payments 100, featuring complete information on each of the companies on our list.

As always, our list contains the 100 companies we see as being the most influential on the space, based on a number of criteria designed to identify the significance of cross-border to their business and how important they are globally. As a result, analysing the leading companies in the space gives a number of insights into what’s going on in the wider cross-border payments market.

First, here’s another look at FXC Intelligence’s Cross-Border Payments 100 for 2025:

This year, we have opted not to break out categories within our main map – reflecting that, as the industry matures, it’s becoming harder to contain this number of cross-border payments players within one space without doing them a disservice. That said, we have explored some of the payments offerings across the companies in more detail below.

In particular, this year’s map saw some new and returning entrants to highlight the impactful growth of stablecoins and web3 within the industry this year. USDC issuer Circle, decentralised payments network Stellar and cross-border liquidity provider Ripple all returned to the map. Meanwhile, blockchain infrastructure providers Paxos, Fireblocks and BVNK are all new additions, with the last of these previously appearing on our 2023 map of Most Promising Cross-Border Payments companies (our 2024 Global Most Promising map is here).

Other new additions reflect the increasingly global reach of the map, including China-based B2B payments provider XTransfer, Japanese financial services group SBI Holdings and Canada-based ecommerce provider Shopify and payment processor Nuvei. Consolidation has also played a role, with former participant and B2B provider Equals merging with Railsr to take a spot on the map.

Below we explore some of the key data behind companies on the Cross-Border Payments 100 list – where they were founded, how old they are and who is leading them – to highlight more trends across the sector.

Cross-border payments leaders originate from wide number of countries

Reflecting the previous year, companies on the Cross-Border Payments 100 are founded across a wide variety of countries globally, though a significant portion are founded in the US (37 companies) and UK (15 companies). On a continent-wide level, a significant portion of companies hail from countries across North America, APAC, Europe and Middle Eastern markets.

The prominence of companies from the US, Canada and Mexico on the list makes North America the most represented region, though while the US dominates there, we found significantly more variation in founding countries across other regions. In Europe, for example, companies on the list are founded in France, the UK, Spain, Germany, Ireland, Switzerland and Belgium, reflecting the diversity of big cross-border players across the continent.

Asia – home to various fintech hubs driving cross-border inclusion – contains the third-highest number of cross-border payments players from the list. Six companies hail from the Middle East and Africa, while Latin America is also represented through companies from Uruguay, Brazil and Argentina.

Leading cross-border payment companies begin to mature

As we’ve found through extensive research, global banks still account for vast amounts of cross-border flows worldwide, which is why they always take up around 20-25 spots on our Cross-Border Payments 100 map each year. Many of these banks have founding dates stretching back to the 19th and 20th centuries.

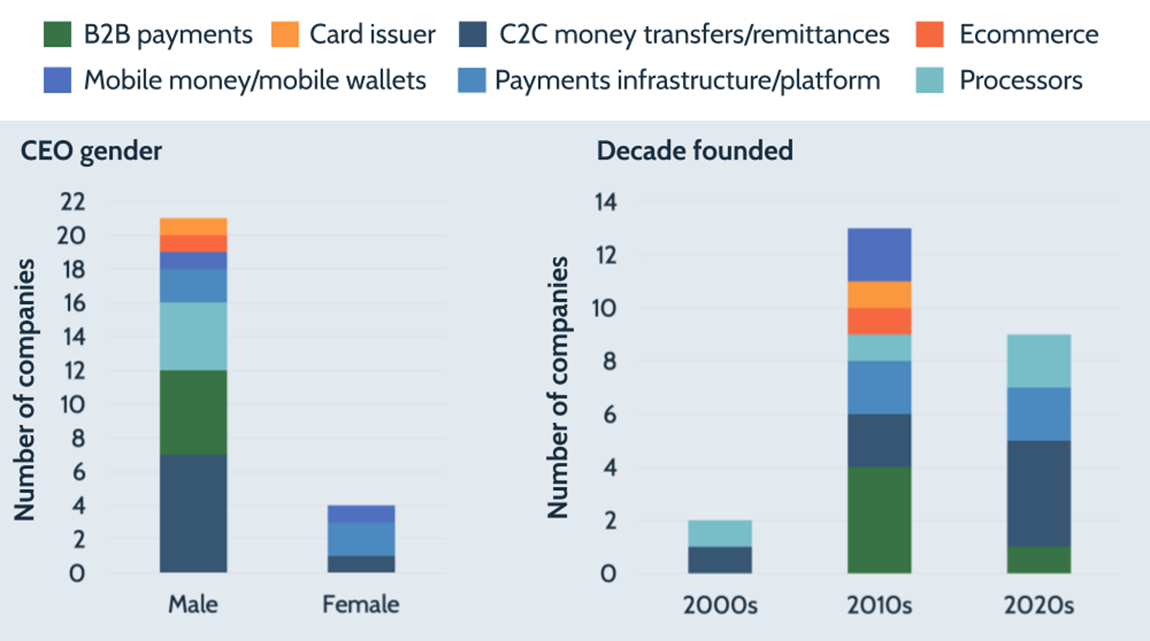

Having said this, a significant proportion of companies on the list were founded after the 2000s, with 31 founded in 2010 or later. This latter figure includes eight of the 11 new additions to the map this year.

This continues to demonstrate the scale and scope that newer businesses in this space have managed to achieve in a relatively short time period, boosted by a combination of factors such as venture capital funding, an accelerated shift to digital and companies undercutting established banks on feed and transfer speeds.

Having said this, some of the payments companies on our list are beginning to mature, having established a strong market presence, and are now increasingly focused on becoming more efficient and profitable.

CEO gender diversity remains low

The gender of CEOs (and CEO equivalents) on our top 100 list remains a challenge for the industry, with just five female CEOs on the list for this year – though this is one higher than last year’s list. Two out of the five female CEOs head up global banks.

As we found in a wider report on female representation across cross-border payments leadership last year, women accounted for just over a quarter of current senior leadership roles across 82 cross-border payments companies – a figure that is significantly better than for those holding CEO positions in the space, but below some other industry measures.

While there are some good performers in the space, there is still some way to go when it comes to boosting gender diversity at the top of the industry. Various initiatives are underway in this regard – see for example Money 20/20’s RiseUp program, which gives women tools and a network to help them on the path to senior leadership. There is also Women in Payments, which holds Symposiums for women (which FXC Intelligence attended and spoke at earlier this year).

The rise of B2B payments

The scale and nature of the businesses on the Cross-Border Payments 100 makes it difficult to assign each company on the list specifically to one category. Having said this, we have linked companies on the list to one or more of a number main business areas, spanning business-to-business payments; digital wallets; consumer-to-consumer payments; payments infrastructure and platforms; payments acceptance and platforms; stablecoins and web3; and ecommerce and marketplaces.

Companies on our list often offered multiple services (e.g. banks, which usually offered a mix of consumer and business payments). As part of our analysis we included them in more than one category, which is why the numbers across the categories on the graphic above total more than 100.

Across their entire suite of products (which could also include other services such as C2C payments, ecommerce and mobile wallets), 61 companies on the Cross-Border Payments 100 offered B2B payments, making this the most popular cross-border business area.

This was followed by consumer-to-consumer payments, which was offered by 48 companies on the list, payments infrastructure and platforms (30 companies) and banking with 26 companies. Not all companies on the list with a ‘banking’ offering were typical banks, though they did offer services to the extent that they could be included in this category (e.g. Revolut, American Express).

The prevalence of B2B payments amongst Top 100 companies speaks to the significant opportunity in this particular space compared to other areas such as C2C and cross-border ecommerce – as of 2024, the B2B cross-border payments market had a global size of $31.6tn, and is set to grow 58% to $50tn by 2032, according to our market sizing figures.

However, it also shows the variety of different company types moving to service this need, from banks to straight B2B players such as Convera, XTransfer and StoneX, to historically consumer-focused players that have increasingly grown towards servicing business payments (e.g. OFX, Wise, Revolut).

Equally, the fact that nearly a third of companies on the list are delivering payments infrastructure and platforms shows the impact of these services on the industry as well as the growth of B2B2X, with companies like Euronet and Wise now white-labelling their money transfer networks to sell to banks and fintechs.

Though they may deliver services in other areas, the majority of companies on our list that primarily focus on B2B payments were founded after 2010. This again tends to exclude most of the banks on our list, which by and large serve both consumer and business customers and account for large B2B flows. However, the rise of B2B payments-focused companies amongst leading cross-border players highlights the growing urgency to serve this market, which is still largely fragmented – particularly when it comes to serving emerging markets.

Stablecoins’ new and returning players

Stablecoins’ impact continue to be a buzzword in the cross-border space. Advocates argue for the potential speed and cost benefits of stablecoins across borders, while in emerging markets they continue to be used to hedge against volatility.

In addition to the aforementioned players added to the map this year, a number of other players on the list have evolved their own stablecoin and web3 capabilities for cross-border payments. PayPal launched its PYUSD stablecoin in 2023 and at its recent investor day expressed intention to build out its crypto payment capabilities, with one of the use cases being remittances. Stripe, meanwhile, closed its $1.1bn acquisition of blockchain platform Bridge in February, while in March SBI Holding’s crypto subsidiary SBI VS Trade signed a deal to launch Circle’s USDC in Japan.

Amongst new and returning stablecoin and web3 payments players included in our Cross-Border Payments 100 map, we see several consistent themes emerging. The majority of these companies launched in the 2010s, with organisations such as Circle and Ripple riding a wave of interest in payment rails beyond traditional banking following the launch of Bitcoin in 2009.

Most such companies were also founded in the US, which has seen various factors that have helped propel the rise of digital currencies, including a relatively open environment for development in earlier years; widespread access to venture capital, high internet and smartphone penetration; growing interest among institutional investors and financial services firms; and a move to online encouraged by the Covid-19 pandemic. Shifts in the crypto market – and particularly, the volatility of currencies – have promoted interest in digital currencies backed by fiat currencies (i.e. stablecoins) particularly when it comes to payments.

While some stablecoin and web3 companies have high employee numbers, others fall at the lower end of the scale relative to other companies across our Cross-Border Payments 100. Combined with the dates these companies are founded, this highlights the speed with which these companies have grown but also the significant variation in the types of companies that are engaging in the space, from established financial giants such as PayPal and SBI Holdings, to new players such as BVNK, which itself saw investment from Visa earlier this month.

The globally diverse nature of digital wallets

Another area where we continue to see significant variation on our mapping is in consumer digital wallets, which have come to span a wide number of meanings and services. While some enable storage of payment cards and other features, others promote easier international transfers and spending abroad.

Globally, businesses on our Cross-Border Payments 100 that offer digital wallets come from a variety of countries worldwide. Companies across the map as a whole originated from 26 countries, but looking just at the 13 companies offering digital wallets as a main business area, these came from 8 countries, highlighting the geographical diversity of this area.

Then there are the companies themselves, which span a wider variety of segments – ranging from telecom operators to fintech startups to tech giants. For example, Airtel Money, M-Pesa, MTN Mobile Money and Orange Money are rooted in telecommunications, with wallets aiming to drive financial inclusion in parts of Africa and Asia through services like P2P transfers, bill payments and merchant payments.

Meanwhile, through Alipay and WeChat, Ant Group and Tencent have effectively built digital wallets that go beyond payments to form ‘superapps’ that form part of Asian consumers’ daily lives, whether that’s through shopping, communicating via online chat, booking services or making investments. In their own ways, Revolut and PayPal are building towards creating Western versions of superapps.

Meanwhile, companies like Western Union, Wise and IDT, through its remittances service BOSS Revolution Money, are focused on using wallets to enable remittances and cross-border spending.

The crux is that digital wallets have come to make up an important part of the strategy for wildly different businesses across the cross-border payments space, highlighting their importance for the industry globally – but they also serve as one of the biggest reflections of how the consumer payments market (and indeed consumer payments behaviour) differs around the world.

Cross-Border Payments 100 points to an industry in flux

Across the Cross-Border Payments 100, we see a number of continued themes from years gone by – the prominence of the US across many founding areas, poor gender diversity at the top and the rise of B2B payments as key offerings. However, these companies are also very diverse and are aiming to achieve very different things, which points not only to the scale of the opportunity in the space but the extent to which its largest players are meeting that need.

Though many of the core players have not changed in 2025, there have been a number of important shifts, pointing to an industry that is still in flux. With a wave of consolidation, new partnerships and global developments already so far in 2025, we could see even more interesting changes in years to come.