The US’s stablecoin-focused GENIUS Act passed in the Senate last week, taking a key step towards law. But what does this mean for the cross-border payments industry?

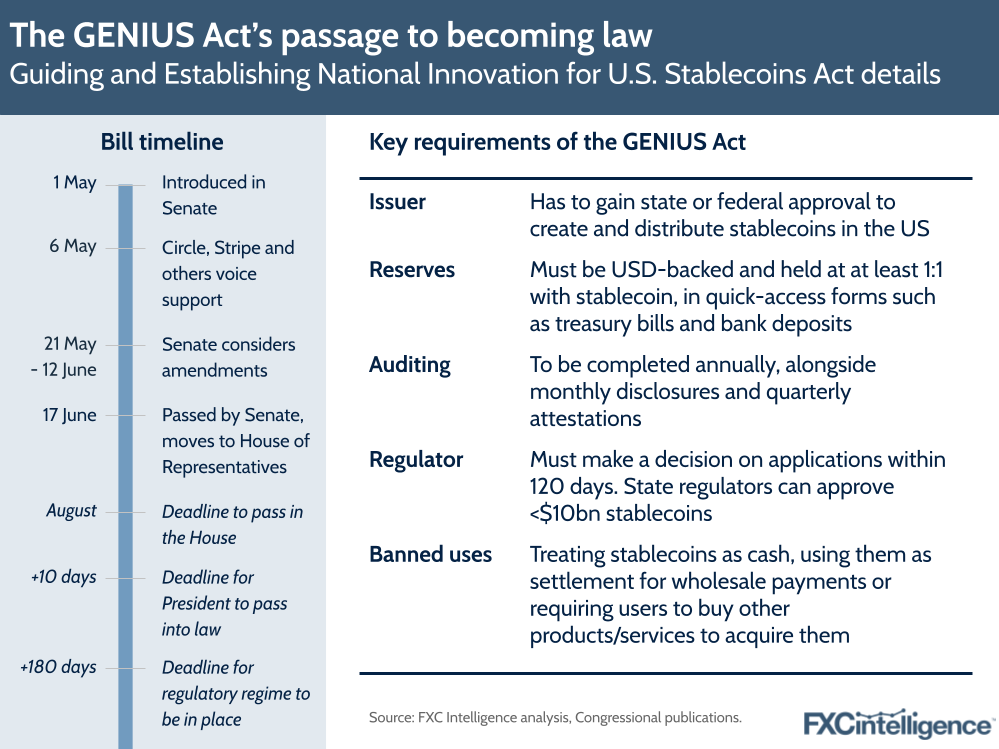

Also known as the “Guiding and Establishing National Innovation for U.S. Stablecoins Act”, the GENIUS Act provides a regulatory framework that many in the stablecoin industry have long been lobbying for. Including rules around how a stablecoin can be backed, what it can be used for and who can issue stablecoins, it provides legal certainty around the use of US dollar-pegged digital currencies that many in the traditional US financial sector have been waiting for.

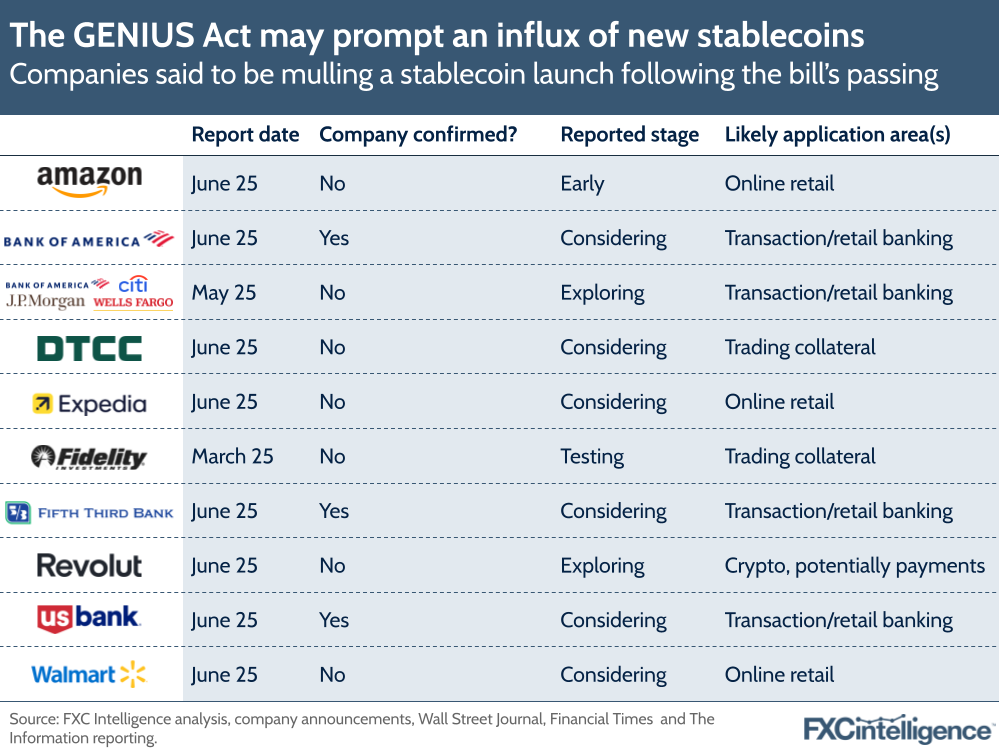

Enabling both banks and appropriately licensed non-banks to issue their own stablecoins, the bill has prompted a wide variety of reports around different companies developing or at least seriously considering their own. In many cases, this has come from the companies themselves, with leadership from the Bank of America, Fifth Third Bank and US Bank all stating that they were looking into issuing their own stablecoins.

There have also been a number of reports from respected news titles concerning organisations across finance, technology and beyond, citing multiple unnamed sources from within the companies in question. These include Amazon and Walmart, who are thought to be exploring their own customer stablecoin as both an evolution of loyalty programmes and to avoid interchange fees, although they may also see revenue benefits from interest yield.

The bill still needs to pass in the House if it is to become law but, given its relatively bipartisan support in the Senate and growing pressure on House Republicans, many expect it to pass before the August recess. If it does, it will be in effect within a year and is likely to see a significant proliferation of different stablecoins within the US across a variety of use cases.

We have been speaking to many leaders in the sector ahead of an upcoming in-depth report on stablecoins, and the majority see the act as being a significant positive development. Those we have spoken to have largely characterised it as beneficial for the industry, with the potential not only to aid the proliferation of stablecoins but also create an increased domestic market for US treasuries, while also extending US dollar dominance.

Others expect growing numbers of different stablecoins to create interoperability opportunities for the industry – something that is potentially aided by the fact that the bill requires federal stablecoin regulators to evaluate the need for interoperability standards for issuers.

However, there were also some concerns around the fact that the bill does not stop the families of government members from issuing their own stablecoins, while some saw the strict reserve requirements removing some utility normally available to bank deposits, which may have contributed to J.P. Morgan’s decision to develop its recently announced JPMC token as a deposit token and not a stablecoin. Restrictions around sharing yield from treasury interest are also a concern for some companies’ operating models.

We’ll have more on the GENIUS Act and the wider stablecoin industry in our upcoming report, set for release next month, but in the meantime you can read some initial thoughts on the bill’s passage through the Senate in our CEO Daniel’s latest Forbes column.