Payment providers are launching agentic payments offerings, but how could this benefit merchants and businesses specifically across borders?

Hype has turned into action for agentic commerce – the concept of AI-powered ‘agents’ working for humans to enable them to search for, compare and pay for goods and services online.

Companies within the cross-border payments space such as Visa, Mastercard and PayPal have all introduced payments solutions focused on allowing merchants to support agentic payments and major merchant marketplaces including Walmart, Amazon and Ebay have also made announcements about their activity in the agentic AI space.

This week, DBS became the first bank in Asia-Pacific to pilot Visa’s Intelligent Commerce solution to enable agentic commerce use cases for Singaporean consumers, while last week, Google announced that it was rolling out its new agentic AI tools to enable people to buy items from Etsy and Wayfair through Google’s Gemini chatbot.

The key concept driving agentic commerce has been reducing the friction involved with consumers searching for products and services they need, comparing them across different platforms and making payments. This has particular implications for cross-border transactions, the providers of which could see increased throughput if consumers find agentic channels offer them quicker and easier paths to purchase.

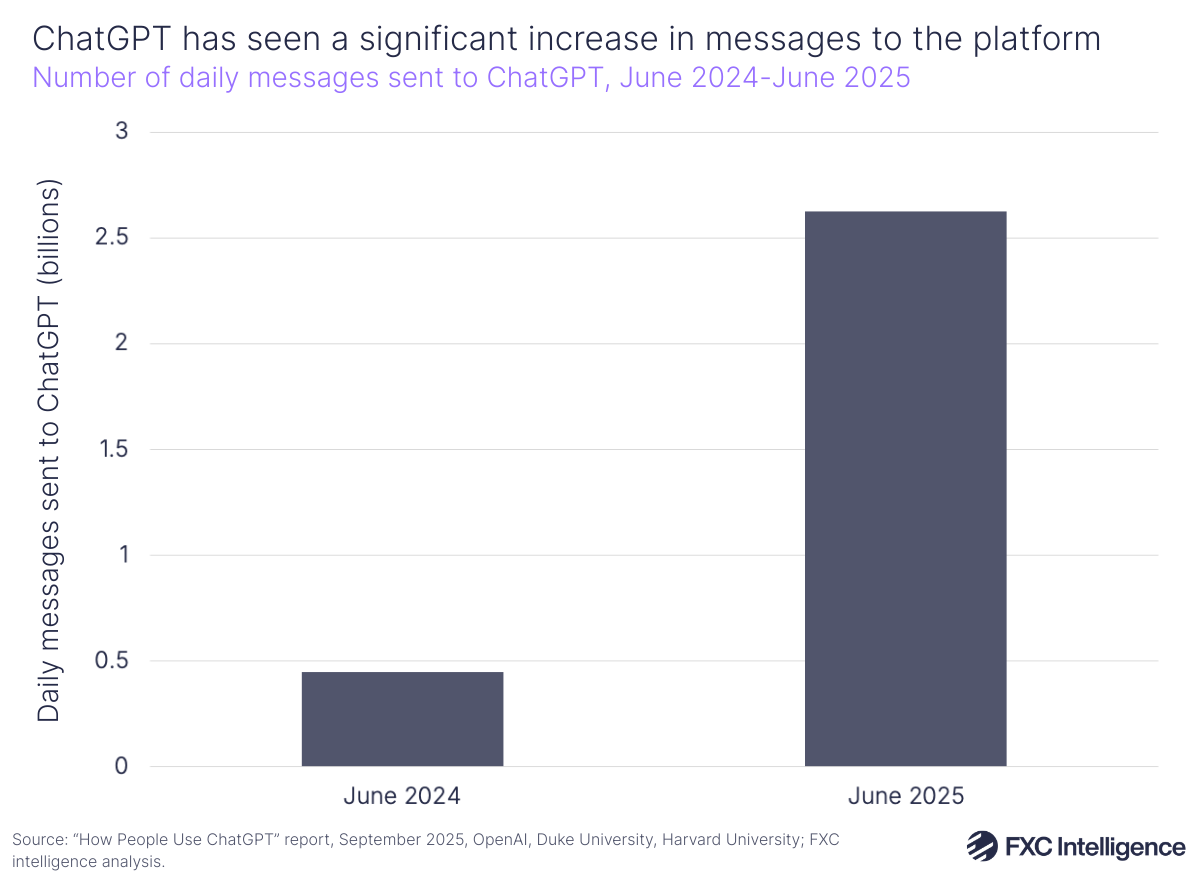

Various reports and studies by cross-border payment providers have highlighted that consumers are showing more interest in AI-led shopping, though building trust with AI platforms remains a barrier. What is clear is that enquiries to generative AI chatbots have grown exponentially: ChatGPT, for example, processed 2.6 billion prompts daily as of mid-2025, up from 451 million in June 2024, according to a study last year.

How agentic commerce changes the flow of online purchases

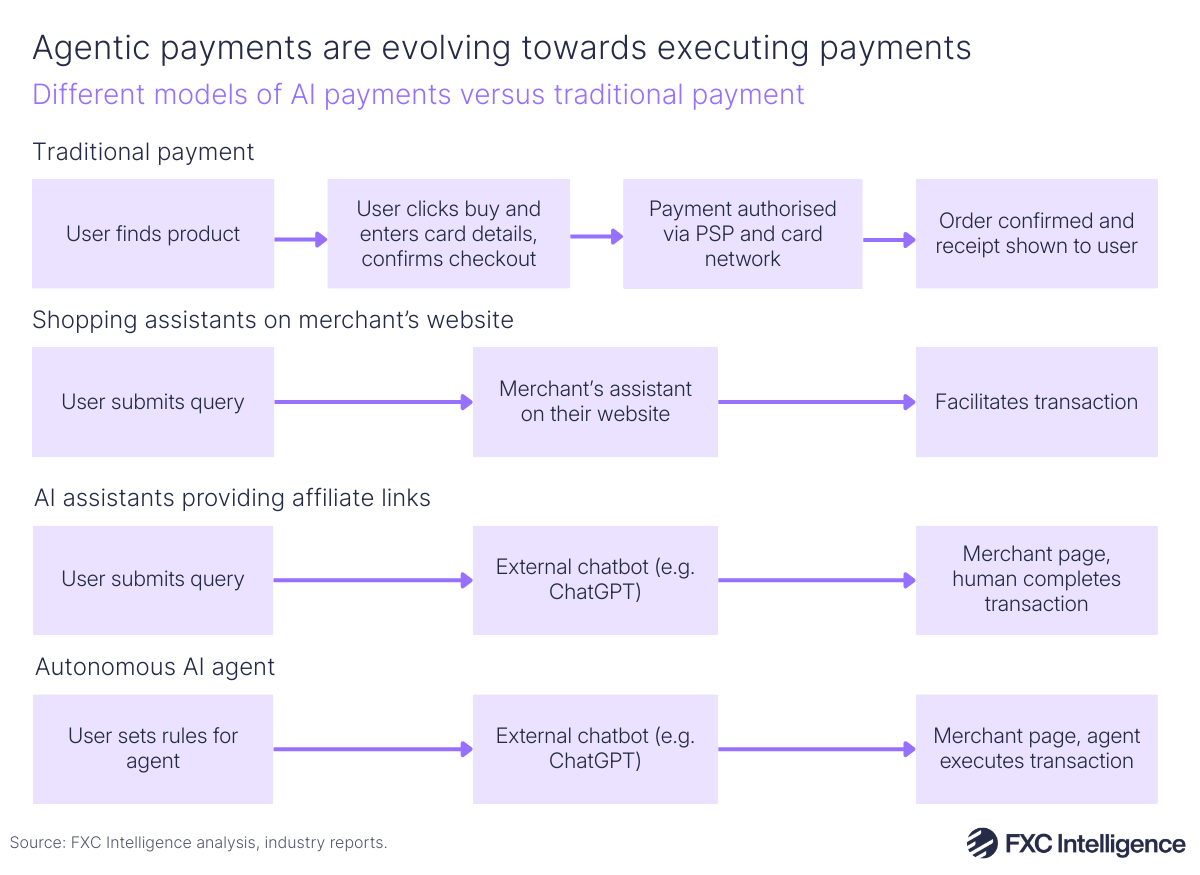

Agentic commerce refers to the process of AI-driven agents, rather than humans, discovering products online, comparing them and potentially initiating transactions within parameters set out by humans.

This has particular implications for online merchants and marketplaces, as well as travel providers, subscriptions and digital services. From the business perspective, agentic commerce could also offer benefits for B2B procurement, with the potential for agents to connect businesses with suppliers to speed up one-time and repeated transactions.

Agentic commerce is still very much an evolving concept, and as part of this there are different models for how AI is used in the buying journey that have developed for over time. Earlier ‘conversational’ AI concepts within ecommerce centred on shopping assistants within a specific system – for example, Amazon’s Alexa – that guide users through discovery and purchasing on that system, and are now being further enhanced by generative AI. Separate from this, users have already been searching using AI chatbots to find different products and services, with responses providing affiliate links through to merchant websites where the user can complete the purchase.

In some cases, agentic AI systems largely appear to be keeping humans in the loop with payments. For example, ChatGPT’s Instant Checkout feature, powered by Stripe, allows users to buy directly from US sellers but still prompts them to tap “Buy” to confirm their order.

However, payment providers are increasingly moving towards a space in which AI agents could themselves execute transactions based on predefined limits set by the user. In this case agents effectively become a new customer type, with users setting specifications for what they want to buy and spending limits, and the agent then going on to discover the right item for them based on those specifications.

The concept is essentially moving the buying journey from the user to an AI agent, and the payments part of this comes with additional complexities. Payment systems have been designed specifically with human users in mind, so creating a system in which agents are acting on behalf of users creates new problems to solve around verifying agents, ensuring that transactions are not happening fraudulently and also that user’s payment details are protected.

Mastercard’s Agent Pay, for example, is a payments infrastructure offering that enables secure agentic payments, built in partnership with Microsoft and IBM as well as acquirers and checkout companies such as Braintree and Checkout.com. It uses a tokenisation system called Agentic Tokens, which would enable autonomous agents to transact with tokenised payment credentials so that agents aren’t sharing sensitive customer data. In addition, the agentic tokens can be used to trace and authenticate transactions made by AI agents, each of which is registered and verified by Mastercard through its Agent Pay Acceptance Framework.

Connected to this, there has been a recognised need in the industry to ensure that agents buying on behalf of users are authorised to do so, that the purchases they are making accurately reflect what users are asking them to do and that there is accountability if incorrect or fraudulent transactions are made.

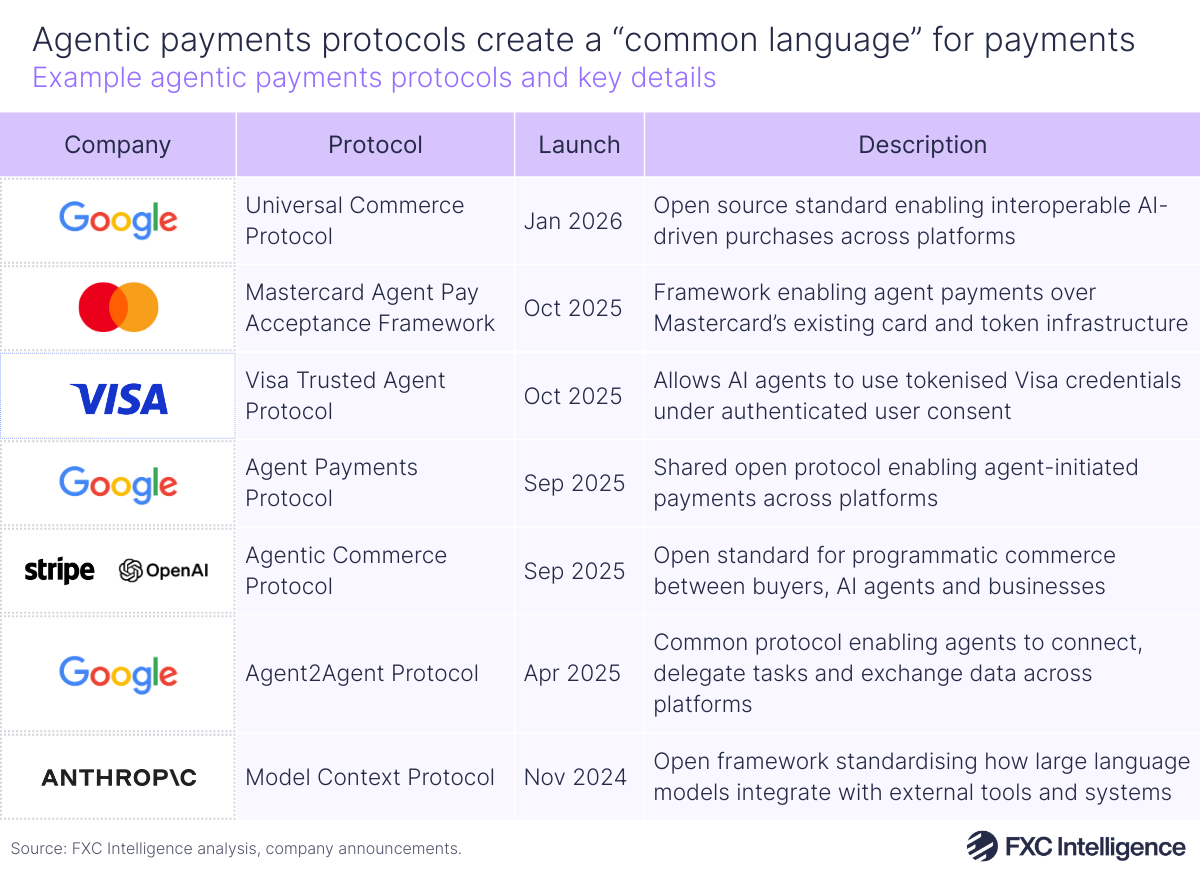

In response, various companies have been introducing protocols to give payment providers a framework for how to create agentic solutions. The protocols are essentially standardised sets of rules that enable AI agents to interact, share context and coordinate with each other and external systems.

For example, in September 2025, Google launched Agent Payments Protocol (AP2), an open protocol it developed with global payments providers to allow AI agents to initiate transactions across different platforms. The protocol uses a system called Mandates, which are essentially digital contracts that serve as proof that transactions are authorised and reliable and capture the users’ intent.

Google has since followed this with the introduction of Universal Commerce Protocol (UCP), its new open standard that covers agentic commerce more widely. This essentially allows AI agents to operate with the different systems put in place by merchants and payment providers through a single “common language”. This means that each AI agent does not have to have a separate system in place to enable an ecommerce transaction through a particular merchant.

How does an agentic cross-border payment work?

With both domestic and cross-border payments, paying with AI agents is not currently set to alter the specific payment rails that enable money movement on the backend of payments. Payments providers are however creating infrastructure to mask user’s credentials, ensure AI agents can be authenticated and work with merchants to ensure backend infrastructure can handle AI-generated transactions at scale.

AI agents would initiate transactions through existing payments and settlement infrastructure, with agentic AI being the orchestration layer that enables the payment – in other words, the AI agent acts as the buyer, but the underlying payment rails supporting the cross-border payment stays the same.

This has also been indicated by the introduction of standards such as Google’s AP2, which supports a number of different payment types, including cards and transfers as well as stablecoins, to prevent creating a “fragmented ecosystem” across payments. Because the agent is effectively replacing the user within the existing payment flow, agent identity and authorisation are critical, as interfaces need to know that agents are verified and working on behalf of the user with their explicit consent.

The interface for making payments is also not set to change. For example, AI agents could access and make a payment through an international merchant’s checkout user interface, or push a USDC stablecoin payment by accessing the owner’s wallet and submitting a transfer. The key change is that the purchase is being done programmatically by a third-party agent, rather than a human being, which is why a significant portion of the work around agentic payments has been ensuring websites can recognise AI agents as authentic, authorised agents acting on behalf of a buyer.

Agentic payments is still in its nascent stages, but some companies have already alluded to its cross-border potential. For example, in its description of Agent Pay, Mastercard gives an example of how a small textile enterprise would be able to use their AI agents to enable sourcing, optimise payment terms and manage logistics with an international supplier, with an AI agent being able to complete a cross-border purchase using a Mastercard virtual corporate card token.

Currently, the focus on the industry appears to be on how the payment is initiated and decided upon. Rather than the consumer manually entering payment details, an agent operates within predefined limits, querying the available balances and the funding sources it is permitted to use before triggering the transaction. Once the payment has been initiated, the existing payment providers for the merchant would perform FX conversion and settlement.

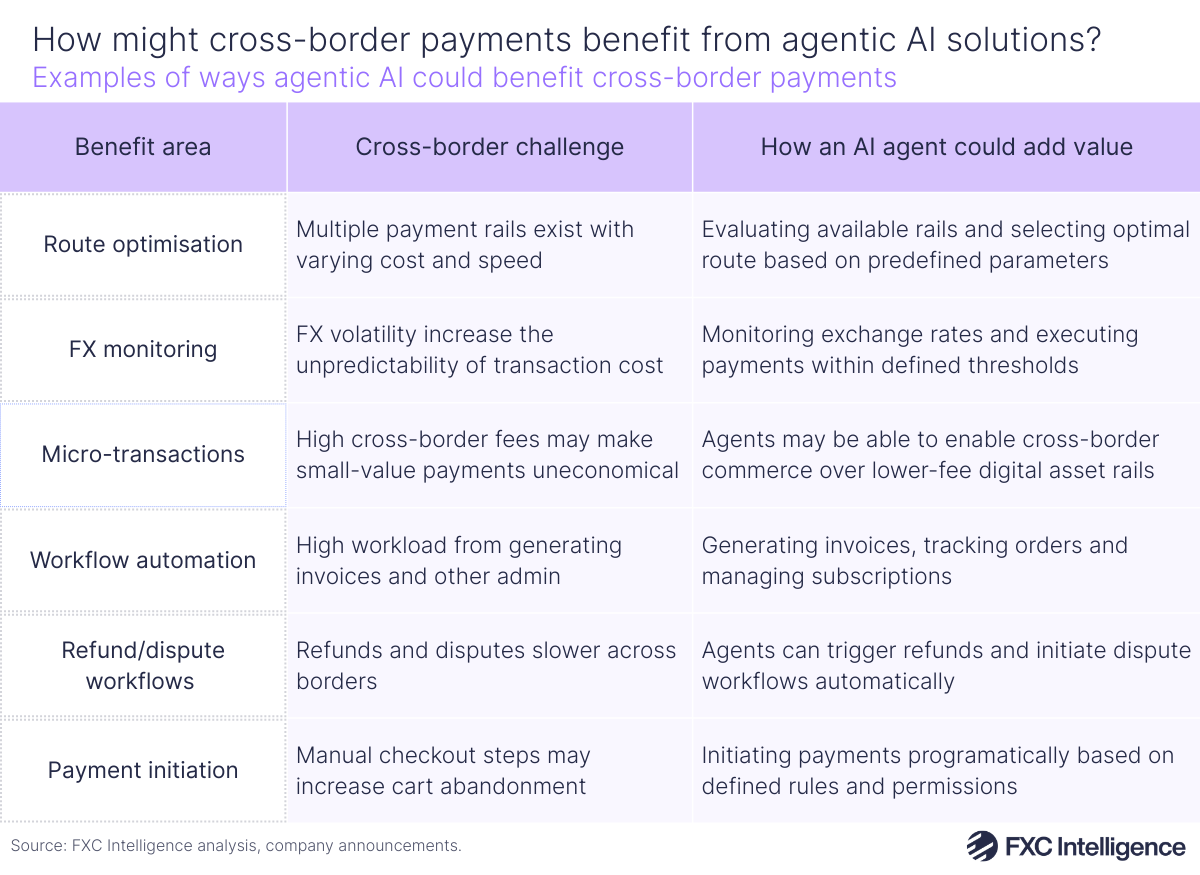

This is not to say that agentic AI could not also be used to enhance the processing side – for example, PayPal has said that its AI assistants can generate invoices, confirm payments and process refunds when conditions are met and handle payment disputes, all using PayPal’s existing APIs. At the payments infrastructure level, agentic AI could also assist with dynamic payment routing, with AI agents able to analyse transactions and dynamically select the most efficient path for a payment considering various factors, such as transaction costs and processing speeds.

Several commentators have linked the potential of agentic payments to open banking, which enables account-to-account payments using secure APIs. Agentic payments could add an additional layer on top of this, enabling an agent to make payments directly between bank accounts. Truelayer, for example, has launched an experimental project that enables an AI assistant, such as Claude AI, to perform various banking and payment operations through its APIs.

Some providers also suggested stablecoins have a role to play in agentic payments, citing their potential to reduce fees and friction, particularly for smaller payments. Last week saw Coinbase announce the launch of Agentic Wallets, an agentic payments infrastructure that allows AI agents to hold and store digital currencies in a wallet, and then allow human users to program those wallets with specific limits to control how much they can spend. One of the core use cases for this is in agentic commerce, as it is designed to enable agents to send payments to other agents or users.

What are payments providers doing in the agentic commerce space?

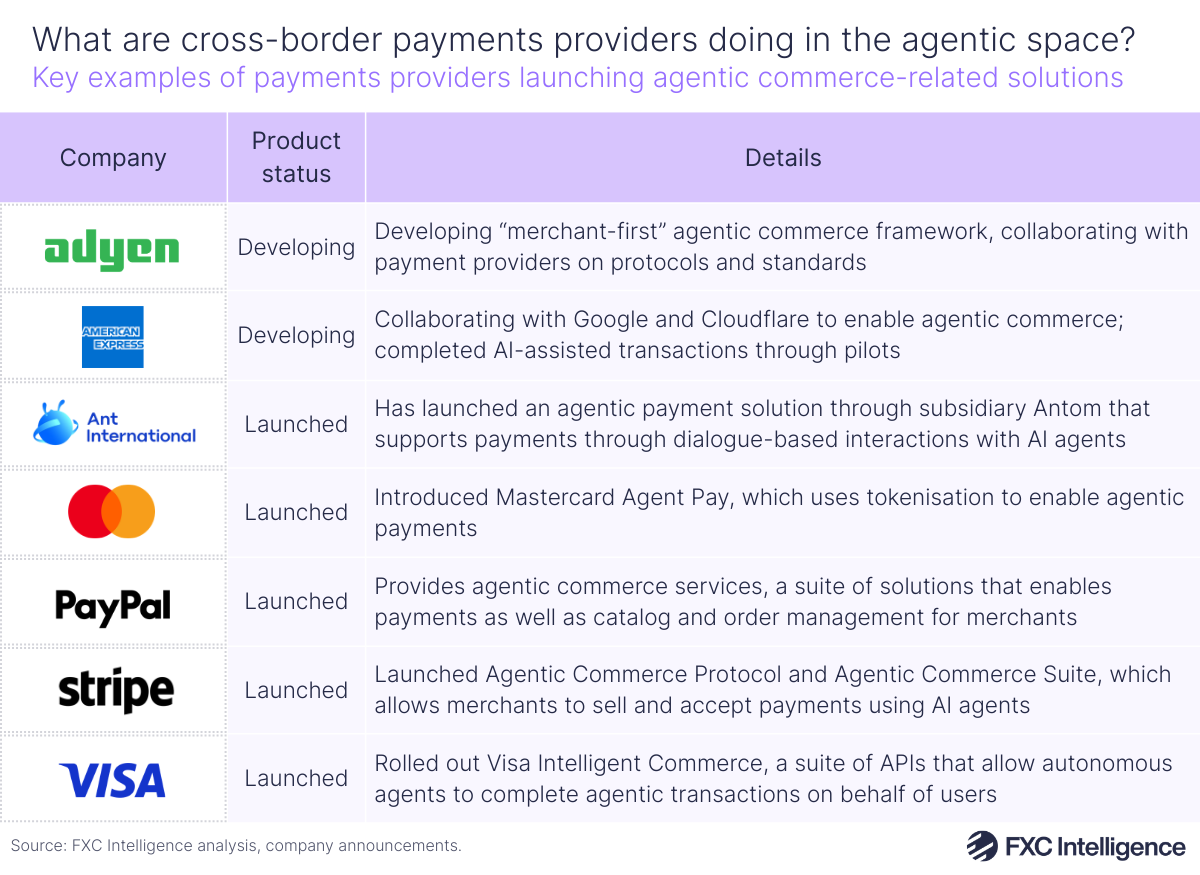

Payments providers of various stripes have been introducing products to support agentic commerce. Visa, Mastercard and PayPal for example have all built payment infrastructure solutions to enable merchants to support transactions made by buyers through AI agents.

Meanwhile, Stripe has introduced Agentic Commerce Suite, which allows merchants to sell via agents more easily by making their product catalogue discoverable, simplifying their checkout and then allowing them to accept agentic payments.

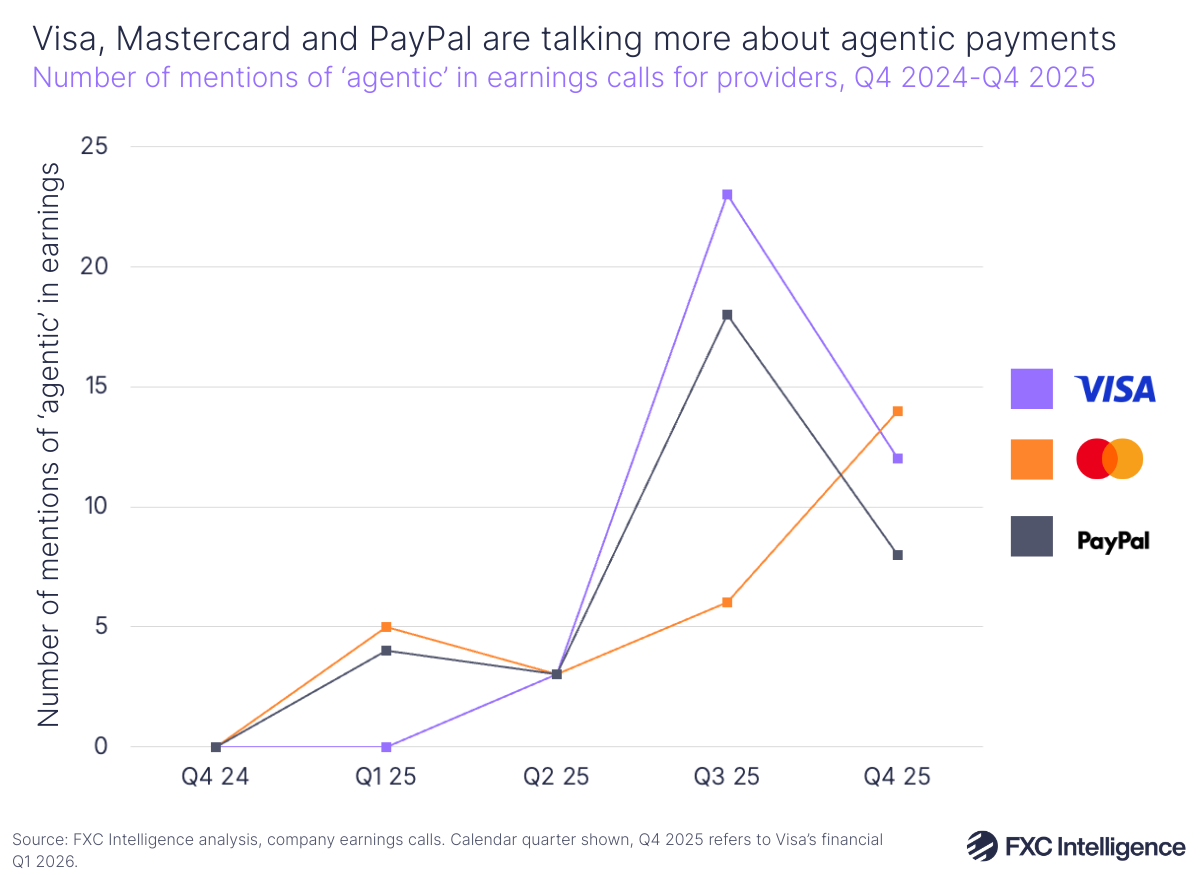

Visa, Mastercard and PayPal have also been speaking more about agentic commerce in their earnings calls as they ramp up their activity in the space.

In its recent Q1 2026 (calendar Q4 2025) earnings call, Visa said that it was already working to enable agentic commerce with more than 100 partners, with the company’s agentic solutions already live in the US and CEMEA (Central and Eastern Europe, the Middle East and Africa) and pilots ongoing in APAC and Europe, with the LAC region soon to follow. Mastercard has enabled Agent Pay with US issuers, and has said it is working to enable its global issuer base by the end of Q1 2026.

PayPal, meanwhile, has onboarded clients through its store sync offering, which helps merchants to make their products easier to discover across AI channels such as Perplexity and Microsoft Copilot. However, it added during its Q4 2025 earnings call that agentic “won’t materially impact 2026 growth”. There was a similar sentiment from Adyen, which said in its Q4 2025 earnings that it was continuing to collaborate with Open AI, Google, Mastercard and Visa on relevant agentic commerce protocols, but is positioning it as a long-term opportunity that will not play a big part in 2026 revenues.

However, other companies have reported that they are already seeing significant transactions through AI agents. Last week, for example, Alipay reported that its AI Pay solution exceeded 120 million transactions in the previous week.

Generally, major companies are still at the earlier stages of introducing these payment solutions and don’t yet have data to share on how it will impact their revenue. However, the global reach of Visa, Mastercard and PayPal across merchants and consumers globally – as well as other collaborators on Google’s AP2 protocol such as Adyen, dLocal and Payoneer – signals the potential for global merchant acceptance of cross-border agentic transactions.

Beyond these major players, a number of companies are emerging to specifically support transactions made through AI agents. This includes Inflow, a payments infrastructure provider enabling merchants to accept agentic payments, and Skyfire, which provides Know Your Agent (KYA) capabilities, thereby enabling transactions.

Meanwhile, ecommerce platform Swap, founded in 2022, has developed a platform specifically focused on enabling AI storefronts for merchants. The company’s website says that its platform allows storefronts to learn from customer transactions, building intelligence that can help inform agents and helps them with discovering products.

What is the cross-border opportunity for agentic payments?

The growing throughput and transactions that stem from consumers buying through agents could be significant for cross-border transactions, where buyers can face additional friction in where and how they make payments.

A key aspect of agentic payments has been in reducing friction in buying decisions, and by doing this enabling merchants to benefit from higher numbers of transactions. Amazon, for example, said in its Q4 25 earnings call that customers were about 60% more likely to complete a purchase through its generative and agentic AI-powered assistant Rufus than customers who do not use the assistant.

In traditional ecommerce, a human buyer might be deterred by following through on purchases due to complexity around international shipping fees, taxes or the need to convert to other currencies. However, with AI agents there is the potential for the agent to handle some of those difficult steps in the process – for example, navigating merchant sites in a different language, calculating the total cost of payments (e.g. including FX) and authorising the transaction. Taking out the additional steps from this process could help encourage more people to initiate transactions for products in other countries, in turn raising the volume that passes through payments providers.

One aspect mentioned by several payments companies in the space has been the potential to add greater personalisation to the buying process for customers, further encouraging them to commit to purchases. American Express, which has piloted AI-transactions with leading platform partners worldwide, has touted the benefits of the company’s “global closed-loop network that connects millions of buyers and sellers directly”, providing the company with valuable insights that can help it deliver more personalised experiences for customers.

Companies have espoused the potential of AI agents when it comes to monitoring not just exchange rates, but also the best possible payment rail method defined with the agent’s parameters for a specific situation. For example, in its report on the rise of agentic commerce, Visa highlighted that it sees use cases in AI agents being able to autonomously perform currency conversion and execute international payments at the best exchange rate. This is particularly significant on the supplier side of agentic commerce, where businesses managing cross-border transactions can optimise how they settle invoices and time payments using predefined conditions for agents.

It has also been suggested that agentic AI could assist in automating payments reconciliation, a burdensome manual task that involves having to match incoming and outgoing payments, with humans needing to verify invoices. AI agents could essentially help to remove a lot of this work by automatically matching, interpreting and resolving any cross-border payment discrepancies across systems, without requiring manual intervention.

Moves from Visa and Mastercard have already highlighted that key players in the cross-border payments space are positioning themselves for a future in which more merchants are accepting AI payments. The goal is to capture more of the transactions that are flowing through the companies’ networks by introducing solutions that aid the development of agentic AI solutions for payments and merchants accepting those payments.

For example, in October 2025, Mastercard partnered with PayPal to integrate Agent Pay into PayPal’s wallet. This partnership is expected to allow “hundreds of millions of customers” to transact with PayPal’s merchant base globally through agentic payments. As these transactions pass through Mastercard and its co-branded card offerings, it increases transaction volumes it can obtain through these cards.

Separately, B2B payments provider Convera has noted that agentic AI could have numerous benefits for accounts payable and receivable teams. This includes helping with sanctions and fraud screening, as agentic AI can automatically analyse patterns and flag unexpected payments and deviations, such as a company randomly receiving funds in an unusual currency.

Do consumers want to use agentic commerce?

Data from various sources appears to show that while AI is being used by some consumers in buying decisions, it is likely a large share of consumers are still reaching the stage of purchasing through Google and other search engines.

The world’s population is increasingly using chatbots powered by generative AI as a starting point for search. Although it is far from the only example, ChatGPT is one of the biggest generative AI platforms, having grown to 700 million users as of July 2025, according to a September 2025 report from OpenAI, Harvard and Duke University.

According to this research, ChatGPT processed 2.6 billion prompts per day in June 2025. By comparison, Google reported 5 trillion searches annually in March 2025, around 13.7 billion per day, which puts ChatGPT at roughly 19% of Google’s daily search volume.

In terms of what users actually ask for, the study found that 51.6% of ChatGPT usage across prompts from late June 2025 was from ‘Asking’ intent – i.e. users seeking information or clarification to inform a decision – compared to 34.6% for ‘Doing’ (i.e. requesting an output) and 13.8% for ‘Expressing’ (neither asking for information or for the chatbot to perform a task).

This gives a sense of how large language models such as ChatGPT are fulfilling users’ information gathering needs that would previously be served by search engines. However, the extent to which users would actually use agents to make purchases is a different question, on which studies have delivered varying results.

In December, Morgan Stanley claimed that agentic shoppers could represent between $190bn and $385bn in US ecommerce spending by 2030, accounting for 10-20% of the total US ecommerce market. Meanwhile, an October report from Worldpay highlighted that 40% of survey recipients said they were ready for AI-led shopping, though recipients in China and the US are currently much more prepared than in France and the UK. On the other hand, the latter report did also highlight that just 5% of respondents had no concerns with agentic AI shopping, with common concerns being identity theft, incorrect or unauthorised purchases and fraud.

Generally, studies and reports on current consumer behaviour seem to highlight that there remains a gap between consumers using chatbots to find information, often about products and services they wish to buy, and the extent to which they would trust an AI agent to autonomously research and make payments for them. Agentic commerce therefore requires more work from different stakeholders to encourage this trust, but if they can do so there is a growing pool of AI-using customers to capture.

Next steps for agentic commerce

Though cross-border payment providers are stepping into the space, agentic AI payments are still largely unproven and require continued work to prove their trustworthiness for consumers.

For merchants looking to integrate agentic AI capabilities, it will be important to make their product catalogues more readable for agentic AI services and will require thinking about agents as being the buyer, rather than a human. That means ensuring that their content is discoverable by AI and that payment systems are built to support this.

Crucial to decision making will be which AI-powered agents merchants choose to work with, which therefore informs payment providers on who they want to collaborate with and how they can build payment solutions to target consumers where they are making purchases from merchants.

For cross-border payments providers, being transparent on costs could also become more important. For example, if AI agents can compare costs across FX margins, shipping fees and taxes in order to provide consumers with the best possible deal, this makes it more important for merchants to be able to give their prices directly in local currencies or offer dynamic currency conversion at sale. It will also be important for payments providers in the space to remain mindful of regulatory scrutiny, particularly if the industry increasingly moves towards autonomous agents executing payments on behalf of users.

From a strategy point of view, companies operating in the space should at least be tracking the share of traffic and conversion moving through AI agents and assessing where agentic AI can fit into their models.

While the AI agentic commerce opportunity is still in its early stages, what the industry can’t ignore is the growing share of traffic that is moving through AI chatbots, and in turn a shift in consumer behaviour that merchants are recognising and wanting to accommodate. The fact that many providers in the space are collaborating on open protocols and launching infrastructure solutions in the area suggest that they want to be ready to meet this opportunity should it push further into global commerce.