Google has made some notable steps related to payments this year, having just launched a brand new open standard for agentic powered transactions, signed a multi-year deal with PayPal and moved to launch its own blockchain. Below, we explore the company’s current and future potential in relation to cross-border payments.

Google’s activities today span a vast number of industries globally, from cloud computing to consumer hardware to media and entertainment. Payments have historically formed a smaller part of Google’s ecosystem, though the company has many different touchpoints in the space, from its well-known Google Pay and Google Wallet apps to the significant intake it receives from businesses paying for advertising and other services.

This year, the company has seen growing moves into payments, having launched a new standard to support autonomous ecommerce transactions, developed alongside 60+ institutions, and announced its intention to launch a new blockchain solution. Also this year, the company has announced a muti-year deal with PayPal to integrate several of its solutions across Google’s Platforms, signed a partnership with Revolut and is also working with several remittance providers to help boost their appearance in search, helping them capture more remittances customers.

In this report, we explore Google’s current role in payments, who it is competing with and what recent moves indicate about its strategy going forward.

Google’s current payments footprint

Google’s current payments footprint spans its consumer wallets, merchant services and a growing role in cross-border payments through partnerships with various players such as PayPal, Wise and Revolut.

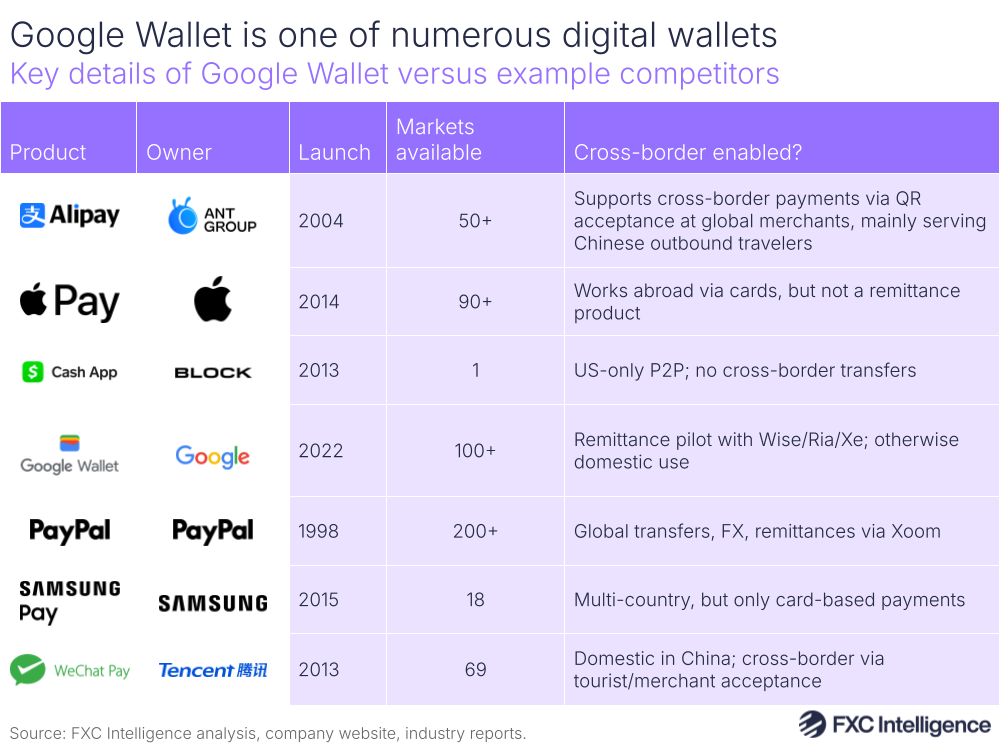

Google’s primary consumer-facing payments function is Google Wallet – its secure digital app enabling users to store payment cards, tickets, passes, keys and ID on their Android smartphones, tablets or watches. When users have added a payment method to their Google Wallet, they can use it to make payments through Google Pay – the mobile payment service enabling contactless payments in-store, through apps or in person to other Google users.

Initially, Google launched Google Wallet in 2011 as a mobile payments system enabling contactless payments. The company then launched its rebranded Android Pay in 2015 to support in-app purchases and loyalty programs. In 2018, Google Wallet and Android Pay merged to form the single Google Pay brand before, in 2022, Google began to phase out its Google Pay brand to bring in Google Wallet across some markets as one unified app for payments, IDs and loyalty cards.

As of 2024, Google Pay has now been replaced in many markets (such as the US), though it still exists as the company’s primary application in India. In this country, Google Wallet launched in May 2024, but is used to house non-digital payments items (e.g. boarding passes, gift cards, loyalty cards).

The impact of payments is not specified in the earnings results of Google’s owner Alphabet, though it is likely a relatively small portion compared to other segments; advertising accounted for 76% of Alphabet’s total earnings in 2024.

Google does monetise payments made on its Google Play Store however, by taking a percentage-based service fee on digital goods and services purchased within apps, similar to Apple on its App store. Google says that 99% of developers on its store are eligible for a fee of 15% or less when they participate in the different programs offered by Google Play.

Crucially, Google has not in the past moved to own traditional payment rails outright. Rather, the company has focused on positioning itself as more of a connector of systems – embedding payments across its various services while integrating with payment service providers to enable processing and settlement. This includes global card networks (e.g. Visa and Mastercard) and hundreds of banks and payment service providers, as well as national payment systems such as UPI in India, PayNow in Singapore and Pix in Brazil.

The main impact these payments products have within the Google ecosystem however are not the revenue they produce themselves, but rather from the way they play into Google’s wider gains as a company focused on being users’ gateway to services online.

This year has already seen a number of notable movements from Google in payments, with some of these having particular relevance to cross-border.

Google’s move into remittances

Google has recently formed new agreements with some players in remittances, having already made some steps in this area such as in 2021, when Google Pay partnered with Western Union and Wise to enable US-based users to send money to Google Pay users in India and Singapore.

In 2025, the company is growing its remittances activity – in July, Google formed a partnership with Ria and Xe (both owned by Euronet) to expand the reach of these businesses across Google’s digital channels and, according to Euronet, “make it easier for Google users to find and conduct cross-border money transfers via Ria and Xe’s services”.

This was followed by the news that Google had also partnered with Wise, in addition to Ria and Xe, to test a new remittance feature via Google Wallet and its search functions. The feature allows users to compare and send money through providers across “high-demand” routes to India, the Philippines, Mexico and Brazil.

Though still in the early stages, the move adds an additional layer to Google’s existing wallet, increasing stickiness – particularly for remittance customers who already use the Google Wallet app for its other functions. It also shifts Google into something of an aggregator for money transfer providers, similar to other price comparison platforms.

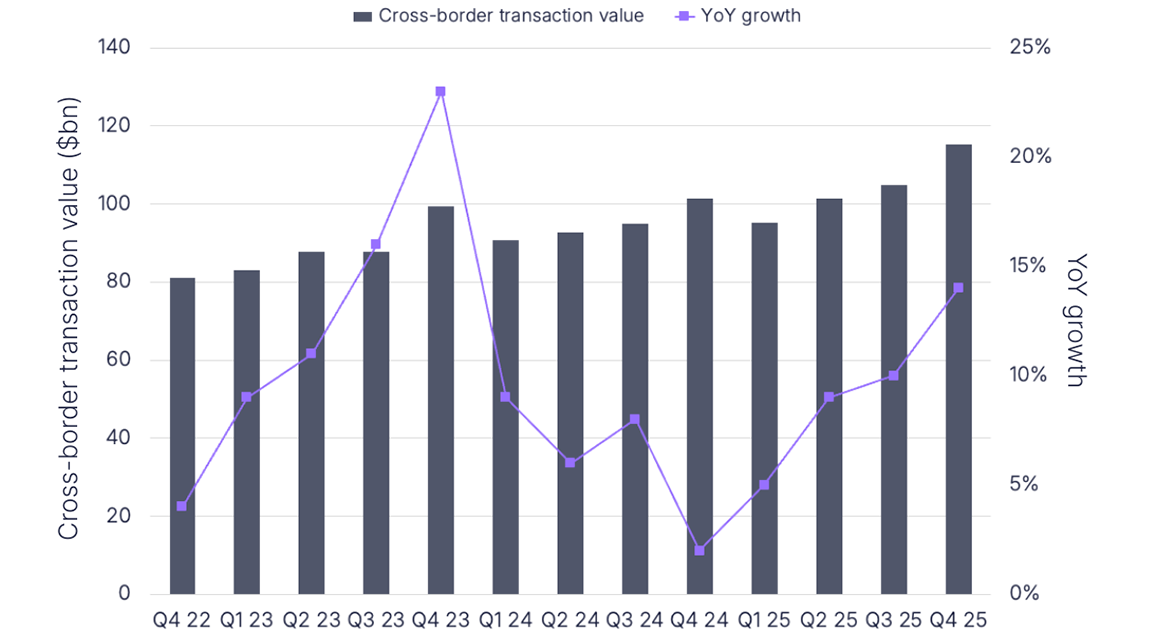

With Google Wallet having a significant user base already, the partnerships it continues to form in this space could see it adding to competition in money transfers – many of which already aim to secure customers based on low margins and FX fees, but for which this could create increased pressure to do so.

Google’s open protocol for agentic AI

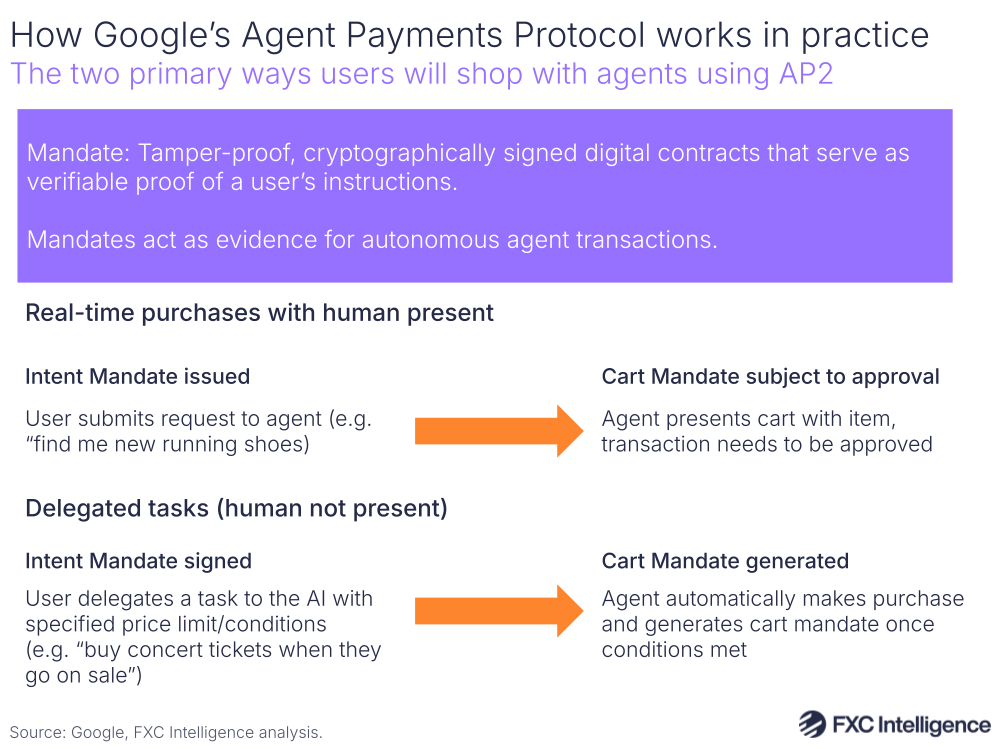

Agentic AI has been a major theme in payments recently as companies look to shift their AI offerings beyond customer experience-led innovation to intelligent AI systems that can act autonomously on the behalf of users to execute transactions. Google is tapping into this with the recent launch of its Agents Payments Protocol (AP2): essentially, a universal set of rules for AI payments that it has developed alongside more than 60 companies in a bid to capture and shape AI payments moving forward.

Google’s launch is targeted at handling some of the problems that exist when it comes to making a payment through a digital assistant; namely, how those assistants can prove they are acting on the users’ behalf; how merchants or payment providers can verify the request is not a scam; and ensuring users aren’t charged for something that they didn’t actually want.

In response to this, Google has introduced a new system of Mandates – digital contracts that act as proof of a user’s instructions and provide a paper audit trail that allows users, payment providers and merchants to verify transactions. When a user makes a request to an agent (e.g. “buy new running shoes”) this is the Intent Mandate, while a Cart Mandate is generated at the point the requirements are met and the transaction is either ready to be approved or made automatically (depending on the human’s instructions).

The new system is Google’s move to capture and set the standard for how AI agents handle money, instead of allowing lots of incompatible systems emerge. It is payments agnostic and therefore separate from Google Pay, meaning it’s intended to work across different cards, banks, cards and cryptocurrencies.

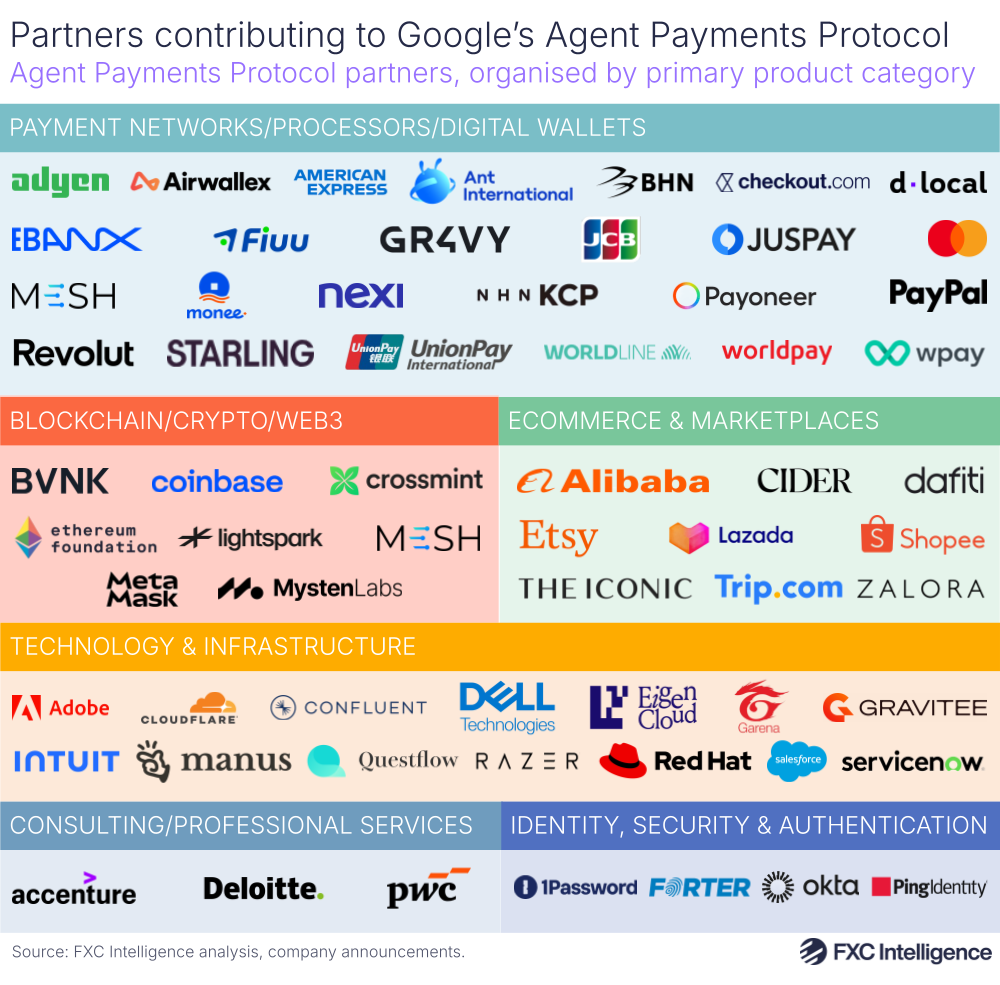

A significant proportion of Google’s AP2 partners fit into the category of payment networks, processors and digital wallets from a wide variety of regions.

A key unifier of these companies – from processors such as Adyen and PayPal to card networks such as Mastercard and more B2B-focused providers such as Payoneer – is the significance of cross-border payments to their businesses, highlighting the potential that these players see in agentic AI for global commerce. The companies here are also based in a wide number of countries worldwide, spanning North America, South America, Europe and APAC.

Google’s move to unify agentic payments could have wider implications for the industry. Theoretically, agentic payments could seamlessly route payments through whichever payment method is cheapest or fastest for transactions, having benefits for the end user and the transaction.

Aside from the consumer ecommerce angle, Google also specifies AP2 could be used by enterprise companies for B2B applications, such as allowing businesses to autonomously secure partner-built solutions through Google Cloud Marketplace. The “global” aspects of the protocol are emphasised by some payments providers’ comments in the wake of the protocol’s launch. Airwallex Co-Founder & CTO Jacob Dai said that the system “gives businesses and consumers the confidence to delegate tasks to AI agents”, while Payoneer’s Vice President of AI Guy Shalev said that the company saw “enormous potential in AI agents to simplify financial workflows for millions of small businesses”.

Inside Google’s PayPal partnership

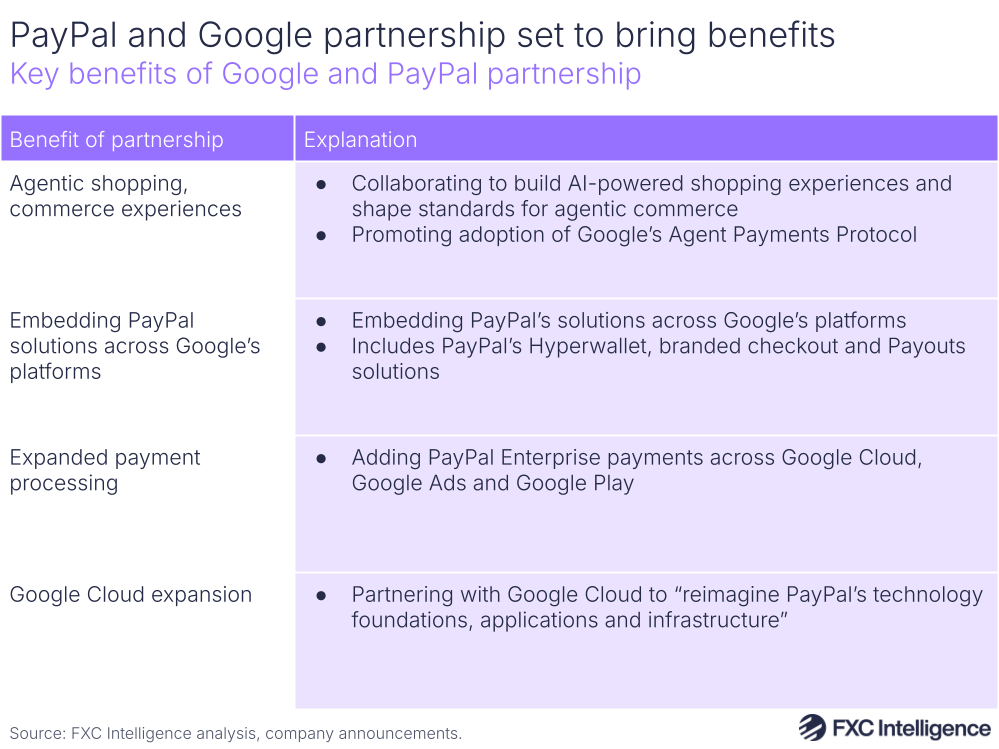

On the back of its AP2 launch last month, Google and PayPal announced a multi-year partnership focused on delivering a number of significant benefits to each company.

This includes adding agentic shopping experiences combining Google’s expertise in AI and PayPal’s existing solutions with global payments; embedding PayPal solutions – including branded checkout and its payout platform for merchants Hyperwallet – across Google’s platforms; adding PayPal’s Enterprise payments across Google Cloud, Google Ads and Google Pay; and PayPal partnering with Google Cloud.

PayPal is one of the world’s most significant global payments acceptance networks, with infrastructure spanning more than 200 markets. The deal therefore serves to not only back up Google’s AI payments push, but also serves to make it easier for global businesses to interact and pay for its services across other platforms.

Google’s new Layer 1 blockchain for cross-border payments

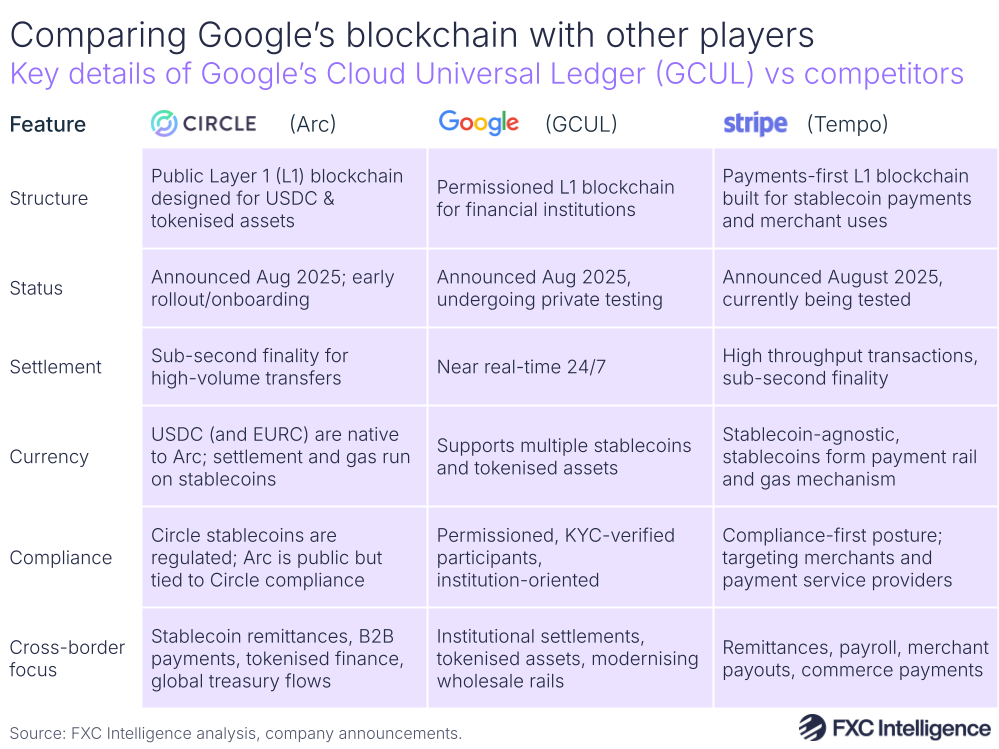

Also this year, Google joined a number of tech providers announcing new blockchains. Currently being tested and with a full rollout expected in 2026, the Google Cloud Universal Ledger (GCUL) is a Layer 1 blockchain network with a specific focus on financial institutions and payment providers.

The blockchain could have several implications for payments, including enabling faster international transfers and wholesale payments between banks, tokenising financial assets and settling payments. It is a permissioned blockchain (unlike bitcoin and ethereum), meaning access will be restricted to approved institutions.

According to reports (and Google’s Head of Strategy Rich Widmann), the blockchain will have several features that make it stand apart from other recently introduced blockchain networks in the cross-border payments space, namely Stripe’s Tempo and Circle’s Arc. For one, the system is “neutral” meaning it hasn’t been tied to just one company’s product or services. The system will also be based on Python, which many financial institutions already use for much of their business and which lowers the barrier for entry for some financial institutions.

Though Google is not the first to introduce a payments blockchain, its movement into this as one of the world’s most connected players globally signals how significant the trend towards stablecoins and blockchains has become. Moreover, Google already exists at the discovery layer of ecommerce across search, shopping and ads – however, the blockchain positions Google Cloud as a larger intermediary within payments by exposing it to stablecoin settlements.

Google is currently testing its blockchain, having already engaged clients such as derivatives marketplace CME Group, which is currently exploring tokenisation and payments solutions using the platform. Market participant testing has been set for late 2025, with a public launch tipped for 2026. However, a key question for the blockchain (as with much of the regulation around stablecoins) will be how it is governed and whether financial institutions trust the system enough to adopt it.

Expanding to new markets

Google has also continued to expand its Google Pay movement globally, with the system now integrating or in touch with various national payment schemes worldwide.

In September, Saudi Arabia’s Central Bank (SAMA) announced that it had enabled the launch of Google Pay through Saudi Arabia’s national payment system Mada, which connects electronic payments, ATMs, point-of-sale systems, banks and merchants across the country. This follows integration of Google across many different systems in countries globally, including the UK, Singapore, Brazil, the US and India.

Google Pay is particularly significant in India, where it has tapped into a massive demand for mobile payments kickstarted by the country’s instant real-time payments service UPI, which has itself resulted in the launch of several well-known players, including Paytm and PhonePe.

The company initially released its mobile payments app Tez in the country based on UPI, which has since been renamed Google Pay. The app accounted for over a third of nearly 20 billion UPI transactions in August 2025 across all UPI-enabled apps, making it the second most-used app based on the service in the country.

Google is integrating with other payment systems worldwide to help boost its reach. For example, last year, the company added Brazil’s popular payment method Pix to Google Pay, and this year boosted it further with integration on Google Chrome to boost ecommerce checkouts.

Overall, Google’s expansion across these systems continues to highlight its role as a consumer/merchant interface – however, some instant payment schemes have begun to connect internationally (e.g. UPI with PayNow in Singapore) to enable payments via cross-border interoperability. Google could benefit from being the front-facing app that consumers are using to make these payments, thus positioning it as an enabler for international travellers following its success in India.

How Google’s strategy compares to other tech peers

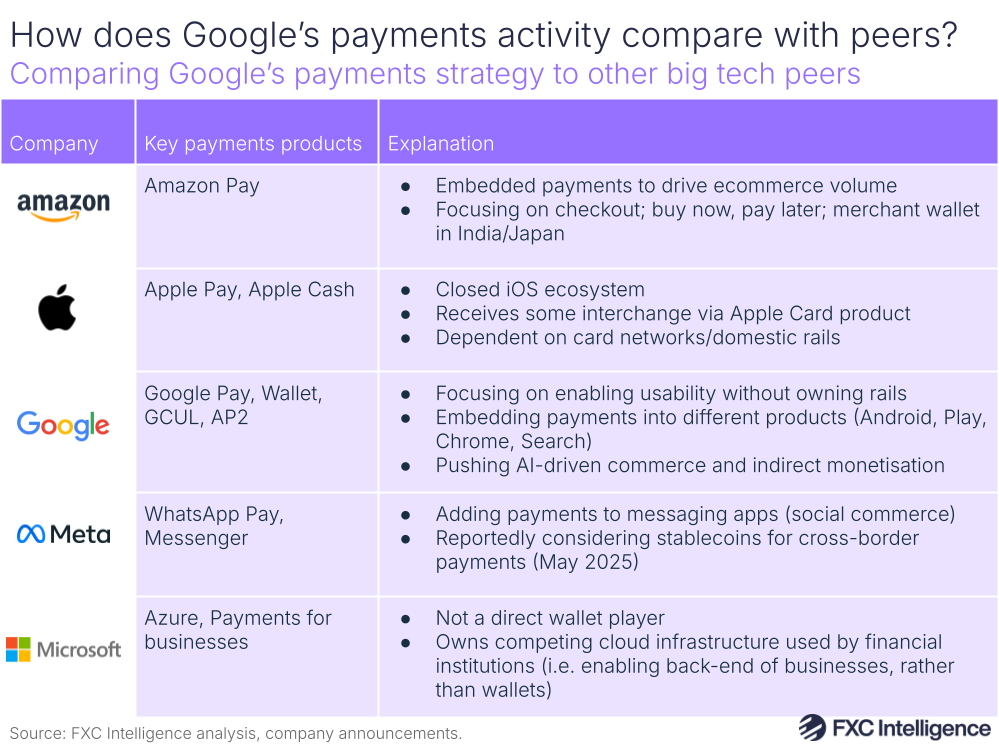

Google’s main focus historically has not been on payments rails, but rather using payments as a value-add for other services – building out its frontend wallets, embedding payments into its various services and linking up with other systems.

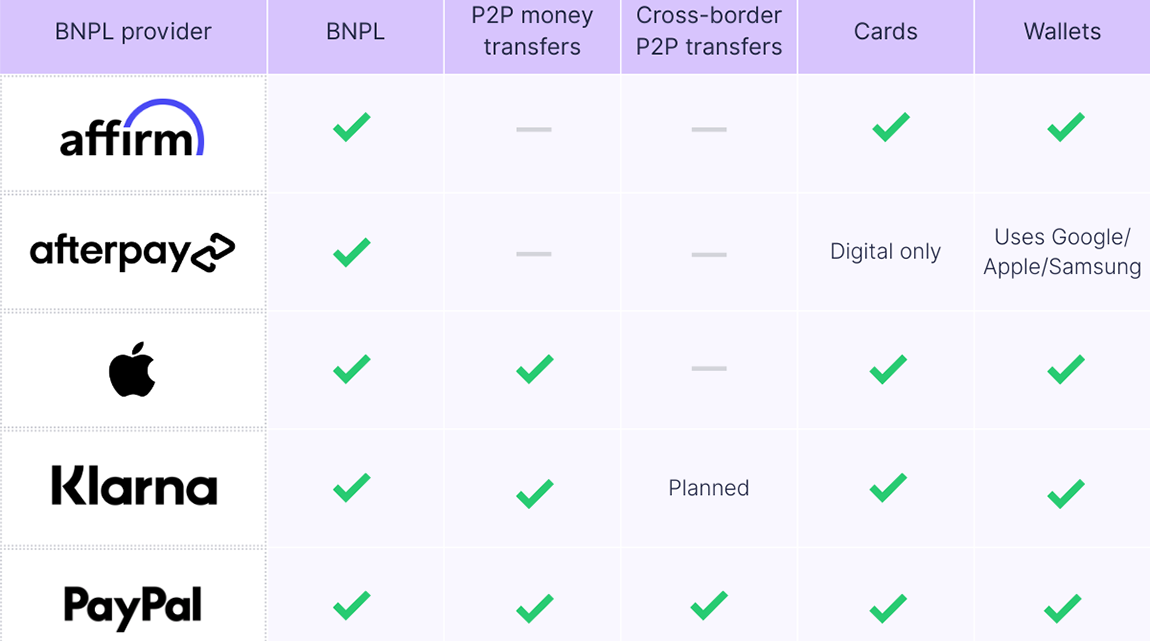

This move towards partnerships is also seen in other tech players’ moves into the payments space. Apple – often seen to have a closed ecosystem where it prioritises its own products – continues to expand Tap to Pay on iPhone across Europe and has removed its own BNPL service to integrate Klarna with Apple Pay. Meta, meanwhile, has looked to embed payments into messaging apps in the past and after its Novi stablecoin wallet failed in 2022, the company has begun exploring the use of stablecoins in cross-border payments again this year.

While Google does see revenue from transactions in some areas, the company has mostly approached payments as a means of driving the strengths of its other core areas of business, which is about advertising for businesses and easing the conversion of users who see those adverts towards making purchases.

The company’s future relevance in payments will depend on a number of factors: the extent to which it can standardise the cutting edge of cross-border commerce across areas such as agentic AI; whether financial institutions choose to adopt its blockchain for wholesale cross-border payments; and the extent to which it can continue to promote its wallet as a leading orchestration layer for consumer payments.