Growing its fintech sector has been a critical part of Saudi Arabia’s Vision 2030 strategy, and a string of recent announcements suggests it’s paying off. We look at the country’s cross-border payments growth and potential to identify where the opportunities lie.

This month, companies across the payments industry have made announcements related to their operations, projects and partnerships in Saudi Arabia, with many seeing the country as key to their growth in the wider Middle Eastern region, itself one of the key emerging markets globally that the payments industry sees as vital to its future expansion.

While the United Arab Emirates has long been a critical hub for the fast-growing Middle Eastern financial sector, Saudi Arabia has been growing in prominence as part of the country’s Vision 2030 strategic framework. First launched in 2016, this is designed to diversify the Kingdom of Saudi Arabia’s economy away from oil dependency, expanding a host of key sectors and building the country into a critical global hub for business and finance.

With payments being so central to this, and the country already having seen significant growth and transformation under the framework, this report explores the current and emerging cross-border payments opportunities in Saudi Arabia, and looks at the companies already focusing on the region.

Recent cross-border payments moves in Saudi Arabia

September has been a particularly strong month for payments announcements relating to Saudi Arabia, with multiple companies issuing press releases or otherwise reporting on their moves in the country.

The vast majority of these have been timed to coincide with Money20/20 Middle East, the fast-growing fourth event from payments’ biggest dedicated conference, which is now held annually in Saudi Arabia. The presence of the event here, rather than in the UAE, speaks to the growing strength of the country’s fintech sector in the wider region. However, the sheer number of major companies to announce Saudi Arabia-based moves specifically at the event also suggests a specific prioritisation of the country within the Middle East.

Many of the announcements indicated developments designed to better conform to operational requirements or best practices within the country. Visa, for example, announced that its Visa Acceptance Platform was now hosted on local cloud infrastructure within the country – the first time the payments giant has made such a move. This is to align Visa with a mandate from the Saudi Central Bank (SAMA), increasing the levels of integration Visa is able to achieve and so reducing frictions for those making or offering Visa-based payments within the country.

Meanwhile, card issuance player Paymentology’s commercial registration in the country is enabling it to boost its on-the-ground presence – a move many see as critical to doing business within the country.

Ongoing efforts by SAMA have also translated into increased connections for key financial networks and products, with the central bank announcing several additions to its national payment scheme Mada, namely Google Pay and Alipay+, with the latter unlocking cross-border QR code-based payments that connect local merchants to Alipay+’s 1.7 billion user accounts. First launched in 1990 but having undergone a significant rebrand and development in 2015, Mada has seen several key additions in recent years, including the 2018 addition of Apple Pay and the 2022 acceptance of Discover cards.

Efforts to boost the country’s financial infrastructure, which forms part of the wider financial goals for Vision 2030, have also seen key players boost their networks in the country, with Thunes rolling out real-time cross-border payments into the country via its Direct Global Network as well as supporting the launch of Saudi digital wallet player barq’s enhanced remittance services.

Meanwhile, MoneyGram also announced a key partnership in the country, with Saudi remittance player Enjaz integrating its network infrastructure and so gaining access to over five billion digital endpoints globally.

The impact of Vision 2030

Vision 2030 was cited in many of the announcements made at Money20/20 Middle East, and for good reason: it is the most important driving factor for Saudi Arabia’s financial and fintech development, laying out a wide variety of specific annual and mid-term goals for the sector.

Overall, Vision 2030 lays out a slew of strategic objectives for Saudi Arabia at three levels, which all fall under three overarching goals, termed “Vibrant Society”, “A Thriving Economy” and “An Ambitious Nation”. Objectives relating to the financial sector are handled by the Financial Sector Development Program (FSDP), whose 2022 charter identified three top-line objectives that it directly contributes to as well as 21 that it indirectly contributes to.

The objectives at the top level are to “enable financial institutions to support private sector growth”, “ensure the formation of an advanced capital market” and “promote and enable financial planning”, although more broadly the FSDP is focused on creating a “thriving financial sector that serves as a key enabler” to Vision 2030’s objectives, including both in terms of funding Vision 2030’s wider delivery and providing the financial infrastructure and access to support it.

To achieve this, Saudi Arabia has laid out a variety of goals and aspirations for its financial sector that are both far reaching and in the process of significantly transforming the country’s financial landscape, particularly when it comes to payments.

How Saudi Arabia is performing against its fintech goals

Central to this are the country’s fintech goals, which are framed around the country’s vision of becoming a leading global fintech hub with a digital-first financial ecosystem and an environment where fintech innovation can thrive.

As well as targeting greater financial inclusion through greater access to financial products, the country is also targeting a pronounced jump in the share of payments being made through digital channels.

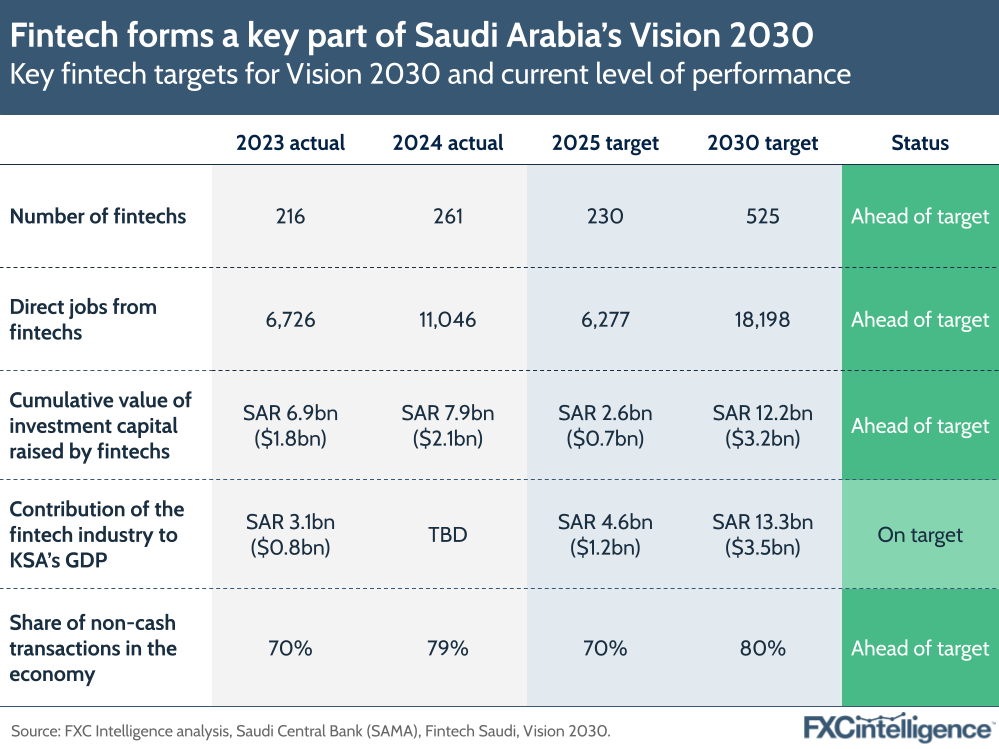

Saudi Arabia is looking to significantly grow the number of fintechs forming part of the financial sector, as well as increasing both investment in such fintechs and the contribution of the fintech sector to the wider economy.

On all of these metrics, it is so far either on or ahead of schedule, with the country seeing a proliferation of both entirely home-grown fintech players and local arms of major international fintechs.

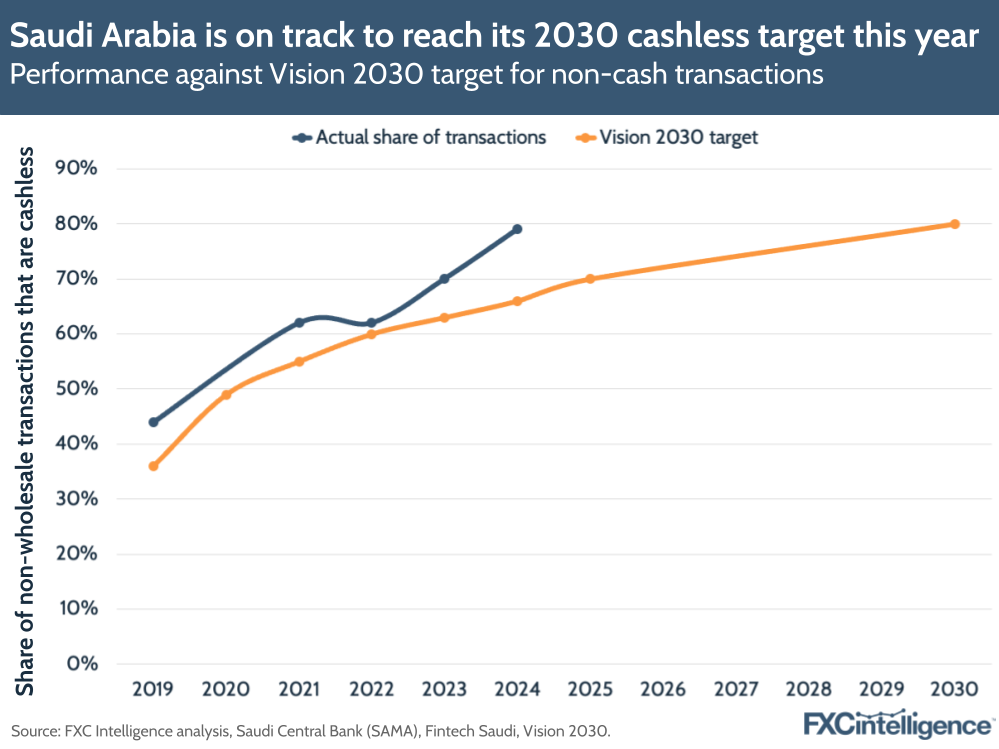

The target to grow non-cash transactions in the economy saw Saudi Arabia set out a goal of 70% of all transactions being non-cash by 2025 and 80% by 2030. For comparison, in 2019 the non-cash share of transactions stood at 44%, or 36% for individuals.

Such a rapid pace of change has required significant and rapid development of payments infrastructure across digital and in-person channels on both the consumer and business sides of the landscape, as well as the development and proliferation of further financial instruments to hold and spend money, including digital wallets, and means of making payments, such as QR codes.

Despite the ambitious goal, the country has risen to the challenge, reaching the 2025 goal two years ahead of schedule in 2023. Numbers shared for 2024 earlier this year show the share is now only just below the 2030 target, with 12.6 billion transactions – 79% of all of those made in the Kingdom – being through non-cash means, according to SAMA.

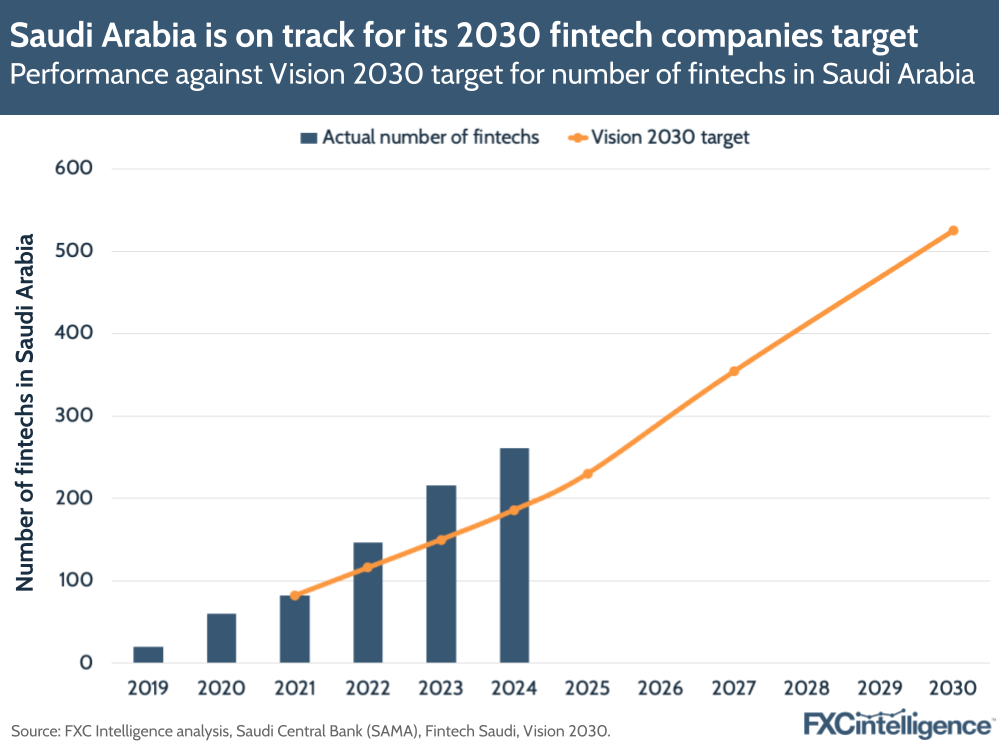

The proliferation of fintechs solving for a variety of payment infrastructure needs has been critical to delivering this change, and here there have also been significant improvements. Data published by SAMA and Fintech Saudi shows that, as of 2018, the Kingdom had just 10 fintechs registered in the country across its various regulators. However, this has risen dramatically over the past few years: in 2022 it entered triple figures for the first time, and as of 2024 stood at 261 – above the 2025 target of 230, although still some way from the 2030 target of 525.

Together, these fintechs directly employ around 11,000 people – well above 2025’s target of around 6,300 – 71% of whom are Saudi nationals and 39% of whom are women.

A significant portion of Saudi Arabia’s fintech sector is also in payments, with Fintech Saudi identifying 79 payments fintechs, including 12 electronic money institution (EMI) digital wallets.

Saudi Arabia’s cross-border payments players

Looking at the companies licensed under SAMA specifically, there are a significant number who directly offer cross-border payments services and solutions. Our analysis of the 38 banks and 27 payments companies currently listed as having licences on the central bank website identified that 46 of the 65 companies (71%) currently promote some form of cross-border payment solution.

Banks are disproportionately represented, with all of the 24 foreign banks and 11 local banks, as well as two out of the three digital banks, having such an offering.

Meanwhile 58% of the 12 EMIs, which are typically some form of digital wallet, had an overt cross-border offering, with some offering P2P payment services only within the country.

The smallest share, however, was payment institutions, which most commonly offer point of sale solutions in the country. Of the 15 registered in the country, only two (13%) specifically promoted cross-border solutions, although as a country looking to grow its tourism, and already having significant inbound travel, particularly for religious regions, it is likely that other providers will also have cross-border flows as part of their transactions.

Saudi Arabia’s growing cross-border payments opportunity

Although still growing its global presence as a key player in the fintech landscape, Saudi Arabia already sees significant flows across a number of channels and use cases, and is seeing continued growth in many areas that speak to an ongoing opportunity for the cross-border payments sector.

Consumer money transfers

As a country with a significant migrant population, Saudi Arabia has significant outbound consumer money transfers, with data from SAMA published for a number of channels that speak to the breadth of the opportunity in C2C payments.

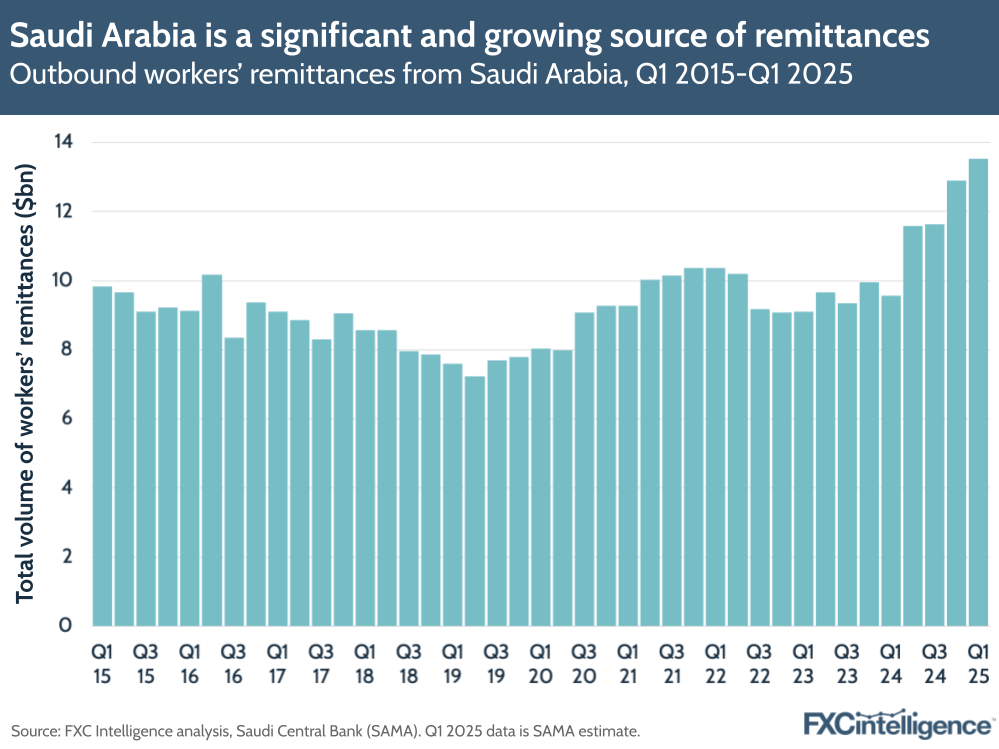

Its quarterly publication of outbound workers remittances, currently available up to Q1 2025, shows that while there was a period of contraction in 2022 and 2023, there has been growth across 2024, with Q1 2025 seeing a 41% increase to $13.5bn. This follows full-year growth of 20% to $45.7bn in 2024, following slight YoY contractions for FY 2022 and FY 2023.

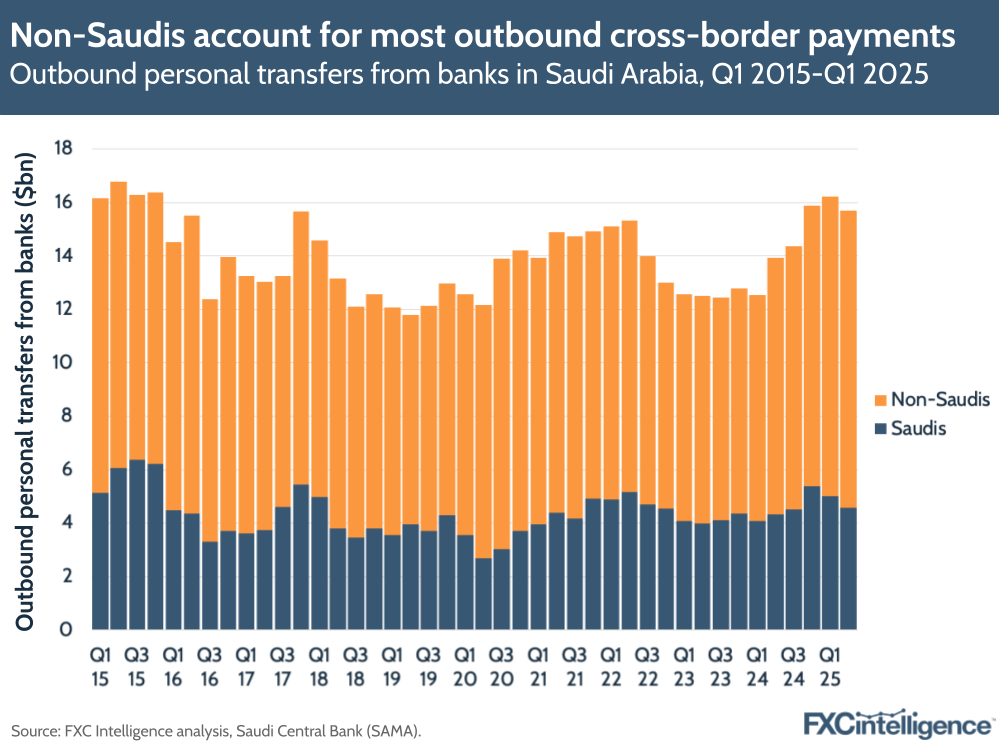

Looking to outbound personal cross-border payments made from banks, a metric that covers a wider range of use cases and typically trends towards higher value payments, there is a relatively similar picture. In Q2 2025, the most recent quarter data is available for, there was a 13% YoY increase in transfers to SAR 58.8bn ($15.7bn), the fifth quarter in a row of double-digit growth after a period of contraction across 2022 and 2023.

Within this, around 70% is from non-Saudis, a split that has remained relatively consistent over the last decade despite payments from non-Saudis having seen faster growth than for those from Saudis in the last few quarters.

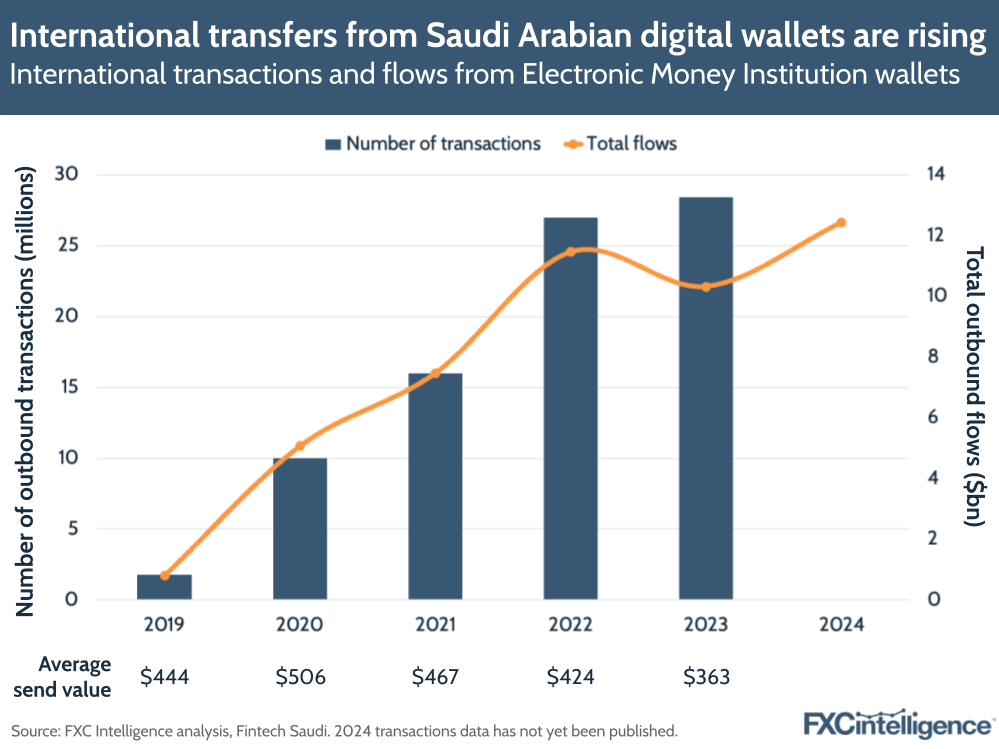

Meanwhile cross-border payments from EMI digital wallets, which are likely to trend towards lower value payments compared to banks, have also continued to see growth. While Fintech Saudi reports “modest decline” in the total value of P2P payments using such digital wallets within the country, the combined value of international transfers grew 20% YoY in FY 2024 to SAR 46.6bn ($12bn).

Data on the number of transactions has not yet been published for 2024, although in 2023 this stood at 28.4 million, meaning that the approximate value per transfer was around $360.

While the totals remain far below those of banks, which in 2024 saw cross-border payments sent by individuals total around $56.7bn, the continued growth speaks to ongoing adoption of digital wallets, particularly among those with cross-border needs.

C2B payments and the role of travel

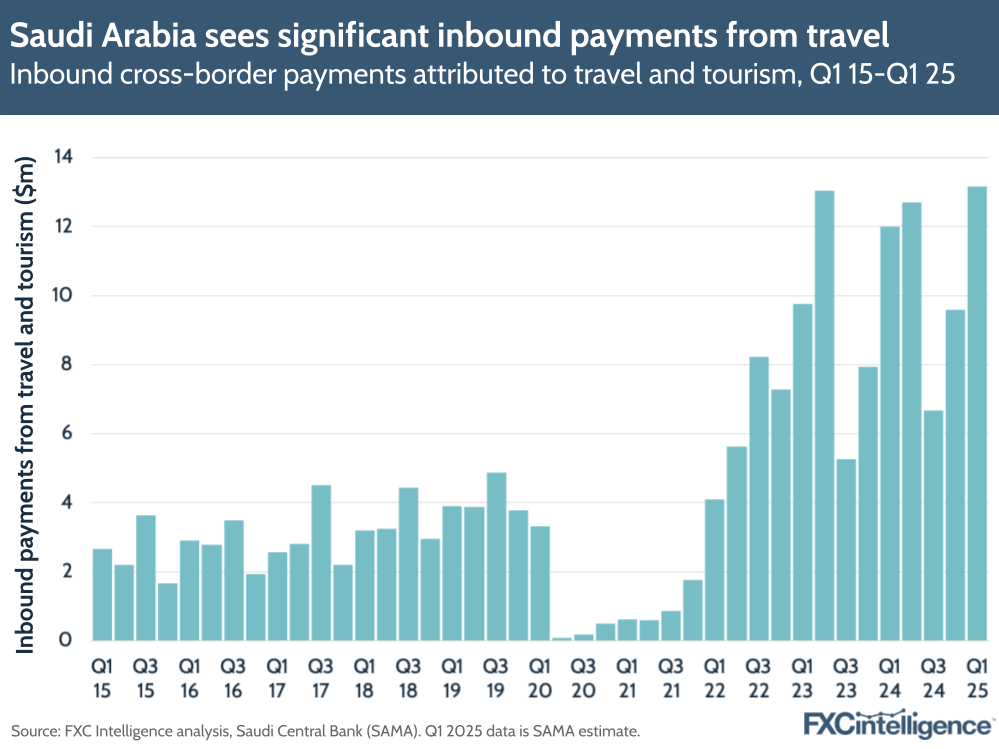

Cross-border consumer-to-business payments are not always easy to effectively and fully track, however a key area for Saudi Arabia in this regard is cross-border payments attributed to inbound travel. While increasing tourism is another key focus for Vision 2030, the country already sees significant regular travel as a result of it being home to the Islamic holy city of Mecca.

As a result, the country sees significant inbound travel associated with pilgrimages, specifically Hajj and Umrah. Hajj occurs annually on specific dates in the Islamic calendar, which translates to slightly different dates in the Gregorian calendar each year, and results in a surge in C2B payments inflows during the 10-day period during which it occurs.

Umrah, meanwhile, can occur at any time during the year, but also contributes to elevated inbound payment flows.

Cross-border payments from religious travel, as well as tourism and other non-leisure visits to the country are reported as inbound payments from travel and tourism by SAMA, and in Q1 2025 saw 10% YoY growth to $13.2bn, while full-year 2024 saw 14% growth to $41bn.

Notably, while this segment inevitably saw a sharp drop during Covid-19, growth in the following years has seen it consistently reach far higher levels than before the pandemic, with 2023 seeing more than twice that of 2019.

B2B payments

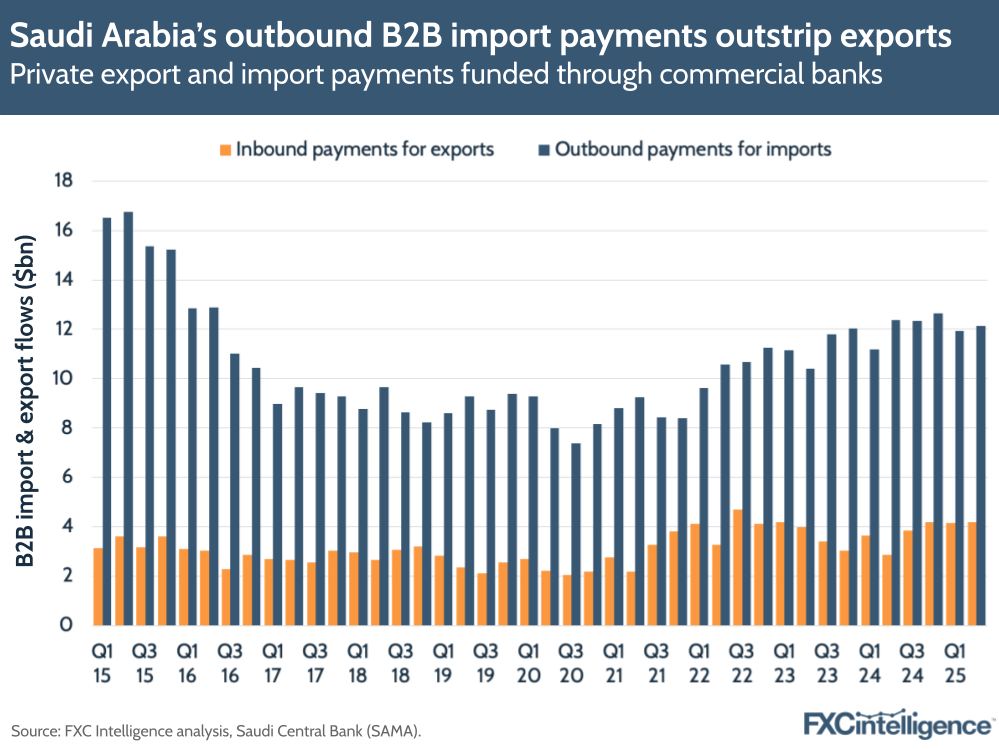

While there are fewer metrics for B2B payments, data on import and export payments present the clearest indication of the sector, with the country sending considerably more abroad to pay for imports than it receives in export payments.

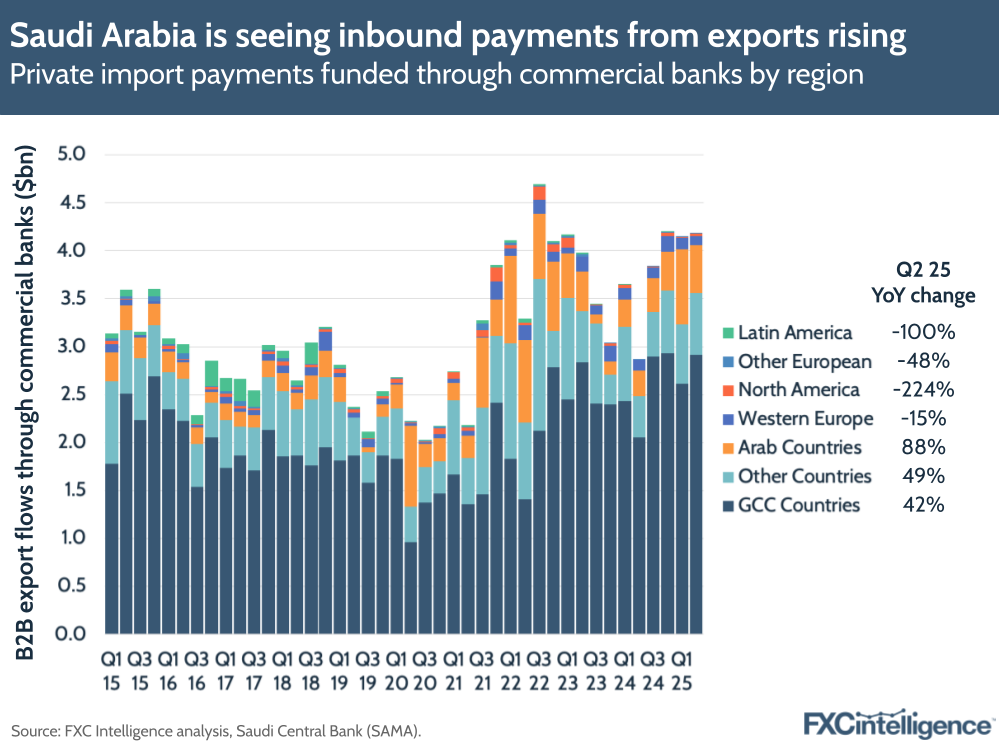

SAMA data on import and export payments sent using commercial banks shows that outbound payments for imports reached $12.1bn in Q2 2025 and $48.6bn in FY 2024. Meanwhile, inbound payments for exports reached $4.2bn in Q2 2025 and $14.5bn in FY 2024.

This puts Saudi Arabia’s B2B payments at a level smaller than those of consumer payments, although the sector is likely to see growth as the country realises more of its Vision 2030 objectives. As a result, B2B payments may have greater future growth potential than C2C payments, particularly when it comes to inbound payments, which saw a 47% YoY increase in Q2 2025 and have seen growth for the last four quarters after a period of decline.

Within this, some regions are proving to be far greater sources of growth than others. While North America has seen a sharp contraction in payments for exports from Saudi Arabia, increases among Arab countries have been the biggest source of growth, with payments from this region climbing by 88% in Q2 2025.

Future developments

While Vision 2030 is still being realised, the successes of it so far, particularly in the fintech space, as well as the recent flurry of announcements from major players in the sector, speak to strong potential for cross-border payments in both Saudi Arabia and the wider Middle East.

While macroeconomic uncertainties have created headwinds for many areas, the country’s ongoing growth across many areas of payments speaks to the future potential of the space for the cross-border sector as a whole.

If it is to meet its 2030 goal, Saudi Arabia still has to add more than 200 fintechs in the country and, while many of those will be home-grown, there are likely to be many more that are international players.

How big the country could become in the cross-border payments landscape remains to be seen, but it’s clear there is immense potential for the sector within the region.