Adyen has reported its latest results for H2 2025 and FY 2025, which saw the company grow its wallet share for customers, drive revenue growth and make significant inroads in both financial products and agentic payments. However, the company’s share price fell after its results, with reports suggesting this was due to softer than expected payments volumes in H2 2025 and a cautious growth outlook for 2026.

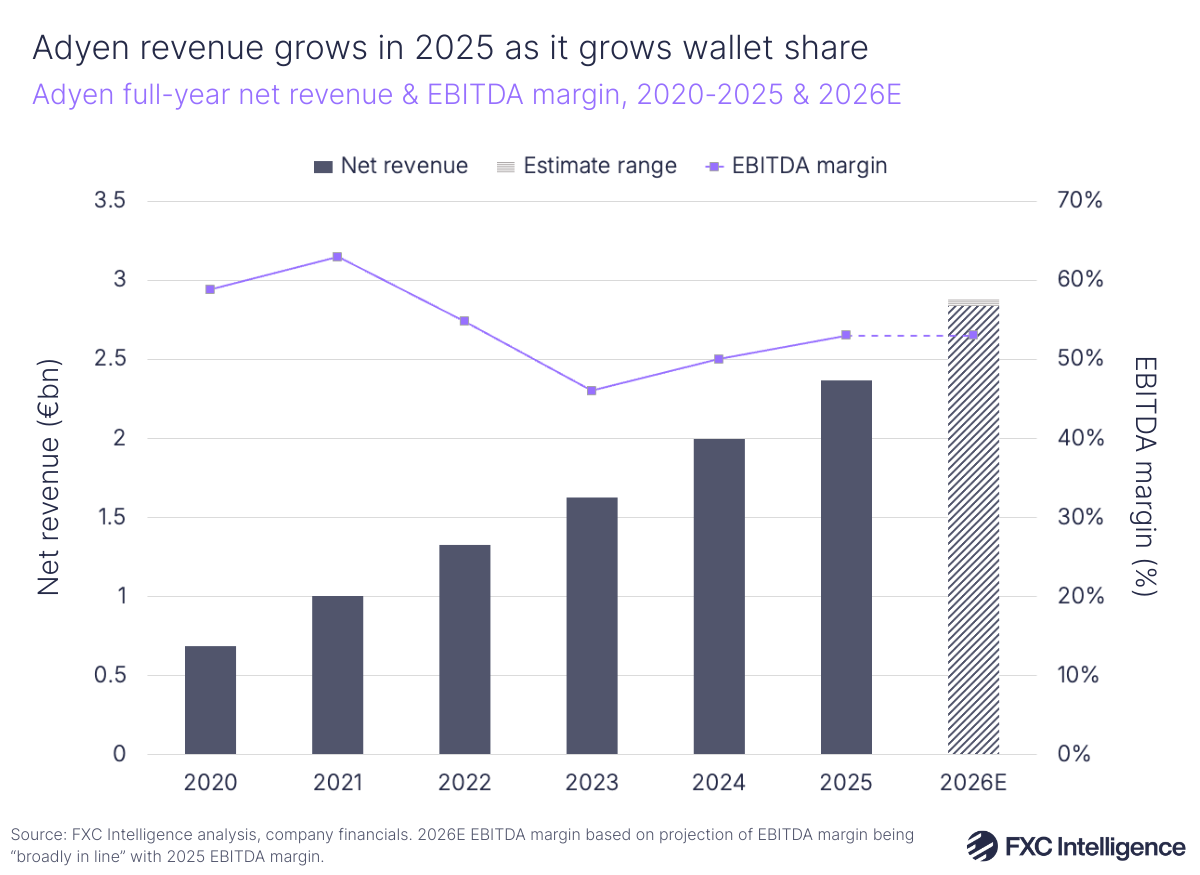

In H2 2025, Adyen’s net revenue rose 17% to €1.3bn ($1.5bn based on historical exchange rates over the period), driving 18% YoY growth in the company’s FY revenue to €2.4bn ($2.8bn). The company noted that net revenue rose 19% in Q4 on a constant currency basis and 15% on a reported basis, highlighting the impact of foreign currency headwinds on Adyen’s business during the period.

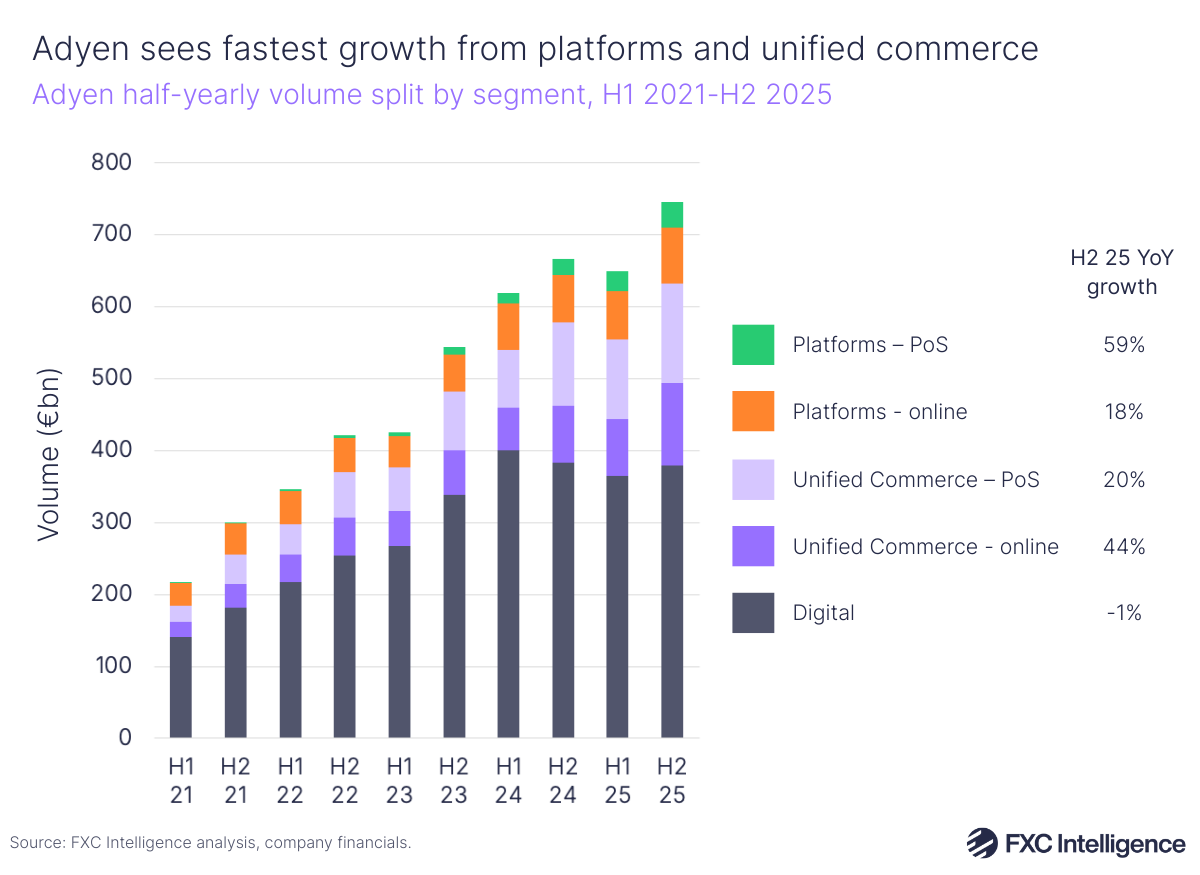

Total processed volume rose 12% in H2 2025 to €745bn, led by gains across the company’s Unified Commerce and Platform solutions but hampered by a 1% decline in its Digital segment. This rate of growth was slower than in H2 2024, when total processed volume rose by 22%, though Adyen said that Q4 2024 specifically was harder to compare against, given that this period saw significant wallet share gains across APAC-based online retailers.

For the full year, volume rose 8% in 2025 to €1.4tn, slower than the 33% growth reported in 2024. Having said this, the company’s profit margin has remained solid, with EBITDA margin rising to 53% in 2025 on the back of a 26% increase in EBITDA to €1.2bn.

Unified Commerce drives volume shift in Adyen’s H2 25

Adyen saw mixed performance across the three segments it reports. In H2 2025, Digital – the company’s core segment, spanning its online, in-app and subscription activities – saw net revenue grow 7% while volume declined by 1% (excluding a single large-volume customer, volume grew 11% YoY).

The company said it was seeing a pronounced shift in its volume mix, driven by customers moving to its Unified Commerce segment – its payment acceptance platform that spans both online and offline payments. Unified Commerce volumes rose by 30% and accounted for 34% of the company’s total volumes in H2, up from 29% in the previous year period, while Digital accounted for 51% of volumes, down from 58% in H2 2024.

Continuing this trend of diversification for Adyen, volumes rose 28% YoY for Platforms – the company’s payment services offering for platform and marketplaces – meaning it took 15% of Adyen’s volume share during H2 25. Platforms net revenue rose 45% YoY to €143.3m, supported by strong underlying growth across SaaS.

Across the full year, Adyen saw 54% of volume from Digital, 32% from Unified Commerce and 15% from Platforms, with Digital seeing its share of volume fall by around 8% while Unified Commerce grew its share by 6% compared to 2024.

Adyen noted that it continues to see benefits from increasingly targeting point of sale (PoS) solutions within its Platforms offering. PoS volumes within the Platform segment grew 59% during H2 2025. Meanwhile, ecommerce was a more significant driver for Unified Commerce in H2, with non-PoS volumes growing 44%.

Having said this, volume growth across all segments was slower than the previous year period. PoS volumes saw strong YoY growth at 27%, driven by expanded partnerships with clients including Starbucks and Uber, but this was lower than 47% in the previous year.

Revenue grows across different regions despite headwinds

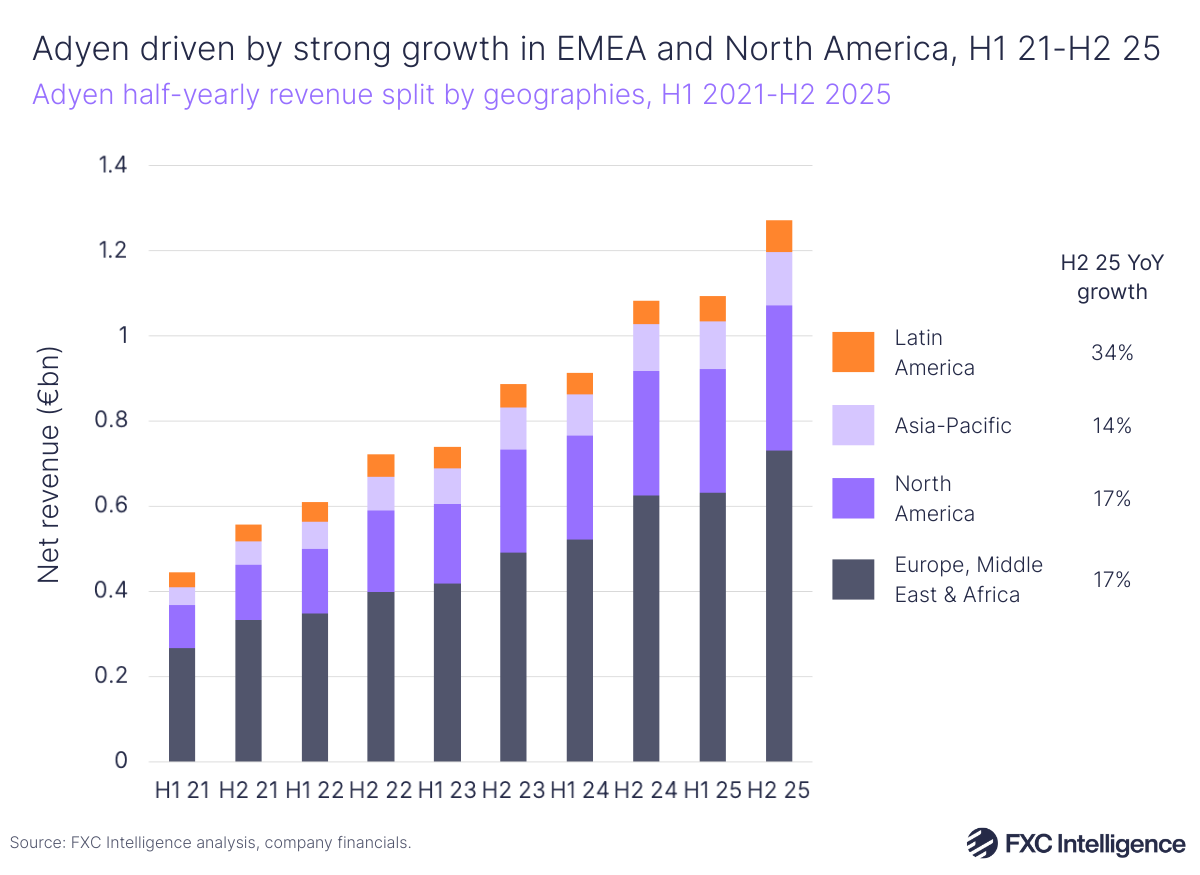

In H2 2025, Adyen saw its fastest revenue growth in Latin America, at 34%, while both Europe, the Middle East and Africa (EMEA) and North America had revenue increases of 17% and APAC grew by 14%. For the full year, Latin America revenue grew by 26%, EMEA rose by 19%, North America saw 18% growth and APAC had an increase of 14%.

EMEA and North America remained the two largest sources of revenue for Adyen, with 58% and 27% of the total revenue share for the company in 2025, respectively. Adyen continued to grow its share of wallet in these regions (i.e. existing merchants are routing a larger proportion of volumes through the company). However, EMEA growth was offset by lower market volume growth, while North America revenue saw headwinds from slower traction among APAC-based online retailers (which have their billing locations in North America), as well as a weaker US dollar.

APAC continued to grow as Adyen grew its relationships with existing customers in the region, while in Latin America the company said it was specifically growing wallet share with international customers.

Adyen’s Intelligent Money Movement targets enterprise opportunity

As part of its earnings, Adyen gave an update on Intelligent Money Movement (IMM), a process which builds on its existing financial products to enable better money management and money movement for enterprises specifically.

Adyen has supported business payments for some time (for example, launching Payout Services in 2023) as well as offering financial products, such as issuing bank accounts and liquidity services. However, in its H2 2025 earnings, the company has highlighted a new focus on capturing more of the flows that are passing through large enterprises with IMM. Initially focusing on marketplaces, travel, mobility and insurance, IMM aims to enable businesses to collect funds, hold balances and pay out to different entities globally through one system.

Adyen says it is targeting this area more due to a continued shift as platforms embed cards into their work, and enterprises want to enable things like payouts without relying on external banking relationships. In particular, it noted that as enterprises scale they can often build up fragmented networks of banks and payment providers to support their treasury operations, which can often increase their risk and visibility into liquidity.

Though IMM builds on Adyen’s product suite, this new framing sees Adyen increasingly focus on its role as building financial infrastructure for businesses beyond payments, which continues a trend we’ve seen of companies in the cross-border space increasingly targeting the B2B opportunity as they mature.

Adyen eyes agentic commerce opportunities as it expands team

Adyen also espoused the benefits of its Dynamic Identification system. Discussed at the company’s investor day in November, this is an “intelligence layer” drawing data from trillions of interactions across payments made through its platform that can create operational benefits for merchants. This data is helping feed into Adyen Uplift, the company’s payments solution that uses AI to help increase conversion rates and reduce the cost of transactions for businesses.

Another area where this could hold significant benefits is in agentic commerce – referring to transactions made by AI-powered ‘agents’ instead of humans. Adyen is currently collaborating with a number of companies in the AI space to develop open standards for agentic commerce, including OpenAI, Google, Cloudflare, Visa and Mastercard.

The company is expanding its platform to enable agent-initiated transactions and says its intelligence could help drive “measurable revenue growth, cost savings and operational efficiency” for merchants. With this said, having done research with its merchants Adyen appears to still be at the development stage of the opportunity. CFO Ethan Tandowsky said during the earnings call that the company is not expecting agentic commerce to drive short-term revenues, but that the company is trying to be in the right position to support customers seeking agentic payments to drive growth over a longer period of time.

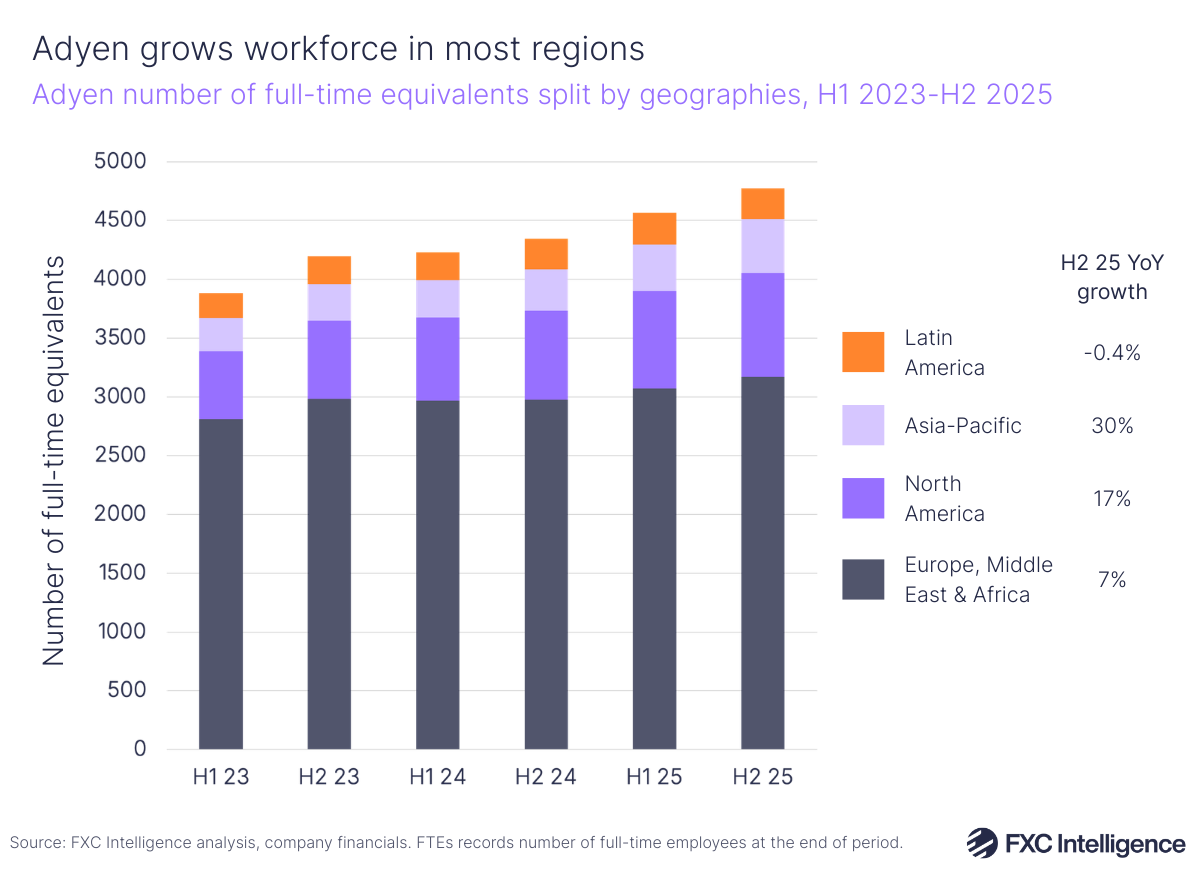

Adyen is targeting growth through its platform products, with a goal of continuing to grow its customers, add to its share of wallet and help customers with new initiatives such as agentic commerce, while growing its team globally. Having added 203 full-time equivalents in H2, to bring its total to 4,771 at the end of 2025, Adyen expects to hire an additional 550 to 650 new team members, primarily in the US.

Going forward, Adyen expects 2026 net revenue of 20-22% YoY on a constant currency basis in 2026. It expects to keep its EBITDA margin “broadly in line” with 2025, and increase this to above 55% by 2028.