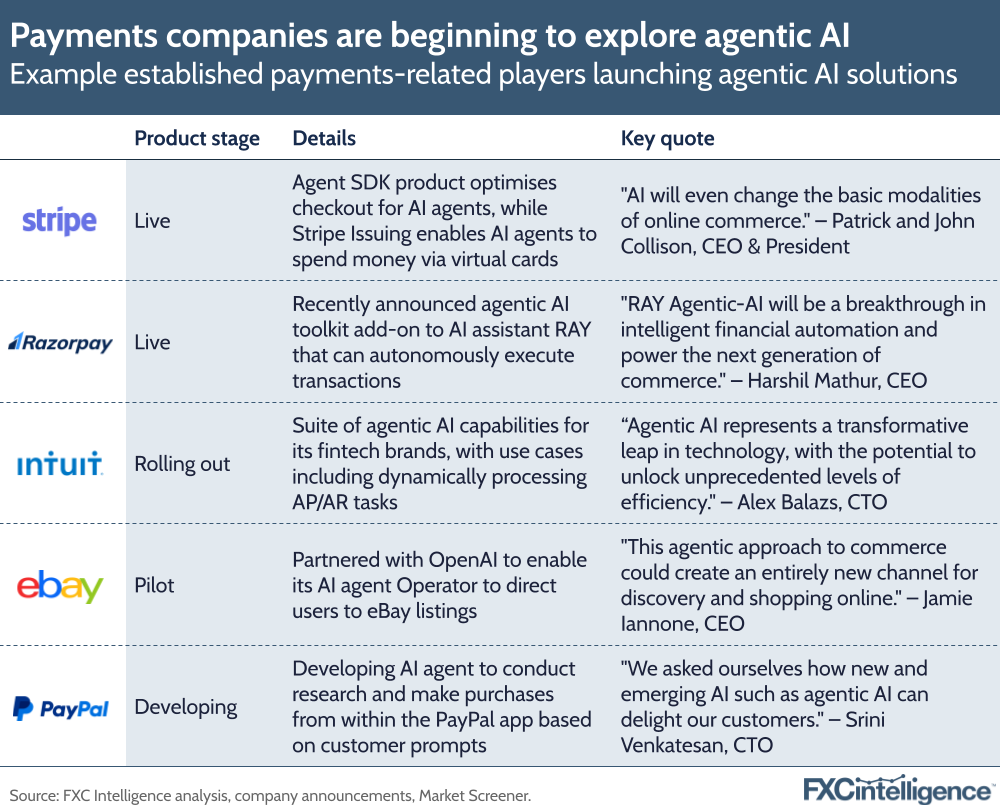

Last week we released a report analysing how payments players were approaching AI, and while much of the focus is on generative AI and its use in tackling issues such as fraud, we also identified agentic AI as a small but fast-growing area that has the potential to be significant for payments.

Agentic AI is a form of artificial intelligence where AI agents, essentially autonomous systems or programs, are used to independently execute ongoing processes, take initiative and make decisions, without human involvement beyond initial instructions. Such agents are intended to learn on the fly from their environment and prior experiences, automate processes with multiple stages and interact with other AI systems or agents as required.

With potential applications including research, shopping agents, customer support, personal assistants, financial management and infrastructure maintenance, agentic AI is emerging as the next major area for artificial intelligence.

There is particular potential in payments, as agentic AI creates a new category of payments – those initiated by AI agents – that can be applied to a broad range of verticals, from consumer ecommerce through to B2B transactions. This requires systems that can not only make the payments but can receive and process them, something that some companies have begun to explore.

PayPal and eBay are among those exploring agentic AI-enhanced shopping, while Stripe has already launched a software development kit designed to improve the shopping experience for AI agents. In time we may see entirely separate payments interfaces designed for AI, helping increase the velocity of transactions made using the technology.