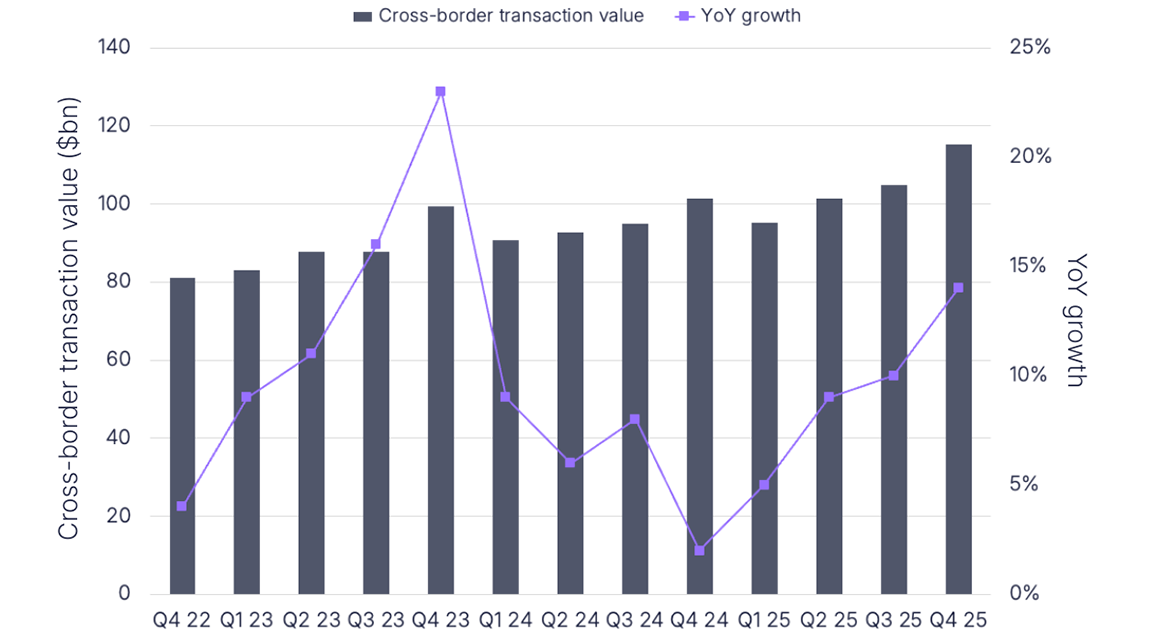

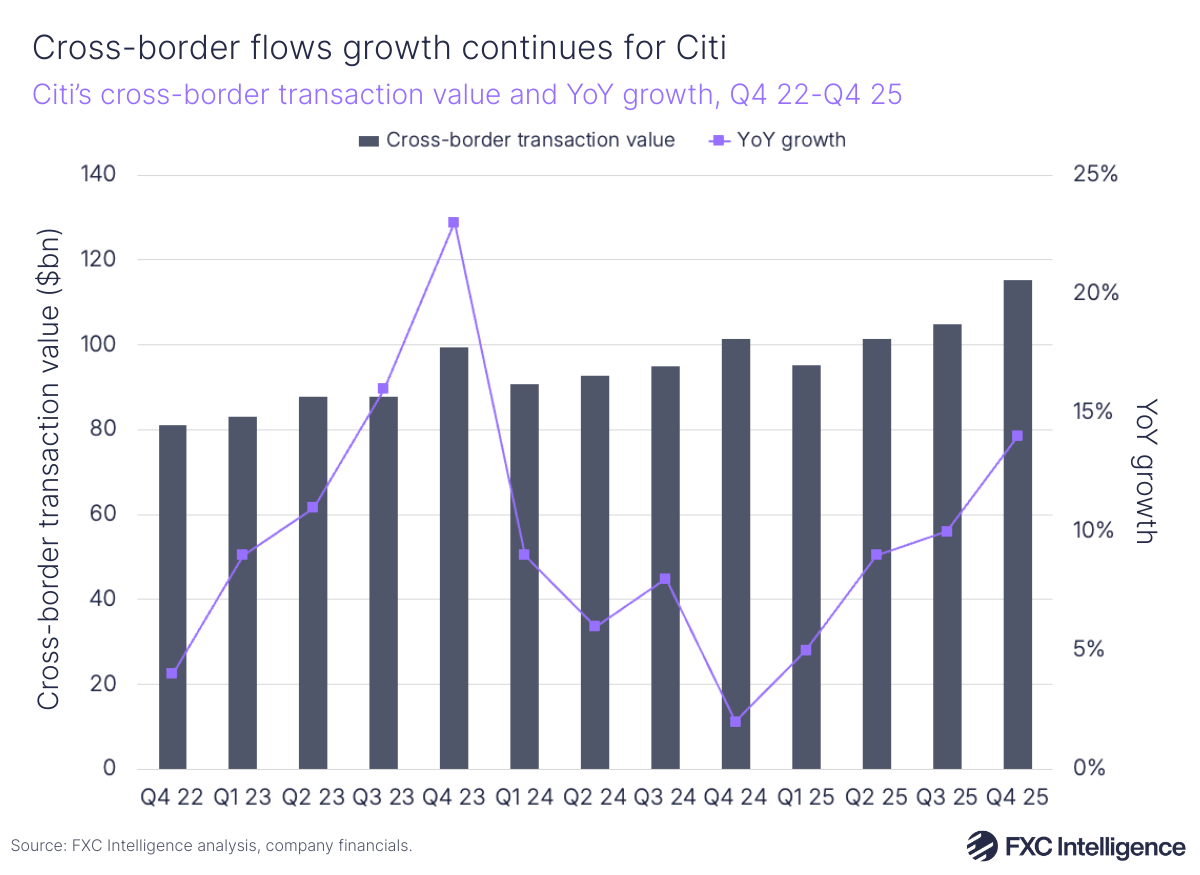

Citi has announced its Q4 2025 results, seeing its overall revenue increase 2% YoY to $19.9bn, alongside a 14% YoY rise in its cross-border transaction volume – the US bank’s fastest growth in this metric since Q4 2023.

In Q4 2025, Citi’s cross-border transaction flows reached $115.2bn, a 10% increase from Q3 and a 14% rise YoY. Looking at 2025 as a whole, cross-border transaction flows rose 10% YoY to $416.4bn. These cross-border flows made up the equivalent of 15% of deposits in Citi’s Treasury and Trade Solutions (TTS) unit, which is reported under the bank’s Services division. For comparison, this ratio was 14% in Q4 2024. Overall, Services saw revenues increase by 15% YoY in Q4 to $5.9bn – accounting for 30% of overall revenues.

Citi saw some headwinds however, with overall net income contracting 13% YoY to $2.5bn, falling below analyst expectations. The bank cited a one-time loss tied to its planned sale of its Russian operations as a key driver behind the drop.

TTS segment overall revenue increased 6% YoY to $4.2bn, though non-interest revenue, which includes the majority of Payments revenue, fell 20% when compared to Q4 2024. Citi CFO Mark Mason said he expects momentum for both TTS and Securities Services to continue, citing growth in assets under custody and administration.

Also during Citi’s earnings call, CEO Jane Fraser highlighted the impact that AI is already having on the bank’s operational capabilities. She explained that the bank is building AI into its money movement and risk management processes and that it is now beginning to focus on how it can use AI tools and automation to improve the client experience and reduce its expenditure. Following the latest earnings call, Citi’s share price closed 3.3% lower than on the previous day, likely driven by the drop in profits despite strong performance elsewhere.