So far, 2025 has been the year of stablecoins in the financial industry. Industry conferences and events have been filled with a flurry of content and conversations about the emerging technology, while many banks and financial institutions have launched a range of related products and services. But how are companies actually thinking about stablecoins? To find out, we take a look at the earnings calls of key industry players.

Since the passing of the US’s GENIUS Act, which aims to create a comprehensive regulatory framework for stablecoins, many companies have ramped up efforts to explore use of the digital assets.

Major companies including PayPal, Visa, Mastercard, HSBC and J.P. Morgan have all already launched some kind of stablecoin-related product, service or feature, with expectations that more are on the way.

To get a better understanding of how this space is evolving, we looked into the Q3 2025 earnings calls of 25 key companies from across the cross-border payments industry, including banks, payment service providers and B2B payments providers.

Stablecoins receive less focus in Q3

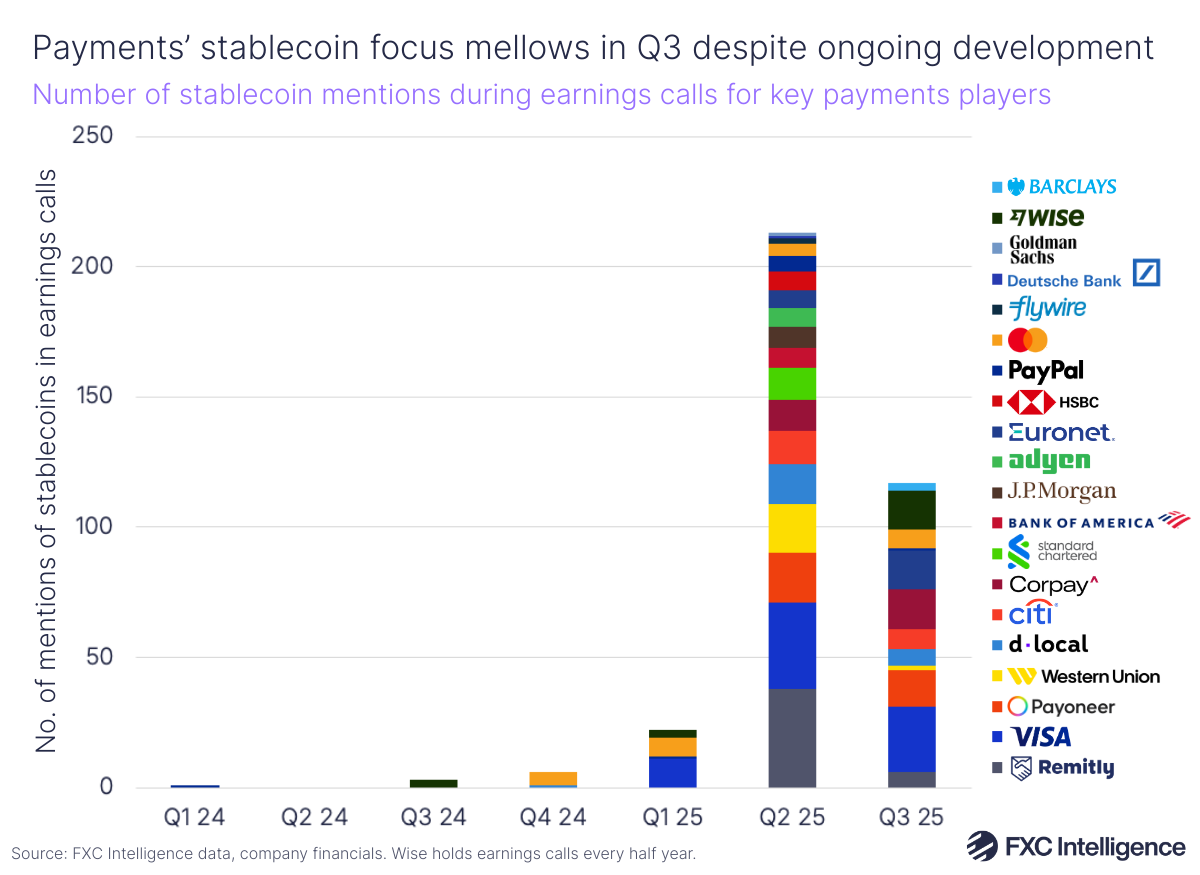

To ascertain how much of a focus organisations are placing on stablecoins, we measured the number of times the term ‘stablecoin’ or equivalent was mentioned during the latest set of earnings calls by the 25 companies.

Overall, there appears to have been a dip in the amount of discussion centred around stablecoins in Q3 earnings calls. Of the companies analysed, 12 (48%) mentioned them at least once in Q3, representing a fall from 18 (72%) in Q2.

However, this decline is not necessarily indicative of a reduction in the amount of stablecoin-related developments. Standard Chartered, Deutsche Bank, J.P. Morgan and HSBC were some of the organisations that discussed stablecoins during their Q2 earnings calls but didn’t in Q3 – despite all of them either actively developing a stablecoin-related product or feature, or already having at least one live.

Of the companies analysed, Visa had the highest number of stablecoin mentions in Q3, with 25 during its earnings call. Corpay, Euronet and Wise took the joint-second spot, with 15 mentions each, while Payoneer followed closely behind with 14.

Wise, which only holds earnings calls every half year, only referenced stablecoins in response to analyst questions. In the past, the company has remained steadfast that the technology doesn’t yet support it in its goal to move money in the fastest and lowest-cost way. However, in October, the company began looking for a product lead in the digital assets space and CEO Kaarmann explained that Wise is investing in its infrastructure to ensure it has “the best on and off-ramps to make use of this new technology”.

Meanwhile, Remitly, which clocked the largest number of stablecoin mentions in Q2 (with 38), focused less on the technology during its latest earnings call, only mentioning it six times while sharing key updates on how it was using them.

Of the analysed companies that did mention stablecoins, Barclays (3), Western Union (2) and PayPal (1) referenced them the least. Barclays’ latest call represented the first time it had discussed the technology, as Group CEO C.S. Venkatakrishnan responded to an analyst’s question, saying that the bank is currently studying stablecoins, with a view to positioning itself to be able to act if it deems necessary. Western Union briefly discussed how it is testing the technology in its earnings presentation, while PayPal simply said it is “aggressively innovating” in stablecoins but did not expand further, despite already having launched its own PYUSD stablecoin.

Key Q3 2025 stablecoin developments

Although there was less focus on stablecoins during the earnings calls, many companies are still working on developing stablecoin-related products and services behind the scenes. Q3 also kicked off with US President Trump signing the GENIUS Act into law; a key development looks to define licensing requirements, reserve standards and consumer protections regarding stablecoins.

Stablecoin market enjoys rapid growth

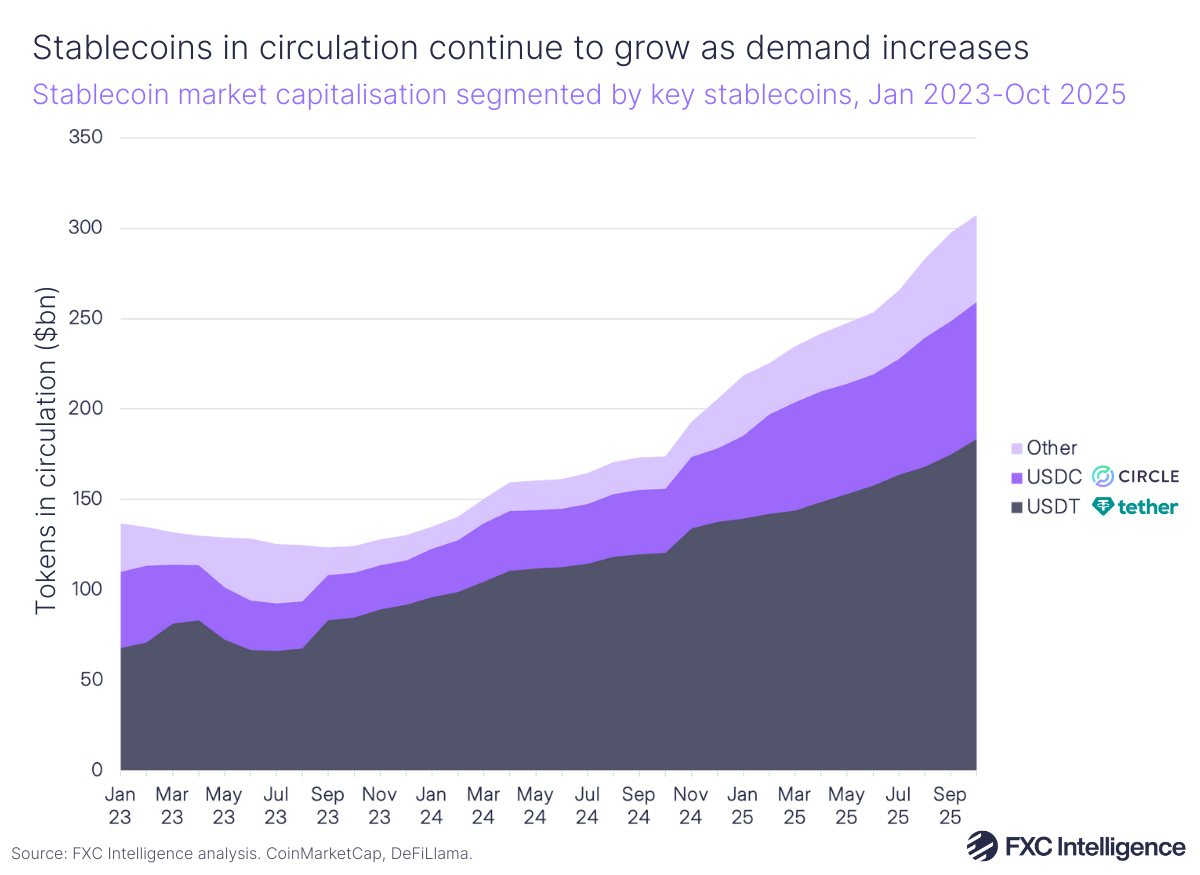

Although attention surrounding stablecoins by major cross-border payment players reduced, the largest stablecoin issuers continued to enjoy significant growth in Q3.

USDC’s issuer Circle reported its second earnings as a publicly traded company in Q3, seeing 66% YoY growth in revenue to $740m. This was largely driven by the success of USDC, which saw its number of tokens in circulation rise 108% YoY to $73.7bn. As a result, USDC saw its share of the total number of stablecoins in circulation increase by more than 400 bps YoY to 25%. Circle also reported a 77% YoY rise of on-chain digital asset wallets holding at least $10 in USDC to 6.3 million.

Meanwhile, Tether continues to dominate market share, with the amount of USDT in circulation rising 52% compared to October 2024, reaching $183.4bn. However, USDT has also seen its own share of total stablecoins in circulation decline – falling 970 bps since October 2024 to 60%.

This trend appears to have started with President Trump’s election in the US, followed by the launch of the GENIUS Act, with which USDT does not comply. In response, Tether has since announced plans to launch a new GENIUS Act-compliant stablecoin: USAT. This highlights the impact the Act has had on the overall stablecoin market, while the continuing increase in tokens in circulation appears to show that demand for them is also on the rise.

How much attention did tokenised deposits receive?

During 2025, a small number of banks have suggested that tokenised deposits may offer a better solution to enabling real-time money movement than stablecoins.

Citi reiterated this stance during its Q3 earnings call, during which CEO Jane Fraser said that the bank has invested “heavily” in this technology and warned of a potential “overfocus” on stablecoins. Despite this, the bank does not appear to have any plans to step away from stablecoins fully, saying it will continue to offer its stablecoin-related services and is still considering issuing its own Citi-branded stablecoin.

Elsewhere, J.P. Morgan’s blockchain business unit Kinexys launched its deposit token JPMD in June, which became available for its institutional clients’ use on Coinbase’s Base blockchain in November. HSBC also offers its own tokenised deposit service.

Despite this, only two of the 25 company earnings calls analysed contained mentions of tokenised deposits. Citi explicitly mentioned them five times, while also discussing integrating its Citi Token Services with its Clearing platform. The only other company that mentioned tokenised deposits was Payoneer during the Q&A portion of its call. CFO Bea Ordonez discussed how the company has integrated Citi’s tokenised deposit technology to enable treasury management use cases.

What’s next for stablecoin usage?

Although the overall mentions of stablecoins were down compared to the last quarter, it is clear that a significant amount of work continues to progress behind the scenes for a number of banks, payment service providers and money transfers operators.

Regulatory clarity in the US looks set to improve throughout the next year thanks to the GENIUS Act, while major European banks begin to take action in response and many players across the globe continue to closely monitor stablecoin progression.

Whether or not the hype that has surrounded stablecoins for much of this year has begun to die down remains to be seen, although their usage looks set to remain, if not grow.