Stablecoins may have set the cross-border payments world alight in recent months, but on the bank side, it is tokenised deposits, a cousin technology of the digital currency, that is often translating into real-world projects.

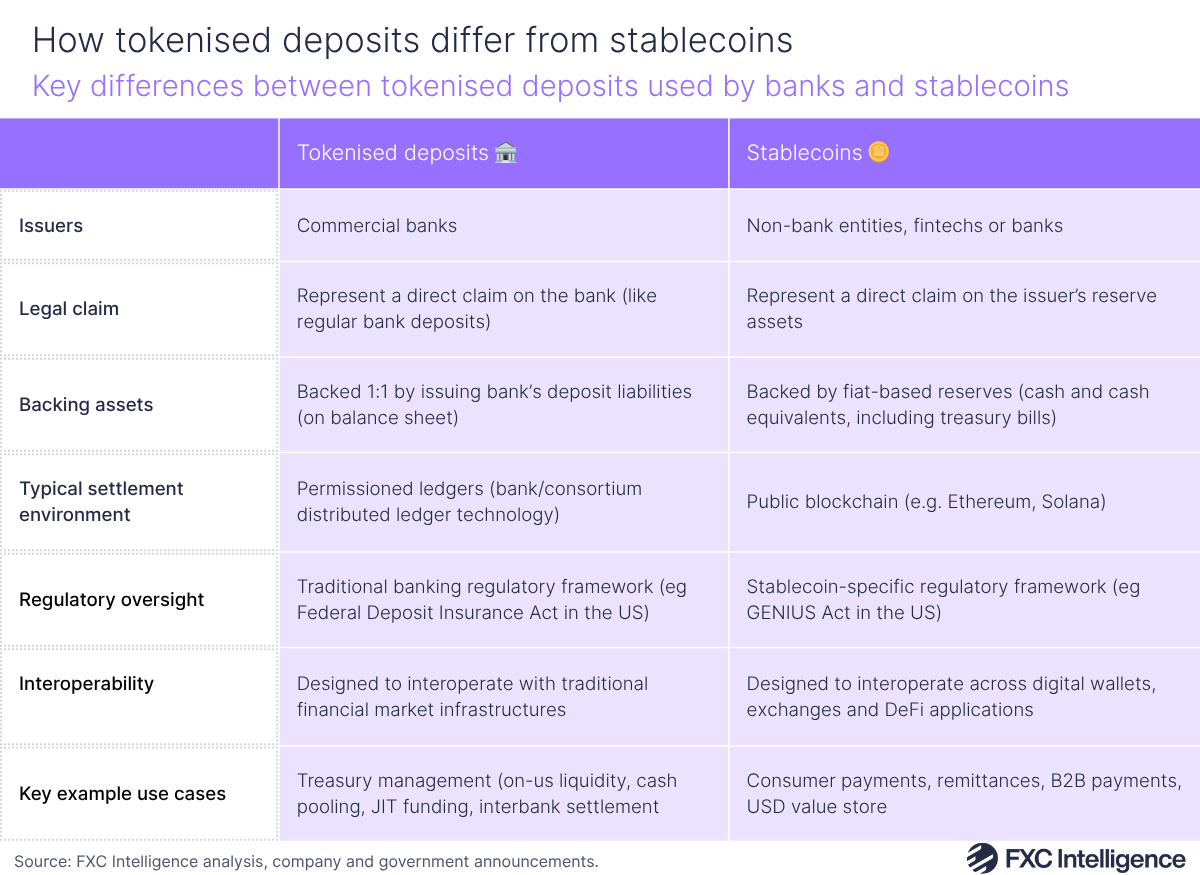

Despite some reporting that may imply otherwise, tokenised deposits are not stablecoins. While both are forms of distributed ledger technology (DLT) – the term for blockchain-based and related technologies that pair decentralised record keeping and consensus mechanisms to provide immutable records of assets – they differ in a number of crucial ways.

Most significant is their backing. Stablecoins are backed 1:1 by fiat reserves, typically cash and cash equivalents, and those reserves have to be maintained at levels matching or above their circulating supply. Tokenised deposits, however, are essentially just digital representations of existing bank deposits. As a result, they are subject to the same rules that oversee bank deposits themselves and do not require banks to hold large amounts of cash and cash equivalents that they cannot use for other banking applications in order to maintain.

They are very similar in many other respects, but with some structural differences. Although both can be used with any form of suitable digital ledger acting as their rails, stablecoins are most commonly used on public blockchain systems, while tokenised deposits are more commonly used on privately run permissioned ledgers that form part of banks’ own treasury management infrastructure.

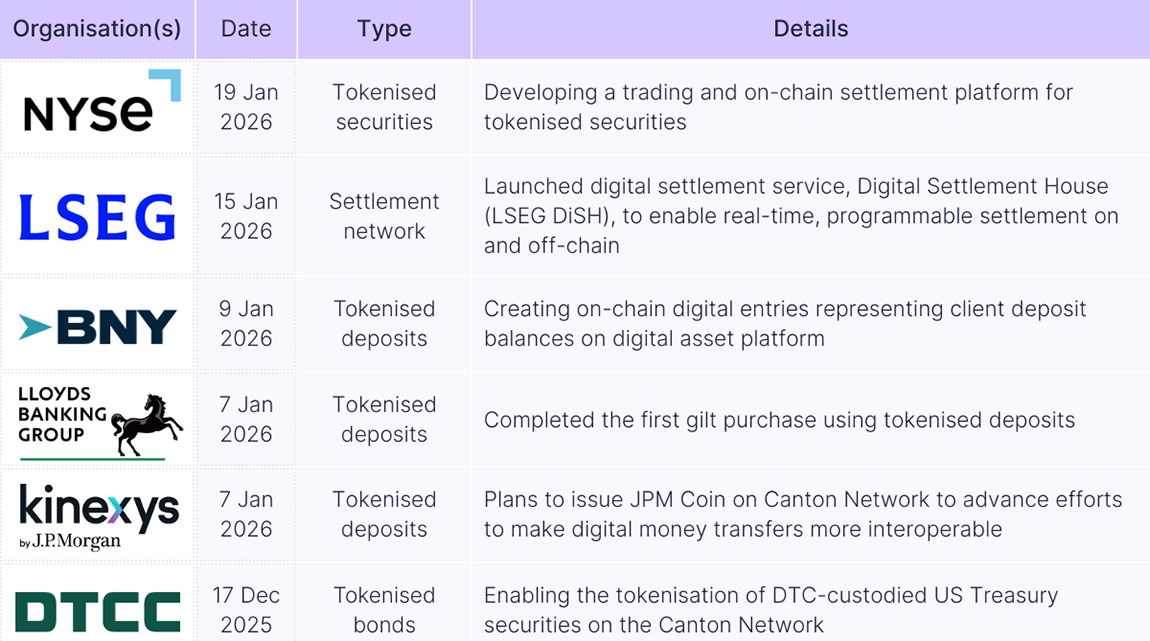

J.P. Morgan’s Kinexys, one of the longest running tokenised deposit solutions, for example, moves an average of $2bn across its own private permissioned blockchain infrastructure each day. However, it has recently launched the pilot of the J.P. Morgan Deposit Token (JPMD) on Coinbase’s public blockchain Base. The reason for this is that while Kinexys enables treasury management for the company’s own clients, using JPMD on a public blockchain would allow clients of the bank to send it to their own clients, who could receive the token itself as a form of payment, despite it ultimately representing a claim on the original bank deposit.

While an early mover in this space, J.P. Morgan is far from the only bank making use of deposit tokens, particularly as a means of treasury management. Last October, Citi launched Citi Token Services for Cash, which is specifically designed for its clients to make 24/7 cross-border transactions. Meanwhile, HSBC announced last week that it had completed its first cross-border transaction using a deposit token, for Ant International, using its new Tokenised Deposit Service.

Meanwhile, in Switzerland a consortium of Post Finance, UBS, Sygnun and the Swiss Bankers Association recently reported on the results of their deposit token feasibility study, in which they concluded that payments between customers of different banks were viable and legally compliant.

Others have also begun working towards their own rollout, with VersaBank piloting the technology in the US and Japan Post Bank working towards a JPY-based launch. There are also reports of similar explorations at other players including SBI Shinsei and Deutsche Bank.

That’s not to say that no bank is exploring stablecoins, however. Societe Generale’s subsidiary SG-Forge, for example, has already launched EURCV, a Euro-backed stablecoin, and in June became the first major bank to launch a dollar-pegged stablecoin when it released USDCV in July.

However, with potentially lower barriers to entry than stablecoins and requirements better in line with their existing infrastructure, tokenised deposits are an appealing option for banks, but time will tell how much adoption they ultimately see within the wider market.