dLocal has continued to report record quarterly growth in Q3 2025, in which it saw strength in Brazil and cross-border volumes offset slowdowns in other markets. In our latest post-earnings call series, we discussed what’s driving dLocal’s performance and strategy with COO Carlos Menendez, with additional insights from Interim CFO Jeff Brown.

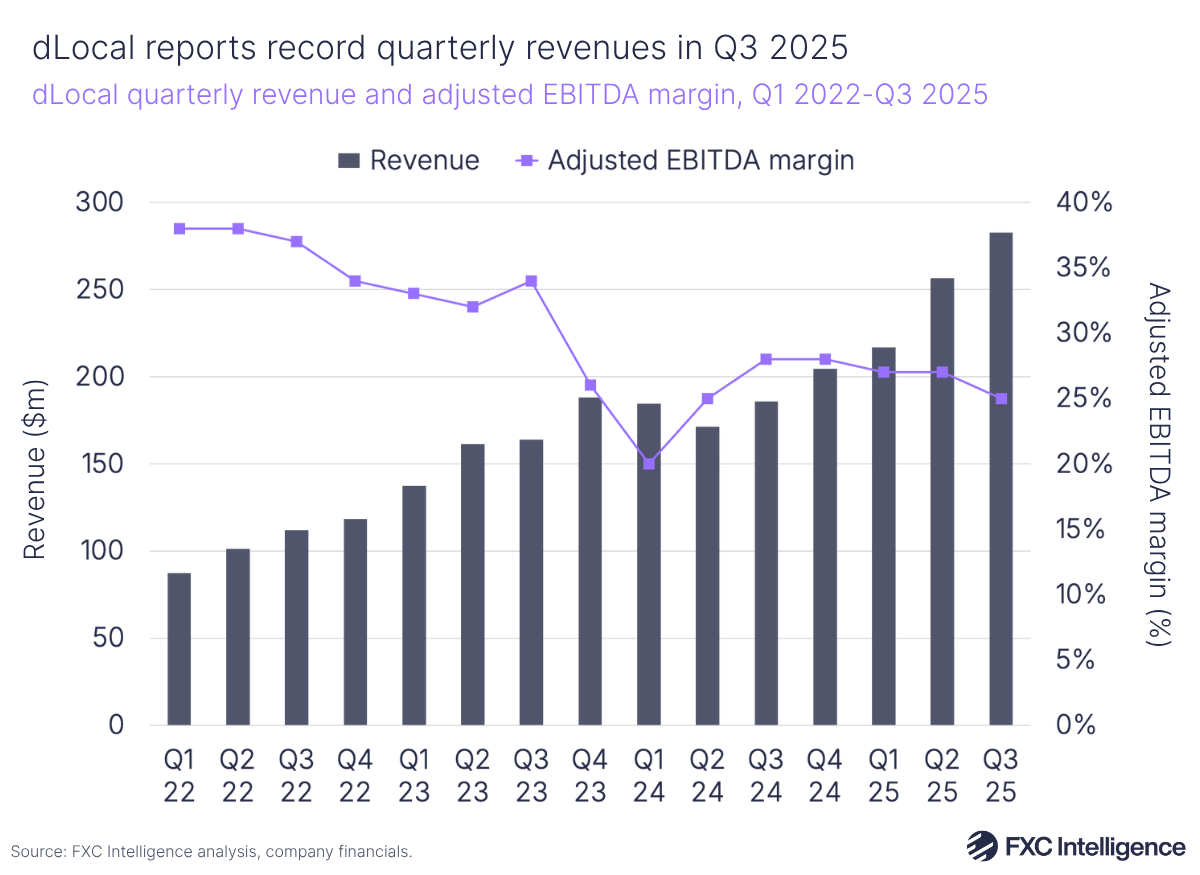

dLocal has reported strong growth in Q3 2025, with quarterly revenue rising by 52% YoY to $282.5m on the back of total payment volume (TPV) rising 59% YoY to $10.4bn.

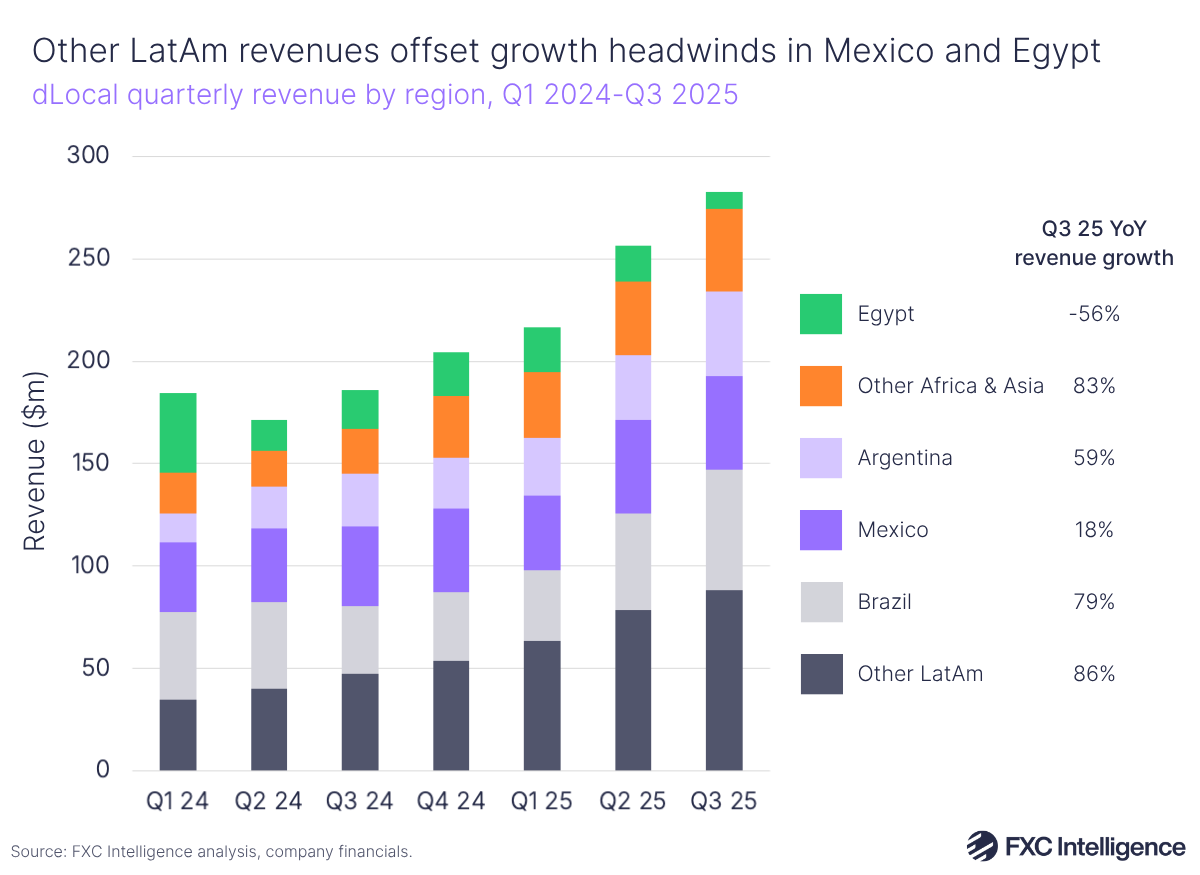

Despite seeing some headwinds in Mexico and Egypt, the Uruguay-based payments processor noted particular strength from its clients in Brazil, Argentina and other markets in LatAm, Africa and Asia.

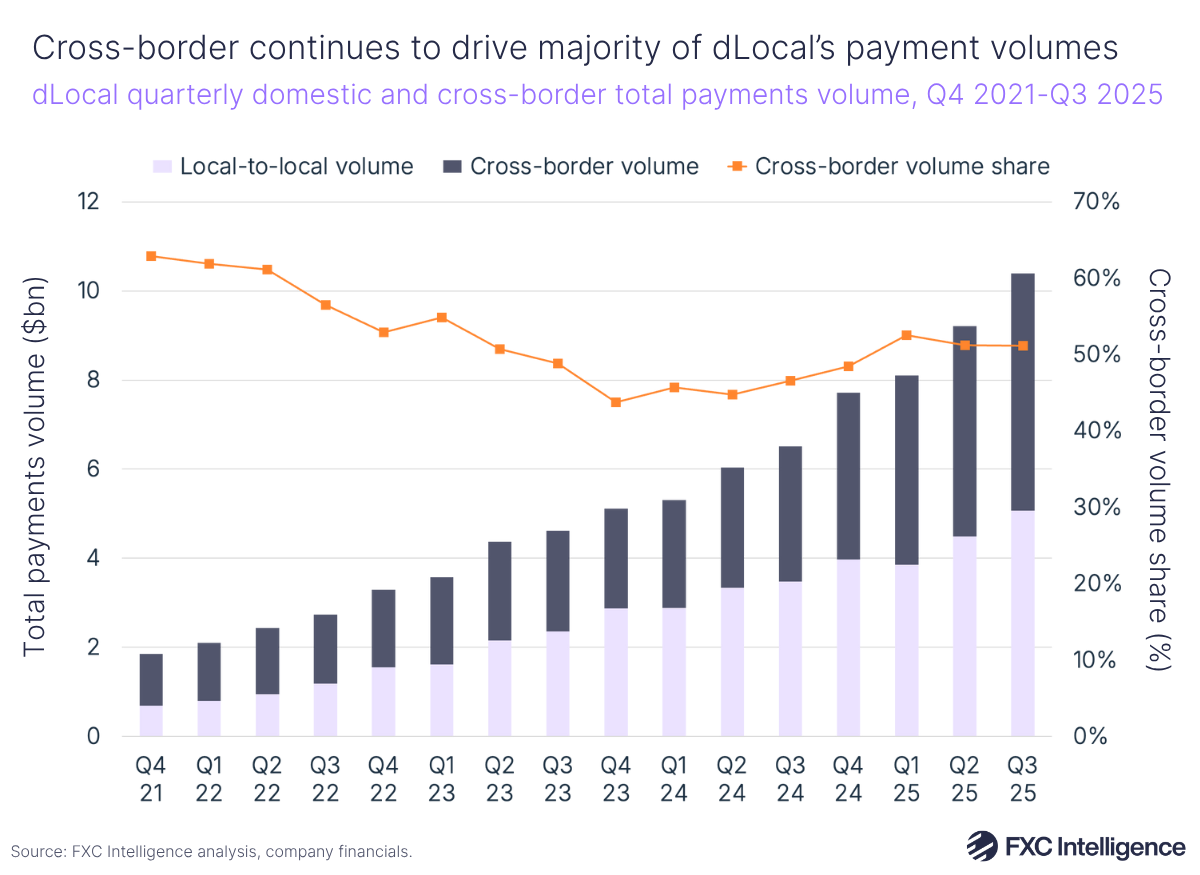

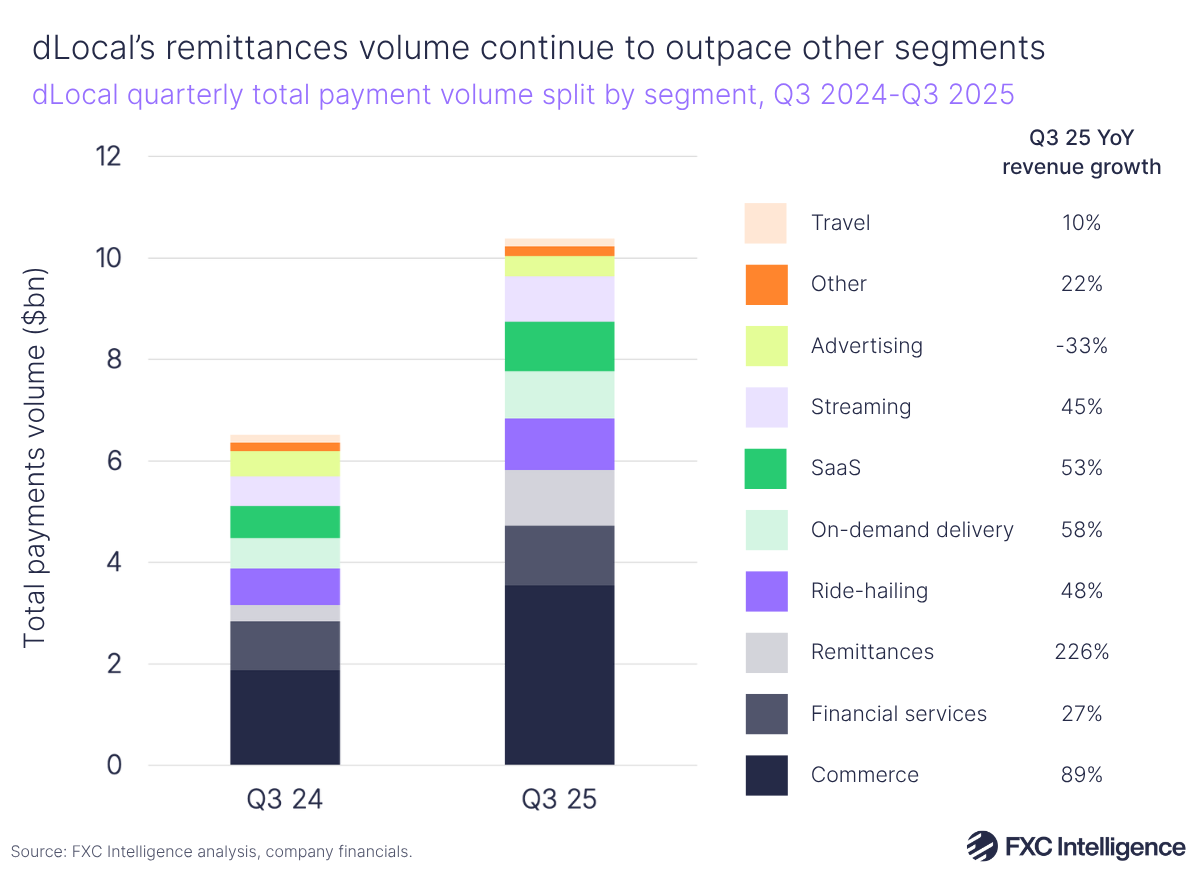

Cross-border payments volume growth continues to significantly outpace local volumes growth and again accounted for the majority of the company’s quarterly volumes in Q3. A strong driver in this has been the company’s Remittances segment, which saw significantly faster volume growth than any other segment at 226%. dLocal also continues to see strong net revenue retention, showing the company’s continued success in upselling existing clients.

dLocal continues to build out its network and partnerships, though it is seeing a particular focus on product innovation, in particular growing its stablecoins presence through its partnerships with stablecoin infrastructure providers Circle and Fireblocks. Aside from this, the company also gave an update on BNPL Fuse, which aggregates local buy now, pay later (BNPL) providers to enable merchants to provide flexible payments through its API, and is increasingly using AI to shore up efficiency across its business.

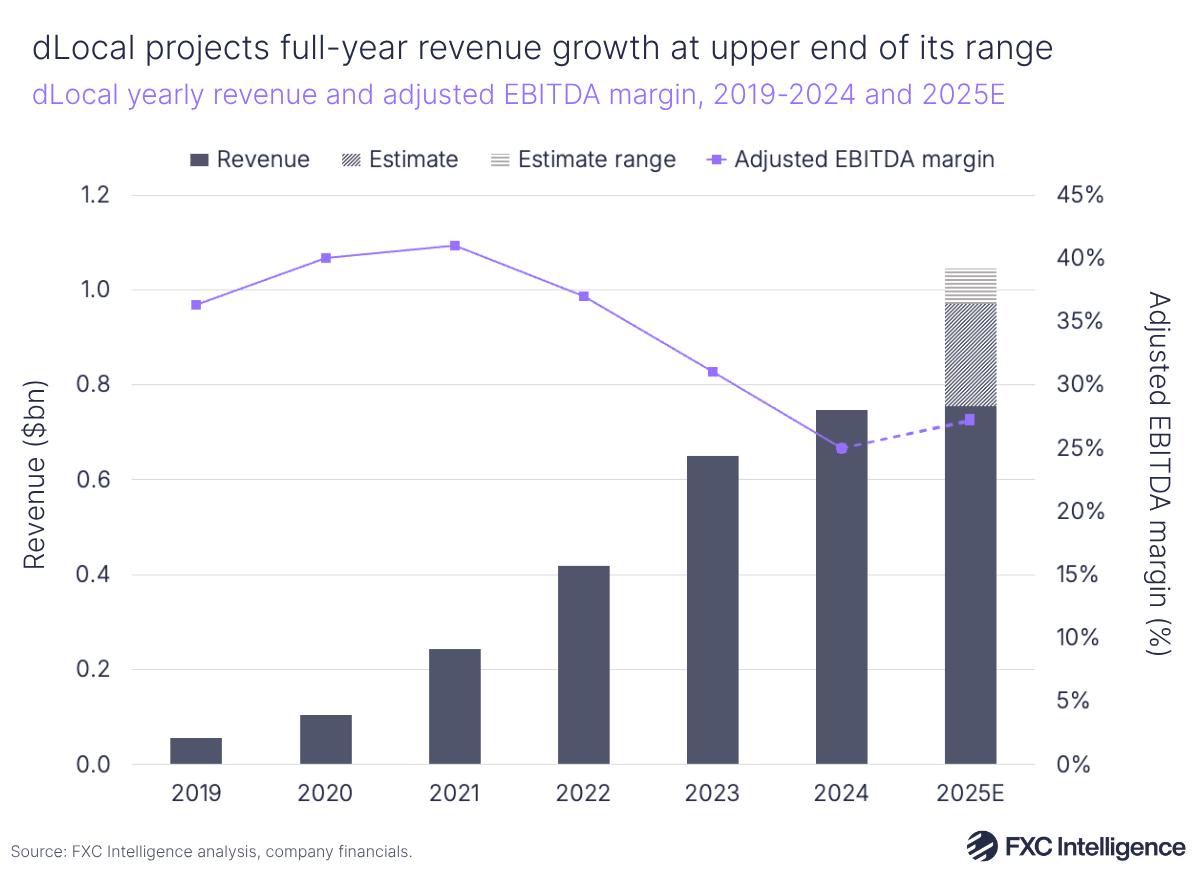

On the back of its results, the company reaffirmed its guidance for 2025, in which it projects dLocal could surpass $1bn in annual revenues at the upper end of its range. To discuss dLocal’s key drivers and ongoing strategy, I spoke to Chief Operating Officer Carlos Menendez and Interim Chief Financial Officer Jeff Brown.

dLocal’s Q3 2025 revenue drivers

Daniel Webber:

Jeff, Carlos, a pleasure to be here with you. Your revenue and TPV volumes are both up for the period – what’s driving that?

Jeff Brown:

TPV was up across all products – pay-ins, payouts, cross-border and local-to-local – and we were really strong across various markets. As you saw in all of our earnings materials, we’re seeing continued growth and customer demand for our products and services. In terms of specific regions, we had a very strong quarter in Brazil and Other Latam, which were really helping us drive results.

Carlos Menendez:

As we continue to grow, we have a follow-your-customer strategy where we launch a market with a particular customer at their demand. But then we also have a strong cross-sell behind that in terms of how we bring in other customers into that same market.

When we talk about the growth, we’re seeing a lot of it is with existing customers, but what we are really getting is further depth in the countries that we are. A lot of the growth that we’ve seen in particular was in Brazil and other markets that are established and continue to grow for us, along with stronger growth outside of LatAm.

dLocal reports record growth in Q3 2025

For the fourth quarter in a row, dLocal reported record quarterly revenue in Q3 2025, with significantly faster growth than the previous period at 52% YoY to $282.5m. This was driven by the company’s payments volume rising 59% YoY to surpass $10bn for the first time.

Based on its revenue and volume figures, the company saw a slightly compressed take rate overall, down from 2.85% in Q3 2024 to 2.72% in Q3 2025. The company also noted that its net take rate (gross profit divided by TPV) fell from 1.07% in Q2 25 to 0.99% in Q3 25 due to a weaker contribution from Egypt, volatility in Argentina and payment mix shifts in Mexico.

dLocal’s Q3 EBITDA represented 70% of its gross profit, which rose by 32% YoY to $103m. The company also noted that its net revenue retention (NRR) has been above 100% since 2020 and rose to 149% in Q3 2025, which was higher than many of its public peers.

On the back of its results, dLocal reiterated its full year guidance ranges from Q2, though it expects its TPV to hit the top end of its 40-50% growth projection, equating to between $35.8bn and $38.4bn. Revenue is expected to hit the upper end of a 30-40% growth range for 2025, equating to $970m-1bn, while adjusted EBITDA is projected to land between the midpoint and upper end of a 40-50% range. This would drive a 27% adjusted EBITDA margin, up from 25% in 2024.

How dLocal is achieving best-in-class net revenue retention

Daniel Webber:

Your NRR numbers are exceptionally strong. What is driving your number higher than competitors’?

Carlos Menendez:

We open markets at our customers’ behest where they want to expand and grow, but then we push very strongly to bring in new customers and drive their volume.

The NRR figure is really an output of the quality of our service, the connectivity and the ability to take care of all payment types in a market. Our customers trust what we’re delivering to them, and they take their growth and they give it to us.

When Pedro [dLocal CEO Pedro Arnt] and the whole team raised the public estimates in terms of volume, it was that ongoing reflection that we were hearing from our customers that were extremely happy with our level of service, our economics and our global coverage. I can’t think of another public competitor that we have that lets you get so many markets with one API. We come across regional competition but from a global basis, we are the key leaders.

Jeff Brown:

[We have] so many markets and so many APMs [alternative payment methods], and so many payment methods as well. It’s the interlay of the two.

Remittances and cross-border services drive volumes

Daniel Webber:

Remittances is an exceptionally strong area for you now. Talk us through what’s really working for remittances, why that’s resonating and why it’s a good fit for you.

Carlos Menendez

We started as a collections business, effectively. We are collecting payments on behalf of our merchants who are selling things around the world. That tends to bring us to a position where we’re long in the currency in a market. And so, we start with a fair amount of reais and pesos and so on.

In those markets, we can provide competitive rates to companies that are doing remittances in those markets and looking to get local currency. So that really is a virtuous cycle where we’re building up the volume in one area of the business on the pay-in side, allowing us to be very competitive on the other side.

Not only do you get long in a currency, but you also have all the operational scale of having the local licences, bank accounts and connections for the last mile, and you can really make that delivery quite a nice business.

Breaking down dLocal’s performance by segment

dLocal’s cross-border volume growth continues to outpace local-to-local volume growth. The former saw 75% YoY growth to $5.3bn – 51% of TPV – while local volumes grew 46% to $5.1bn.

Remittances continued to grow faster than other segments, at 226%, including dLocal’s largest contributors Commerce, which grew 89%, and Financial Services, which rose 27%. Based on its outlier growth and the way dLocal has presented different segments in its Q3 presentation, Remittances has become a significantly more important segment as part of its overall mix.

Pay-ins reached $7.2bn, up 55% YoY. Meanwhile, payouts remained a lower portion of dLocal’s mix at $3.2bn, but saw faster growth at 70%, driven by Commerce, Remittances and Financial services. The rest of dLocal’s segments – which span Ride-hailing, On-demand delivery, SaaS, Streaming, Advertising, Travel and Other services – all rose at a double-digit percentage growth rate except for Advertising, which fell by 33%.

Separately, dLocal’s BNPL Fuse is now live in six countries, with two more to follow across LatAm, Africa, the Middle East and Asia. The solution is focused on local volumes and offers a higher take rate on payment volumes than other local payments through a revenue sharing model that dLocal has local partners. However, the company doesn’t see this as leading to a significant shift in mix back towards local volumes and away from cross-border.

dLocal’s move into the BNPL market

Daniel Webber:

You’ve been expanding into BNPL. Who are you serving there and where are you seeing traction?

Carlos Menendez:

That’s a great area and it speaks to two things: cards and APMs. When we talk about APMs, a lot of the strategy there is about bringing effective, established card functionality to the APM market.

We have a world where some people have access to traditional credit cards and others don’t, but everybody wants some access to credit and that’s a proven innovation we can focus on. With BNPL Fuse, we can give our merchant partners access to multiple BNPL offerings in various markets via one API connection. So it’s really our innovation strategy that focuses on proven customer and merchant needs around the world and how we facilitate that and tie the two ends together.

This is not our balance sheet, to be super clear. We are not lending money, but we’re facilitating a one-to-many connection. So this is something you’ll hear more about. BNPL and sales finance are well-established consumer desires – particularly as you approach many of the holiday seasons around the world – and it’s about having their dollars stretch a bit further. From our merchant side, you get a lot of interest in driving more sales, which is connected to what we can do with our local expertise.

Jeff Brown:

To reiterate, we’re not taking any credit risk here. We’re providing the middleware between BNPL players and our merchants.

dLocal’s stablecoins strategy

Daniel Webber:

Walk us through what you’re doing in stablecoins and the use cases that you’re focusing on.

Carlos Menendez:

We basically have a three-pronged stablecoin strategy. One prong is the treasury side of it, where effectively we’re using stablecoins to move money around the world quicker and independent of bank holidays and opening hours. So, the treasury team uses that as needed for internal positioning. Secondly, we have another strategy of facilitating payments for merchants who want to accept stablecoins.

The third element is the on and off-ramp. We’re part of the Circle Network. We’ve recently joined them on their Arc platform. It’s really about, once again, leveraging the deep local currency we have.

We were part of Circle’s network before to facilitate on and off-ramps, because although people could in theory spend stablecoins, really the demand is for moving the money around. Then at some point you need to buy local goods with it, and that’s where the fiat element comes into play.

dLocal partnerships target emerging markets and product innovation

Through its partnerships with global brands and fintechs such as Western Union, Capitec and Nigerian neobank Grey, dLocal is continuing to position itself as a leader in emerging markets.

During the quarter, the company also extended its reach into stablecoins, partnering with infrastructure provider Fireblocks to plug its payments infrastructure into Fireblock’s on/off-ramp ecosystem. After the earnings call, dLocal announced that the company is partnering with US-based remittances provider Félix, to enable instant stablecoin-funded transfers through WhatsApp to Mexico, Guatemala, Honduras and El Salvador.

Also in Q3, dLocal announced it was one of many payments providers collaborating with Google on its Agent Payments Protocol – a new standard the company is working on to try and unify how transactions are made through AI agents.

How tokenisation bolsters payments security

Daniel Webber:

Can you walk us through how you approach payments tokenisation and why it’s important?

Carlos Menendez:

We focus on innovation in proven areas in the payment space. One of the key needs underneath APMs, besides credit, is the security of the transaction.

By tokenising the transaction, you’re protecting the underlying transfer and the underlying consumer because you have a single use or token (in some cases for recurring payments) separate from the underlying indexation of the account that facilitates ongoing sales while protecting your information underneath it.

There’s demand from consumers to make sure that this is a safe way to pay and tokenisation addresses that.

Daniel Webber:

Who is your typical customer for that?

Carlos Menendez:

This is a value-add for our merchant customer. It puts in a tokenised anonymous element identifying the underlying APM transaction methodology, similar to how tokenisation works in credit and debit cards, so that you can just hit the in-between number without risking the underlying credentials from a fraud and security perspective.

We continue to add integrations and markets as we have discussed in the past. But primarily, we are working on BNPL, tokenisation and general APM expansion; those are the main elements.

Revenue growth shifts across core markets

dLocal continued to see strength in its core markets, though some headwinds changed its key revenue drivers in Q3 2025. LatAm remained key to the company’s revenue, growing 61% YoY to $234m and accounting for 83% of dLocal’s revenue. This was spurred by 86% growth in Other LatAm revenues as well as rebound in Brazil, which saw revenue growth of 79% after several quarters of low or even negative growth, while Argentina grew 59% and Mexico grew 18%.

Geographic diversification continued to drive gross profits overall, with these rising 47% YoY in Other LatAm markets, 41% YoY in Other Africa & Asia, 76% YoY in Argentina and 90% YoY in Brazil. By contrast, gross profits fell 22% in Mexico and 41% in Egypt.

The company linked Brazil’s rebound to a strong reacceleration in growth across some of its global relationships, combined with some additions from 2024 and some recent wins. It also said that Brazil has a higher share of cross-border and take rate composition than Mexico, where a recent increase in tariffs for low-value goods has caused a slowdown in its business.

In Argentina, the company noted gross profits fell 16% QoQ due to spread compression, higher processing costs and inflation, though TPV has been recovering after the country’s recent elections. The country accounts for 11% of the company’s gross profit and therefore, Arnt said, should not see an overfocus from investors.

Africa and Asia revenue grew 19% to $48.2m, and excluding Egypt – where the company saw impacts from losing wallet share with a major merchant that it had also mentioned in Q2 – the region’s revenue rose by 83%. dLocal flagged some wider risks, including ongoing changes in Brazil’s fiscal and tax regime as well as FX regime shifts or devaluations in emerging markets such as Egypt and Bolivia. Having said this, it also noted that overall gross profit rose by 4% QoQ driven by volume growth across frontier markets, including strong performance in Colombia, Bolivia and Nigeria.

How AI drives efficiency, fraud detection and customer service

Daniel Webber:

How are you using AI at dLocal and what’s been the impact of that?

Carlos Menendez:

Without a doubt, AI is a rising tide that we are all part of. Besides internal AI tools, which we are using to [reduce] administrative burden and drive more productivity from employees themselves, we have strong AI use in a few areas.

In the fraud area, for example, with modelling and handling of chargebacks, the AI processes we’re putting in there has allowed us to get better win rates, fraud prevention and authorisation. We have smart routing, for which we use AI to determine the optimal way to approve a transaction, based on ongoing data sets.

We are also using AI for the first layer of our customer service responses. When we get enquiries, they tend to be very similar and repetitive. We have been able to use AI to facilitate those interactions and improve the SLAs for our merchants and our consumers.

Finally, we’re a technology-first firm – we have a lot of engineers and tech specialists and so on, and AI is increasing their productivity in terms of coding and facilitating growth in the maintenance of the underlying platform.We’re seeing that ripple through the organisation, too.

Those are the main areas where we’re using AI effectively: to approve more transactions, fight fraud, reply to customers better and just continue improving the underlying platform in a more efficient manner.

Daniel Webber:

Carlos, Jeff, thank you.

Carlos Menendez and Jeff Brown:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.