Wise reported strong results in its financial H1 2026 earnings, equivalent to calendar Q2 and Q3 2025, in which the global money transfer company saw a 12% YoY rise in revenue for the period to £658m.

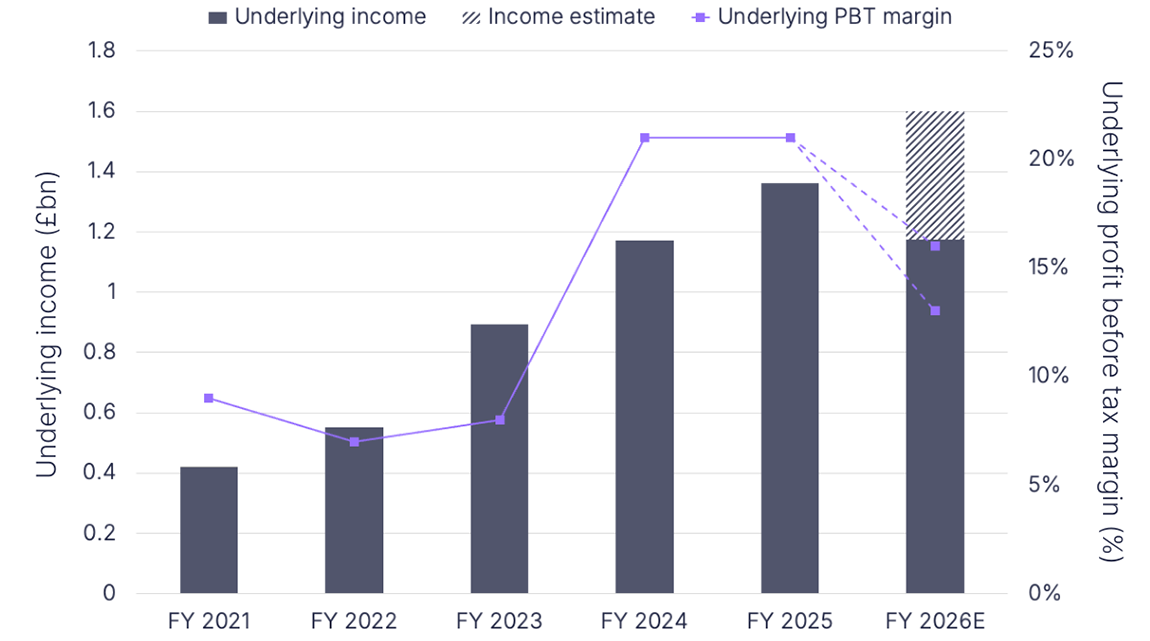

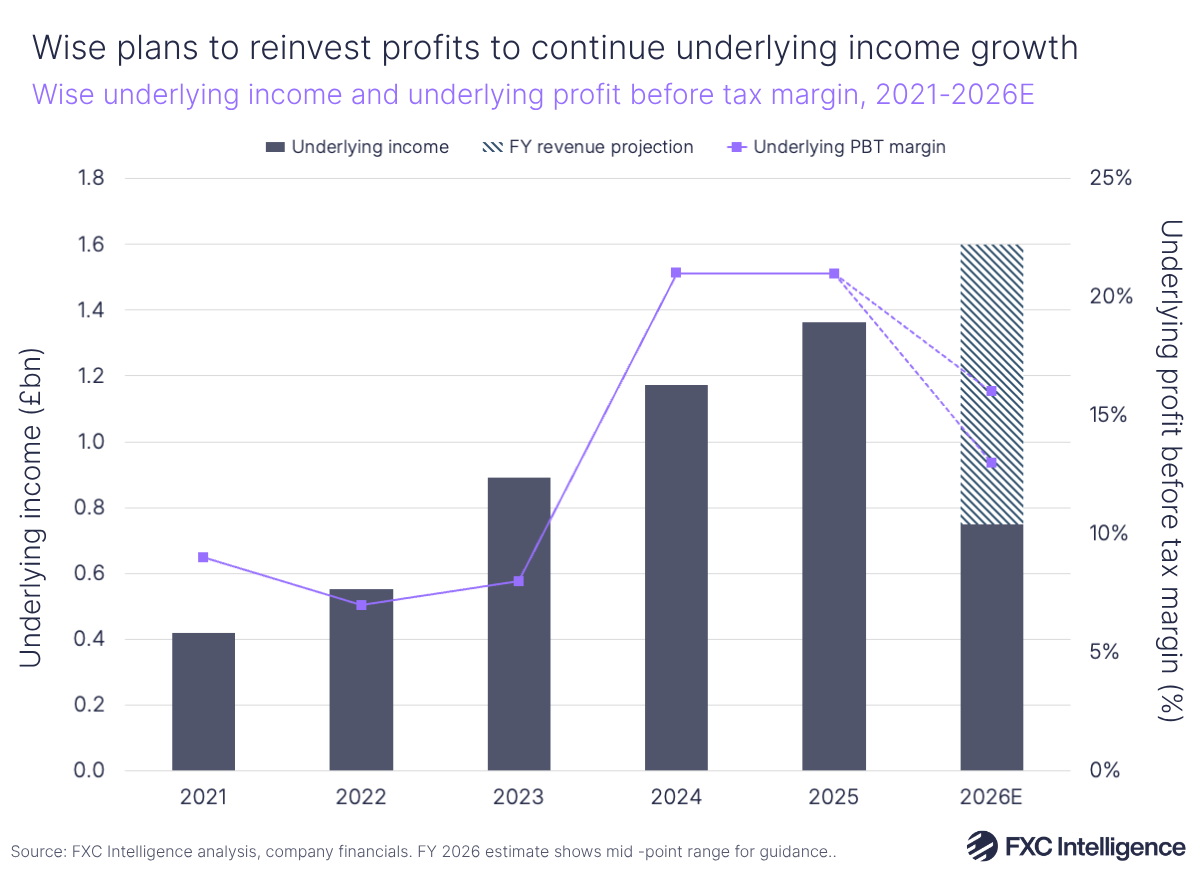

On a quarterly basis, Wise’s underlying income grew 15% YoY to £387.5m, bringing its H1 underlying income to £749.5m. The company’s underlying profit before tax (PBT) margin was 16.3%, while it has plans to move towards an underlying PBT margin of 16% for FY26 – the top end of its medium-term guidance of 13-16%. Wise says it hopes to remain within this bracket by continuing to invest in its infrastructure, marketing and products, which it ultimately hopes will improve transaction speeds and unit cost.

Wise’s number of active customers continued to grow at a steady rate, increasing 18% YoY to 13.4 million in financial H1 2026. Its number of active consumer and business customers grew at a similar rate within this, increasing 18% and 17% YoY respectively. During the earnings call, Wise CEO Kristo Kaarmann explained that around 70% of people currently discover the company through word of mouth. Marketing spend has increased significantly however, rising 52% YoY in H1 26, as Wise attempts to accelerate the growth of its customer base through further brand awareness initiatives.

Cross-border end volume increased by 24% in both Q2 (to £43.7bn) and H1 (to £84.9bn). This increase was largely driven by growth in Wise’s business volumes, which rose by 38% YoY compared to financial Q2 2025 and 35% YoY compared to H1 2025. Meanwhile, consumer volumes also grew, although at a slower rate, rising 20% YoY in both Q2 2026 and H1 2026. Volume per customer also increased, rising 2% YoY for personal customers and by 15% for business customers in Q2 2026.

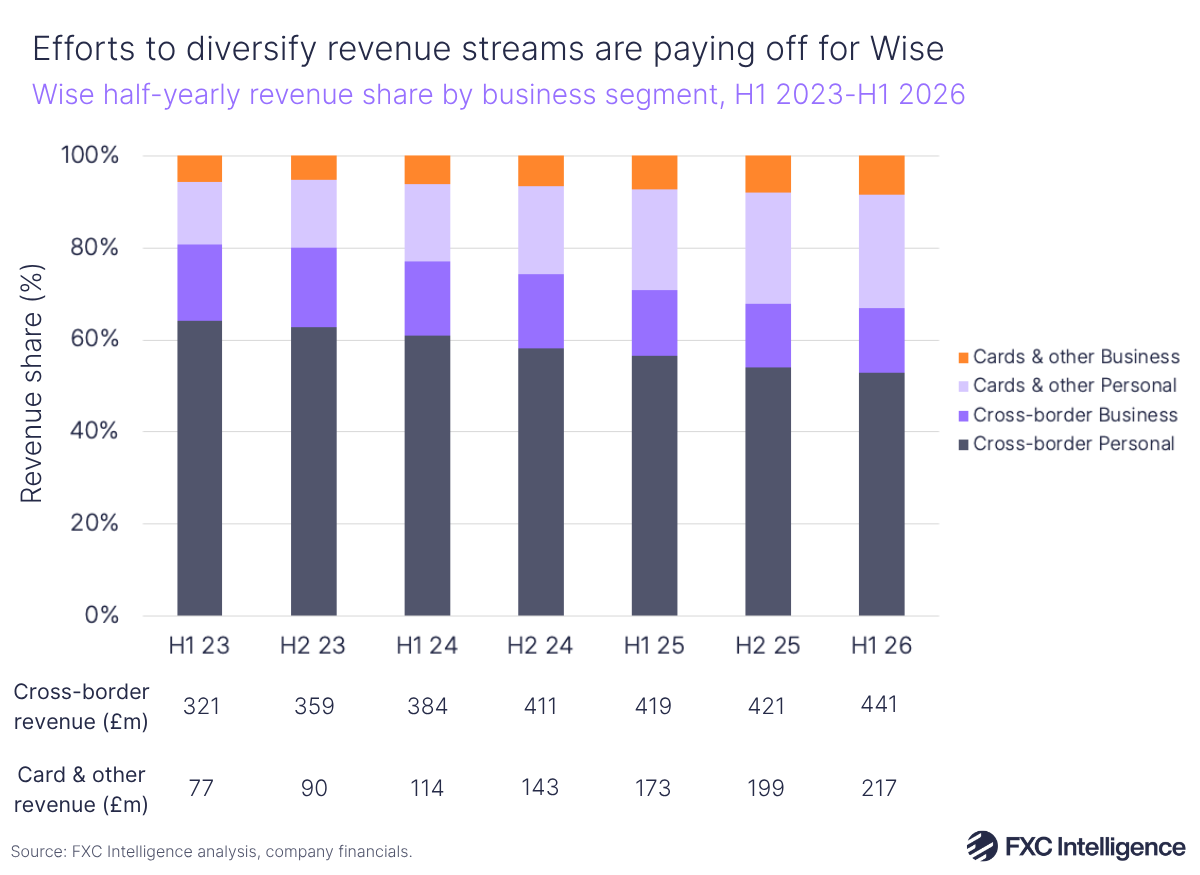

Cross-border revenue grew by 5% YoY to £441m in H1 26, although accounted for a lower share of overall revenue – falling from 71% in H1 25 to 67% in H1 26 as Wise looks to diversify its revenue base and create multiple growth engines. This came as card and other revenue streams (covering Wise’s non-cross-border revenues) increased 26% YoY to £217.1m in H1 26. Consumers continue to drive Wise’s bottom line, accounting for 79% of cross-border revenues and 74% of card and other revenues.

Stablecoins became a recurring topic of discussion during the latest earnings call as the CEO fielded a number of questions about Wise’s position on the technology. In the past, Wise has largely remained steadfast that stablecoins don’t yet support it in its goal to move money in the fastest and lowest-cost way. However, in October, the company began looking for a product lead in the digital assets space, potentially signalling a softening in this stance. During the earnings call, Kaarmann explained that Wise is investing in its infrastructure to ensure it has “the best on and off-ramps to make use of this new technology”.

Despite increases in a wide range of metrics, Wise’s share price fell slightly following the call. This fall was likely caused by a drop in the company’s reported profit before tax, which decreased by 13% YoY to £254.6m. However, Wise will undoubtedly look to continue its growth in the coming quarters, with plans to make further improvements to its underlying payments infrastructure and its pricing to establish itself as one of the lowest-cost money transfer providers.