Corpay beat its Q3 revenue projections on the back of strong corporate payments growth and recent acquisitions, and is now targeting further opportunities with stablecoins. We spoke to Group President at Corpay Cross-Border Solutions Mark Frey to explore what’s driving the company’s global payments arm.

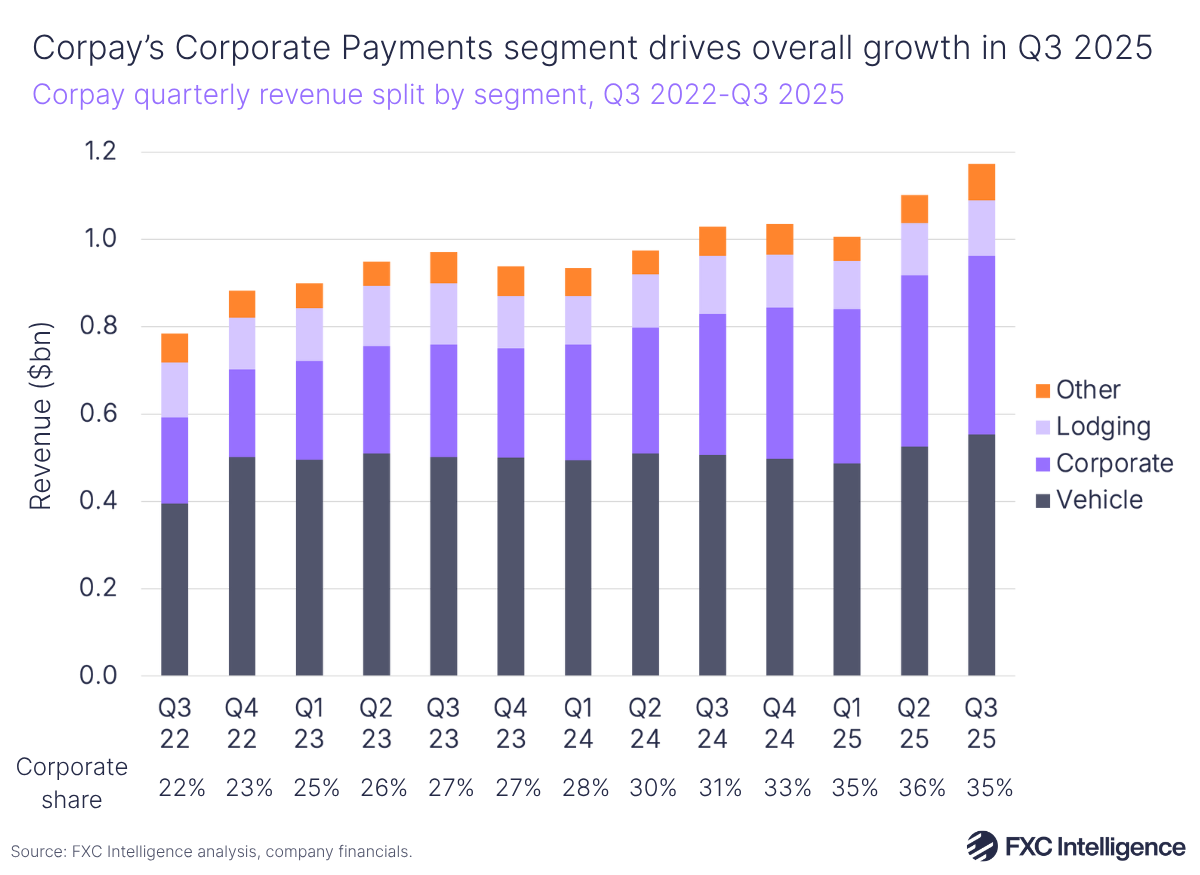

Corpay saw another successful quarter in Q3 2025, with revenue rising 14% to $1.2bn on the back of continued growth of its Corporate Payments segment.

Cross-border is a key area for Corpay’s future growth, with Corporate Payments revenue rising by 27% to $410m and taking a 35% share of Corpay’s overall revenues, up from 31% in Q3 2024.

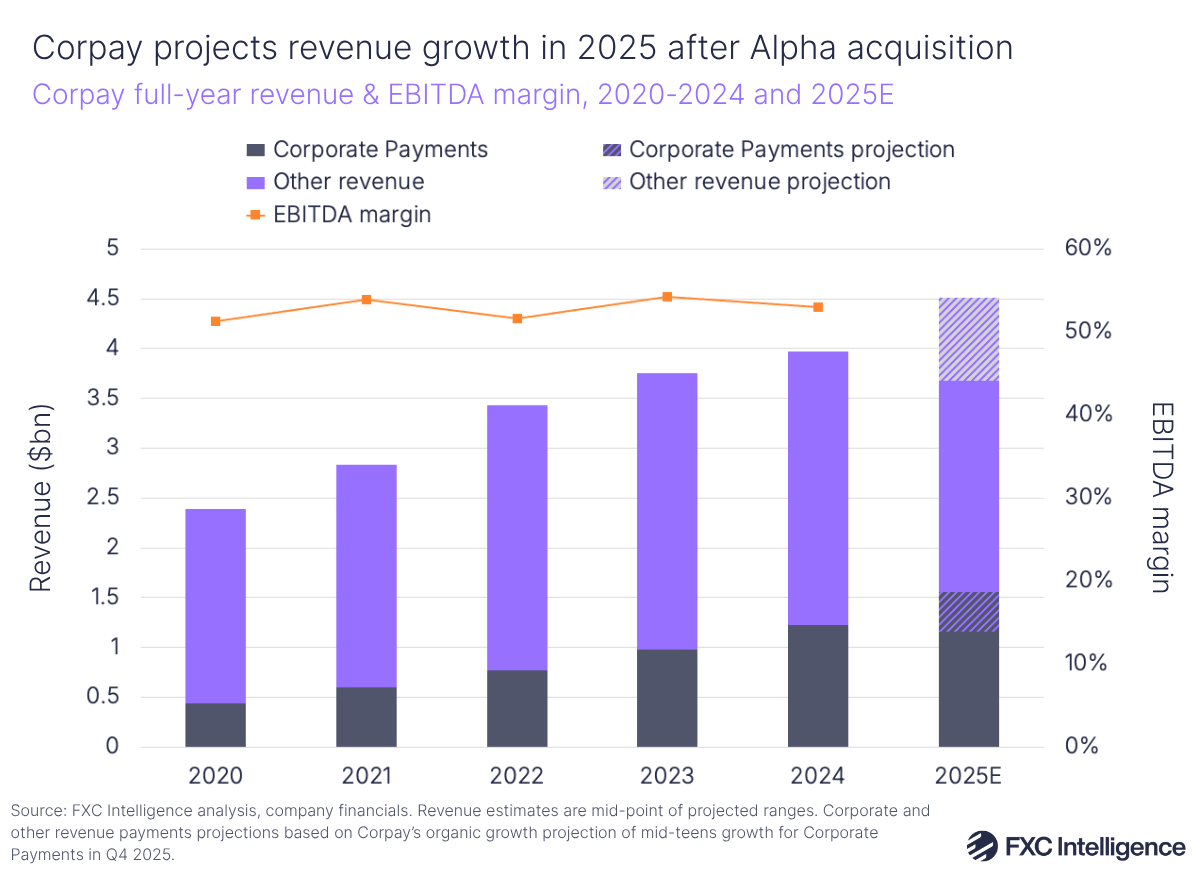

The company is supporting this with key acquisitions, including Alpha and a 34% stake in AvidXchange, alongside which it sees key potential for on and off-ramping using stablecoins in partnership with Circle. It continues to target growth across four key areas within its Corporate Payments channel: spend management, AP automation, cross-border risk management and global bank accounts.

To find out what’s driving Corpay’s recent performance and how Alpha and stablecoins are set to transform the company’s strategy going forward, we spoke to Group President at Corpay Cross-Border Solutions Mark Frey.

Corpay’s Corporate Payments key drivers for Q3 2025

Daniel Webber:

Mark, I know it’s been a very busy autumn with closing the Alpha deal, and the Corporate Payments business continues to be a great driver. Talk us through what’s driving growth for Corpay.

Mark Frey:

Speaking specifically about our business in cross-border, it was a very successful quarter. Again, record sales performance overall, running a little bit ahead of expectations, and that allowed us, in conjunction with Corpay overall, to issue a beat and a raise [an outperformance of expectations leading to increased future projections] going forward for Q4.

New business continues to be very strong. We continue to see a very active and building pipeline in the financial institutions business. Our on-ramp, off-ramp business continues to build momentum and we continue to see big client wins in that area, leveraging our fiat currency rails.

We’re doing lots of work around stablecoins and digital currencies today, which is not resulting in economics yet but we’re building that infrastructure for the future. Our hedging business continues to do well. Our payments business is thriving right now. The alternative banking solutions and our bank and account products that we sell to corporates, financial institutions and private markets are really beginning to take hold in the marketplace and are performing quite well.

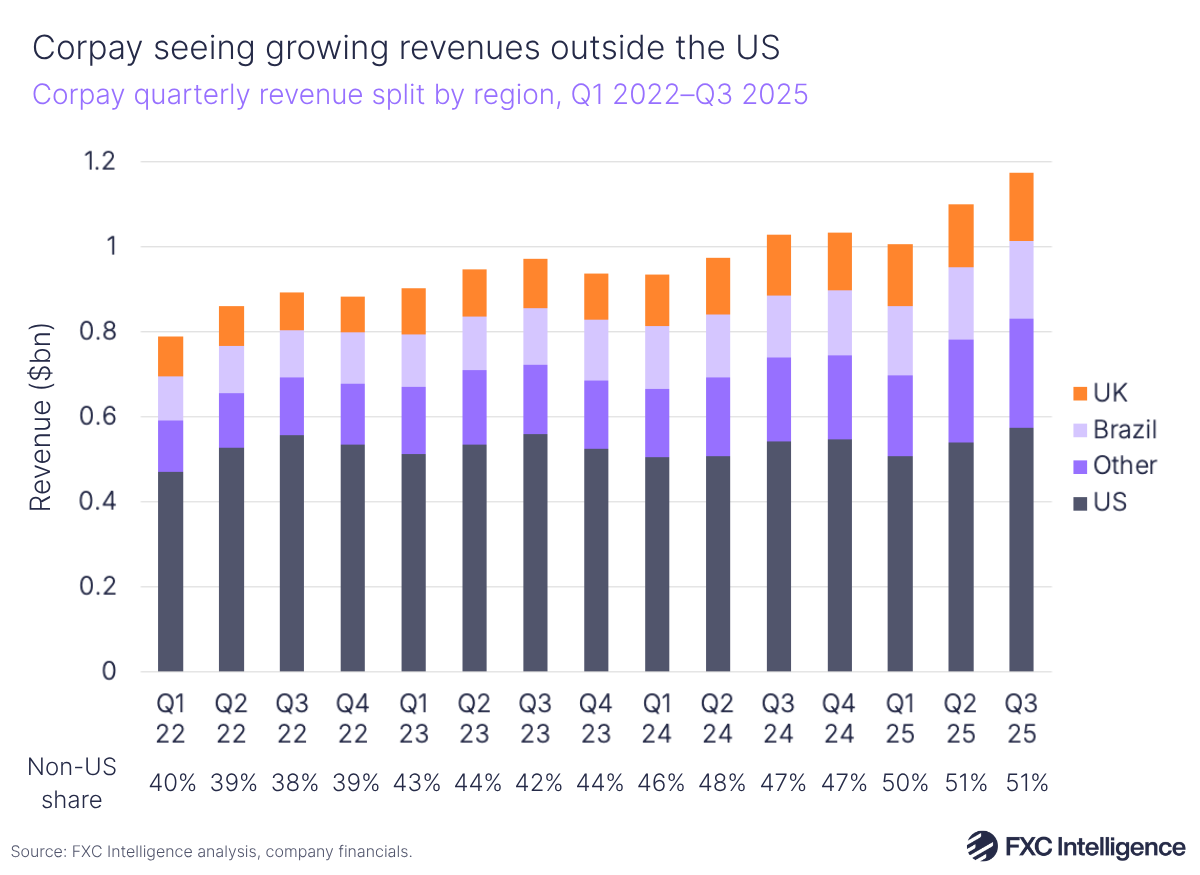

So, it’s been a really good quarter. Most of our growth is still coming from APAC, Canada, Europe and the UK. The US continues to be a little bit subdued due to the Trump tariffs ultimately. The level of uncertainty and the cost pressures that a lot of businesses are facing, whether they be export markets or import markets, are weighing on some of those businesses.

Aside from that, we see robust strength across all geos, all segments and we’re continuing to perform well.

Cross-border services continue to drive revenues

Corpay says that it continues to take shares of the cross-border market across the US, UK, Europe and Asia, due to strong sales, robust client acquisition and recurring activity. Spanning risk management and mass payment solutions, it is projecting its cross-border business could make up around $1.2bn in revenue for the company next year.

On a reported basis, Corporate Payments continues to grow faster than Corpay’s other segments, rising 27% to $410m, versus Corpay’s largest segment Vehicle Payments, which grew 9% to $553m, and Other (containing Gift and Payroll Card operating segments), which increased by 24% to $83m. Lodging Payments, meanwhile, declined by 5% to $127m.

Corpay expects Corporate Payments to grow in the mid-teens, including a 3% headwind for float – i.e. interest income earned on client funds before they are dispersed – as well as revenues from its recently added Alpha acquisition. As part of this, the company expects its Corporate Payments business to grow by around 16% (17% excluding float incomes) in Q4 2025.

Spend volume rose 57% to $68bn in Q3, and is on track to be over $250bn annually on a run rate basis. However, the company did note that revenue per spend dollar was lower (0.60%, down from 0.72% in Q3 2024) due to onboarding large enterprise cross-border clients and new payables.

Alpha expands Corpay’s global presence

Daniel Webber:

Where does Alpha fit into the overall business and strategy?

Mark Frey:

I think of the Alpha business as two halves. There’s a corporate business that is very UK and European-centric. There’s a small business in Canada and a small business in Australia that will augment our local positions in those markets, but it does open up a number of new geographies for us in continental Europe, which is a high priority for us.

We’ve been systematically building across the continent country by country, with boots on the ground in each jurisdiction. Alpha will advance that materially. The Netherlands, Austria and Germany will all be net new, and in Malta we’ll go from three people to 153 people, so it’s a commanding presence in that market.

It will also add significantly to our existing presence in Spain, Italy, France and others. So, it really bolsters our market position in what we think is a highly attractive market in the corporate space in Europe.

Also, it is a very strong franchise in UK corporate as well, which is our bread and butter and very much down the fairway in terms of the way that we think of growing our business. We’re aligned in terms of what Alpha brings to our existing businesses.

The private markets business is something that we’ve been focused on in the corporate business for about 18 months. We gained confidence in this segment by taking a business from $5m to a $75m run rate in an 18-month time period. Seeing what Alpha had built prior to that and thinking through how we could accelerate Alpha’s growth in the private market space is something that was super attractive about this transaction.

It’s not just the FX capability and selling hedging to private markets customers, but also the account solutions that they have built in the UK and Europe and how we can take Alpha’s really strong presence there and extend that to Singapore and the US, given our licensing set, so that we truly can sell a global solution to their existing UK and European-centric customers. That is a very clear pathway to growth and how we can accelerate the growth of that business going forward.

There’s also some very nascent capability that Alpha has in the rates and commodity space, which we’ve been evaluating for an extended period of time. We really have been holding off building a business in that sector because we expected to close this Alpha transaction.

The plan now will be to take that capability and really begin to scale that to where we can sell it to our existing customers and significantly scale economics with a lot of our customers in the commodity space and larger corporates that are looking for rate solutions as well.

We think it is a really strong fit. We think that we can accelerate the growth of that Alpha business and it will fit very nicely into our overall strategy. Finally, we’re actually very aligned in terms of cultural sensibilities across the business. They are a very high-work rate, high intelligence, capable, motivated team, both at the executive level and the individuals in the team. That aligns very much with the way that we think about growing our business, and we couldn’t be more excited.

Alpha and other acquisitions bolster Corpay

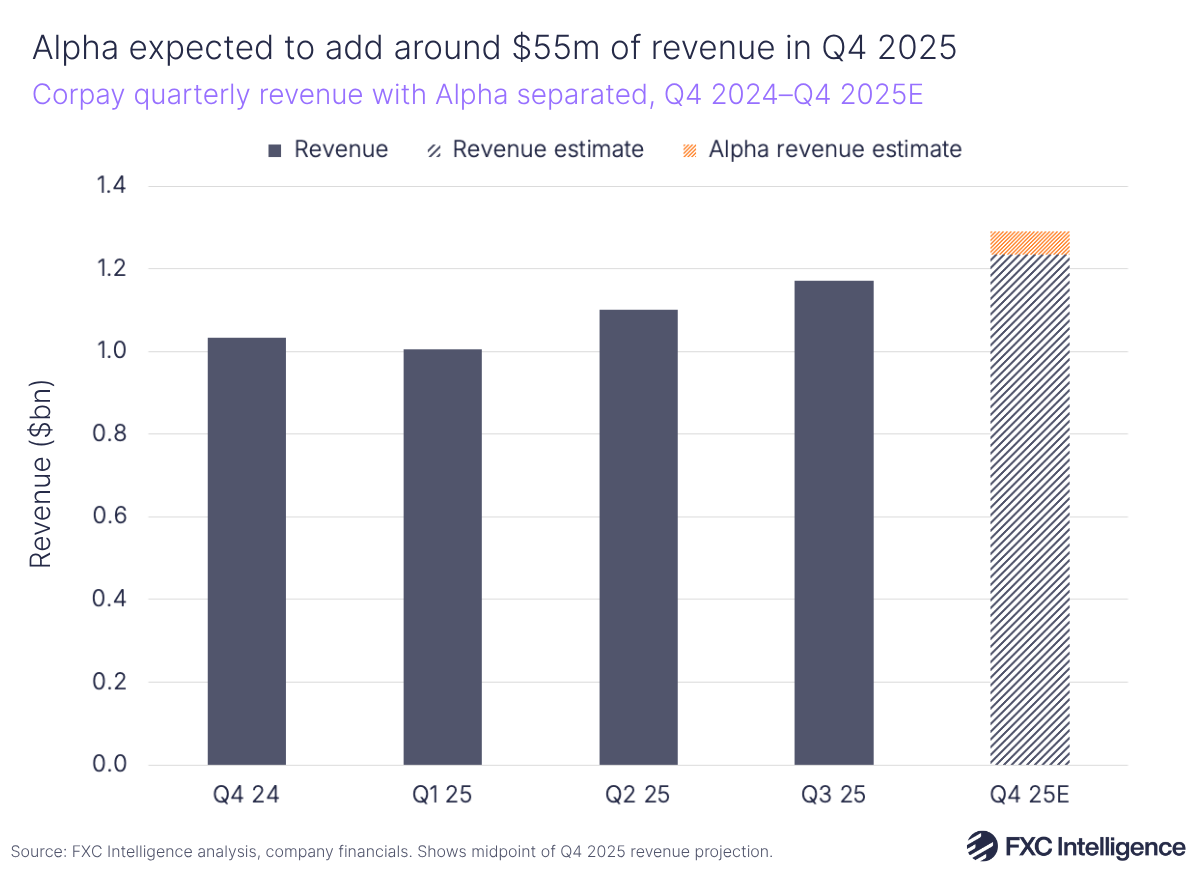

Corpay closed its Alpha acquisition at the end of October, and the company is expected to add around $55m in revenues to the company’s bottom line in Q4. The company noted that Alpha’s organic growth is expected to be 13%, though excluding float this would be 31%, showing the impact of interest on this business.

Separately, TPG and Corpay completed their acquisition of AvidXchange in the middle of October, with Corpay now holding a 34% stake in the business. Corpay said that AvidXchange has been fully integrated into its mid-market AP automation strategy, with cost cuts already underway, strong alignment on restructuring, expected accretion in 2026 and a major focus on improving AvidXchange’s growth rate so that Corpay may eventually acquire the entire company.

Also during the earnings call, Corpay gave an update about Mastercard’s recent $300m investment in the company, through which Corpay will become an exclusive provider of cross-border payments solutions to Mastercard’s financial institution customers. The investment deal is closing on 1 December, with Corpay targeting its first conversions from Q1 2026.

Corpay’s “build, partner, buy” strategy for acquisitions

Daniel Webber:

With regards to acquisitions, what’s the framework you are thinking about with this?

Mark Frey:

We’ll continue to look at everything in the space and evaluate its attractiveness. But I’d say that there’s two things that we’re really focused on now.

Number one, we’re very focused on network expansion plays. Being able to connect directly to as many in-country schemes as possible, to be able to clear payments directly.

That’s something that’s super attractive to us. So that’s network expansion in the fiat context. Secondly, it’s infrastructure capability that allows us to become more native in the stablecoin space. That is the other thing that I’d say we’re spending a lot of time on right now.

Then there’s the build, partner, buy, and for us, there’ll be a combination of all three, quite frankly. We’ve done a number of active partnerships in the space, we’re building capability and I would be very surprised over the next couple of years if we didn’t buy something in the space as well.

Corpay sees growing revenues outside the US

Based on our calculations, non-US revenue accounted for 51% of total Corpay revenues for the second quarter in a row, with growth in Brazil (26%), the UK (12%) and Other regions (29%) outpacing the US’s 6% YoY growth. The US remains central to Corpay however, with its revenue contribution rising to $575m to account for 49% of total revenue.

Why multicurrency accounts are gaining traction with customers

Daniel Webber:

The global bank and multicurrency business is really gaining traction, with $3bn in deposits and projected to be a $200m business next year, which is more revenue than some businesses make entirely in this space. What’s driving that?

Mark Frey:

It’s a great piece of the business. It’s built on a foundation of trust and accountability with clients, ultimately, where their customers are coming to them looking to open up operational accounts in less than a week, with the assurance that the accounts will actually get opened and that they’ll be able to move forward with confidence.

They’ve done a tremendously good job of providing those solutions in the UK and Europe for funds domiciled in those jurisdictions. The opportunity for us, given our licensing footprint and the infrastructure that we’ve already built, is that we’ve already built these solutions in the US. That means we can sell our existing Corpay solution to Alpha’s customers that are looking to domicile accounts in the US.

We’re going to be launching our Singapore-based accounts probably in the front end of Q1 next year, which will allow us to have more of a global construct that we can sell to these customers. It is the exact same value proposition we’ve been able to align, in terms of where we think we’re going in regards to the customer frontend tech and how that’s going to work.

Again, Alpha has built some wonderful technology that is customer facing that allows customers to manage their business quite effectively. We want to take that technology and use it as part of the go-forward organisation.

Corpay raises full year revenue guidance

Corpay raised its guidance for 2025, with total revenues for FY 2025 now expected to grow 13-14% YoY to be between $4.505bn and $4.525bn. It has updated its outlook due to beating its Q3 expectations, improved FX rates and recently closed acquisition and investment.

Corpay sees Corporate Payments as being a $10bn company in the long term through its various drivers. In the meantime, the company said that its Corpay One spend management business currently accounts for around $250m in revenue, while its mid-market AP automation and payments business – currently around $400m – could grow to $500m in the coming years, particularly if it opts to fully acquire AvidXchange.

Finally, Corpay expects its global bank and multicurrency account solutions to be a $200m business next year.

Inside Corpay’s stablecoins strategy

Daniel Webber:

People often ask what the real B2B use cases for stablecoins are, with many opportunities currently requiring working with more sophisticated corporates. With that in mind, what B2B stablecoin use cases are you actually seeing gain traction?

Mark Frey:

We don’t ever have corporate customers come to us and say, “hey, I’d like to make a stablecoin payment”. We do have customers on occasion that say, ”hey, I have this problem. I have this incoming credit that comes into the UK after the wire cutoff. I want to be able to liquidate that sterling cash and move it to the US, but it’s coming in after the cutoff. Is there a way that you could solve that?”

What we would traditionally say prior to the digital world is that we’ll create a credit solution, whereby I’ll execute a trade at cutoff, I’ll extend you credit, I’ll give you that liquidity in the US and then you can settle to me the next day. That’s a very balance sheet-intensive way to solve that problem for the customer, but that’s the way we would traditionally solve that problem.

Now, what we’re doing is we’re just providing customers access to a digital wallet. They can move that money after hours on Saturday morning, if they want, and they can move that liquidity across to us and we can do on-chain FX liquidity and deposit and credit the US dollars back to them.

So, it’s opened up the world of the always-on, 24/7 payments, post-cut off and on the weekends, that is much less balance sheet and credit intensive for the solutions that we would typically deploy for customers in those spots.

Daniel Webber:

Mark, thank you.

Mark Frey:

Thank you very much.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.