Our Buyer’s Guide: Stablecoin Payment Infrastructure is now out (learn more about purchasing a subscription or read the executive summary), so we’re continuing our series digging into the technical aspects of stablecoin payments infrastructure. Kicking us off for the new year is the topic of merchant settlement and the role stablecoins can play.

As interest in stablecoins grew within the cross-border payments industry in 2025, stablecoin payouts were one of the use cases that quickly gained traction. In many emerging markets, stablecoins have become increasingly popular not only as an alternative payments infrastructure, but also an alternative currency to hold value, particularly in regions with currency volatility. As a result, platforms that pay out to marketplace sellers, gig workers and creators are increasingly seeing requests to support payouts in stablecoins, with Mastercard & Thunes, Worldpay and Nuvei among those to have already announced the capability.

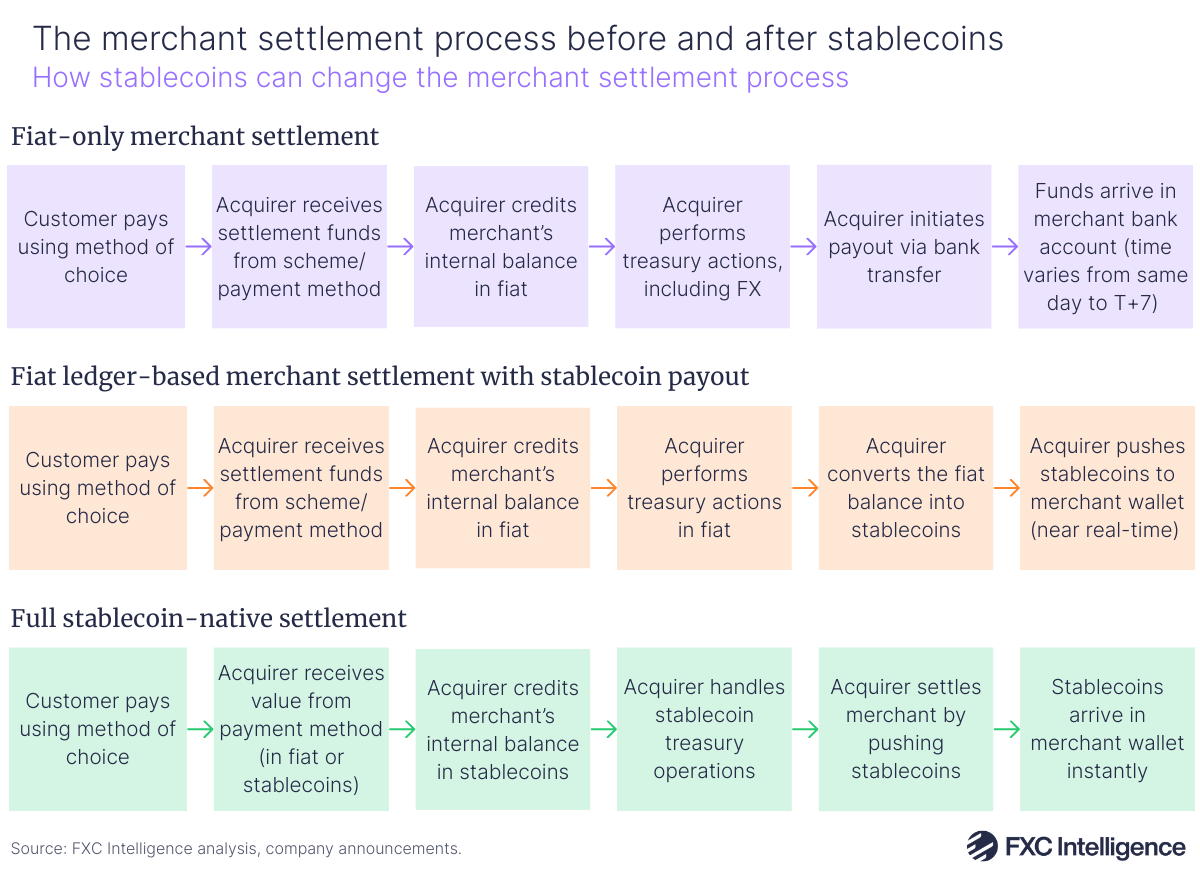

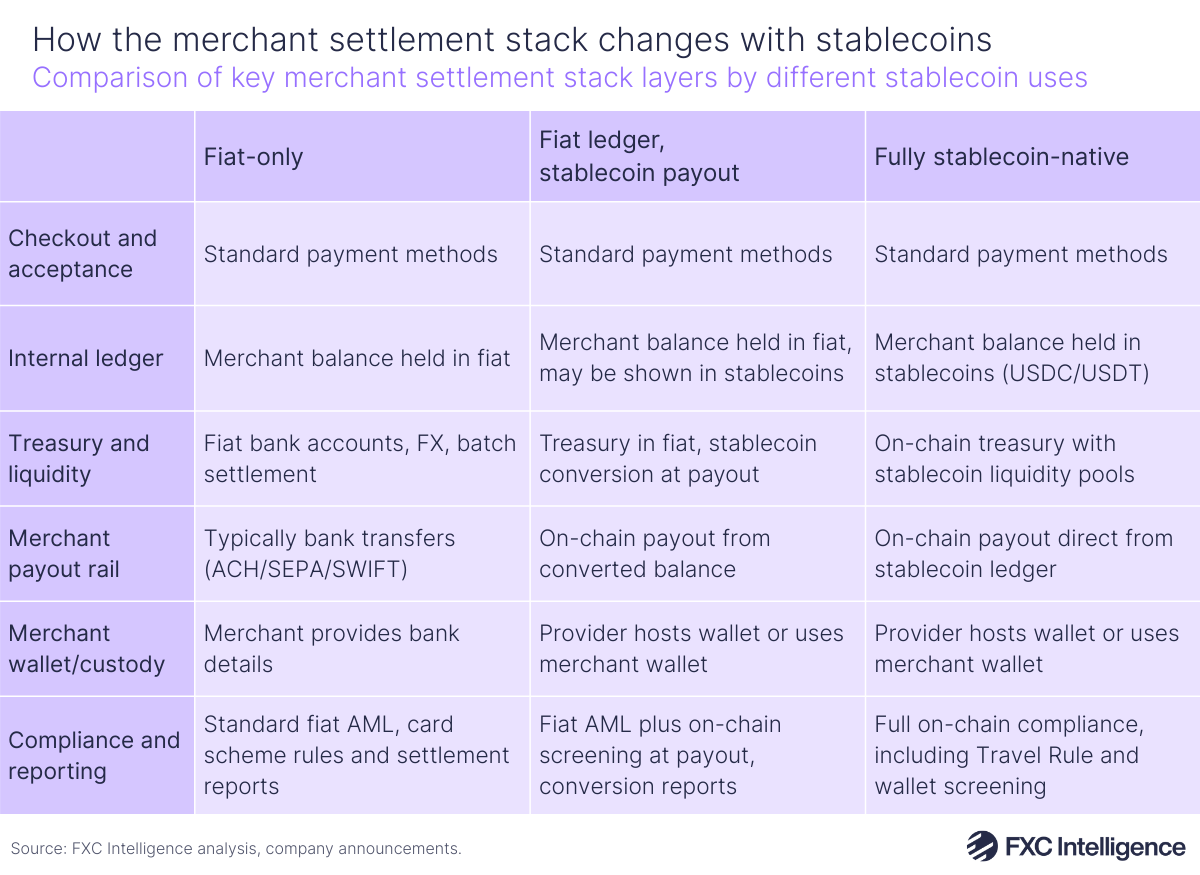

As an alternative form of merchant settlement, stablecoin payouts simply see the final part of the process replaced with stablecoin rails. The funds are handled as normal, but rather than being pushed to the merchant’s bank account they are instead converted into stablecoins and then pushed to a digital wallet assigned to the merchant.

This may also see the acquirer or payment service provider handle ‘synthetic’ stablecoin balances, where a merchant’s balance is maintained in an internal, fiat-denominated ledger as normal but it is represented in their statement in stablecoin equivalent. This enables the merchant to see their balance in stablecoins before payout without significant infrastructure lift, but can mean this will be an approximation rather than a real-time value.

Stablecoin payouts require additional infrastructure solutions on the part of the acquirer. They need to handle the conversion of funds to stablecoin – typically either USDT or USDC, depending on the payout market – which is often aided by a stablecoin infrastructure partner that can ensure compliance requirements such as the Travel Rule are properly followed. However, they often need to also handle the creation and management of the wallets that the stablecoin is held in.

While many crypto-first merchants may have their own external wallets that stablecoins can be pushed to, merchants in non-Web3 settings are more likely to need to have a wallet created for them as part of the payout process. This is a commonplace part of the payout solution for most players, and typically sees a regulated wallet-as-a-service provider handle their creation, hosting and ownership, including security factors such as private keys.

This will typically see the stablecoin wallet being an embedded part of the platform’s merchant dashboard, where they can then make payments to other wallets or otherwise move money. In some cases it may also be tied to a payment instrument such as a card. Some providers also give merchants the option to connect their own wallet instead if they prefer.

However, merchant settlement with stablecoins can take this a step further than just payouts. Acquirers and payment service providers have the option to more deeply embed payments into the process by introducing a stablecoin-denominated internal ledger that treats USDT or USDC as a settlement currency in much the same way as USD or EUR – albeit with different infrastructure requirements.

Rather than holding a ‘synthetic’ balance in stablecoins, acquirers will convert funds when they are received and maintain the merchant’s internal balance in stablecoins. This means that in addition to the wallet requirements above, the acquirer will typically have greater stablecoin treasury responsibilities, including on-chain liquidity management, resulting in more complex infrastructure.

However, this also allows merchants to see their true real-time balances in stablecoins and support any internal use of the digital currency, such as for supplier payments. It also enables out-of-hours settlement and the ability to program payouts based on set conditions.

While many players are currently opting for the ‘lighter’ version of the stablecoin-based merchant settlements, this more complex alternative may become more commonplace as broader adoption grows – particularly if acquirers and payment service providers also adopt stablecoins for their own internal treasury use.

We’ll be continuing the series next week to mark the release of FXC Buyer’s Guide: Stablecoin Payments Infrastructure. Find out more about the purchasing a subscription to the guide and how it can help you navigate the stablecoin buying process.