With our Buyer’s Guide on Stablecoin Payment Infrastructure now available to license via subscription (learn more about purchasing a subscription or read the executive summary), we’re unpacking some of the many infrastructure topics across the world of stablecoin payments. And first up, we’re looking at stablecoin liquidity.

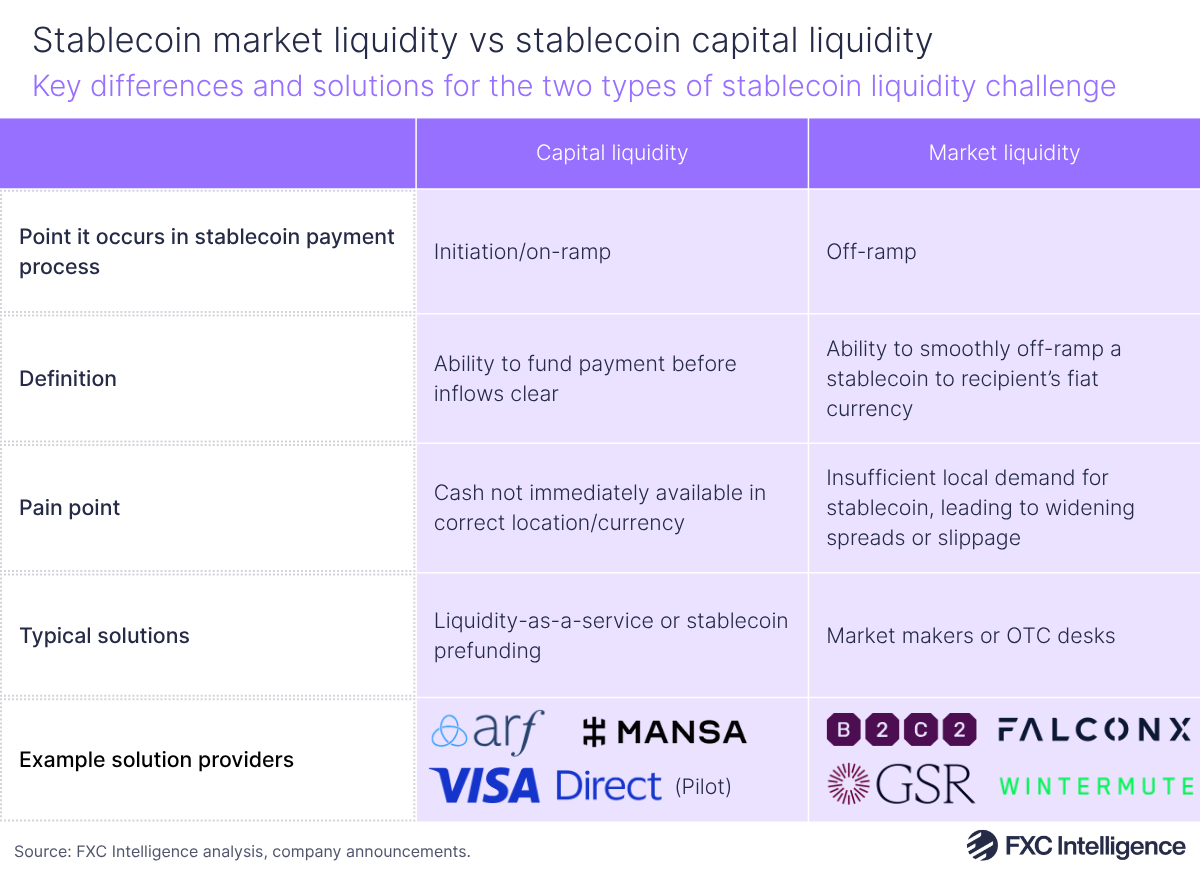

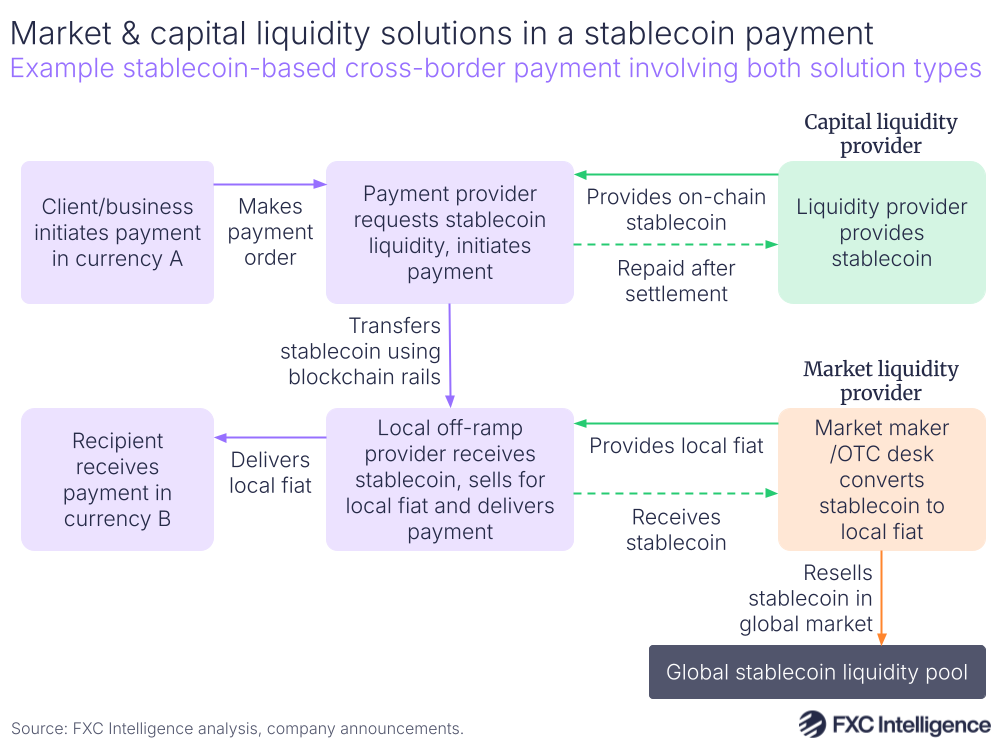

The term ‘liquidity’ gets used in a variety of ways within the stablecoin landscape, and two of the most common can be a source of considerable confusion. The first is market liquidity – the ability to on or off-ramp into or out of stablecoins in a given fiat currency at a stable, narrow spread (the difference between the buy and sell price). The second is capital liquidity – having the funds to cover a payout before incoming payments settle. Both see challenges within stablecoin cross-border settings and both have solutions – but differentiating between them is critical.

Market liquidity challenges, also known as the liquidity gap, occur when demand for a given stablecoin, such as USDC, is too low. This can make it challenging to off-ramp without a provider facing high spreads or slippage, increasing costs to potentially untenable levels. There are a variety of providers that solve this problem, including market makers and over-the-counter (OTC) trading desks, similar to their fiat-based counterparts.

The market maker powers the off-ramp, buying the stablecoin from the payment company or the local off-ramp partner in exchange for the local fiat currency of the recipient. They will then typically resell the stablecoin into global markets where demand exists. Companies that operate in this space include SBI subsidiary B2C2, Wintermute and FalconX. Some operate globally, while others specialise in certain markets.

Capital liquidity, meanwhile, can be a challenge if a provider needs to send a payment before the money funding it arrives, such as if a client’s funds covering it are still clearing, within institutional settings where funds are being moved between different markets, or even if the provider needs to on-ramp to USDC rapidly using domestic payment rails.

There are a few ways to approach this need, which bear some resemblance to their fiat-based equivalents. Arf, for example, provides short-term revolving liquidity in stablecoin with repayment in 1-5 days, through a solution sometimes referred to as liquidity-as-service. Visa Direct, meanwhile, recently announced the pilot of a stablecoin pre-funding service that will allow its clients to pre-fund account-based transfers with stablecoins rather than fiat currencies. Some market maker-type firms also provide credit solutions that cater to capital liquidity needs.

As these two challenges are distinct from each other, it is quite possible to use both capital and market liquidity solutions to deliver a single payment.

We’ll be back next week with more insights related to stablecoin infrastructure. If you’re exploring the landscape, FXC Buyer’s Guide: Stablecoin Payment Infrastructure is designed to identify best-in-class providers that fit your needs and help you make sense of the market. This product is be available to license via subscription by banks, fintechs, corporates, governments, investors and payments companies. Learn more about how it can help your develop your stablecoin strategy.