To mark the release of our Buyer’s Guide: Stablecoin Payment Infrastructure product (learn more about purchasing a subscription or read the executive summary), we’re continuing to review some of the technical but vital elements of stablecoin payments infrastructure. This time we’re turning our attention to the Travel Rule – a critical part of compliance when using stablecoins for cross-border payments.

In simple terms, the Travel Rule is a requirement for any organisation sending cross-border payments to include details of both the payment originator and the beneficiary along with the payment itself, in order to enable traceability in support of AML, fraud prevention and sanction compliance efforts. It is not consistently enforced in every country, but any country that plans to support stablecoin payments either currently supports the Travel Rule or is expected to in the future, making it a de-facto requirement for any player using stablecoin cross-border payments at scale.

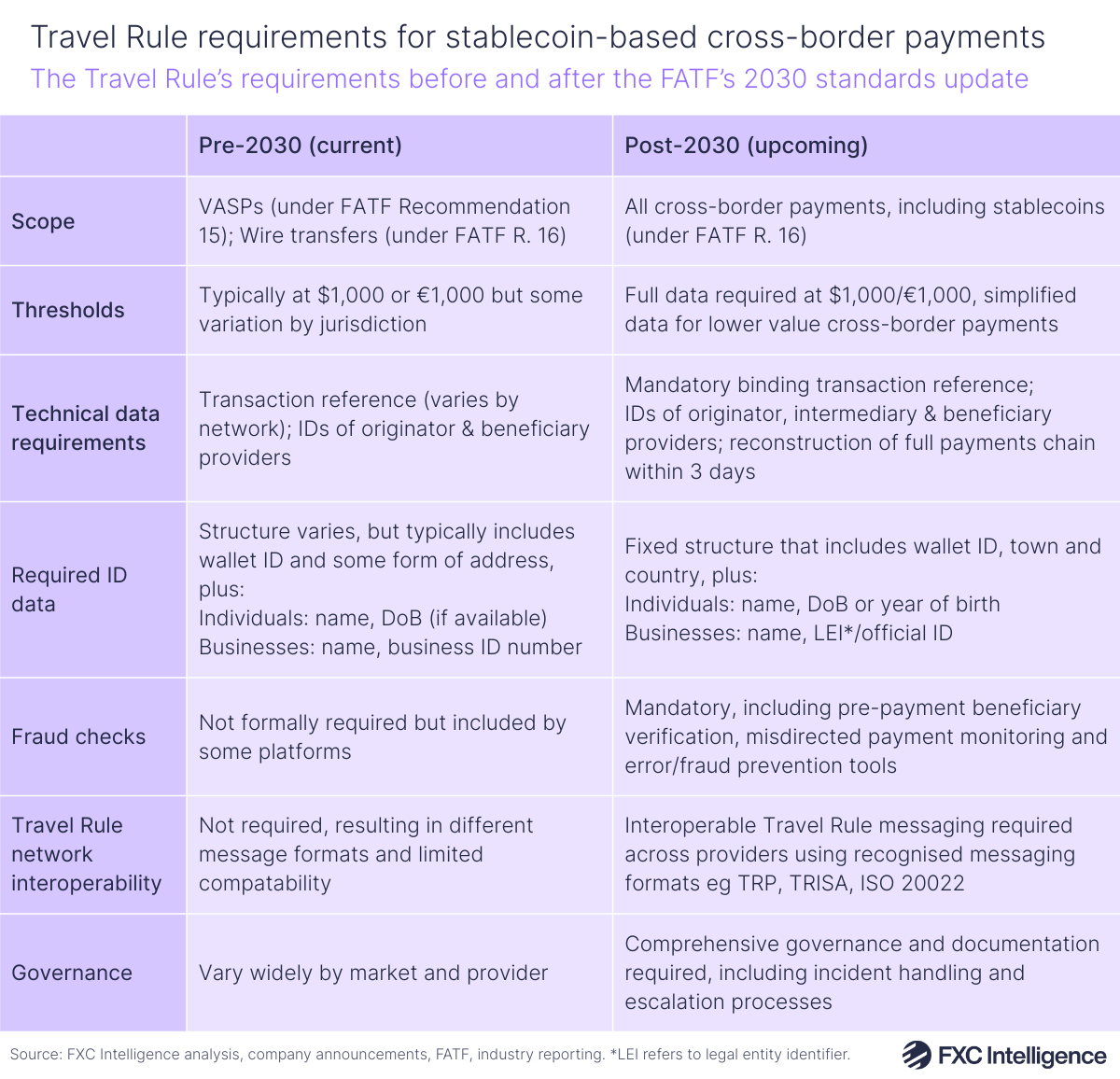

The Travel Rule originates from the Financial Action Task Force’s (FATF) Recommendation 16, which originally focused on wire transfers, with Recommendation 15 applying this to stablecoin payments via virtual asset service providers (VASPs). However, recent updates have seen stablecoin and other alternative network payments brought into the central requirement, increasing the consistency and strength of the requirements in the process. And while those recommendations have to be signed into local laws to take full effect, the FATF expects them to be fully in place by 2030, with many providers aligning with the updated Travel Rule before that date.

This essentially means that any stablecoin-based cross-border payment sent by a provider on behalf of an individual or business entity needs to be compliant, with payments over €1,000/$1,000 following the full rules, providing key sender details including name, address and date of birth for individuals or business identifier and location for businesses. Currently, information on the sending and receiving entity also needs to be included, but this is being expanded to include all entities in the payment process, which can resolve transparency issues related to using intermediaries in the blockchain payments process.

However, this information cannot simply be put in the metadata of the payment, as it would be visible to anyone who cares to look and therefore pose a significant privacy risk. Instead, the information has to be conveyed via a separate network or tool, with the ordering, intermediary and beneficiary institutions all verifying and retaining the data so that it can be assembled for review as needed. This sees the data being transmitted independently of the payment itself, but with a reference or other signifier that ensures one is connected to the other. At present there are some requirements relating to this, but with the standards update this identity data will need to be ‘bound’ to the payment in a manner similar to how ISO 20022 references connect messages to the settlement of payments on fiat networks including Swift, SEPA and FedNow.

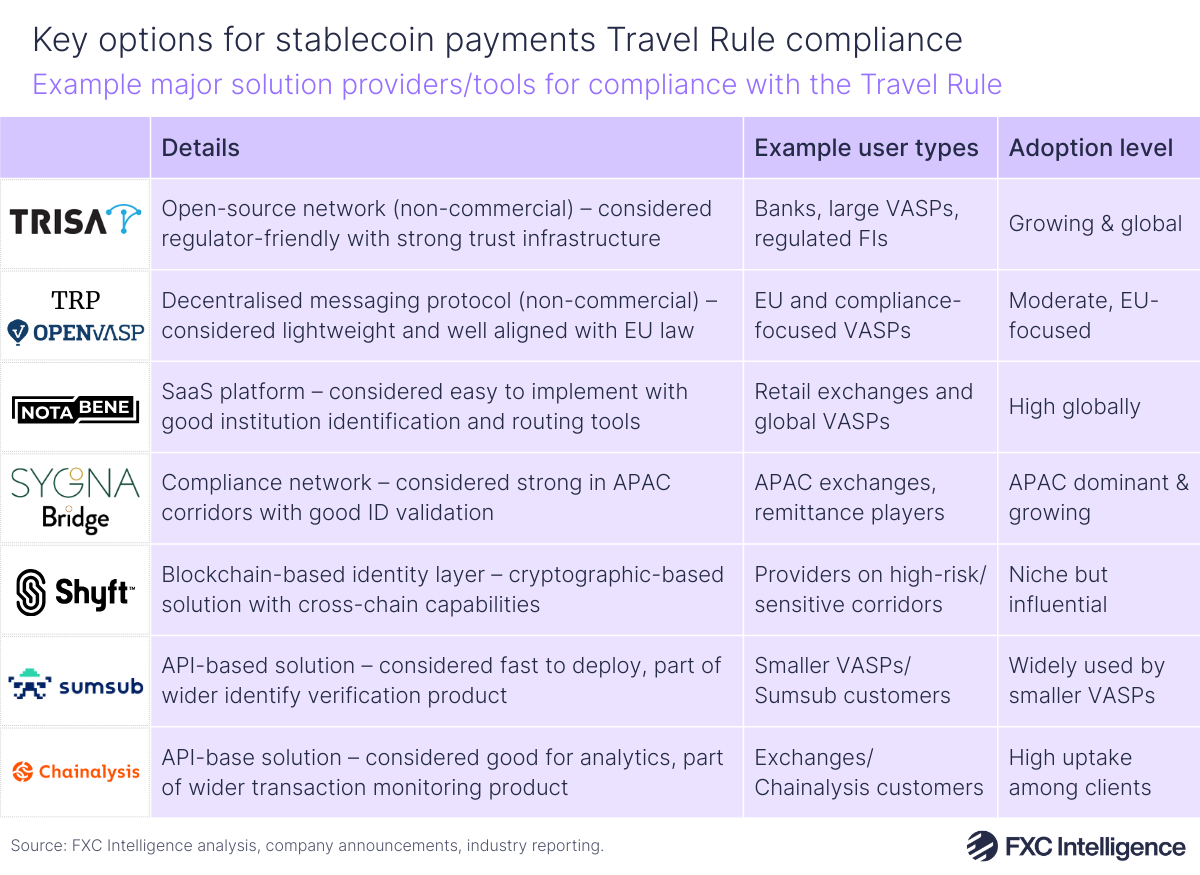

There are a wide range of solutions for this data collection and conveyance, some of which are non-commercial networks or protocols with strong adoption in certain regions, such as OpenVASP’s TRP in Europe, or among certain provider types, such as TRISA, which is favoured by larger players.

However, there are also a significant number of commercial solutions, some of which have gained significant and growing popularity, including Notabene and Sygna Bridge, while some are part of wider groups of tools, including those from Sumsub and Chainalysis. Almost all of these are not run via blockchains, although the blockchain-based Shyft Network, which is favoured for highly sensitive applications, is a notable exception.

Many players favour using a single solution, although this can create challenges when other parties in the payment use a different provider or tool. However, many providers already interoperate, including Notabene, TRISA and Sygna, and the updated requirements mandate interoperability across fiat, stablecoin and mixed rails.

While parts of the Travel Rule are still being implemented, the move towards a global standard is set to continue stablecoins’ march towards widespread adoption. Next week we’ll take a deeper look at VASPs, but in the meantime learn more about how FXC Buyer’s Guide: Stablecoin Payments Infrastructure can help you find the right providers while increasing your understanding of the overall market.