With our Buyer’s Guide: Stablecoin Payment Infrastructure product now available (learn more about purchasing a subscription or read the executive summary), each week we’re exploring a different topic related to stablecoin payments infrastructure. Today it’s time to look at Layer-2 blockchains, how they work and why they matter.

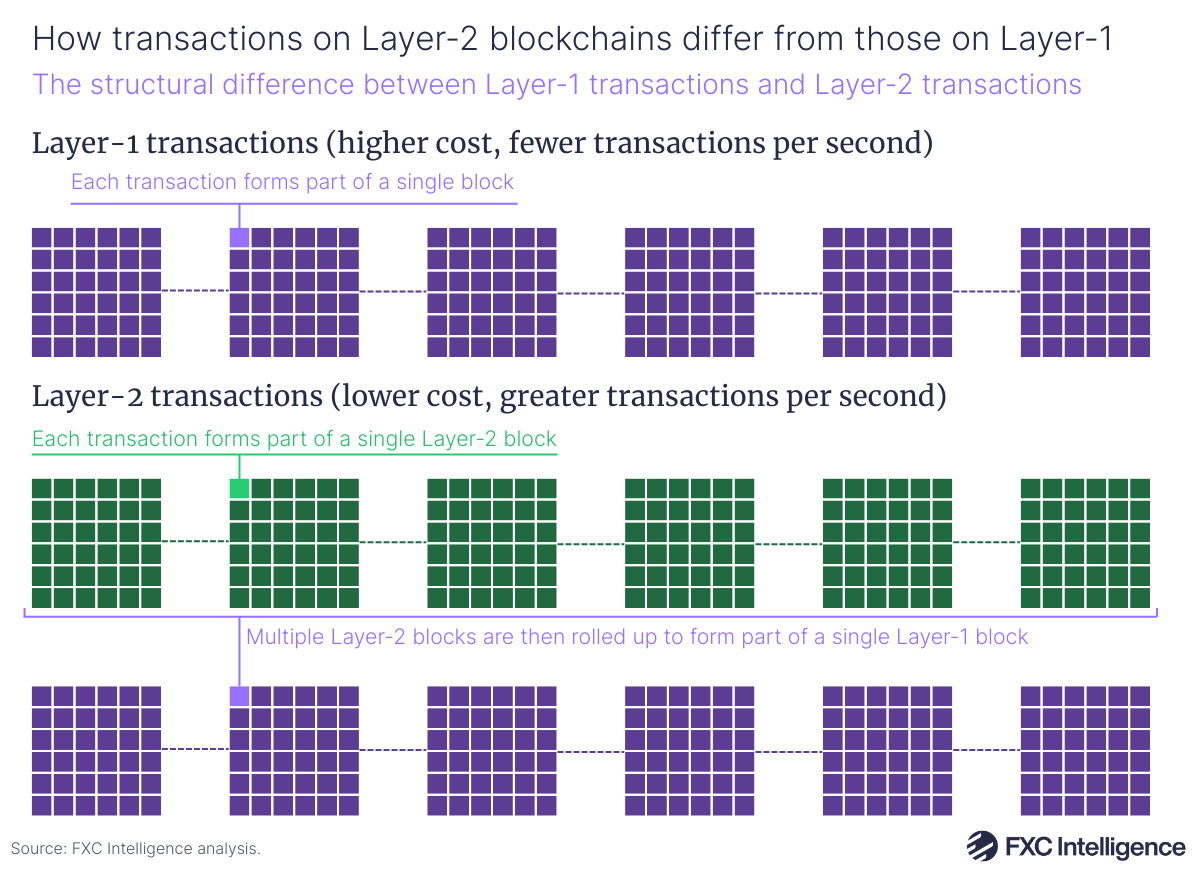

Blockchains, the networks on which stablecoins are moved, are not all alike. They vary in a wide range of ways – from the architecture that determines how they run to the speed at which they process transactions – but at their core, they are all essentially globally agreed-upon ledgers made up of digital ‘blocks’, which themselves are formed of batches of transactions. Each block is agreed upon via a consensus mechanism, which varies depending on the blockchain in question but typically requires significant movement of information around the world in the process. This limits the amount of data a blockchain can process at a given time, and therefore caps the number of transactions that it can handle each second. For example, Ethereum, the most popular blockchain, handles less than 100 transactions a second, which makes scaling a challenge and also pushes up the cost per transaction.

A popular solution to this problem is what are known as Layer-2 blockchains. Built on top of a Layer-1 counterpart, Layer-2 blockchains run their own chains on which transactions are processed to form blocks, but these are then bundled together in what are known as ‘rollups’, with the compressed data committed to the underlying Layer-1 blockchain as part of one of its blocks.

This approach means that for every block formed on the Layer-1 blockchain, multiple blocks are formed on the Layer-2, resulting in a greater number of transactions per second. The gas fees to process the transaction on the Layer-1 blockchain are also split between many more transactions, making the cost per transaction considerably cheaper. Layer-2 blockchains also enjoy the same security as their Layer-1 counterparts.

However, there are some trade-offs. First of all, the level of use of such blockchains is lower than some major Layer-1 blockchains, meaning that liquidity can be a greater challenge.

Furthermore, while transactions achieve local finality near-instantly on Layer-2 blockchains, they will not achieve batch finality until they are settled as part of a rollup on the Layer-1 blockchain, which typically takes several minutes and, depending on the system architecture, true ‘hard’ finality may only be achieved several days later.

The majority of Layer-2 blockchains are built on Ethereum, but there are many to choose from, with popular examples including Arbitrum and Base. Within Ethereum-based Layer-2 blockchains, there are also two types of rollup method: optimistic rollups and zero knowledge (ZK) rollups. The former is typically cheaper, with a system that assumes transactions are valid unless challenged but which includes a seven-day period for withdrawals to be challenged. The latter uses cryptographic proofs to validate batches, resulting in faster finality, but is typically more expensive.

Layer-2 blockchains can also cause challenges for compliance with the Travel Rule, a common requirement for cross-border transactions using stablecoins. The use of rollups creates intermediaries in the transaction that complicate compliance with the requirement, while the bundling process can make it harder to verify sender and receiver identities across different layers.

We’ll be digging into the Travel Rule in more detail next week, but in the meantime why not learn more about FXC Buyer’s Guide: Stablecoin Payments Infrastructure, which is designed to help you find the right providers while boosting your understanding of the overall market.