After a defining 2025, how is 2026 set to shape cross-border payments? Here are our predictions for the defining trends of the year ahead.

2025 was a year of transformation for cross-border payments, and 2026 is set to continue to build on what last year started, with significant moves across the industry. Many trends set in motion in the last twelve months and beyond are set to produce significant impacts over the next year, with lasting ramifications for companies across the payments landscape.

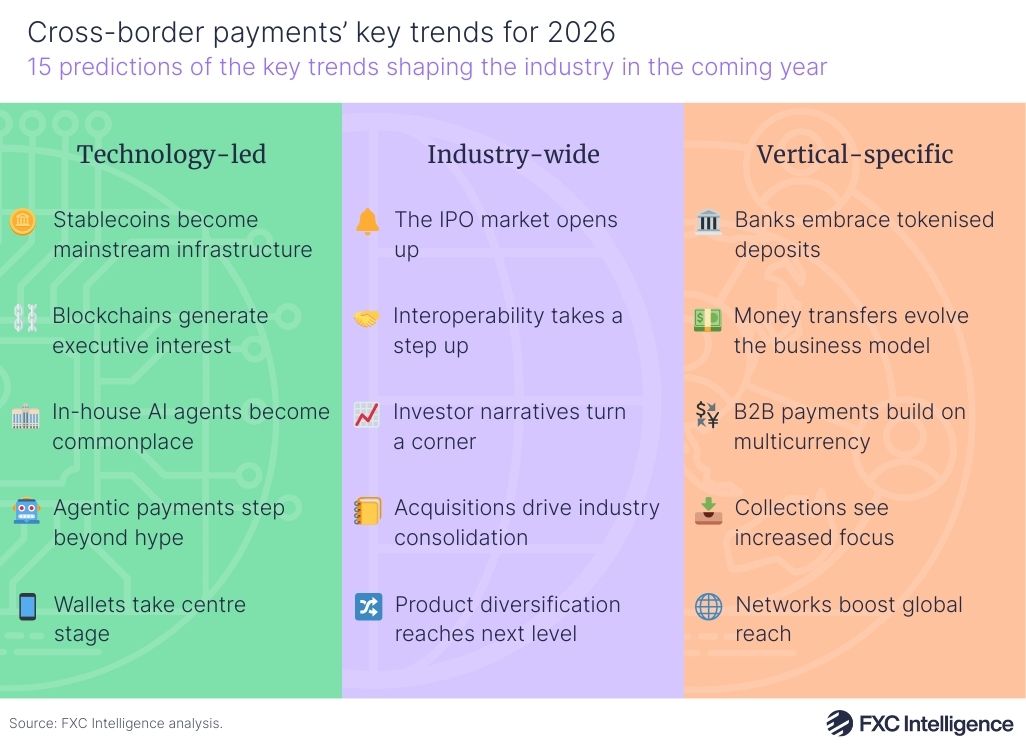

In what is now a yearly project, we’re laying out our predictions for the year ahead, once again grouping them into three categories: technology-led, industry-wide and vertical-specific in the same way as we did in 2025. In the last couple of years we’ve had a good track record for predictions, which proved largely correct both last year and in 2024, but will we hit the mark this year?

While we have diverse expectations for the industry in the coming months, one notable theme for this year is the realisation of efforts already set in motion. We aren’t expecting any radical new initiatives to come out of left field, but instead expect to see quite transformative effects of changes that have already begun across a wide range of areas, including regulatory, business and technological fields.

The technology trends shaping cross-border payments 2026

Technology may only be one of a number of areas driving change in cross-border payments but it remains one of the most influential, and is set to continue to be a vital element for the industry in the coming year. In 2026, expect less hype and more maturation, as the industry sees areas such as stablecoins and AI move to their next phase of development.

Stablecoins become mainstream infrastructure

After dominating the cross-border payments discourse in 2025, stablecoins are not going away in 2026, although they may well see some reduction in their most intense hype. Instead, with many companies already exploring the technology for internal treasury, and a fair number beginning to release stablecoin-focused products, the next year is set to see the technology establish itself as a notable and growing part of the industry’s go-to infrastructure. This is likely to be most common in emerging market corridors, which we previously highlighted dominating stablecoin’s base cross-border payments TAM of $16.5tn, and will ultimately shift the focus from broad ideation to practical details.

Blockchains generate executive interest

Relatedly, the wider world of blockchain technologies will see growing interest, and this is set to drive a greater understanding of the underlying technology at a board level. While much of the industry’s senior leadership knew little to nothing about the technology a year ago, this has begun to change and will only grow in 2026. Understanding and decision making about specific blockchains is set to become an executive concern, particularly given the speed and cost ramifications of such choices, as well as the emergence of payments-focused blockchains that are set to launch in the coming months.

In-house AI agents become commonplace

While 2024 was the peak year for AI hype in the payments industry, 2025 continued to see significant discussion of the technology and its behind-the-scenes use, particularly as some in the industry began to see measurable financial outcomes from artificial intelligence. However, while much of the focus so far has been on applications such as process optimisation and productivity, one area that is set to see growing interest and adoption in the coming year is the use of in-house AI agents.

Bringing together a company’s internal data alongside broader data and insights, such agents are starting to see use by some in the industry such as SUNRATE, Citi and Bank of America to improve information retrieval and ensure accuracy and consistency, reducing time to complete tasks in the process. Expect the technology to become more ambitious and widespread in 2026, with more players discussing their use of the technology in earnings calls and beyond.

Agentic payments step beyond hype

On the payments side, agentic AI is also set to continue its growth, with the industry beginning to get the first true sense of how significant an opportunity this market is and could become, rather than just the initial discussion. With several networks processing their first agentic payments towards the end of 2025, including Visa and Mastercard, 2026 is likely to see numbers related to such payments being reported for the first time, while non-public players such as Stripe are also likely to share more tangible information about how these payments are being used, building on the insights it shared following 2025’s Black Friday event.

Wallets take centre stage

One area of technology that is set to see a much greater level of focus in the coming months, however, is digital wallets – and crucially, there are several reasons for this happening. Firstly, rises in multicurrency products and stablecoin-based digital wallet solutions are increasingly converging, and in 2026 we can expect to see more fiat-stablecoin hybrid wallets emerge similar to that recently announced by Remitly. Meanwhile, 2025 saw the announcement of several solutions to interconnect domestic digital wallets, including PayPal World – which is set to include PayPal, Venmo, UPI and Mercado Pago – and TerraPay’s Xend, which includes Airtel, Barq and M-Pesa. These provide similar solutions to AliPay+, which already provides cross-border payments capabilities to wallets including AliPay, GrabPay and Touch ‘n Go; in total, PayPal World, Xend and AliPay+ plan to see more than five billion individual digital wallets gain cross-border payments capabilities by the end of the year.

Industry-wide trends shaping global payments in 2026

From a structural and business perspective, the cross-border payments industry is also set to continue to evolve in 2026, building on trends that we’ve seen emerge over the past few years. Changes in wider market conditions are in particular set to have a powerful impact on the industry, with lasting effects for companies in many verticals and of many sizes.

The IPO market opens up

While 2025 saw something of an end to the industry’s IPO drought, most notably via Circle’s blockbuster market debut, there are still many players that have yet to make the jump. Market conditions and in particular a drop in valuations saw many players hold off, but with valuations climbing once again and increasingly mature noises coming from companies such as Stripe, Rapyd and Airwallex, 2026 is looking much more promising for IPOs from a number of organisations – and once a few decide it’s finally time, we can expect to see others following suit.

Interoperability takes a step up

Interoperability has long been a watchword of cross-border payments, with companies across the industry announcing efforts to interlink or otherwise connect different payment initiatives on a near weekly basis. A number of domestic payment networks announced interlinks in 2025, while many B2B2X players expanded their connectivity across a host of payment instruments. 2026 is set to see this take a step further, with increased focus not only on interlinking different endpoints, but also on increasingly bridging the fiat-stablecoin world, as well as crossing further bridges into domestic systems.

Investor narratives turn a corner

While many public players reported strong results in 2025, with Corpay and Remitly among those to repeatedly raise their projections for full-year earnings, many in the industry struggled to win the hearts and minds of investors, with several well-performing companies ending the year at a lower share price than they started. While the causes are complex, investor narratives have undoubtedly played a role and this year we expect to see a renewed focus on communicating the broad growth levers of the cross-border payments industry, with Remitly already seeing some early success in this area with its December investor day.

Acquisitions drive industry consolidation

Meanwhile, we are also likely to see some publicly traded companies instead opt to exit the markets via acquisition, following in the footsteps of Intermex and Argentex – which were both subsumed in 2025. With share prices not always reflecting the potential of companies in the sector, organisations with sufficiently large war chests are in a strong position to acquire high-potential companies. It is therefore likely that we will see at least one, if not a few, notable acquisitions over the next 12 months, resulting in an industry that is more consolidated than at present.

Product diversification reaches next level

Another impact of investor perspectives is a greater focus on product diversification, with many companies looking to expand their revenue per customer beyond pure cross-border payments. This is not limited to one sector, with companies across B2B, consumer and beyond making moves to diversify their offerings in 2025, including MoneyGram’s refounding as a fintech and OFX’s 2.0 project. However, in 2026 we can expect to see this trend develop further as companies look for the next steps in their growth, with broader solutions, packaged solutions targeting specific client profiles and novel approaches to offerings in the sector.

The cross-border payments trends impacting specific verticals

While there are many trends that have ramifications across the industry, there are also those that are highly specific to some verticals within cross-border payments in particular, with ramifications for how those areas operate. This year we expect to see a number of major developments in certain verticals that feed from wider trends in the industry as a whole.

Banks embrace tokenised deposits

The rise of stablecoins has prompted excitement from many corners of the industry, but within banking it has indirectly resulted in a surge in interest in a cousin of the technology: tokenised deposits. This blockchain-based technology has already started seeing some real-world initiatives develop, aided by the fact that it is more easily added to existing banking infrastructure without notable operational changes compared to stablecoins. In 2026, we expect this to step up considerably, with the technology becoming more common for many Tier 1 and Tier 2 banks, as well as greater exploration of its wider ramifications and limitations.

Money transfers evolve the business model

The consumer money transfers sector, meanwhile, has seen a number of relatively radical announcements over the past year. MoneyGram announced a stablecoin-based app product; Western Union announced both its own stablecoin and plans for a broadening group of digital services; and Remitly announced a membership solution that includes send now, pay later, stablecoin and fiat wallets, cash back and credit. The trend here is not just for products that go beyond just sending money, but which shift the business model to focus on recurring engagement potentially even with a monthly fee, and we expect to see this becoming more widespread in the coming year.

B2B payments build on multicurrency

Meanwhile, growing numbers of B2B payments players have launched their own multicurrency offerings, while some such as Airwallex have made this a central part of a wider array of synergistic solutions for their target customers. In 2026 we expect to see such multicurrency products evolved further, with an ever-increasing focus on not only enabling customers to hold funds but also to access more supporting solutions that are specifically tailored to their needs. As a result, we may see some companies launch more tailored sub-offerings, as well as a greater clarification of the different customer types within this sector.

Collections see increased focus

While for many network, B2B and payment services-focused providers, the major narrative of the last few years has been framed around emerging markets, this year a new focus is beginning to emerge, in the form of collections. Although hardly a new area – Rapyd, Payoneer, Nuvei and dLocal, are just some of those to offer solutions – collections has often been an afterthought in the sector, particularly from a narrative perspective. However, as the challenges and opportunities in this space become more complex, we are seeing this begin to change. Expect to see a greater focus on meeting the needs of increasingly diverse alternative payment methods, as well as how different infrastructure solutions can better support clients’ evolving collection demands.

Networks boost global reach

Finally, over the last few years, networks and other payment infrastructure players have taken on ever-greater shares of the world’s cross-border payments flows, with the sector’s rails becoming increasingly complex and varying. As many players compete for business, increasing their reach and capabilities has been a central priority for many in the sector, with Thunes among those to announce a host of new collaborations to expand its network in 2025. In 2026, that trend is only going to continue, with partnerships and other infrastructure-focused initiatives proliferating in order to boost not only geographical growth, but also payment instrument growth. Expect continued focus not only on emerging markets and alternative payment methods, but also interoperability with areas such as stablecoins as demand and interest climb.