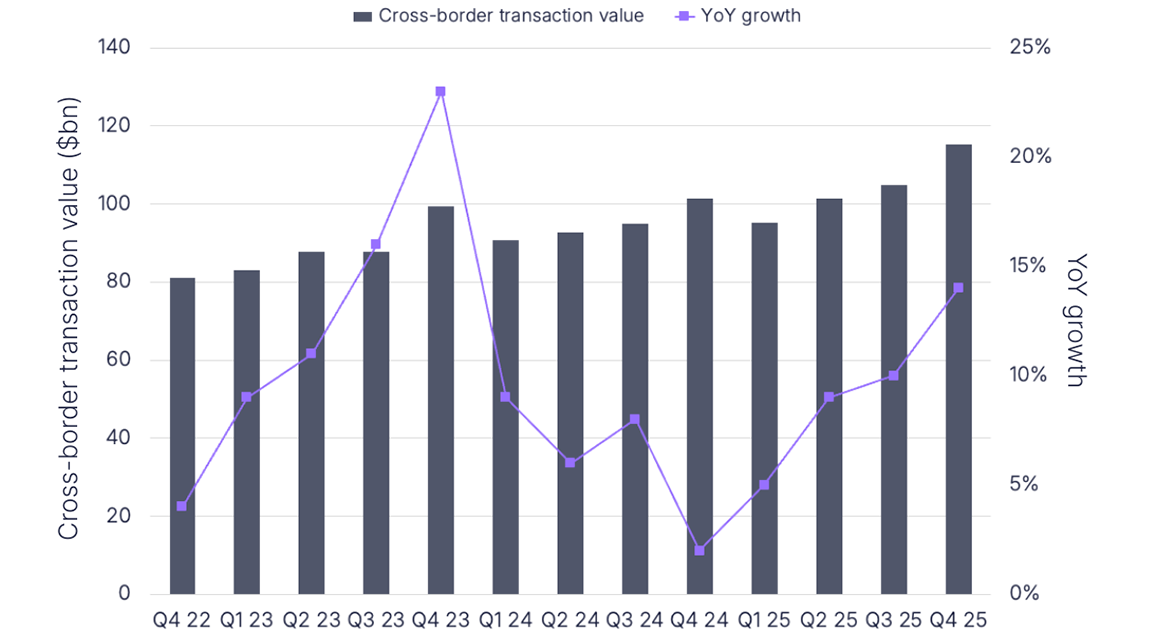

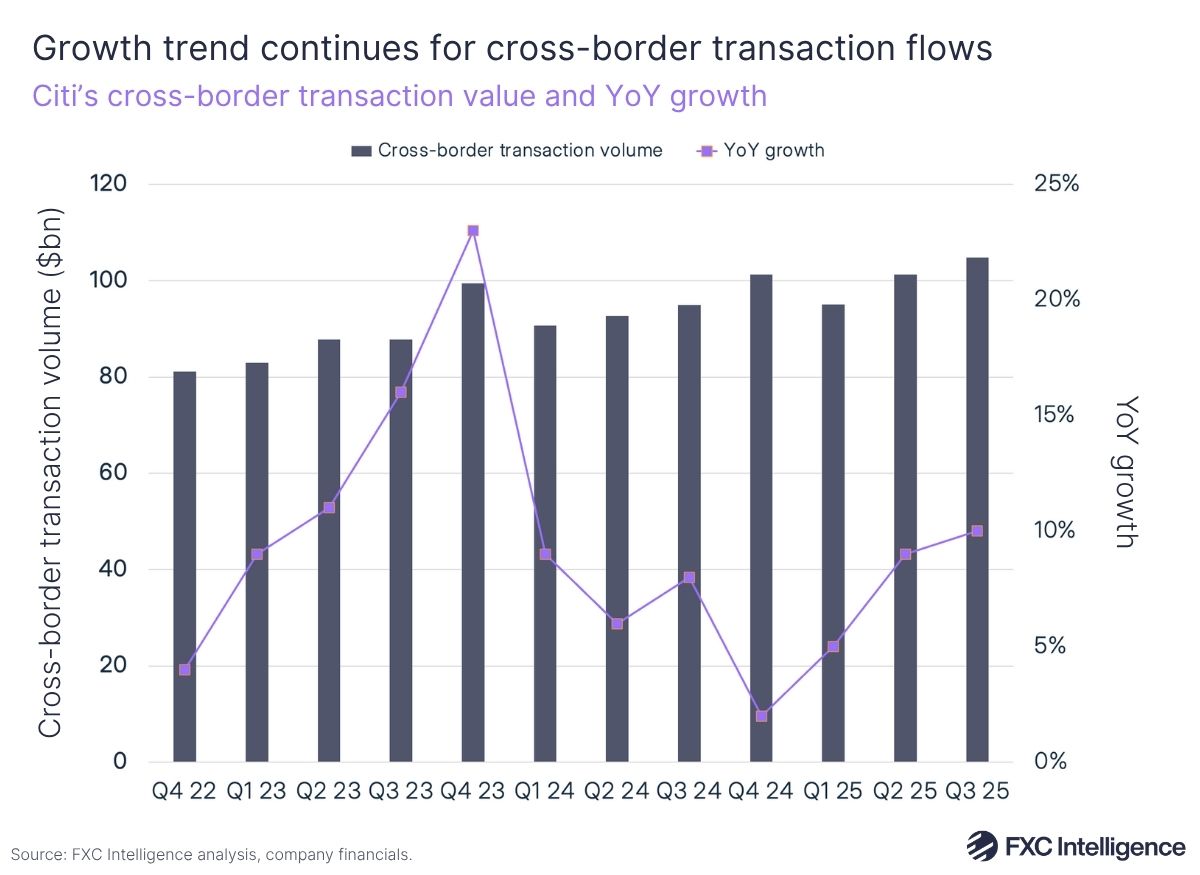

Citi has announced its Q3 2025 results, in which it saw a 9% YoY increase to $22.1bn in overall revenue and a rise in its cross-border transaction volume of 10% YoY.

Cross-border transaction flows once again proved to be a key driver behind Citi’s overall Payments segment. In Q3 2025, these flows grew to $104.8bn, representing a 3% rise QoQ and 10% YoY. During the earnings call, Mark Mason, CFO at Citi, attributed some of this rise to the bank’s efforts to roll out digital products and services into new markets.

Citi does not specifically report cross-border payment revenues, with the bank’s Payments segment being part of its Treasury and Trade Solutions (TTS), which sits under its larger Services division. Citi’s overall Services revenue climbed 7% YoY in the last quarter to $5.4bn – accounting for 24% of overall revenues – with Services net income rising 9% YoY to $1.8bn. TTS saw revenue increase 7% YoY to $3.9bn, while the segment’s non-interest revenue, which comprises the majority of Payments revenue, enjoyed a 14% rise YoY to $0.8bn.

CEO Jane Fraser discussed plans to integrate Citi Token Services, the bank’s in-house digital asset and tokenisation platform, with its 24/7 clearing platform to enable clients to send funds to third-party banks in over 40 markets in real time. This comes as the bank continues to focus on enabling always-on digital payments across multiple borders and currencies.

Stablecoins became a focus during the Q&A section of the call, with Fraser explaining that Citi currently views tokenised deposits as a more suitable solution to enable low cost, real-time money movement. As a result, she said Citi has invested “heavily” in this technology.

“Our clients want interoperable, multibank, cross-border, always on payment solutions,” she added. “They want it provided in a safe and sound manner, and they want all the complexities solved for them – compliance, reporting, accounting, tax and AML. That, frankly, is best done by tokenised deposits.”

In light of this, Fraser said she believes there is currently an “overfocus on stablecoins”, although stressed that Citi will continue to provide on and off-ramp solutions for stablecoin exchanges; providing custodial solutions for crypto assets to its asset management clients; and providing corporate cash management services to stablecoin providers. She also shared that Citi is still considering issuing its own Citi-branded stablecoin, but this appears to remain in the very early stages.