Remitly continued its strong growth trajectory in Q3 2025, with recent launches and expanded reach enabling the remittance service provider to exceed guidance and report further profits. We caught up with CEO Matt Oppenheimer for more insight.

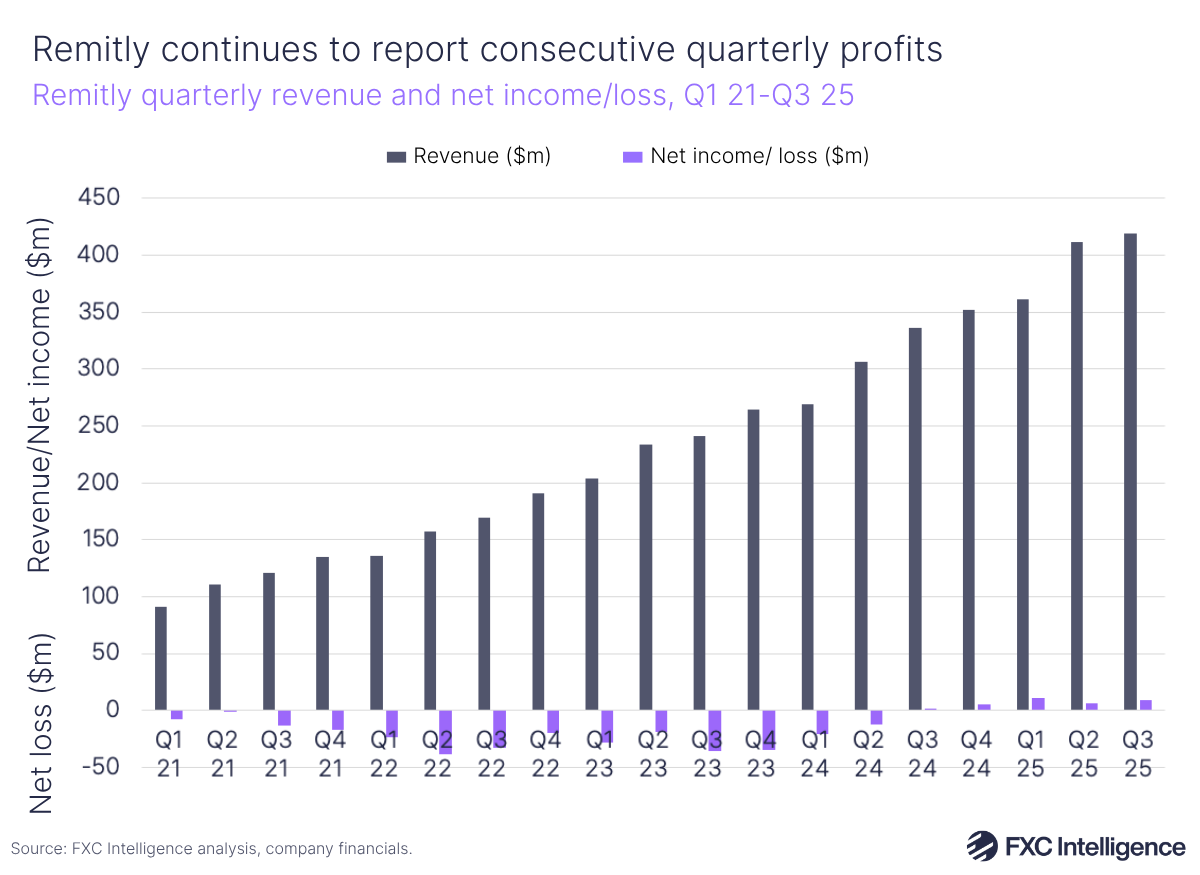

Remitly reported record revenue in Q3 2025, increasing 25% YoY to $419.5m. This growth drove a 29% rise in adjusted EBITDA to $61.2m – resulting in an adjusted EBITDA margin of 15%.

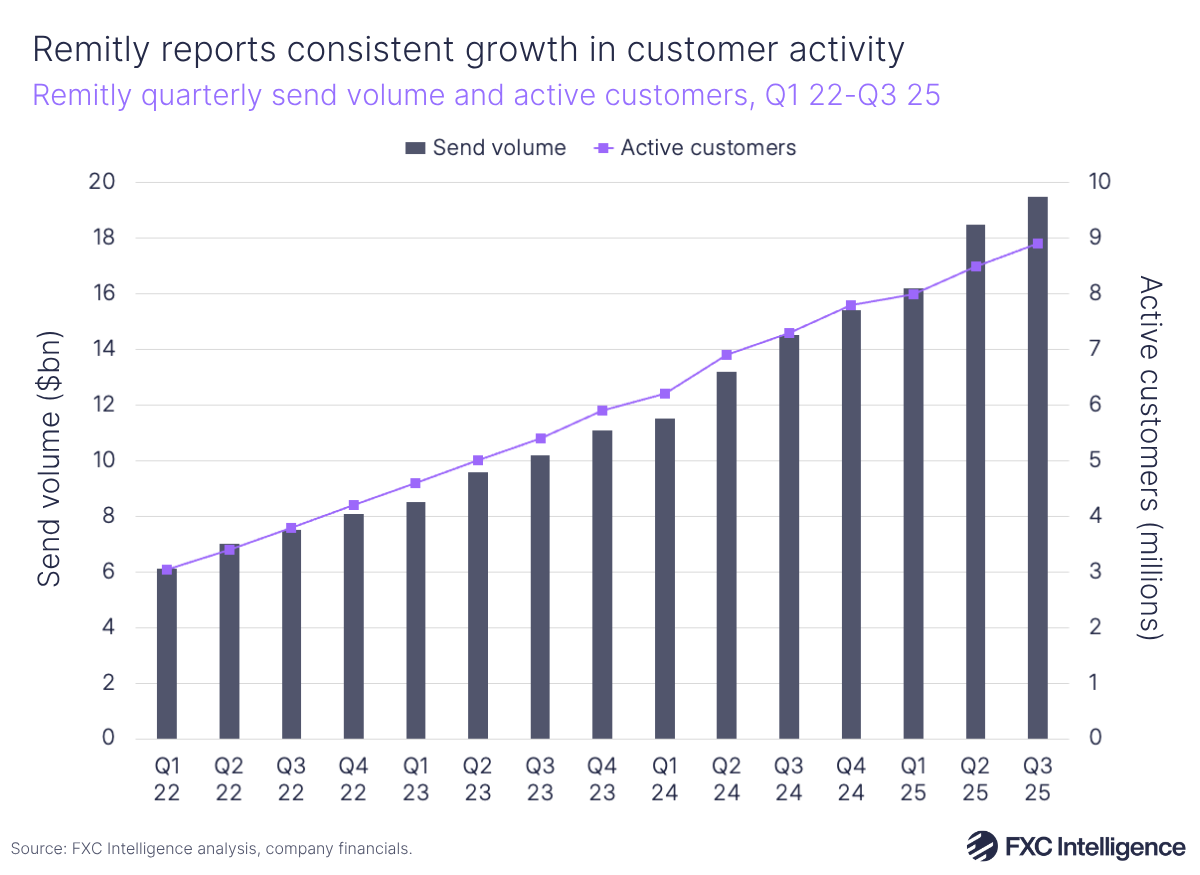

The latest set of strong results follow the official launch of the company’s membership service, Remitly One, in September. The remittance player says the service has already gained significant traction, while over 100,000 users have already used its send now, pay later Remitly Flex offering, which enables customers to send up to $250, paying it back in instalments in up to 90 days. These offerings also contributed towards 21% YoY growth in the number of active Remitly customers – to 8.9 million.

Q3 also saw the expansion of its Remitly Business offering, which launched in the US in Q2, to businesses based in the UK and Canada.

To find out the key drivers behind the company’s recent success and plans for the future, we spoke to CEO Matt Oppenheimer.

Remitly momentum continues throughout Q3

Daniel Webber:

You once again exceeded your previous expectations, posting your fifth quarter of net profit in a row. Talk us through your successes in Q3.

Matt Oppenheimer:

We’re really pleased with our Q3 results at Remitly. Our third quarter financial results exceeded guidance and we feel they really reflect the momentum from the last quarter.

Remitly’s send volume increased 35% year-on-year to $19.5bn for the quarter. We also served 8.9 million customers last quarter, while revenue grew 25% to $419.5m. From a bottom line perspective, GAAP net income was once again profitable at $8.8m and we delivered adjusted EBITDA of $61.2m, which represents a 15% adjusted EBITDA margin.

It’s important to note that these numbers also reflect the early stages of some of Remitly’s growth initiatives as we extend the types of customers we’re serving and the products that we’re offering them.

Remitly outperforms previous estimates and continues profitability

Remitly’s strong Q3 2025 results saw the company report yet another record revenue total of $419.5m – a 25% YoY increase. While this represents slightly slower growth than seen in the previous two quarters in 2025, Remitly still performed better than its Q2 estimates suggested, having forecast between $411m and $413m.

This growth contributed towards the company’s fifth quarter of net profit in a row, and second highest quarterly profit total of $8.8m.

First look at Remitly One performance

Daniel Webber:

You recently launched your membership service Remitly One, what can you tell us about how that has performed so far?

Matt Oppenheimer:

If we look at Remitly Flex, which is the anchor benefit for Remitly One, it nearly doubled sequentially, which reflected really strong growth in active users, exceeding 100,000 users as of 30 September. Given that Remitly Flex is a credit product, we’re managing the risk carefully, with losses in line with our original expectations. So we’re really excited about that.

We have also seen strong early momentum on some of the other benefits that the Remitly One membership offers, including our wallet that enables users to store money in the Remitly app, as well as our card offering and other features that we’re rolling out. So the launch has been a real highlight during Q3.

Remitly sees focus on high-amount senders pay off

Daniel Webber:

In the last quarter, Remitly expanded its reach with high-amount senders. Tell us about your approach and what you’ve seen happening in this area.

Matt Oppenheimer:

The headline, if you look at high-amount senders, is that it grew at a faster rate than total company volumes. It grew 40%, primarily led by higher customer send limits. We increased send limits to $100,000 for certain corridors and really targeted marketing campaigns towards that customer segment.

Given our name, we’re obviously very much associated with remittances and the core of who we serve is lower income or lower-amount senders. However, it’s really important to recognise that we’ve also served the high-amount sender segment as far back as 2012 when we launched US to India transactions. Indian and American customers sending money back to India had very high average transaction sizes.

But what’s been different over the last 12 months is we’ve made it a much more intentional focus. We have optimised the speed and the unit economics for lower average transaction size transactions, and it’s easier for us to move up-market and remain competitive in terms of reliability and price.

These efforts mean that we’re now able to better serve existing customers who previously had a lower send limit. We used a lot of our data analytics and sophisticated risk systems to dynamically increase the amount that customers can send. It has also helped us add a lot of new higher income customers who are sending money from developed to developed countries.

If you think about our upper funnel marketing previously, which you would’ve seen if you’ve been through Heathrow Airport for example, we’re already reaching those customers. But now we have a product that is increasingly catered towards sending higher dollar amounts, which we can do uniquely well. As a result, we’re seeing our high-amount sender volume growing at a fast rate.

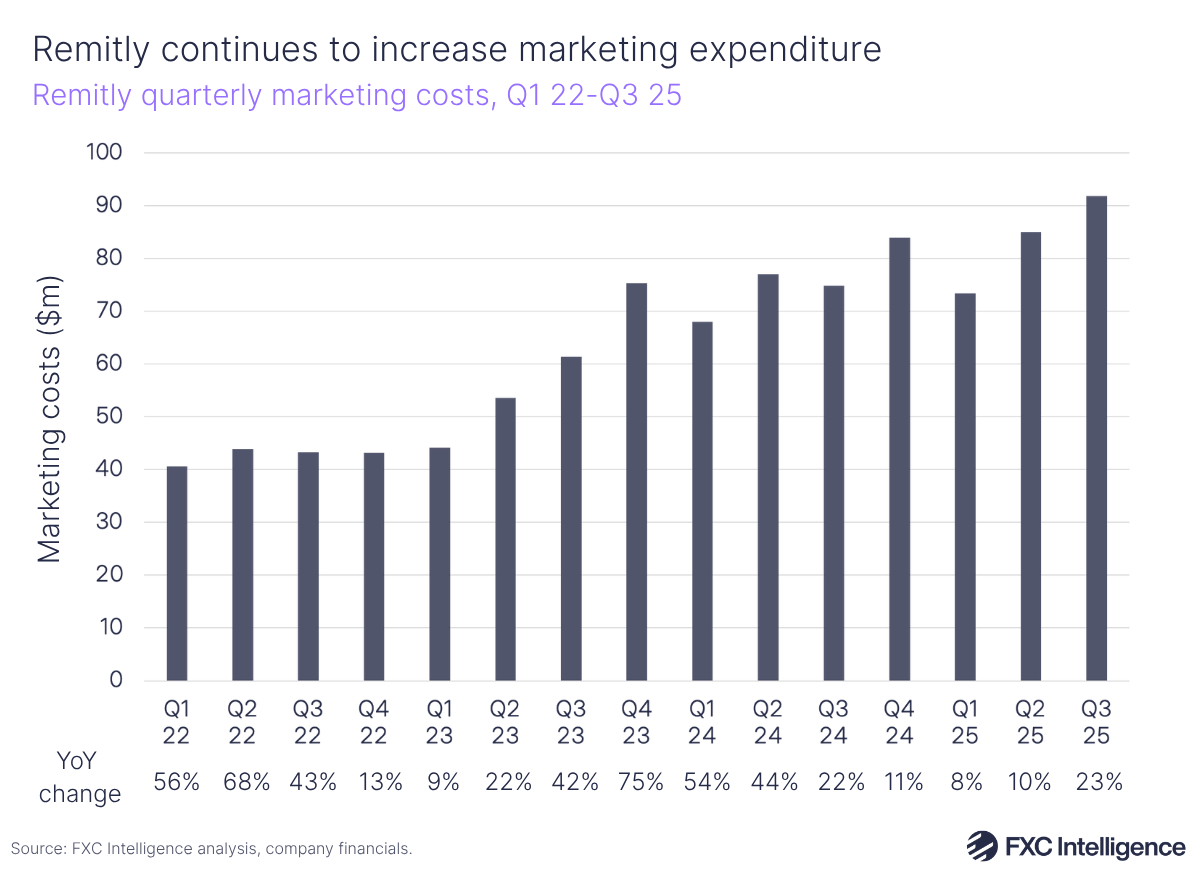

Remitly increases marketing spend in line with revenue growth

Having placed a strong focus on marketing to higher-amount senders, Remitly’s overall marketing expenditure rose to a higher amount than in any previous quarter. The company committed $92m to marketing to support its wider growth strategy.

This spending increase follows Remitly’s expansion of its product offerings, targeted at both consumers through Remitly One and businesses through Remitly Business. The company’s non-GAAP marketing expenses accounted for 22% of revenue in Q3 2025, matching the share of revenue spent on marketing in Q3 2024.

Expanding Remitly Business

Daniel Webber:

Remitly scaled its Business offering in Q3, expanding to the UK and Canada. What kind of reception and adoption have you seen in these countries?

Matt Oppenheimer:

Earlier this year, we launched Remitly Business to specifically target small businesses and we saw good traction. Now we have launched this offering in Canada and the UK, which is really exciting.

We’re starting off by supporting the smallest of businesses or micro businesses. We believe we can serve them uniquely well given that we have optimised the unit economic speed and reliability. We don’t have large sales teams or large overhead to serve where other companies in the space serve, such as medium-sized businesses and large enterprises.

We’re focusing on those micro businesses, whether that’s freelancers; people who want to collect payments from somebody in the US, the UK or Canada; or somebody like Mary, who I talked about a couple quarters ago, who moved to the US 20 years ago from the Philippines.

She has grown her own small bookkeeping business, with a very small team of around five employees in the Philippines, and she needs to pay them. Mary needs to be able to get money back to those five contractors back in the Philippines, and Remitly can do that uniquely well for her.

Following our efforts, business send volume doubled sequentially, driven by our platform enhancements, market expansion efforts and focus that we have in this area.

Daniel Webber:

To what extent were you able to leverage your existing core business capabilities to now serve business customers?

Matt Oppenheimer:

We have definitely been able to leverage our existing platform and infrastructure. The network and platform that we’ve built in terms of payments, collections and funds disbursement across billions of bank accounts, 470,000 cash pick up locations, 170 countries and all of the risk management that needs to go into cross-border transactions, it’s very transferable.

One of the biggest realisations we had in the last 12 months is that we started at the lower end of transaction sizes, call it a few hundred dollars on average, and we can now move up market easier than other firms can move down market because we’ve optimised a very difficult part of the cross-border payments flow, which is low average transaction size to emerging markets. As we move up with those strong unit economics and very reliable products, whether that’s high dollar senders or small businesses, that platform is very extendable.

There are of course elements including bulk payments to multiple recipients or necessary adjustments to make for going through KYB compliance verifications as opposed to KYC, but we’ve done a good job of rolling out a lot of those features and I think the product traction that we’re seeing with customers is really exciting in the small business space.

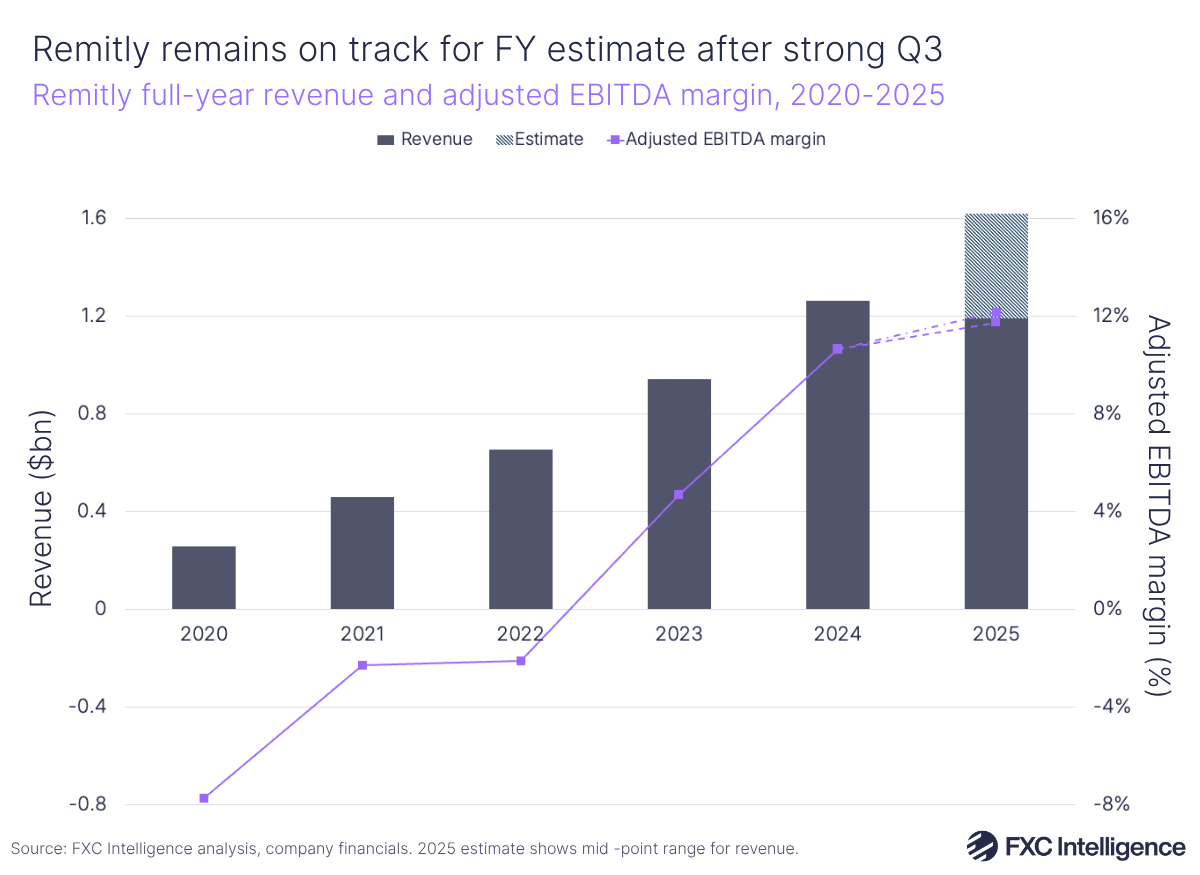

Remitly on track to hit FY estimates

In its latest earnings call, Remitly revealed that it expects to continue its consistent revenue growth, although estimates this at a slower rate than seen in the first three quarters of 2025, with guidance projecting revenue of between $426m and $428m. This represents projected growth of 21-22% versus Q4 2024, which would be the lowest reported YoY revenue growth since it became a public company.

Meanwhile, Remitly also expects GAAP net income to remain positive in Q4, and projects adjusted EBITDA to sit in the range of $50m-52m. This would result in an adjusted EBITDA margin of around 12% – the company’s lowest since Q2 24.

In Q2, Remitly bumped up its FY estimate to between $1.61bn and $1.62bn and the company has stuck closely to this estimate in Q3 – expecting revenue to sit between $1.619bn and $1.621bn for FY 2025. Current figures suggest Remitly is on track to achieve this and, if it can, it would have enjoyed a growth rate of 28% YoY. Given that Remitly has consistently performed better than its past projections suggested it would, it may well do the same again in Q4.

Remitly’s stablecoin strategy

Daniel Webber:

Last quarter, you announced plans to utilise stablecoins to solve specific customer problems. How is that going and how do you see your use of stablecoins advancing?

Matt Oppenheimer:

We’re really excited about what stablecoin technology enables us to do and there are three main areas we’re focusing on. The first is being able to improve our FX treasury and cash management, which is already live.

The second is the ability to hold stablecoin currency in a Remitly wallet, which we have already launched in the US. As we’ve mentioned, we’re taking the foundation infrastructure that we’ve launched there into other markets where currencies are less stable and where there is demand to hold a more stable currency like the US dollar.

The third is enabling customers to send money to stablecoin wallets just as we send money to bank accounts, mobile wallets and cash pickup locations. I’m pleased that we have also enabled our customers to send money into stablecoin wallets in Argentina in partnership with Bridge.

Ultimately, we see stablecoins as an accelerant to accomplish our vision of financial services that transcend borders. We’re excited about the progress there, even though it’s still very early days.

Remitly efforts result in customer and send volume growth

Continuing a very positive trend, Remitly once again reported a record number of active customers, hitting 8.9 million in Q3 2025. This represents 21% YoY growth in this metric, while send volume grew at a significantly faster rate, rising 35% compared to Q3 2024 – resulting in send volume hitting $19.5bn.

Remitly’s customer-first focus

Daniel Webber:

Is there anything else you’d like to share?

Matt Oppenheimer:

I do think it’s really important to always circle back to the amazing customers we served last quarter and we continue to serve. [In Q3] we served 8.9 million customers. When we think about our vision to transform lives with trusted financial services that transcend borders, we realise that we can serve an increasingly wide range of customers.

We’re excited about the opportunity that’s in front of us, being able to really solve cross-border financial services in a way that has never been done before. We believe that for 300 million individuals and millions of small businesses that have cross-border financial services needs, the current systems are just not built for them. We are uniquely positioned to really transform and lead a new way of doing things for customers like the one I just mentioned, as well as the millions of customers that use us every quarter.

Daniel Webber:

Matt, thank you.

Matt Oppenheimer:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.