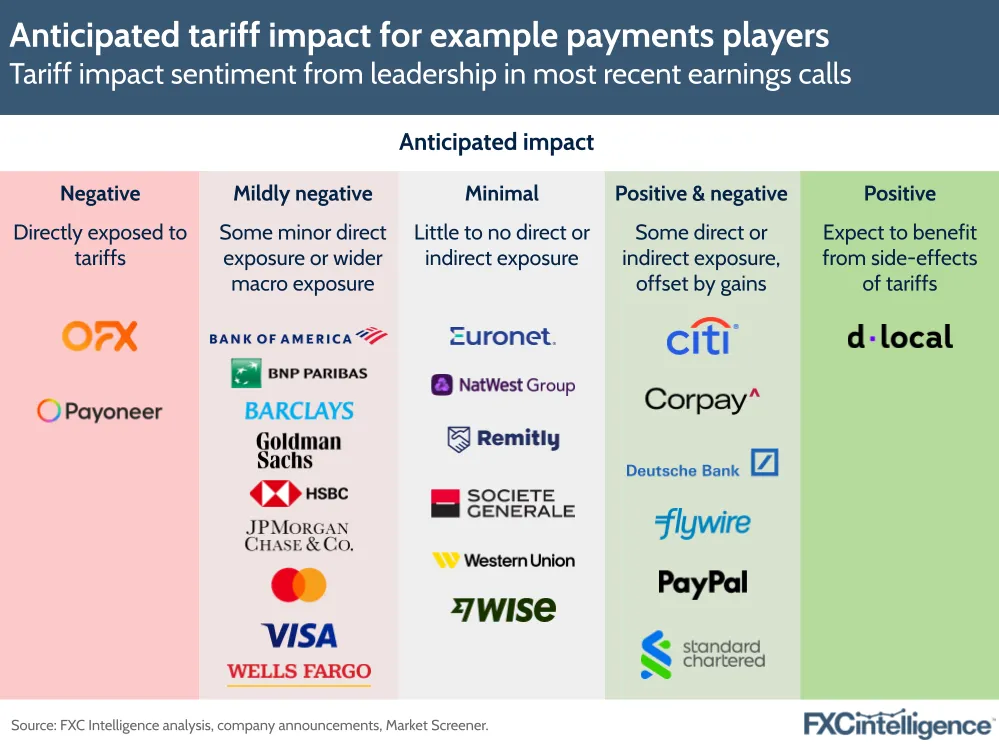

Q1 2025 earnings calls have given us an initial sense of how the US tariffs might impact the industry, and while there are a small number of companies already seeing significant headwinds, for many the outlook remains cautiously optimistic.

Looking across the calendar Q1 2025 earnings calls of banks and non-bank payments companies across the industry, we found that while for most companies it was too early to see the full scale of the impact, the majority were not expecting to see dramatic headwinds from the tariffs.

For many, particularly banks, there is likely to be some broad macro exposure as a result of a wider economic downturn in the US stemming from the policy, with several discussing efforts by their analysts to model scenarios from the tariffs. Several CEOs also used their platform to call for an end to uncertainty related to the situation, but most stopped short of outlining specific numbers.

For those more exposed to travel, particularly Visa and Mastercard, there were signs that declines in US travel were set to cause an impact, although we are unlikely to get a full sense of this until next quarter’s earnings. On the consumer money transfers side, meanwhile, there is not expected to be any marked impact at this stage.

Some players saw exposure from the macro headwinds but also expected to see benefits from shifts in flows or hedging activity in response to the increased FX volatility – something that several corporate-focused players highlighted in their earnings. Emerging-markets player dLocal, however, was the only company we looked at to indicate a potentially positive outcome due to its focus outside the US, although stopped short of providing numbers on this directly.

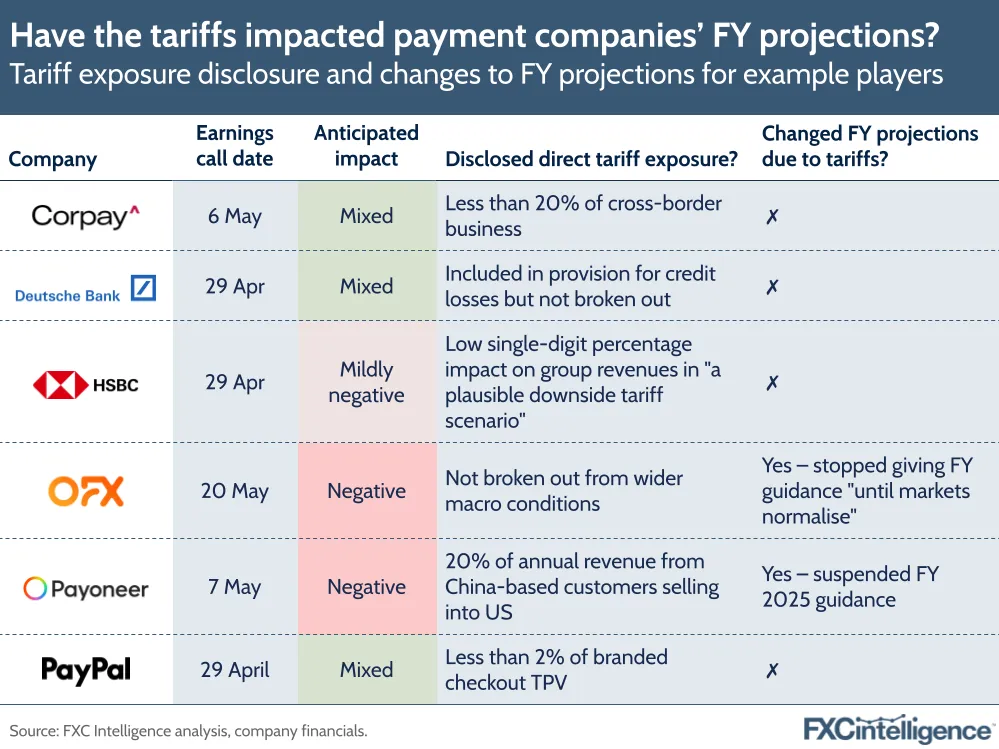

Corpay and PayPal were among the few companies to disclose direct tariff exposure, although for both this was minimal and saw enough offset to retain their previously stated full-year projections. However, OFX and Payoneer, which have higher exposure to the Asian market, saw clear negatives from the tariffs, with both suspending their guidance in response.

Calendar Q2 2025’s results will provide a stronger update on how the ever-changing tariffs are impacting the industry, so we’ll provide a further update once these come in.