Last Friday, the US suspended its de minimis exemption – the rule under which parcels under the value of $800 could enter the country duty-free and with minimal checks. The change has been heavily reported in terms of its impact on cross-border ecommerce, which for some providers could tie in with other knock-on effects from tariffs.

According to US Customs figures, almost 1.4 billion packages – worth $64.6bn – arrived in the US under the de minimis exemption in 2024, with around 73% originating in China. With the exemption gone, low-value commercial shipments to the US from other countries are now subject to full customs controls, duties and taxes. Coverage of this rule change has focused largely on prices going up for products as businesses pass on costs from new duties to consumers.

The US has stated two main reasons for cutting the exemption: to stop fentanyl from being smuggled into the US and to eliminate what many see as a distinct advantage it gives to foreign-owned businesses against American companies. Two examples are Shein and Temu, both of which had thrived from selling merchandise to US buyers at significantly low costs but which many US-based companies have argued are unfairly taking market share in the country.

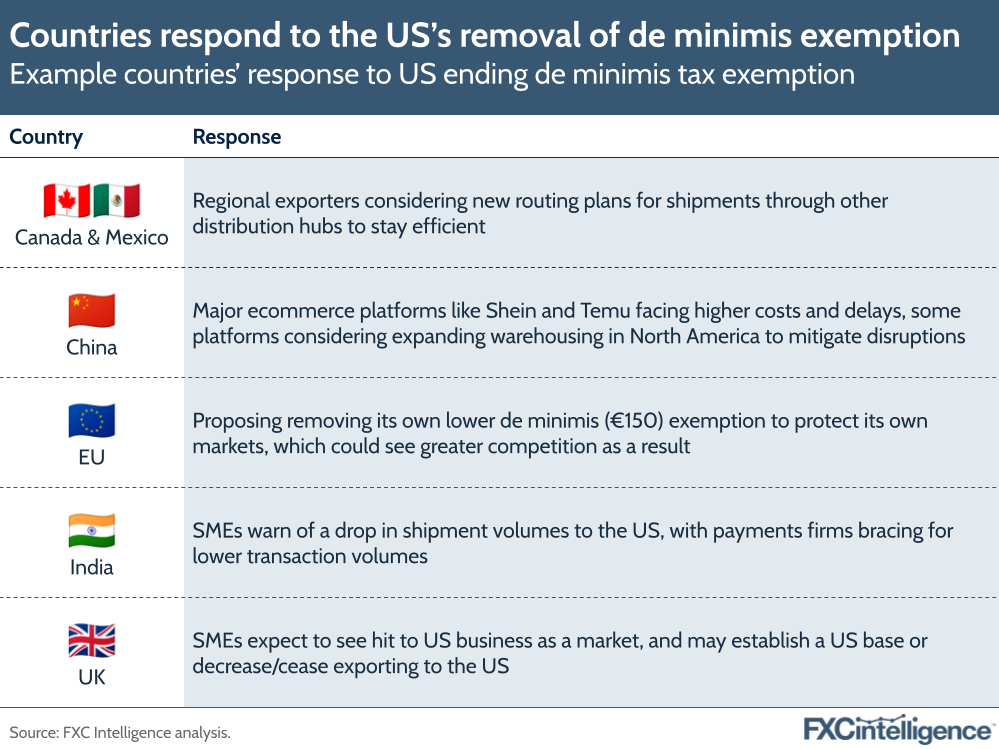

There has been a mixed response on the extent to which the de minimis exemption could affect cross-border payments. India-based processor BriskPe told the Economic Times that it was bracing itself for cross-border shipment volumes declining by 15-25% from India to the US, causing “friction” in consumer spending that could then affect payments companies facilitating these transactions.

Having said this, as the exemption is specifically focused on low-value imports, it is likely to only really have an impact on cross-border payments providers focused on marketplaces with small-ticket transactions. Notably, the majority of public cross-border payments companies did not refer to the lifting of the de minimis exemption in their most recent earnings calls, with the exception of Payoneer, which said that it expects to see “no impact” from this specific change. However, the wider impacts of US tariffs were discussed in more detail.

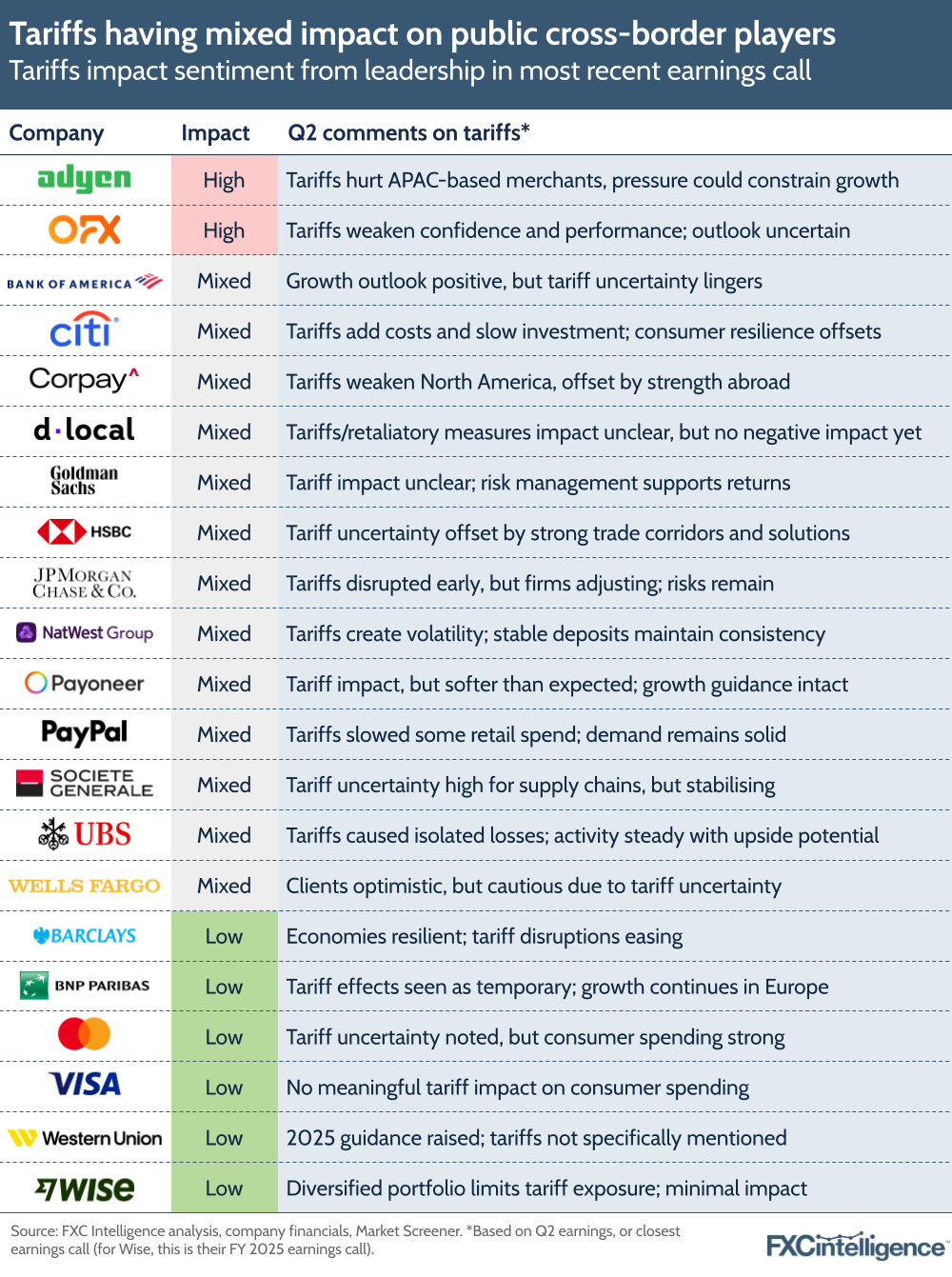

In Q2, companies reported mixed impact from the US tariffs imposed this year. Some of the companies we track (particularly banks) noted that continued uncertainty and volatility had affected client confidence, with some (e.g. PayPal) reporting softer retail spending in certain areas.

Adyen lowered its projections for FY 2025, reporting that its APAC-based customers trading into the US were seeing disruption, in turn constraining its growth in the region. Meanwhile, dLocal said that retaliatory measures to tariffs seen in some countries could be a potential risk, though it hasn’t seen any negative impact thus far.

OFX and Payoneer – two companies that are particularly exposed to tariffs imposed on the APAC region – gave quite different accounts in their earnings. OFX’s revenue declines amid “weak business confidence” prompted it to hold off guidance for 2026, while Payoneer reinstated its guidance at a higher level given a “less severe” environment, despite seeing modest softening in volumes from large ecommerce marketplaces.

Meanwhile, Visa and Mastercard both reported continued resilience in consumer spending, with the latter pointing to a strong jobs market and wages growth, while Corpay noted that markets abroad are making up for softness in North America. Overall, while there has been volatility and pockets of weakness created by uncertainty, public cross-border payments companies have for the most part continued to see steady performance amid tariffs, and in some cases opportunities to capture market share.

How can I track the cost of making ecommerce transactions globally?