dLocal has seen a positive investor response to its Q2 2025 results, in which it significantly raised its guidance amid core market strength and rapidly rising cross-border volume. We spoke to dLocal CEO Pedro Arnt and SVP Corp Dev Christopher Stromeyer to dissect the results and explore the processor’s next steps.

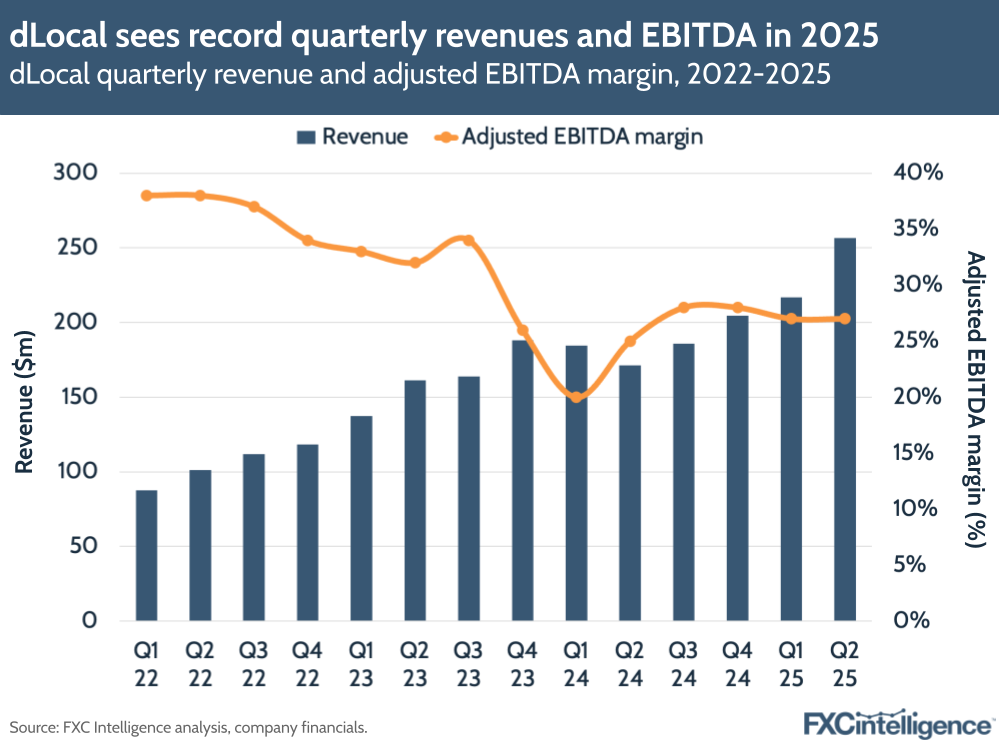

dLocal’s revenues rose by 50% in Q2 2025 to $256m – the fastest growth the Uruguay-based payments processors has seen since Q4 2023. Altogether, strong performance and guidance led the company’s share price to jump by 31% the day after it announced its results, reaching the highest price the company has seen since April 2024.

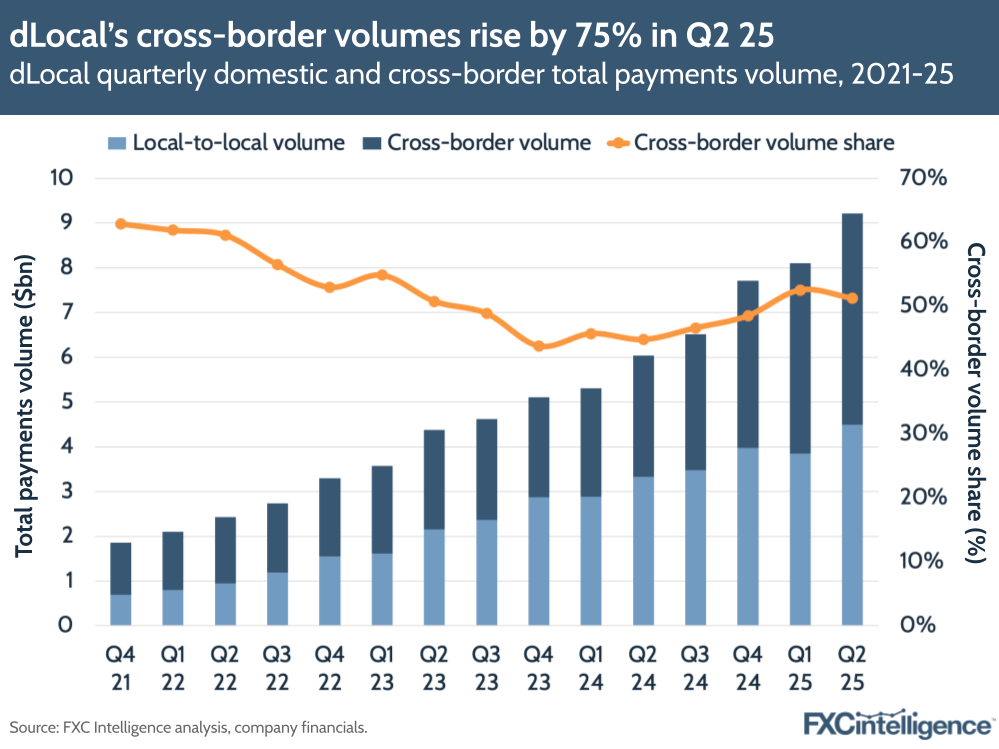

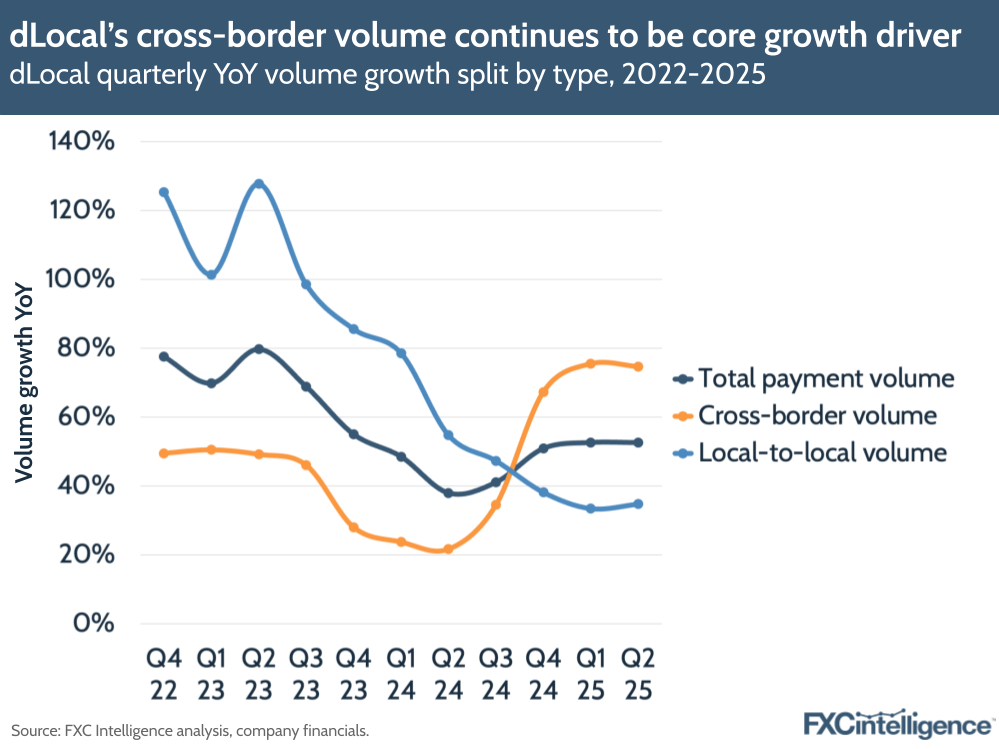

Cross-border volumes remain absolutely critical to the company’s growth, with a spike in growth (75%) versus local volumes (35%) continuing to change the company’s overall volume mix. Geography-wise, the company has seen its core markets of Brazil and Mexico post strong results this quarter, while also noting that markets outside its top three are growing almost 3x faster, helping diversify its business with network expansion.

On a wider strategy level, dLocal has continued to build out its position as a facilitator of alternative payment methods, with new local licences in multiple markets, the launch of a new Pix-based solution (SmartPix) in Brazil, the integration of buy now, pay later (BNPL) solutions across global merchants and active partnerships with Circle and BVNK to enable stablecoin settlement and on/off-ramp services.

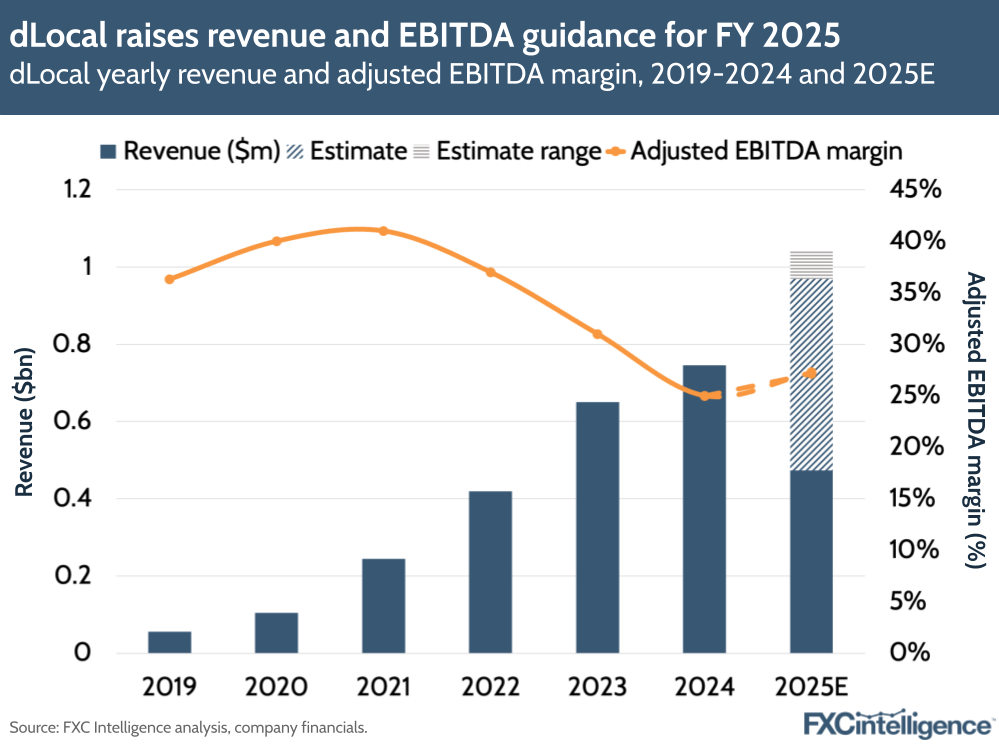

On the back of its earnings, the company has upgraded its annual guidance across its four key growth metrics – revenue, TPV, adjusted EBITDA and gross profit – so that they are all now expected to be at or above the upper end of their original 2025 guidance ranges.

We spoke to CEO Pedro Arnt and new SVP Corp Dev Christopher Stromeyer to find out what’s driven this strong set of results, as well as further explore the company’s strategy regarding stablecoins.

dLocal key revenue drivers in Q2 2025

Daniel Webber:

Pedro, the markets reacted well to a strong set of results. What’s driving growth for dLocal?

Pedro Arnt:

The strong market reaction in large part is because we see strength across the board. We also see sustained momentum implied in the significantly upward revised guidance. That strength is a consequence of a few things.

First of all, we continue to see an increasing interest from global merchants for some of the frontier market segments that we offer. Our business is increasingly diversified away from Brazil and Mexico, our two largest markets, and even if we look at our growth in Africa, Middle East and Asia, it’s far outpacing the growth in our core LatAm markets. We’re really seeing increased appetite for localised payment solutions.

There are two secular trends worth highlighting that drive this across-the-board strength. One is geopolitics and trade wars, where we see some global merchants having access to the markets and these different trade blocs that are emerging. Chinese merchants are having limited access to the US and that implies a reallocation of resources towards the Global South, driving a lot of the growth we’re seeing and expansion into more markets from Asian players.

The second trend is the growing share of payments in emerging markets from non-credit card alternative payment methods (APMs) and local ones. If you see what’s happening with Pix, it’s phenomenal. It has already surpassed UPI in terms of volume. The consistent growth of local wallets across Latin America – Mercado Pago, Yape in Peru, PicPay in Brazil – is significant and requires localisation of payments, which we see in our volumes.

And now there’s a third wave we’re betting on aggressively – the emergence of BNPL and microcredit lenders with embedded payments capabilities. All of that requires localisation of payments and that’s what’s driven such a strong H1 for dLocal.

dLocal raises guidance after strong quarter

dLocal reported record high revenues for the last quarter, up 50% to $256m in Q2 2025, while adjusted EBIDTA grew even faster, by 64% to $70.1m, giving a margin of 27%. Key drivers were rebounds in Brazil and Mexico, as well as strong cross-border volume growth of 75%, driving an overall volume rise of 53% to $9.2bn.

For FY 2025, dLocal now expects 30-40% YoY revenue growth to $970m-1.04bn, driving 40-50% YoY growth in Adjusted EBITDA to $264m-283m. It also expects total payment volume (TPV) to ramp up by 40-50% in 2025, which would see it hit $35.8bn-38.4bn.

The company did note that guidance could be affected by various macroeconomic factors, such as the impact of new US tariffs on cross-border ecommerce on Mexico (though no negative impact has been seen on this thus far); shifting fiscal regimes in Brazil; and potential currency devaluation and/or changes in capital controls.

Breaking down dLocal’s strong payments volume growth

Daniel Webber:

Your revenue growth has in some cases outpaced TPV. What’s driving that, since clearly you’re maintaining or expanding revenue off TPV, not just being pushed down on price?

Pedro Arnt:

We’ve admitted that core processing costs will likely trend down. One focus for this quarter was on taking advantage of other financial services and value-added services to defend monetisation.

The most obvious example is FX, especially exotic pairs, which helps on the take rate, but this quarter we also saw strong pickup in financing options. This includes helping merchants offer financing to consumers in emerging markets and making a spread off of that without taking on credit risk – whether through our BNPL platform or receivable factoring product. Those are some of the reasons why take rates have held up so well this year.

Cross-border volumes surge in Q2 2025

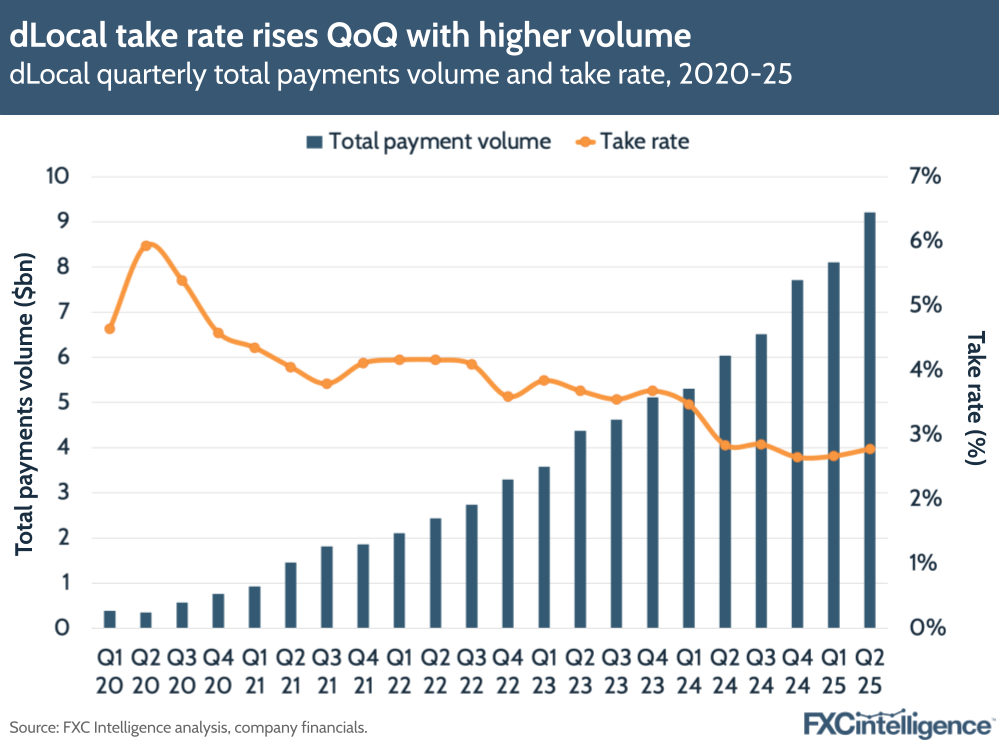

dLocal’s strong cross-border growth (75%) in Q2 2025 versus local-to-local volume growth (35%) continues to be the core driver of volumes, with cross-border accounting for over 50% of volumes for the second quarter in a row (something the company hasn’t seen since Q2 23). This is also the third quarter in a row that cross-border volume growth has outpaced both local and overall volume growth.

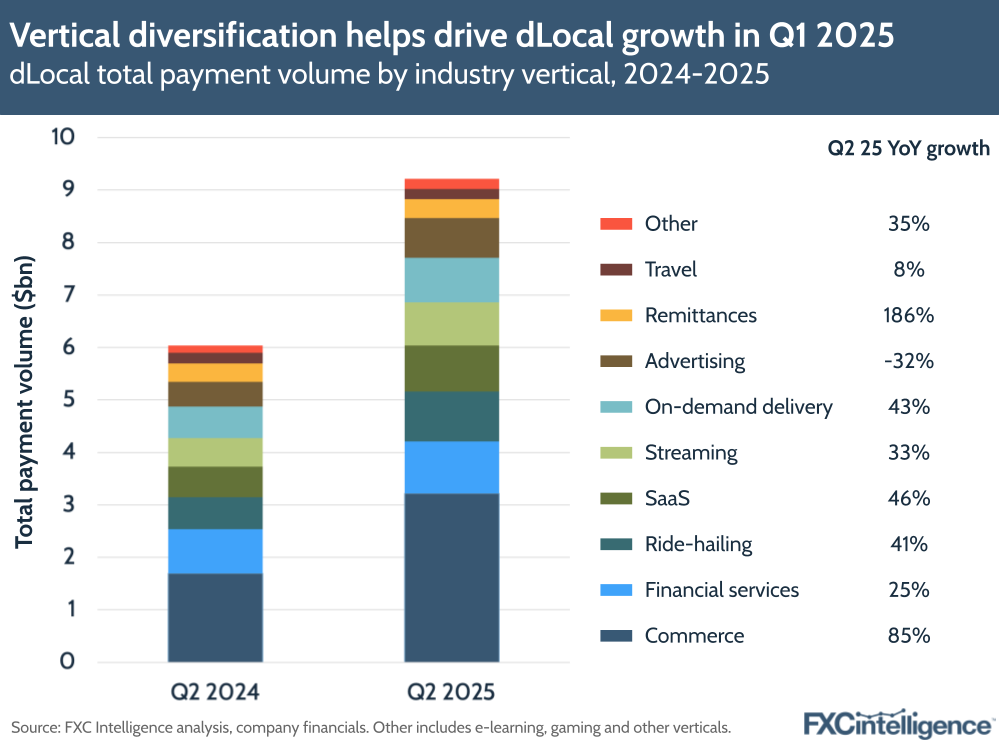

Cross-border is mainly being driven by commerce, SaaS, remittances and ride-hailing verticals across various markets. dLocal also continues to see the majority of its volumes (69%) from pay-ins, which saw 50% growth, though pay-outs volumes grew slightly faster with 60% growth.

The higher share of pay-ins, alongside the recovery of processing costs, influenced an improvement of the company’s net take rate in the quarter (defined as gross profit divided by TPV), though the company said these effects were “partially offset by lower FX fees in Argentina as a result of spread compression.”

Take rate rose by 11 bps to 2.78% compared to the previous quarter, though was down six bps from Q2 2024. During the earnings call, Arnt also said that the company’s revenue per employee is “now better than many of our public company, best-in-class peers who process more TPV than we do”.

Why dLocal is posting faster remittances growth than its peers

Daniel Webber:

From your numbers, the remittances segment is resonating strongly. You’re growing much faster than peers trying to offer payouts for remittances. What’s working for you in that segment?

Pedro Arnt:

The fact we have a very large pay-ins business equips us with local liquidity. We have significant positions in Egyptian pounds, Brazilian reals, Mexican pesos. That allows us to be very competitive on FX pricing on the way in. We’ve built pipes over the years so settlement times are instantaneous. That allows us to offer compelling value to remittance players across many markets.

Christopher Stromeyer:

Being a one-stop shop helps too. We can go to the largest remittance players in the world and give them one API integration for 40+ markets, including what we might call exotic markets or currency pairs, and there are not that many players that can do that. Otherwise, players need multiple local solutions, and this is another great example of the complexity we abstract away.

Breaking down growth across dLocal’s segments

With the exception of advertising, which fell by 32%, dLocal continued to see significant growth across all of its segments, with the standouts being remittances (which grew 186%) and commerce (85%), followed by SaaS (46%), delivery, ride-hailing and streaming.

Stablecoins create key settlement and off-ramp opportunities

Daniel Webber:

When it comes to stablecoins, what are the main opportunities for dLocal?

Pedro Arnt:

We see this as a significant opportunity because we do not believe that stablecoins are here to replace fiat. Stablecoins are a re-architecting of financial infrastructure for cross-border [payments], which start in fiat and eventually end in fiat, and will be that way for many years. We don’t see a maximalist world where everything is in USD-denominated stablecoins.

The first area we’re focusing on is on-ramps and off-ramps from fiat, a huge opportunity for us. Those on-ramps and off-ramps are highly dependent on local liquidity, competitive FX and regulatory and compliance localisation, which is exactly what dLocal is all about. We’re focused on providing transitions from fiat to stable and then from stable back into fiat for consumers across the Global South. We have a very interesting pipeline of opportunities in that space.

The second area is all our merchants are already enabled to settle to us and be settled by us in stablecoin. Here, adoption has been slightly slower. We’ve seen the most interest from remittance players where transaction speed is critical. Smaller ones can save one or two days of credit agreements with us, making transactions real-time. Rather than charge them for those two days of float, they settle to us in stablecoins, which is immediate, so we have seen some pickup on that front.

We don’t see as much with our larger merchants, and this is perhaps characteristic of how stable adoption will come about. If you’re a larger more sophisticated treasury that’s already accessing wholesale FX, then you may not be as sensitive to a 48 hour delay on settlement, and maybe the relative value prop of stablecoins to you is not significantly better as is the case with some end users or SMBs.

The third area, which we’re in the process of launching, is enabling stablecoin as a payment method at checkout for our merchants. In that sense, stablecoins and digital assets are potentially the ultimate alternative payment method (APM). dLocal has always been about offering all the relevant APMs that consumers across emerging markets want to pay in. Although adoption isn’t huge yet, we need to be at the forefront of offering merchants those capabilities should end-user adoption pick up.

Christopher Stromeyer:

Maybe the way to think about this is that cross-border has two elements. The first is how you move the money across the world, and the second is the FX component, the on and off-ramp. At dLocal, we’ve always been agnostic to how we move money in that we do it in the most efficient way we can, whether that is through wholesale banking systems, stablecoins or netting in some markets.

We’ve used stablecoins to move money around internally, and we’ve done that for a while. But given the volumes we move, it’s not always necessarily cheaper, as on and off-ramps to fiat often have larger spreads today, though that might change in the future. In well-used currency pairs, the traditional banking FX system can still be cheaper. Where we do work with stablecoin players like BVNK, we provide the off-ramp. If their customer wants money in South Africa in local currency, we convert it to fiat.

Daniel Webber:

So to confirm, just using stablecoins at scale doesn’t automatically make things cheaper. Some think it’s all free, but that’s only true if you stay in the same stablecoin. Once fiat is involved, liquidity is essential, and that’s where you step in.

Christopher Stromeyer:

It’s all free as long as you stay in the same stablecoin. If you are just moving money around in USDC in one wallet to another, it’s free. The moment there is a fiat component to it, a liquidity aspect comes in and that’s when you need liquidity locally to make that happen.

dLocal’s Brazil and Mexico revenues rebound in Q2 2025

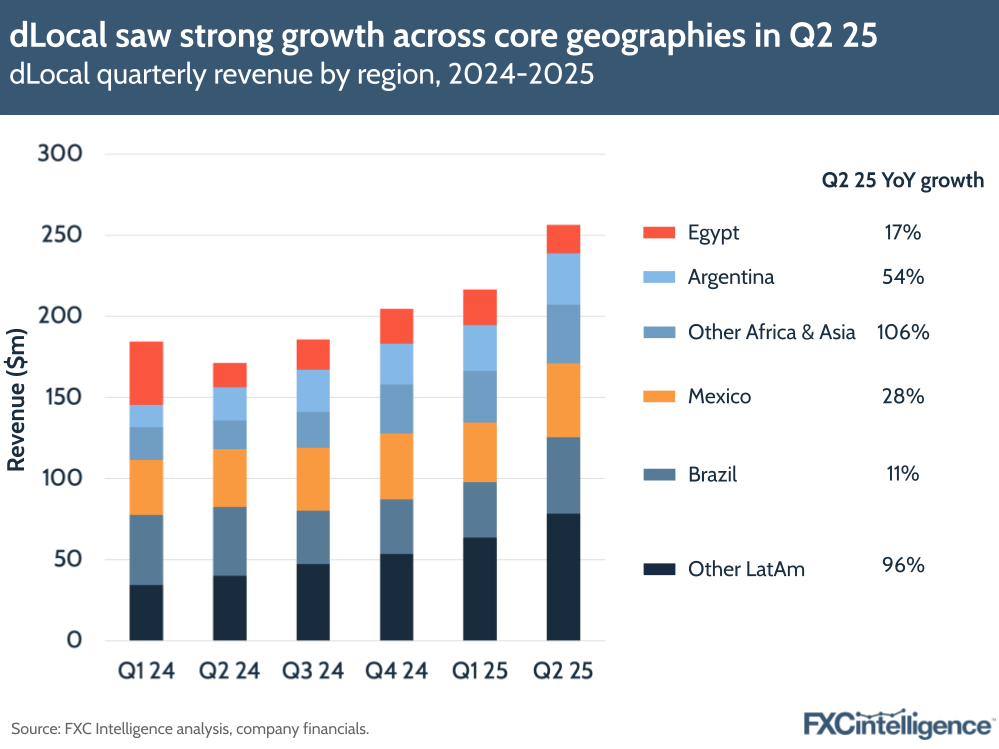

dLocal’s Brazil segment saw 11% revenue growth in Q2 2025 – the first time the segment has grown since Q2 2024. The company linked this to a higher share of installment payments as well as the recovery of one-off processing costs from the previous quarter. It also noted 54% growth in Argentina, driven by higher volumes offsetting, and 28% growth in Mexico, driving overall LatAm growth of 46%.

Africa & Asia, dLocal’s other core market, rose 65% to account for just over a fifth of dLocal’s overall revenue, on the back of a 17% rise in Egypt and a 106% rise in Other Africa & Asia markets.

Geographic diversification and client growth is a key marker for dLocal’s resilience, with the company’s top 50 clients operating on average in 11 countries and using 48 payment methods – up from eight countries and 35 markets 18 months ago. Together, the company’s top three markets represent less than 50% of its revenues, down eight percentage points from 2023.

Tracking growth and APM opportunities across core markets

Daniel Webber:

Anything else you’d like to add?

Pedro Arnt:

The strength in smaller markets plus the rebound in Brazil and Mexico, which had a few weak quarters, is significant. Brazil especially has come back strongly and we see no slowdown into H2.

Christopher Stromeyer:

Also, we’re starting to be clear about our product innovation agenda on a number of fronts. Firstly, how we continue to innovate in APMs, as it’s really important for us to be at the forefront of this globally.

Brazil has been a big innovator and with our SmartPix product we’re taking advantage of that APM opportunity. With SmartPix, you pay with Pix as if your card was on file. We’re also launching BNPL across the world and it’s already in five markets. We’re partnering with local players to add that as an option at checkout and to improve conversion rates.

Daniel Webber:

Pedro, Christopher, thank you.

Pedro Arnt and Christopher Stromeyer:

Thanks very much.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.