Payoneer has seen another solid quarter of growth and restated its $1bn+ revenue projections for the year despite macroeconomic challenges. We spoke to CEO John Caplan and VP of Investor Relations Michelle Wang about the key drivers in Q2, the impact of US tariffs on its business and where Payoneer sees growing opportunities from stablecoins and AI in the future.

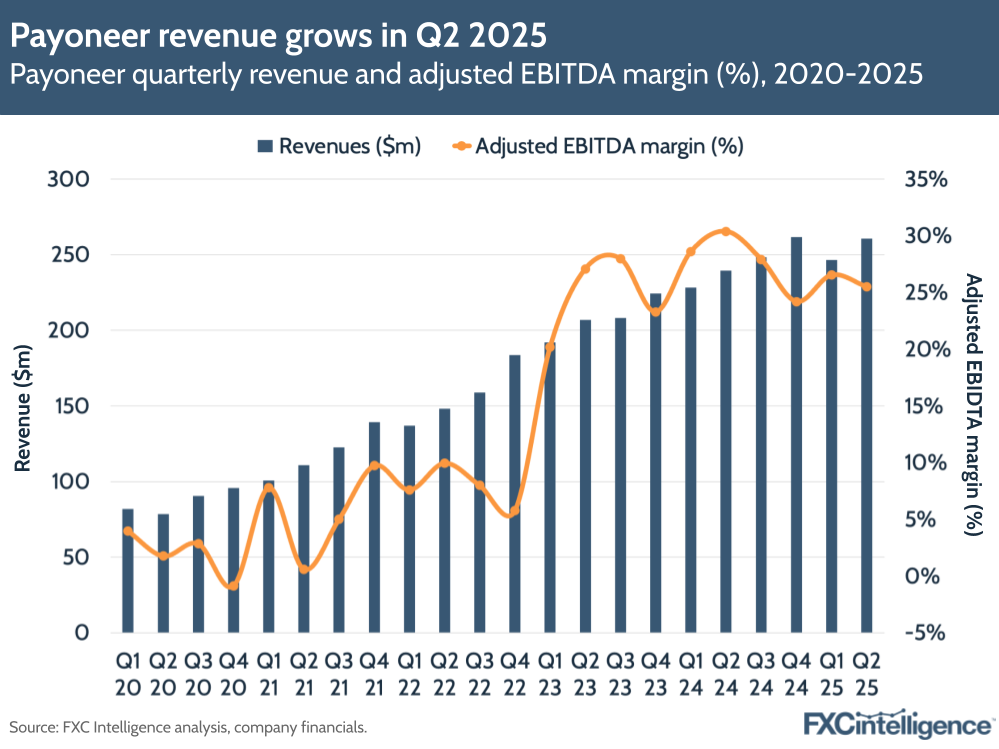

Payoneer reported strong Q2 2025 results, with total revenue up 9% year-over-year to $261m. Key drivers included the company’s B2B franchise, rising adoption of checkout and card products and the implementation of a new pricing strategy.

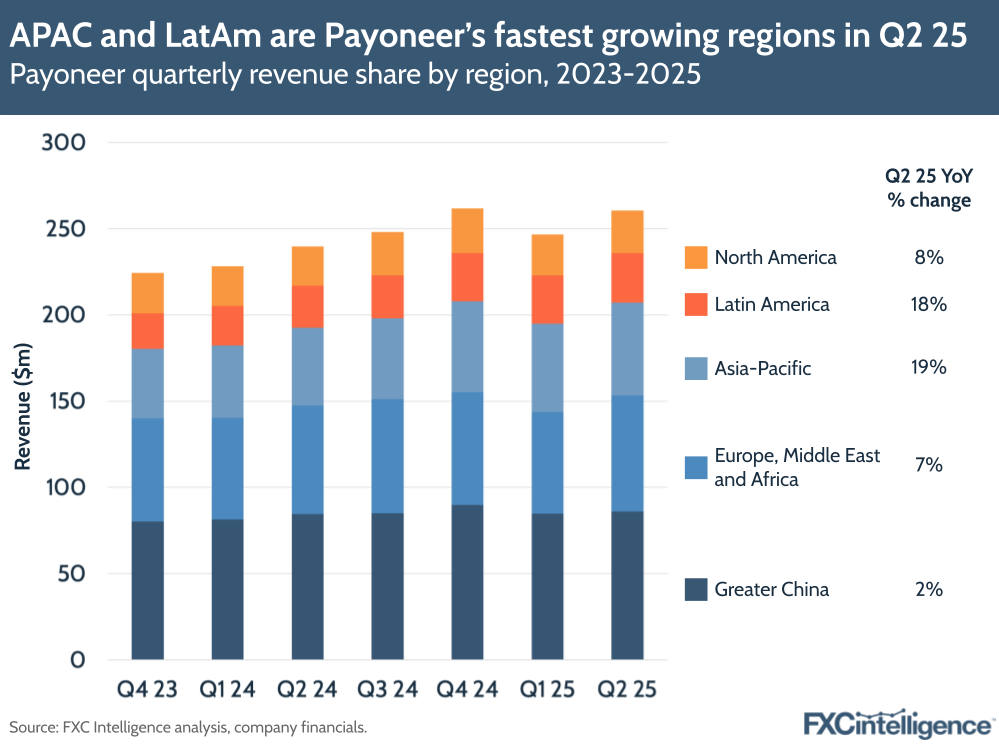

The company has now reinstated its revenue guidance for 2025 after suspending it in Q1 2025 due to tariffs, which is significant, coming as the industry continues to react to ongoing and evolving US tariffs. Payoneer’s activity in China continues to account for a third of its business and remains a core target region, despite uncertainty and faster growth in LatAm and the wider APAC market.

During its earnings call, the company also talked about the key opportunities it sees in stablecoins, including off-ramping to local fiat currencies and working with Citi to integrate digital currencies into real-time treasury management capabilities.

We spoke to Payoneer CEO John Caplan to explore more of the company’s key drivers in Q2 2025, as well as where he sees the business going in the second half of the year and beyond, with additional insights provided by VP of Investor Relations Michelle Wang.

Payoneer’s key revenue drivers in Q2 2025

Daniel Webber:

John and Michelle, a pleasure to be with you. Let’s take it from the top. What’s driving revenue growth and profitability for Payoneer?

John Caplan:

Payoneer delivered a really strong quarter. What’s most important is we reinforced our position as the global financial platform for cross-border small and medium-sized businesses (SMBs).

We’re creating our own tailwind in the business. Our core revenue grew 16% year over year, average revenue per user (ARPU) was up 21%, and adjusted EBITDA reached $66m. All of these are significant achievements.

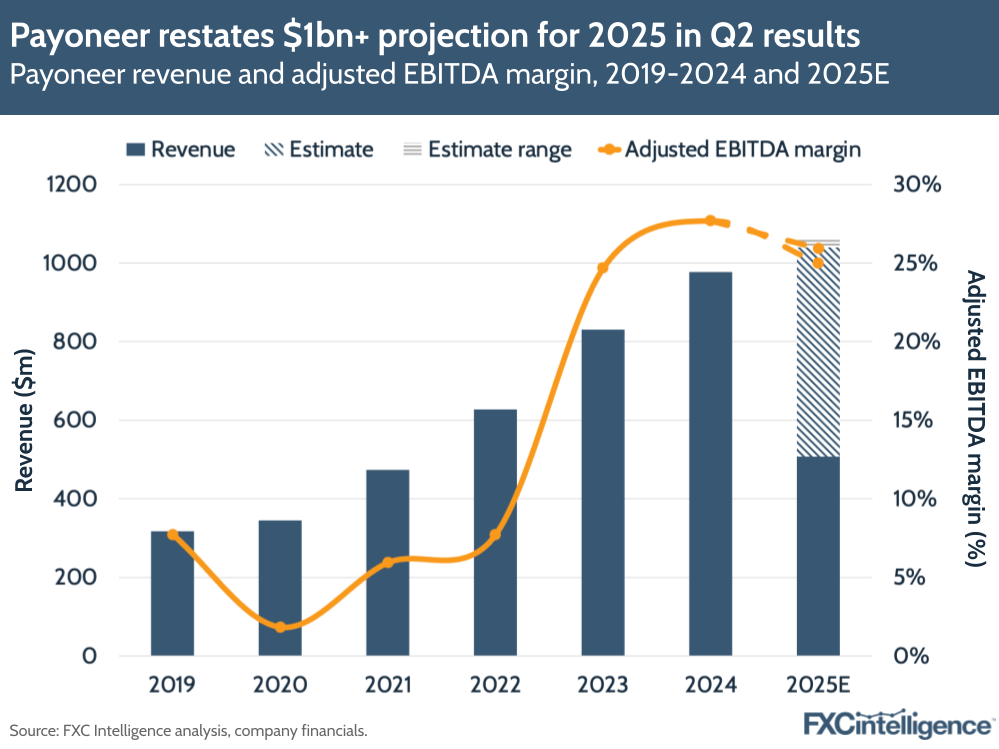

We also brought guidance back, and our new guidance communicates two very important things. First, at the top end of the range, we raised our revenue guidance greater than it had been in February, which is a significant [testament] to the strength of Payoneer. Second, and more importantly, we guided to $43m of core business adjusted EBITDA – that’s three times greater than 2024’s core business adjusted EBITDA.

Payoneer went from -$25m of core EBITDA in 2023 to $14m in 2024, and has just guided to $43m for 2025, so we are unlocking real leverage and profitable growth.

Payoneer reinstates 2025 guidance amid strong growth

Payoneer’s total revenue rose by 9% to $260.6m, with volume up 11% to $20.7bn. Interest income declined for the company by 11%, but revenue excluding this income rose 16% YoY, highlighting the company’s continued resilience as it drives organic business.

Adjusted EBITDA fell by 9% to $66m – the first fall in this metric since Q4 2022 – though this still gave a 25% adjusted EBITDA margin. The company noted that it has seen costs rise due to higher transaction costs, investments and acquisitions, though it expects to more than triple adjusted EBITDA excluding interest in 2025.

Having suspended its full-year guidance in Q1 2025 due to uncertainty around tariffs, the company has now restated these at a slightly higher range, with total revenue expected to rise 6-8% to $1.04bn-1.06bn. Excluding interest income, revenue is expected to rise to $815m-835m, a faster increase at 13-16%. In the medium term (through 2026) the company expects mid-teens revenue growth with an adjusted EBITDA margin of 25%, though in the long-term (beyond 2026) it expects 20%+ revenue growth with the same margin.

Overall, adjusted EBITDA is projected to be within a more moderate range at $260m-275m, which would be between a 4% fall and a 2% rise compared to 2024.

Exploring Payoneer’s B2B focus

Daniel Webber:

What is the impact of your B2B business on your overall revenues?

John Caplan:

Of Payoneer’s total core revenue, 30% comes from our B2B business. It is 50% of our revenue growth. We are the market leader in helping B2B services companies in high-growth emerging markets digitise their payments.

The total addressable market (TAM) or serviceable addressable market (SAM) is so big that we have to be methodical, but we are carving into that market to take share from the analogue, old-world banks – and it’s working.

The highlight is the core business adjusted EBITDA guide, the total revenue guide, and the B2B strength of our franchise. Our 21% ARPU growth in the franchise speaks to bigger customers in the portfolio, more volume per customer and all the pricing work we’ve done, which has dramatically improved our monetisation.

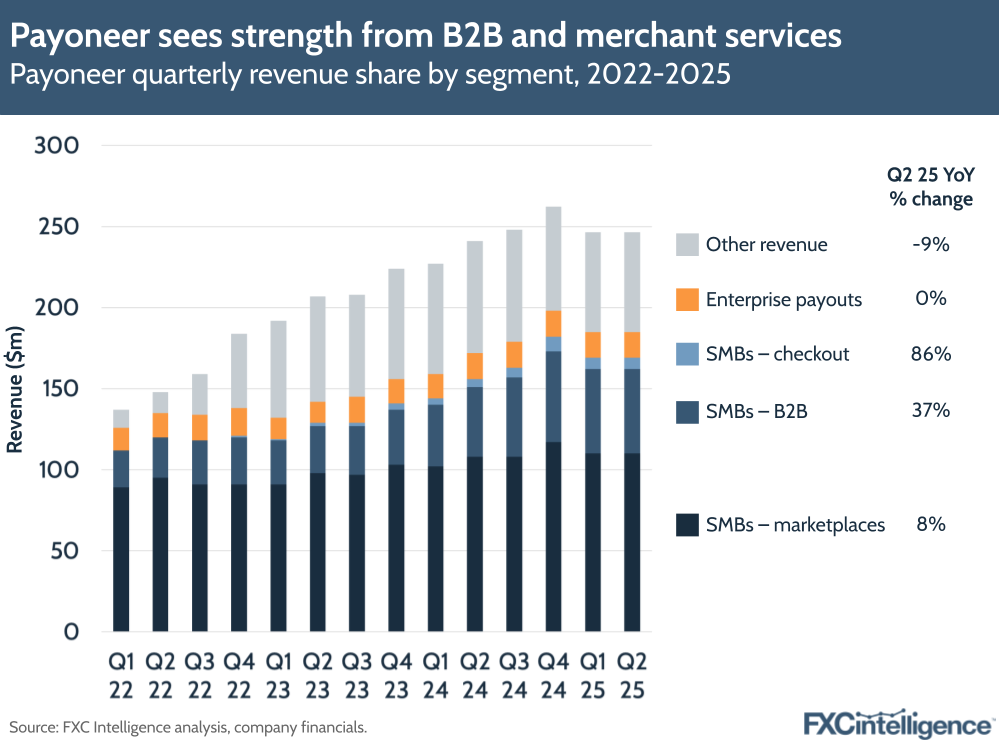

SMB revenues and cross-selling remain key drivers

SMB customer revenue overall was up 18% to $183m and remains Payoneer’s core driver, accounting for 70% of revenues overall. Of this, Marketplaces make up the bulk of the revenue at $116m, though grew more slowly at 8%. By comparison, Checkout (previously referred to as Merchant services) saw rapid growth at 86% to $9m, while B2B rose 37% to $58m.

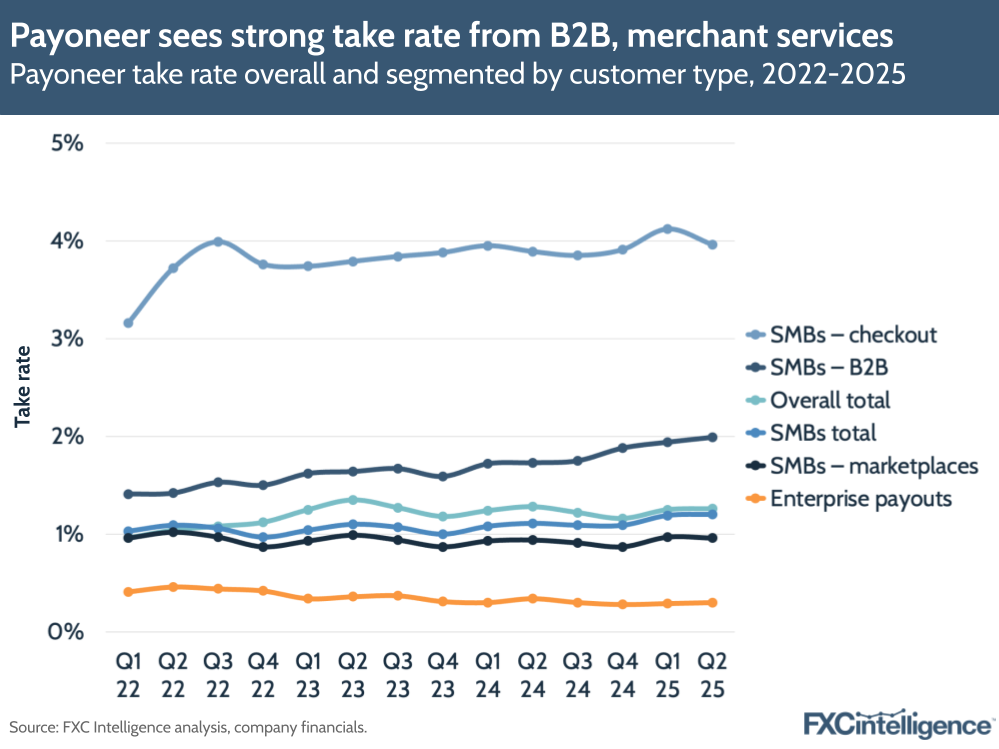

Overall, the company’s take rate for its SMB services has risen from 1.11% in Q2 2024 to 1.2% in Q2 2025, and the company continues to see the highest take rates in its checkout and B2B services, with its B2B take rate rising by the highest margin in Q2 to 1.99%, up from 1.73% in Q2 2024. Across the business, Payoneer also noted it is also successfully cross-selling its products, with 53% of active customers now using 3+ accounts payable (AP) products – up from 40% in Q1 2022.

Moving into Q3, the company expects low double-digit B2B volume growth, accelerating to high teens in Q4, with B2B revenue increasing by roughly 25% for the second half of the year. This will be driven by strong B2B volume growth in its rest of world segments, partially offset by slower growth in its China B2B business.

Stablecoin and blockchain opportunities for Payoneer

Daniel Webber:

How is Payoneer approaching blockchain and stablecoins?

John Caplan:

We are already working with our colleagues at Citibank in some treasury functions [via their tokenised product]. Tens of millions of dollars are already moving through that relationship, and that will scale.

And then we are working towards the provision of Payoneer-enabled stablecoin accounts. Why is that important? Businesses don’t want to hold 50 different wallets. Payoneer’s value proposition is the multicurrency account – you can hold a dozen different currencies in your Payoneer account today. Adding a new currency makes the account more valuable to our customers.

For example, a Payoneer customer in Thailand, Manila or South Korea who sells goods and gets paid in stablecoins can’t currently buy a hammer in Vietnam with stablecoins. The core premise of Payoneer is a multicurrency wallet where you receive multiple currencies and convert them to your local fiat currency. Until you can buy everyday items like a hammer or a glass of orange juice in USDC, you need companies like Payoneer who are the last-mile delivery mechanism for the world’s cross-border trade.

We are not hype-cycle driven – our focus is practical, methodical implementation of innovation to create value for our customers around the globe. We also have extraordinary relationships with the biggest marketplaces in the world and those marketplaces, plus our SMB relationships and multicurrency account, position us well to be leaders in this innovation as we explore it with our partners. But we are measured – we’re not doing press releases for press releases’ sake.

Inside the stablecoins payments opportunity

The key opportunity for Payoneer is in solving the ‘last mile’ challenge in cross-border payments – i.e. enabling business customers to off-ramp coins to the local fiat currency they are using domestically.

In this way, the company sees it as a potential value-add to the existing fiat network, which has been a key aspect of several recent partnerships and acquisitions in the cross-border payments space around stablecoins – as well as our recent coverage of it.

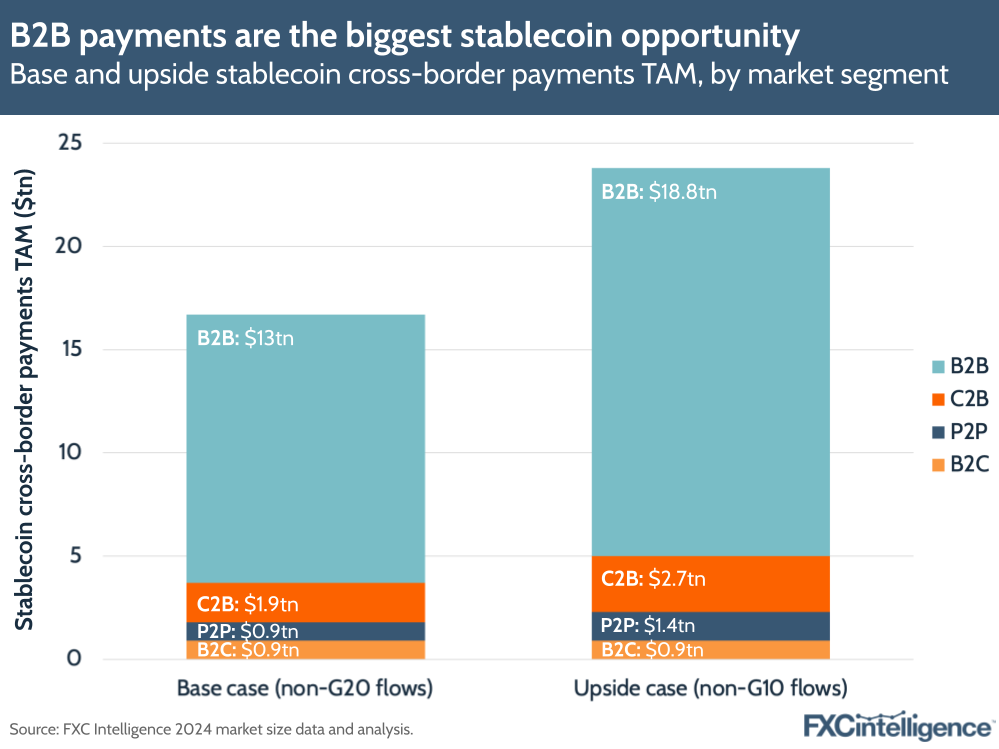

In FXC Intelligence’s recent industry primer on stablecoins, we identified that the B2B space (Payoneer’s key driver) remains the biggest opportunity for stablecoins. Examining flows passing through non-G20 markets specifically (i.e. the base case), B2B accounts for $13tn out of the total TAM, significantly higher than $1.9tn for C2B payments and $0.9tn for P2P and B2C payments separately. However in the upside case, the opportunity is even greater for B2B at $18.8tn.

How AI is driving profitability and productivity

Daniel Webber:

You mentioned blockchain and stablecoin – how is AI impacting Payoneer?

John Caplan:

We’re already seeing a positive impact from the AI work we’re doing in our development life cycle, and in opportunities around our know your customer (KYC) compliance and onboarding activity. We’re excited about the innovation and have some great teams working on it – it’s unlocking leverage in our P&L as well as driving productivity in our organisation.

Michelle Wang:

Beyond the cost side of things, there’s a lot of really interesting opportunities with how AI can help with our go-to-market motions – for example, more targeted search engine optimisation sourcing. Ultimately, the ambition is to use AI to better predict the entire customer life cycle so you can reach customers before they churn, and predict what products or services they might want to improve cross-sell and upsell rates.

Framing Payoneer versus potential competitors

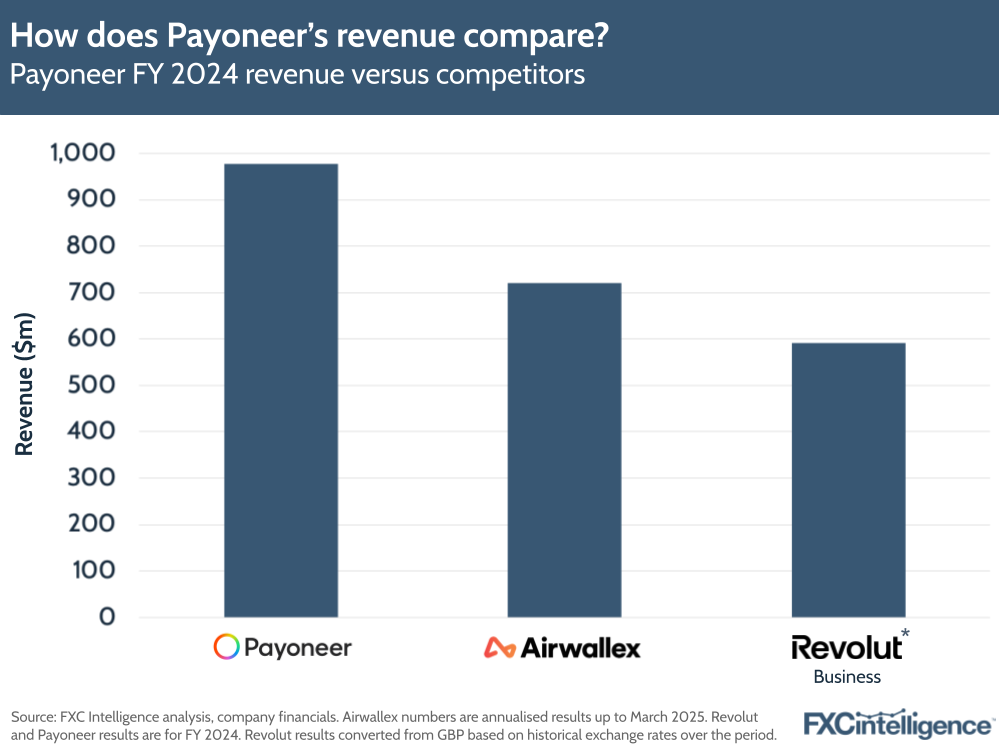

Payoneer appears to be positioning itself as a hybrid between a foreign bank alternative and a provider of AP and AR solutions for businesses aiming to make and receive cross-border payments. This puts them more in competition with other providers of B2B cross-border payments services such as Revolut for Business and Airwallex.

Comparing revenues for these players comes with some caveats, as they have different reporting periods, currencies and regularity of when they report figures (Stripe, Airwallex and Revolut are currently privately held companies). However comparing 2024 results (or in Airwallex’s case, its annualised revenue over 12 months that it reported in March 2025) gives a sense of the size of the different players.

Payoneer’s 2024 revenue result of $978m was higher than Revolut for Business ($592m) and Airwallex’s annualised revenue to March 2025 ($720m). Having said this, both of these players are reporting very strong growth, with Airwallex CEO Jack Zhang telling us in July that the company was approaching $900m in annualised revenue and aiming to surpass $1bn by early Q4 2025, while Revolut for Business saw revenue grow 77% in 2024 to $592m, slightly faster than its overall revenue growth for the year.

In terms of overall volumes, Payoneer had noted a 21% rise in annual volumes to $80.1bn, while Airwallex reported it achieved $130bn in annualised volume up to March 2025. Revolut does not directly report volumes for its business segment, but in its annual report claimed that this metric had tripled in 2024. In terms of total payment volume, Stripe saw this increase by 38% to $1.4tn in 2024.

China and the potential impact of tariffs

Daniel Webber:

How are you thinking about China and the potential tariff impact?

John Caplan:

Our China business is fantastic and strong because China is the leading manufacturing exporter on the planet, and we are the leading provider to cross-border SMBs in China. While tariffs are an unwanted air pocket, the certainty that’s emerging from a policy standpoint enables the entrepreneurs we serve to be very focused on their growth and the geographies they distribute to. We held about 15 events in China last quarter, helping our Chinese customers drive distribution in Europe, Latin America and Asia-Pacific (APAC). We also added 12,000 core customers in China last quarter.

We saw a little bit of softness in marketplace demand in the latter part of Q2, which was reported by others, and expect a couple of hundred basis points of volume softness in Q3 and Q4, and that really depends on the US consumer base. Our China B2B business is 20% of the volume and 10% of the revenue, and we saw 5% growth of that volume because we’re rate limiting our innovation there as we get product market fit. So we’re just scaling our investment with the size of the opportunity in terms of where we are today.

Wayfair also had 40% YoY growth as US consumers are buying stuff from Wayfair. So our China exports business is strong, it’s 15% of total revenue and about a third of China revenue overall.

Policy certainty is what everyone wants. It allows entrepreneurs to improve margins, reduce costs, optimise pricing, drive distribution – all the things that entrepreneurs do to manage and run their businesses. As certainty becomes more clear, our portfolio becomes more and more valuable.

Breaking down Payoneer’s revenues across geographies

Greater China remains a significant contributor to Payoneer’s revenues, accounting for roughly a third of the company’s total revenue, though growth for this region moderated this quarter at 2% (compared to 19% in Q2 2024 and 4% last quarter).

During the earnings call, CFO Bea Ordonez said that there continues to be a split between China, which is a goods business where the company has bigger sellers and the company is “still finding a product market fit”, and the rest of world business, which is a services business. The company’s B2B ‘rest of world’ portfolio makes up 80% of its total B2B volume and around 90% of its B2B revenue, with China making up the rest.

Meanwhile, other regions continue to see strength, with the wider Asia-Pacific region growing 19% while Latin America grew 18%. The company also notes that it has been driving growth specifically in its highest take rate regions APAC and LatAm, which see a take rate of around 2.5%, while North America, China and Europe, the Middle East and Africa have a 1% take rate.

Despite moderate growth versus other regions, the company continues to see strong ICP growth in China with 11% YoY, from 107,000 in Q2 2024 to 119,000 in Q2 2025. China remains a stronghold for marketplace sellers using Payoneer for cross-border settlement, multicurrency accounts and enabling global payouts.

Inside Payoneer’s card spend volume and key customer growth

Daniel Webber:

Payoneer’s card spend volume grew by a record high at 25%. What’s driving that?

John Caplan:

When tariffs were introduced, there was a small blip in advertising buying by China-based customers as they digested the landscape, but card penetration is strong in China. The fastest cards growth was in Latin America, which has seen multiples greater growth than overall usage.

Michelle Wang:

In Latin America, there are many services companies, including a lot of marketing agencies. As we’ve been trying to sell the card beyond just ecommerce sellers who need to buy ads, we’ve found interesting use cases where B2B services companies like marketing agencies buy ads on behalf of clients – sometimes their AP needs exceed AR in certain cases, because they might not be billing all that much revenue across border, but they need to buy ads on behalf of their entire client base.

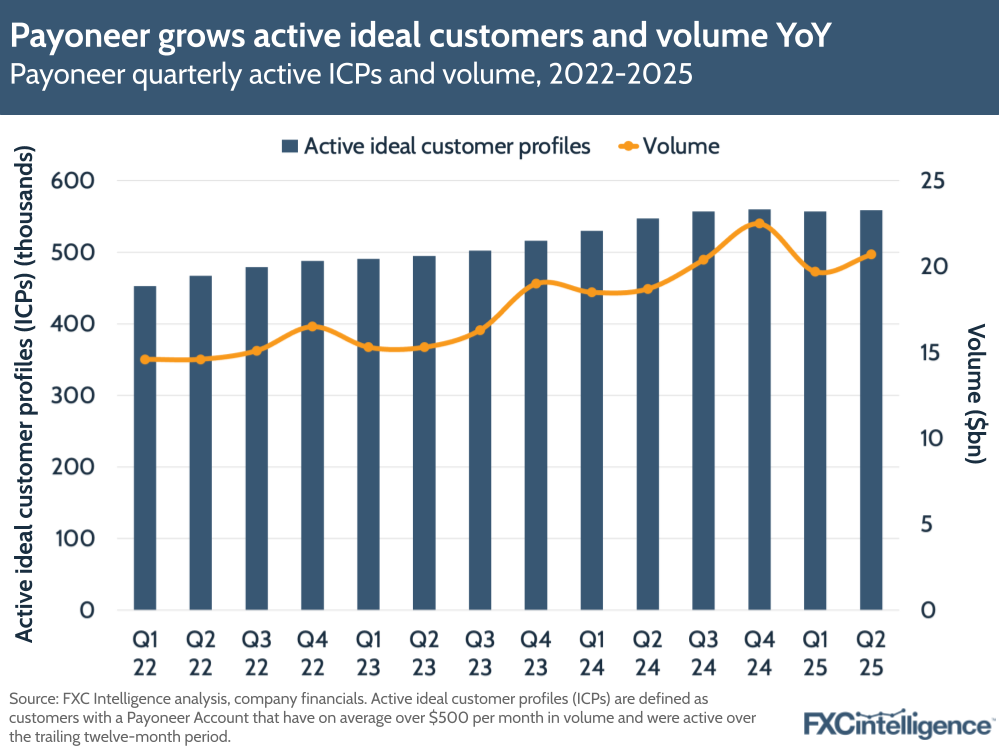

Payoneer retains ICPs while growing customer funds

The company has delivered 13,000 net new ICPs, driving a 2% YoY rise in ICPs to 559,000. New ICP growth has been led by Tier 1 markets, which account for over 60% of Payoneer’s revenues.

Though ICP growth has slowed compared to previous quarters, the number of ICPs with $500-10k of volume a month has grown 3%, while those passing $10k+ of volume a month has declined 6%. However, the company said its retention of ICPs remains higher than non-ICP retention, and over time its ICPs have taken up a higher share of its total customers (around 28% in Q2 2025).

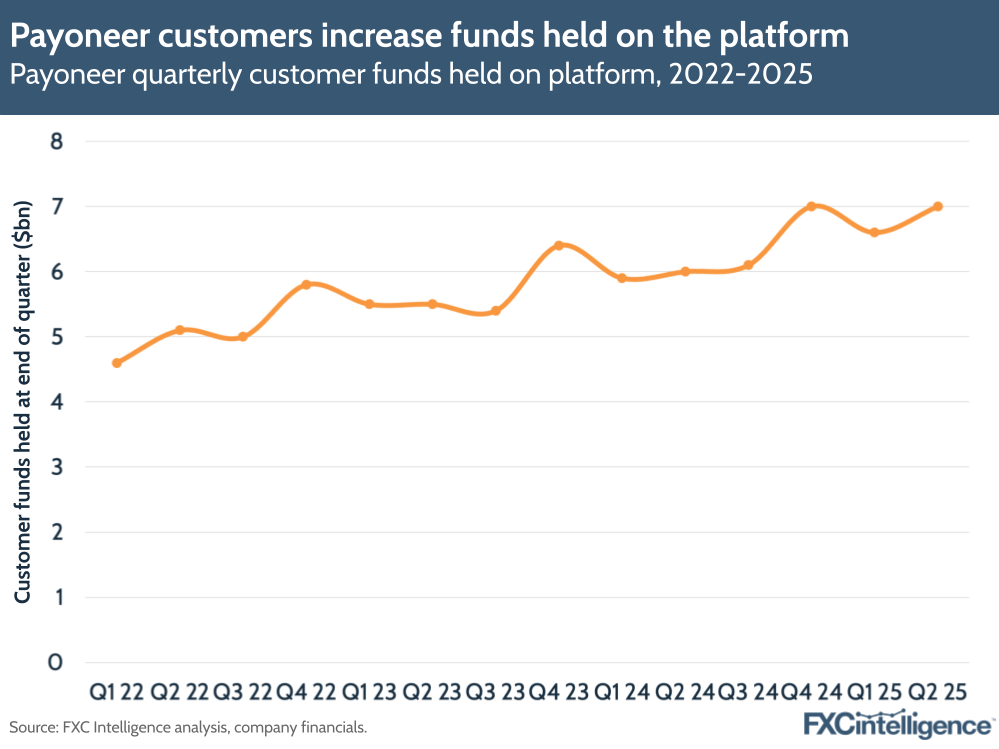

ICP growth also helped drive 17% growth in customer funds being held on Payoneer’s platform.

Daniel Webber:

Anything else you’d like to add?

John Caplan:

We also had a 17% increase in customer balances at Payoneer to $7bn. For readers, this is a proxy for trust. We’re seeing our customers use more and more of our AP products, and hold more and more balances with Payoneer. Some of it is volatile uncertainty in their domestic currencies obviously, but that number was surprisingly large growth and another highlight for the quarter.

Daniel Webber:

John, Michelle, thank you.

John Caplan and Michelle Wang:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.