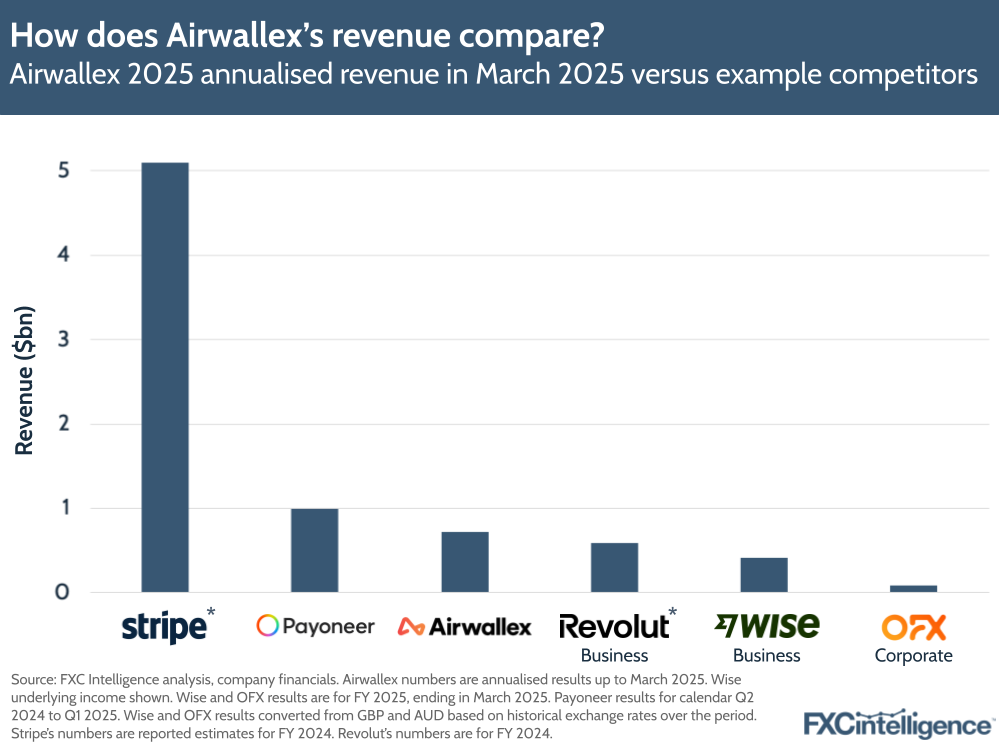

Airwallex has continued to see strong growth across a number of core regions in 2025 and is seeking to pass $1bn in annualised revenue by Q4 2025, according to Co-Founder & CEO Jack Zhang. We spoke to Jack to find out what’s driving Airwallex’s growth this year, how the company is responding to stablecoin hype and how AI could change financial infrastructure in the future.

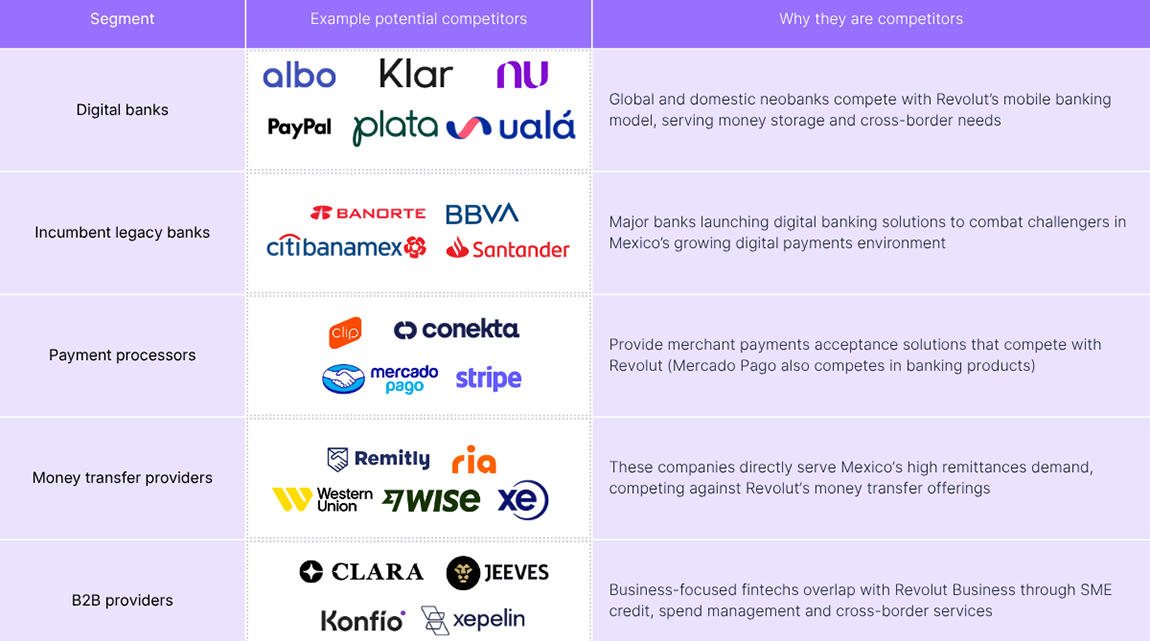

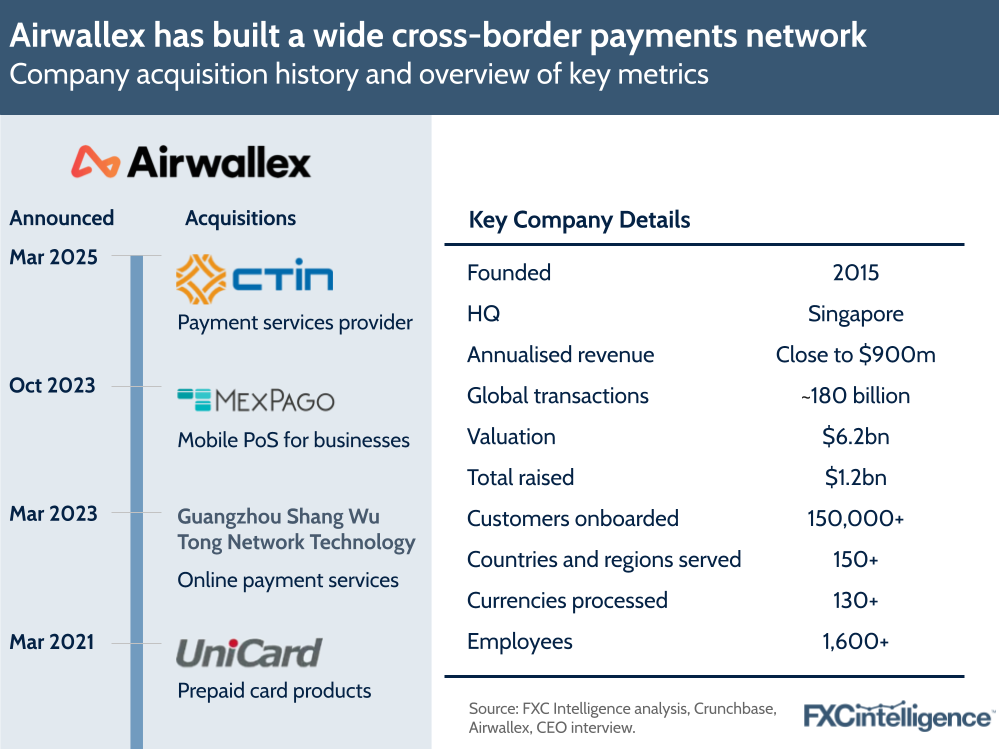

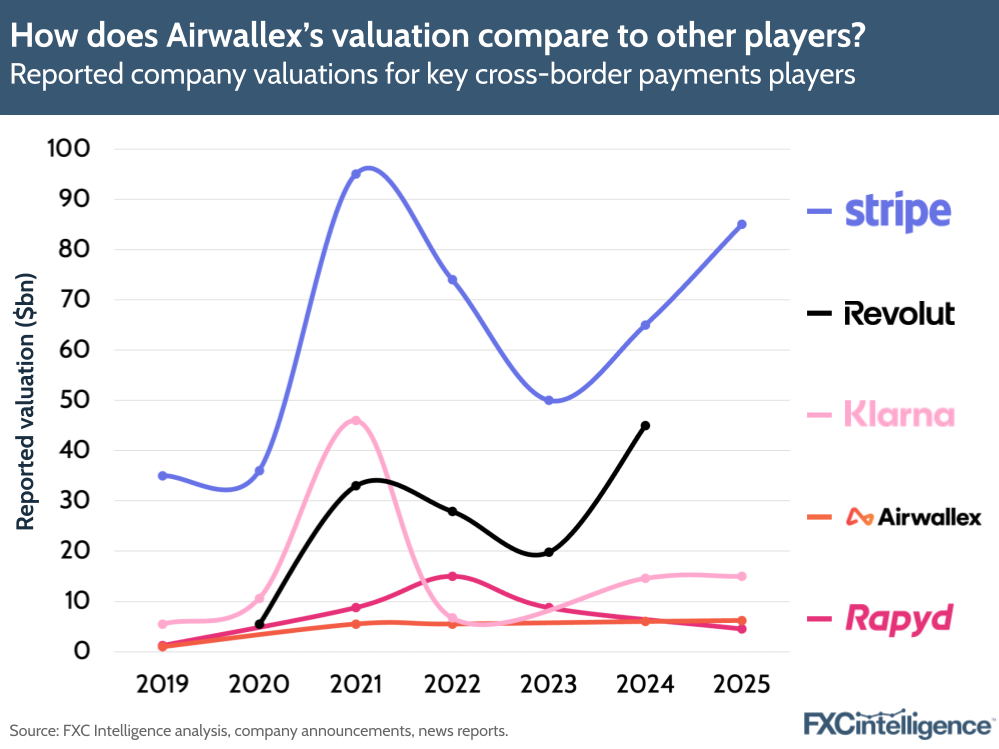

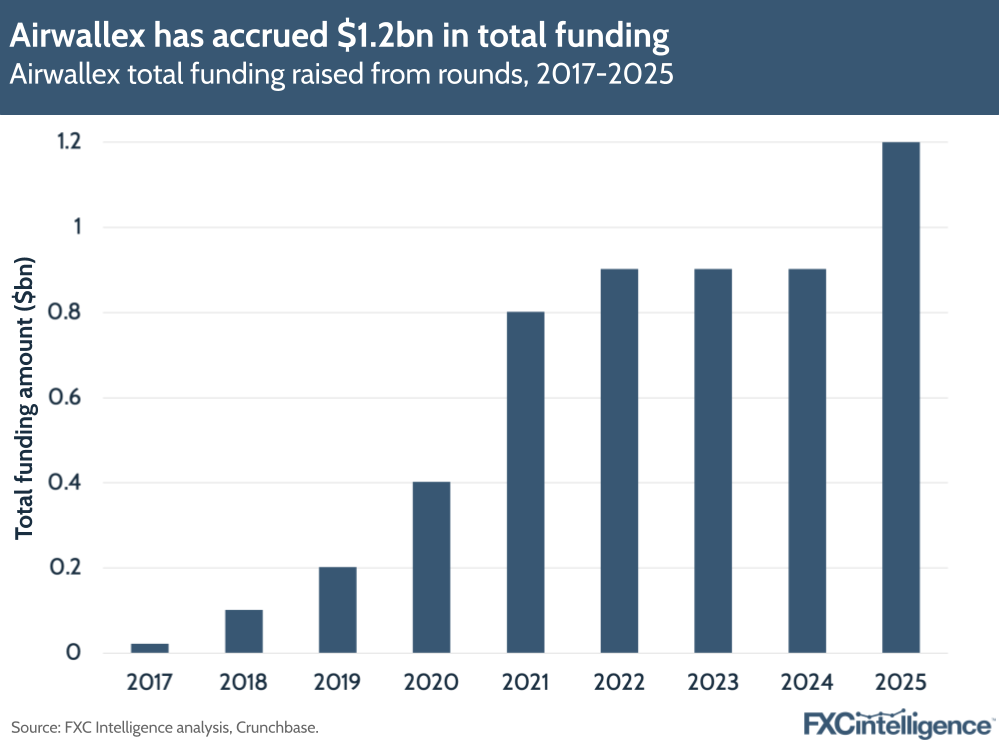

Singapore-based cross-border payments player Airwallex is continuing its upward trajectory in 2025. In March, the SMB-focused company saw its biggest fundraising round yet, securing $300m in a Series F funding round that also brought its valuation to $6.2bn.

In total, Airwallex has now secured over $1.2bn in total funding, helping it build out a global financial infrastructure that supports global multicurrency business accounts, cards and expense management solutions. Established in APAC, EMEA and the Americas, Airwallex has more recently been expanding its financial infrastructure to new markets, including Japan, Korea, the UAE and Latin America.

Altogether, the company is enabling businesses to rapidly send and receive funds across more than 150 countries. It has onboarded 150,000 businesses but has under 100,000 monthly active customers, though aims to boost the latter figure to more than one million by 2030. The company is approaching $900m in annualised revenue and expects to hit $1bn later this year.

Airwallex is aiming to position itself as a global banking platform, rather than a payout or FX player, with only 20% of their transactions currently containing FX. Now, the company is increasingly implementing AI across its internal and customer-facing services, putting the technology at the forefront of its strategy as it targets an addressable global native SMB market of 120 million companies.

We spoke to Jack to explore Airwallex’s rapid growth, the makeup of the business, its ongoing strategy and how the company is approaching stablecoins and AI – the two potentially industry-changing technologies of the moment.

Airwallex’s role in the future of banking

Daniel Webber:

Talk us through where Airwallex is as a business now.

Jack Zhang:

Airwallex is a global financial and payments platform that is building the future of banking. We spent the last decade building the best infrastructure for money movement, card issuing and merchant acquiring. Globally, very few companies in the world have built all these infrastructures using the latest tech stack globally from the ground up.

But more importantly, we evolved from an infrastructure company to a software and application company and [will evolve to an] AI company in the future. We empower business builders, entrepreneurs and operators to scale their business globally leveraging our application, which is a fully vertical integrated financial infrastructure, plus a software stack, plus AI with automation.

I believe the future of banking is a fully vertical integrated stack with infrastructure, software and AI instead of the last 40, 50 years, which was predominantly focused on just regulatory and financial infrastructure. Airwallex is there to empower next-generation or modern businesses to grow their business globally with the entire financial, payments and banking stack.

Daniel Webber:

What are the critical pieces to include as part of that stack?

Jack Zhang:

Critically, you need to own the bank account and all the money movement around the bank account. You need to control all the money in and money out, and then control all the treasury management in the middle on the infrastructure side.

You also need to control the system where the ERP [enterprise resource planning] and accounting come to play. When it comes to ERP, there’s a broad range of applications to manage, such as bill pay, expenses, reimbursement, corporate expenses, vendors and purchase requests, purchase orders and enterprise approval workflows. Then you have the AI layer that is interacting there as a copilot to help you to automate the entire process of a modern business. It’s being called upon by the software and the workflow as a trigger point to automating certain things.

Airwallex’s key revenue performance and drivers in 2025

Daniel Webber:

What numbers can you share to highlight Airwallex’s performance?

Jack Zhang:

We’re processing about 180 billion global transactions. We are close to approaching $900m in ARR [annual recurring revenue] and we’re probably going to be able to get to over $1bn in early Q4 as well. The business is still growing 80%+, year-on-year.

The business account is probably still 45% of the business. The business account is for things like creating a bank account globally that you can manage your treasury with FX globally, you can sort of pay out to vendors and employees and suppliers globally. So that’s a global pay-in, pay-out business account and then treasury.

Then you have corporate card and spend, which more than 50% of our customers use, and that’s another 25% of our business. Combined together, that’s around 70%. The remaining 30% is in merchant acquiring. So you have businesses that use our business account and our corporate card, but about 20% of our business account customers are using merchant acquiring already and the attach rate is growing very fast. Overall, the business has a more than 150% net retention rate.

Daniel Webber:

What about the geographic split of your business?

Jack Zhang:

Just under 70% is APAC and just over 30% is Europe and North America. Europe and North America is growing above 200% year-on-year. And we’re anticipating North America and Europe are going to exceed 40% of revenue within the next six to 12 months.

Targeting payment needs for global SMBs

Daniel Webber:

Are you focusing on all sizes of businesses in all geographies, or are there subsets that are really your targets?

Jack Zhang:

We really focus on modern businesses that we think are globally native. We hope to be the absolute winner of the global SMB banking market. When people think about global businesses 20, 30 years ago, they’re thinking about Coca-Cola and Nestlé, but in reality today, mom-and-pop shops selling on Shopify or Amazon are global businesses. So the scale of a global business is very big now. Every single AI company is a global business. Every app store is a global business.

As we continue to build a brand and build that reputation in the market, hopefully we can gradually move to the upper market over the next decade, but right now, we really focus on sub-1,000 employee global organisations. We do have some large customers like Canva for example who have a few thousand employees as well. As we continue to build out our reputation, and as we’re getting a banking licence and building a trust relationship with our customer, we will evolve to servicing more upper markets as we evolve as well.

Daniel Webber:

Who are your customers using to provide payment services before they come to you?

Jack Zhang:

Normally, they’re using many different banks. For example, they’d use a bank in Europe, a bank in the UK, a bank in Australia and another bank in the US. With Airwallex, they can consolidate more than a dozen banks into a single platform or a few banks into a single platform.

They could use a separate corporate card and spend management platform. In Europe, they could use Payhawk or Spendesk or Pleo. With Airwallex, they can consolidate into a single business account. On merchant acquiring, they could use traditional acquirers or they could use Stripe. So they could migrate everything to Airwallex with that single financial payments platform view globally.

The potential of an IPO versus staying private

Daniel Webber:

What do you think about the potential of an IPO versus staying private, particularly as the public markets have been good to some recent companies?

Jack Zhang:

I think we have a long, long way to go, so the preference is continuing to build while staying private, but internally, we’re IPO-ready next year. We just want to have the optionality, but right now, the management team is focused on staying private, building our growth globally. Ideally, we want to get to a few billion dollars in revenue before we go public.

How stablecoins fit into the financial ecosystem

Daniel Webber:

Let’s talk about one of the biggest topics in the market at the moment. Tell me how you think stablecoins potentially fit into the financial ecosystem.

Jack Zhang:

I think there’s interesting use cases as of today and there’s interesting use cases as of tomorrow. There’s interesting use cases today of paying out to exotic currencies in markets like Africa and Latin America, for both collection and payouts. Remittance providers might want to pay out to those countries and you have big American corporates wanting to collect revenue in those countries. We’re seeing a growing demand or growing liquidity in and out of those exotic currencies.

Daniel Webber:

You’ve talked about the concept or the importance of distribution when you’re moving money as opposed to just pure capability. Talk us through what you mean by that.

Jack Zhang:

There are two use cases: one is the money in, money out for the exotic currencies and the other one is doing a bit of regulatory arbitrage to build a consumer stablecoin application without being regulated in those countries.

Off-ramping stablecoins is relatively easy if you’re working with a provider that wants to move money out of a country, because you can net off inflows and outflows. But for on-ramping, the traceability (i.e. the funding source) of the stablecoin is still very hard to identify.

WIth a distribution [service], like us or Revolut or Stripe, you already know you have a clean funding source, whether you’re getting consumers paying for goods on the internet or people topping up the money into the bank account for everyday living. Whether you are a business paying vendors and suppliers or simply using Airwallex as a global digital bank or receiving payments online with our merchant acquiring product, the money is clean.

We’ve gone through all the anti-money laundering processes. We’ve gone through the KYC and we understand where the money is coming from. And so the off-ramp and the on-ramp become very easy. You can easily convert that clean money into stablecoin then do the off-ramp later. But if you’re just getting a stablecoin out of nowhere without a commerce activity backing it up, there’s a lot of AML issues that need to be solved and I still don’t know today how you solve that exactly.

You have tools for analysis, but a lot of the exchanges nowadays are getting decentralised. If it’s a centralised exchange, of course you have traceability but for decentralised exchanges it is very hard to trace the funding source.

So, one of the bigger challenges is how do you trace the funding source? That’s where the distribution really comes into play. You already have a lot of great customers that have a massive amount of clean funding that you can easily off-ramp to stablecoin and build financial services related to stablecoin.

Multicurrency products and “holding” stablecoins

Daniel Webber:

As you are building a global bank account, holding money is as important as moving the money. What’s your approach to this?

Jack Zhang:

For holding, there’s two parts. One is that you need to provide security so that the customer’s money is secure sitting with the organisation because we’re not a bank, we’re an e-money institution. All the money is safeguarded with the central bank, meaning that your money actually is safer than if it was stored in a bank.

In a bank, they have a loan-to-value ratio and they are essentially lending your money out. But with e-money, the money doesn’t even sit on the balance sheet of Airwallex overnight. It sits in the balance sheet of the Bank of England or different central banks around the world. Every single dollar you put in with Airwallex, we’re not lending it out, it’s a 1:1 ratio. It’s not like you give us $10, we lend $8 out, that’s never happened. Obviously, to build more trust, we need to become a bank. There’s a lot of work to be done there.

Another one is creating yield. So one of the biggest interesting points of stablecoins is offering US dollar yield, especially for consumers in a Global South country. It’s kind of a dollar evasion use case. It’s slightly less relevant for businesses, but it’s still relevant in those markets as well.

But what Airwallex have done is build a multicurrency yield product. We’ve gone the hard way to get regulated in every single country that we can offer a multicurrency cash management product. For example, in Australia we have the first US dollar cash management product launched to businesses.

Traditionally for businesses holding the US dollar, you’re not really getting any yield [without getting] a term deposit. But now with Airwallex, you can get a 4.5% yield with a US dollar cash management product. We partnered with J.P. Morgan and Goldman Sachs for that. On the back of that, it’s really Goldman Sachs or J.P. Morgan triple A-graded money market funds in the US dollar.

Stablecoins allow you to access the same product without regulating. I think this attraction comes from the question: why can you offer a stablecoin yield product into a market of consumer businesses without being regulated in that country? So again, it’s about the regulator arbitrage. If you offer that product in Argentina or Turkey, maybe you get away with it, but as a regulated business like Airwallex, we never do that. If we want to offer the product in Turkey or in Argentina, we will be regulated in that country. We’re not going to offer an unregulated product in those markets.

Daniel Webber:

What do you think about Stripe buying Bridge and launching multicurrency stablecoin products? What are they trying to do there?

Jack Zhang:

Stripe is a master of creating narrative. They are leveraging this acquisition to create a massive brand and put them on the map of stablecoins and almost help create the current stablecoin phenomenon. Whether that’s the reality or not, I’m not sure. The Bridge use case is netting off between people paying money from the remittance use case and netting off with US corporates like SpaceX or Starlink moving money from and collecting money from Global South countries. But the challenge is, how do you know the money that you’re doing remittances for is clean money?

I’m not working there, so I don’t really know how they figure out the risks, but I haven’t really figured that out unless I have the clean funding source in the first place. There’s potentially a use case if they launch a multicurrency stablecoin-backed financial service product in these Global South countries as well. Again, there’s also a bit of regulatory arbitrage there.

If I understand correctly, Stripe is basically reinventing Bridge as a separate entity, rather than the whole Stripe group. I’m not really sure of the legal structure there, but from my understanding they are leveraging different licences so they might have a different risk appetite between Bridge and the Stripe business.

On stablecoins being a long way from “mainstream adoption”

Daniel Webber

There’s been a lot of talk about “programmable money’ or the “internet of our money”. Do you think money will change or will everything stay the same?

Jack Zhang:

If you look at Circle’s business model, people holding USDC are not getting any interest income. They share the interest income with the distributors, which is Coinbase and Binance. The majority of the revenue gets shared out through the distribution channel. So, I don’t really understand why people want to hold stablecoins rather than putting money in the money market fund.

I’m using J.P. Morgan and I’m getting 4.5% on my daily cash. There are other fintechs and savings companies that can get you that product. I’m getting a lot of rewards from my AmEx. I have Apple Pay, I tap everywhere. Is Apple going to support stablecoin? Are all the merchant acquiring players suddenly going to accept stablecoin? The point is that I’d rather understand the use case of stablecoin on what exactly they solve.

The money is already on the internet. Right now, T+2 settles to the bank account and it has nothing to do with Stripe anymore. Of course, [Stripe] will try to build any sort of financial service product that is able to get the money to stay on the internet in the Stripe ecosystem. Stablecoins are one of the means and if people want to hold stablecoin, they can create a yield on the back of that. Or, if they wanted to issue a stablecoin-backed card, that’s great. But I’m not seeing a mainstream adoption of people wanting to hold in stablecoins yet, unless they can spend the money.

Right now, only Visa and Mastercard have the network effect that allows them to issue a stablecoin-backed card to spend. I haven’t really seen a wider spread of “you can spend everywhere”. Maybe there’s a lot of closed-loop use cases, but the closed loop channel has been around for like 20 years.

A lot of retailers are doing this closed loop. Essentially, they are enabling spending across a network of retailers. Maybe they could use a single coin across a bigger network of retailers, but we’re talking about a Visa, Mastercard network and spending across over 200 countries in the last 50 years. To create that level of network, there’s five to 10 years to go, if that’s ever going to happen.

If Visa or Mastercard are saying that consumer behaviour is going to change and move to stablecoin, I guarantee you, Visa and Mastercard are going to throw billions and billions of dollars to compete. So I don’t really see how this just is going to happen overnight and all of a sudden, stablecoin becomes the native payment method. I don’t see that happening yet.

Daniel Webber:

Related to those cards, what do you think of interchange fees? Do you think some of the new stablecoins or something else is going to disrupt the interchange model?

Jack Zhang:

I mean, who’s paying the interchange? Essentially, it’s not the consumers, it’s the merchant. If you’re asking me if Stripe or other payment providers should charge 3-4% for payments, the answer is no. I don’t think we should get charged that much. I think there are other ways of offering cheap and free payment for the merchants, which is what Airwallex is doing.

We’re going to launch a product that almost makes payments free for merchants globally, competing with the existing providers. At the end of the day, this is an ecosystem to incentivise consumers to spend.

I’m not really sure that behaviour is going to change unless the government forces regulation on that. I don’t really see what’s wrong with that ecosystem. I think it’s one of the best ecosystems I’ve seen built in the last 30/40 years.

What the industry doesn’t understand about stablecoins

Daniel Webber:

What do you believe is most misunderstood about stablecoins in the market?

Jack Zhang:

People think stablecoins are moving money cheaper, faster and globally at a scale that is just completely disrupting the current banking rails. I think that is wrong. I think stablecoins are a currency rail in addition to the current banking rail. It will increase adoption. As there is more demand for collection and payout in those exotic currencies, there will be more of a consumer behaviour change towards dollarisation because they want to hold US dollars for anti-deflation.

There’s a long way to go to see how merchants or consumers are adopting stablecoins in developed markets. We are watching that behaviour change and if that becomes true, I think that’s going to be an interesting opportunity for payment providers or banking providers like us to build financial services and monetise on the internet.

At that point, it will be a fundamental threat to the current banking system. These things keep evolving and I’m sure that when that happens, the banks and Visa/Mastercard will change to compete. I don’t think there’s going to be a clear answer yet about what’s going to happen in the next decade. But what I know is, this isn’t going to happen in the next one, two or three years. Either way, it’s going to be an interesting conversation for the next decade to come.

Daniel Webber:

With this in mind, how are you thinking about stablecoins from the Airwallex perspective? How do you ensure that if they do become relevant, you can use them, but if they’re not relevant you don’t have to use them?

Jack Zhang:

The number one thing is getting regulatory approval. Airwallex is getting the regulatory approval everywhere needed to handle stablecoins. And we’re going to closely watch how digital currency can evolve in the next few years. Just the use case alone on collecting and payout to exotic currencies is interesting, but it’s not sufficient for Airwallex to bet the future on it. We’ll be able to partner with providers to support these use cases in a regulatorily compliant manner.

At the same time, we’ll try to build infrastructure so if there’s a fundamental shift of user behaviour on both merchant and consumer, Airwallex is there to compete and lean into building the internet of financial services.

How AI will change financial infrastructure in the future

Daniel Webber:

What are your thoughts on AI in the current payments landscape?

Jack Zhang:

Unlike stablecoins, AI is happening right now. If you think about how traditional financial services are used by businesses and consumers, it is really like a regulatory financial infrastructure that is accessed either via digital banks or the traditional incumbent banks. But in the next decade, how businesses and consumers use financial services is going to fundamentally change.

You don’t really need to be interacting with the infrastructure anymore. You have AI to interact with the infrastructure. For consumers, you would have an AI assistant interacting with your daily life, but also with your financial infrastructure and making most of the transactions on your behalf or most of the recommendations that you need to make a financial decision, and AI will execute it for you.

On the business side, the same behaviour will translate to workflows in the business operating system. So traditional banks are not really interacting with the customers through AI and the business operating system. There’s a massive opportunity for a company like Airwallex to become the backbone of the new economy powered by AI and the modern operating system.

We not only have the financial infrastructure, but we also build the business operating system. Now, we’re injecting an AI co-pilot to allow businesses to automate their business processes and have AI recommend decisions. The customer can interact with Airwallex infrastructure indirectly through either the workflow or through the AI. But either way, I don’t expect the user is going to be interacting with financial infrastructure directly anymore in the next decade.

Daniel Webber:

What do you have to build on your side to make sure that businesses and consumers can work with AI?

Jack Zhang:

I think it’s vertical integration. For AI to work, you need to have a fully vertical integrated financial infrastructure, business operating system and workflow and AI. Right now, the banks only have the bottom layer. They don’t really have the business operating system, which is going to be a fundamental challenge for them to build AI applications.

Daniel Webber:

Thanks very much Jack.

Jack Zhang:

Thank you.