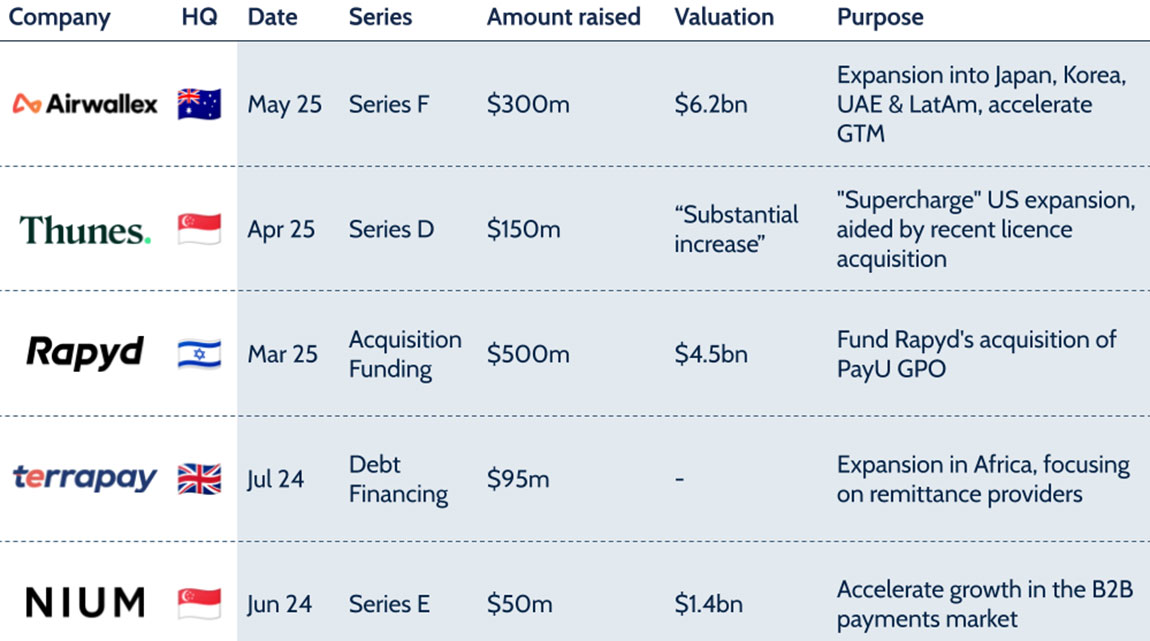

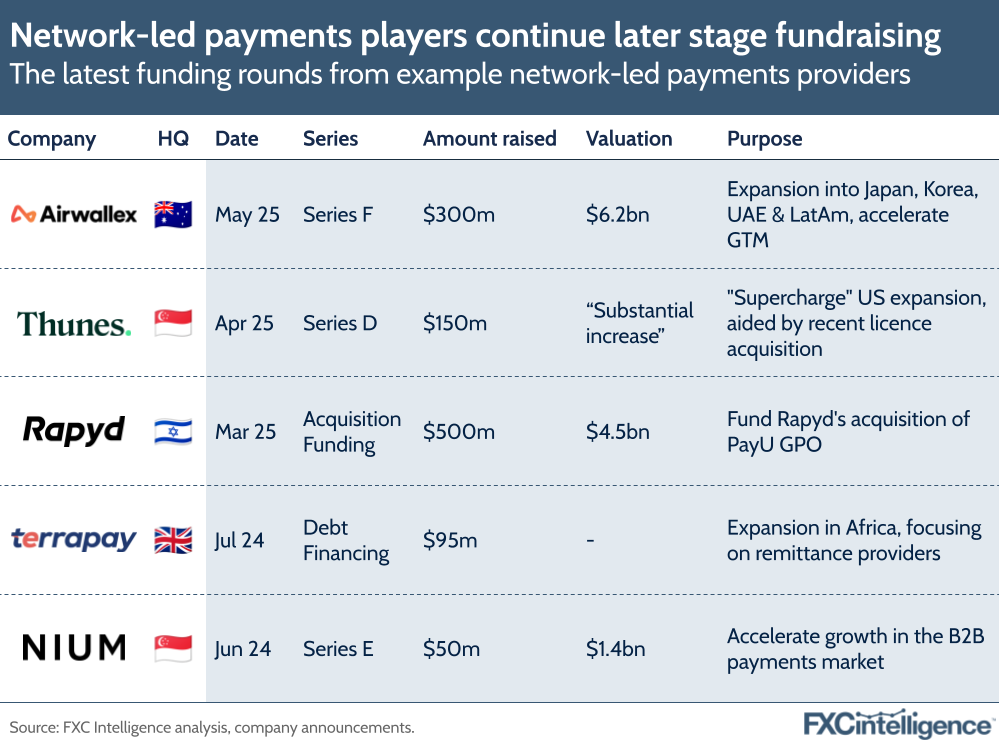

Last week, Airwallex announced that it had raised $300m in a Series F funding round that saw its valuation climb to an all-time high of $6.2bn. It’s the latest in a number of fundraises by well-established network-led payment providers, reflecting both the investment market and the strategies of such players.

Airwallex’s news comes not long after Thunes announced that it had raised $150m in a Series D round, while earlier this year Rapyd secured financing to support its acquisition of PayU GPO. Terrapay and Nium, meanwhile, were among those who announced further fundraises in 2024.

The reasons for such moves are relatively consistent: market growth. Having developed strong presences in their existing markets, these companies are looking to enter new markets to fuel their next stage of growth and are seeking funding to support the process. Airwallex, for example, highlighted Japan, Korea, the UAE and Latin America as key markets it was looking to expand its financial infrastructure offering to, while Thunes is using its funding to support its ongoing expansion into the US. Rapyd’s PayU acquisition, meanwhile, took over a year to complete due to the number of markets it involved, but provided strategic additions in markets including Central and Eastern Europe and Latin America.

Such developments are also interesting because they reflect a landscape where increasingly mature companies are still holding off on IPOs and opting instead to raise further funds to support their continued development. At the start of this year, it had looked like we may see a return of the IPO after the post-pandemic downturn, however recent macroeconomic conditions led by the US tariffs had prompted some of those who were exploring an IPO to pause their plans.

Meanwhile, the amounts raised by such companies continue to climb. According to Crunchbase, Airwallex has raised $1.2bn in funding over the course of its 10 years as a business, while Rapyd has raised $1.3bn and Thunes and Nium have both raised over $300m each. For all, however, an IPO remains some time away.