Remitly has formally entered the cross-border B2B payments market for the first time, targeting small businesses with a service initially available to customers in the US. In doing so, it is challenging in an already active fintech marketplace, with Wise and Revolut among potential competitors, as well as the mainstream small business banking sector.

While Remitly has not yet shared extensive details of its offering for businesses, it centres around international business payments across a variety of use cases. These include paying international teams through international payroll and freelancer payouts, as well as paying vendors or invoices via ecommerce payments or one-time payouts.

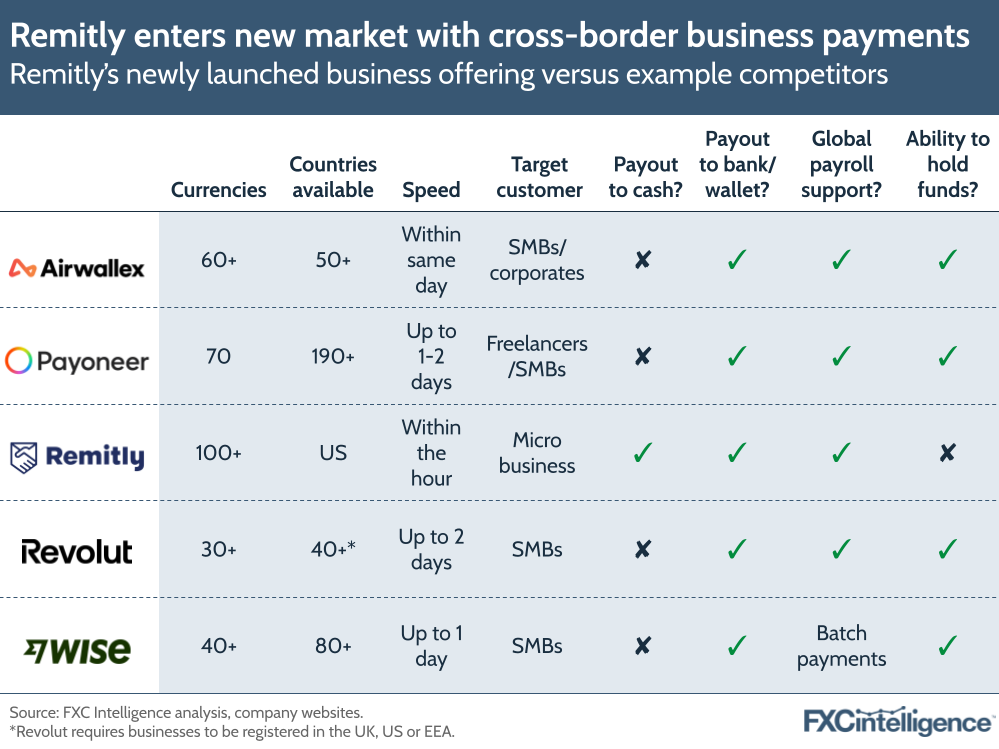

In this respect, Remitly is competing with numerous other players in the industry, many of whom have considerably more extensive solutions beyond their core business payments. Airwallex, for example, provides a full financial platform of solutions for internationally focused businesses, while Payoneer caters to both freelancers and businesses, with solutions including employer of record and connections to major marketplaces. Revolut and Wise, meanwhile, also have a full business account in addition to their business payment services.

However, while Remitly’s offering is likely to evolve over time, it also looks to be targeting more of a micro-business customer type. Such customers had already been using Remitly’s consumer-based services to meet many of their needs, with Remitly conducting know-your-business checks and onboarding manually via their customer service. However, the company had recently begun to discuss how it was pivoting to better address them.

In our most recent post-earnings call interview prior to this latest announcement, Remitly CEO Matt Oppenheimer shared the company’s initial approach with these customers, who are often migrants operating small businesses with employees or vendors in countries that are traditionally popular destinations for remittances.

He explained that such companies “don’t need a lot of the bells and whistles” found in more SMB-focused solutions but instead need a solution closer to a consumer remittance service, and that there was “a unique opportunity” for Remitly to serve such companies.

A key differentiating factor here is the types of payouts Remitly is offering its business customers. While it offers payouts to five billion bank accounts, as well as mobile wallets – a commonplace offering among many B2B payments providers – it also provides cash pickup at 470,000 locations globally, a rarity among B2B players, but well suited to Remitly’s customer profile.

How is Remitly competing on pricing across its product areas?