Corpay continued to note strong cross-border growth in Q2 2025, driven by its expanding Corporate Payments segment. We spoke to Corpay Cross-Border Solutions Group President Mark Frey to discuss the company’s upcoming acquisitions and key drivers for Q2 2025.

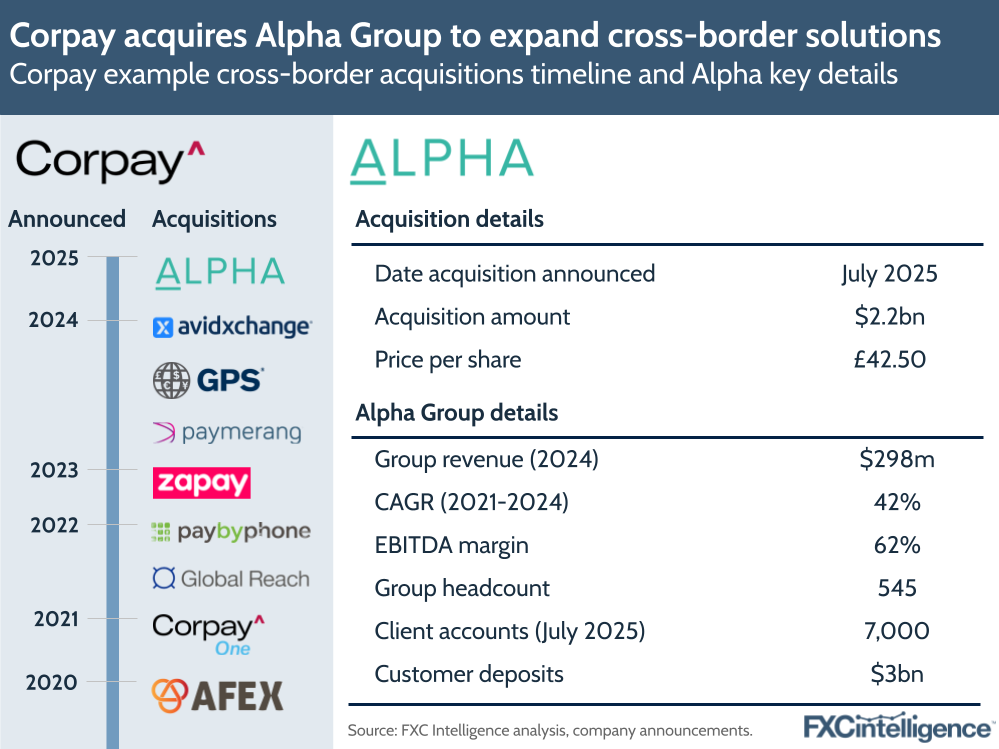

Corpay saw strong growth in Q2 2025, with topline revenue up 13% to $1.1bn, driven by strong growth in the company’s Corporate Payments segment. The B2B payments provider also gave more details on its $2.2bn acquisition of B2B FX provider Alpha Group, which is set to further cement payments as its key growth vehicle moving forward.

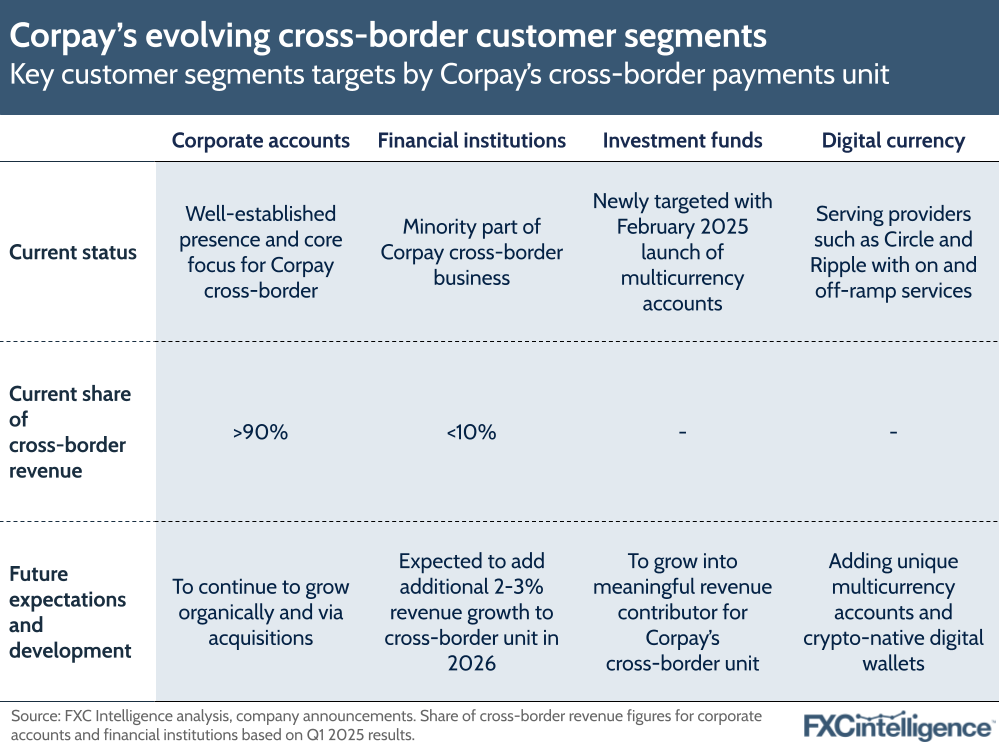

Corpay is extending its cross-border suite – originally focused on corporates and financial institutions – to include stablecoin and digital asset providers as it looks to embrace stablecoins as a third rail. Its recently launched multicurrency account product continues to grow, with 10,000 accounts live (up from 2,000 reported in its Q1 results) and aggregated customer deposits reaching $1bn in July.

Though it noted some softness in North America due to US tariffs, Corpay said this was offset by solid gains in other geographies. To find out more and discover what’s next for the business, we spoke to Corpay Cross-Border Solutions Group President Mark Frey.

Corpay key revenue growth drivers in Q2 2025

Daniel Webber:

Mark, nice to talk to you as ever. With strong organic growth and additional inorganic growth from the acquisitions coming in, what’s driving the growth of the business?

Mark Frey:

Yeah, it’s a couple of things. We continue to retain existing customer revenues very well, consistent with prior trends. We aim to retain 99-100% of our overall base revenue from one year to the next and that’s been quite consistent.

We also continue to sell very well. We had a very successful quarter from a sales perspective and have really been accelerating growth in a few new channels. The institutional private markets business has done very well for us, and we continue to acquire customers at scale in that space.

We’ve also been quietly and diligently working in the digital currency world and virtual assets, and have had significant success from a sales perspective onboarding some blue-chip names and financial institutions that are leveraging our on-ramp/off-ramp capability in that space.

Sales has definitely been a highlight for us over a sustained period of time. I say often that it’s the superpower of our organisation. It is powering the near 20% growth quarter-on-quarter, year-on-year again, and certainly something that we’re leaning into.

Corpay raises FY projections despite tariffs

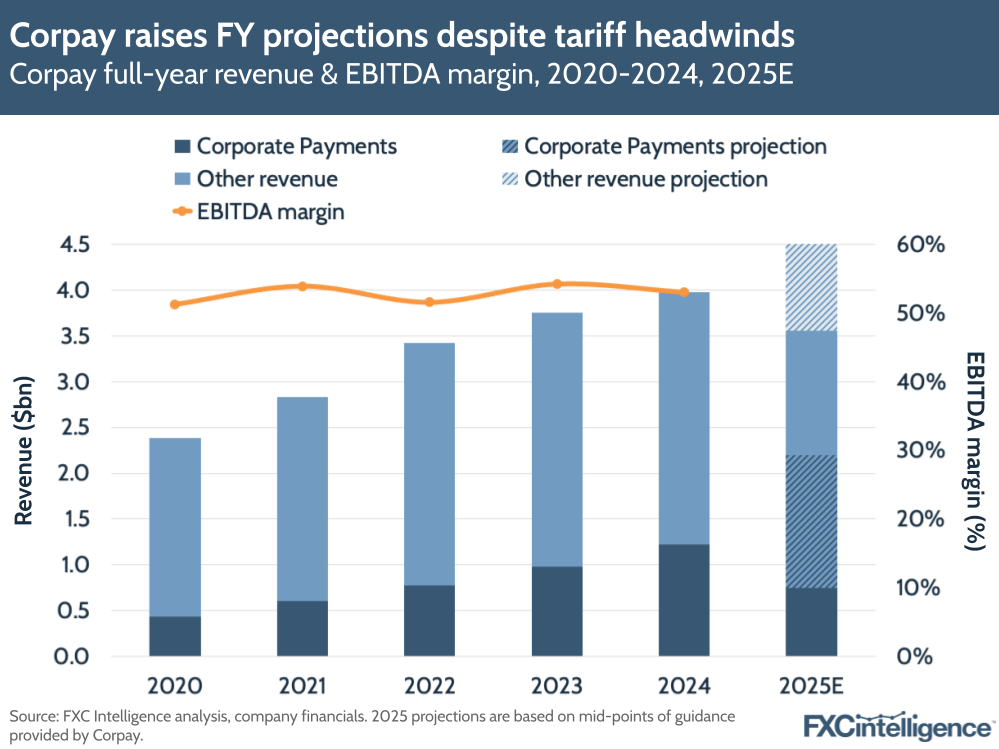

Overall, Corpay saw organic revenue growth (i.e. excluding acquisitions) of 11% across all segments. Adjusted EBITDA grew by 12% to $620.6m, giving a margin of 56%.

The company has raised its full year revenue expectations to be between $4.41bn and $4.49bn, representing between 11% and 13% growth, reflecting FX tailwinds and strong execution, though this does not include reference to the impact of acquisitions that haven’t yet been closed.

Overall, regional revenue rose 30% in Other regions – those beyond the core geographies of the US, Brazil and the UK – with Other now accounting for over fifth of revenues. Meanwhile, the US (Corpay’s biggest segment) grew 7% against the UK (11%) and Brazil (14%), with the company noting slowed US growth due to tariffs. As a result, the US, which usually takes over 50% of Corpay’s quarterly revenue share, accounted for around 49% in Q2.

The impact of US tariffs on Corpay

Daniel Webber:

How much of an impact are you seeing from tariffs?

Mark Frey:

The one geography where we’ve seen an impact from tariffs that is measurable in the business is North America. We see it amongst our Canadian customers and mostly our US customers that are importing products from abroad. They continue to import, but they’re sort of paralysed with indecision in terms of trying to evaluate their business models.

Certainly [among] some of the Mexican corporates that we’ve begun to onboard, we see trepidation in terms of the changing policy environment and what it means for hedging versus non-hedging. We’ve seen an almost negligible impact of the tariffs in Europe and the UK – a little bit of noise in terms of market volatility in response to China and Australia, but very little actual impact in terms of overall flow.

One of the great parts of our business is that it is very diversified across geographies and customer segments. We haven’t materially slowed down at all due to the slowdown with tariffs that some other organisations have experienced. Those businesses that are particularly North American-focused would probably have a tougher time in this environment versus our more global footing. We’re certainly thankful for the geographic and segment diversity that we have within our network.

Corporate Payments drives Corpay growth in Q2 2025

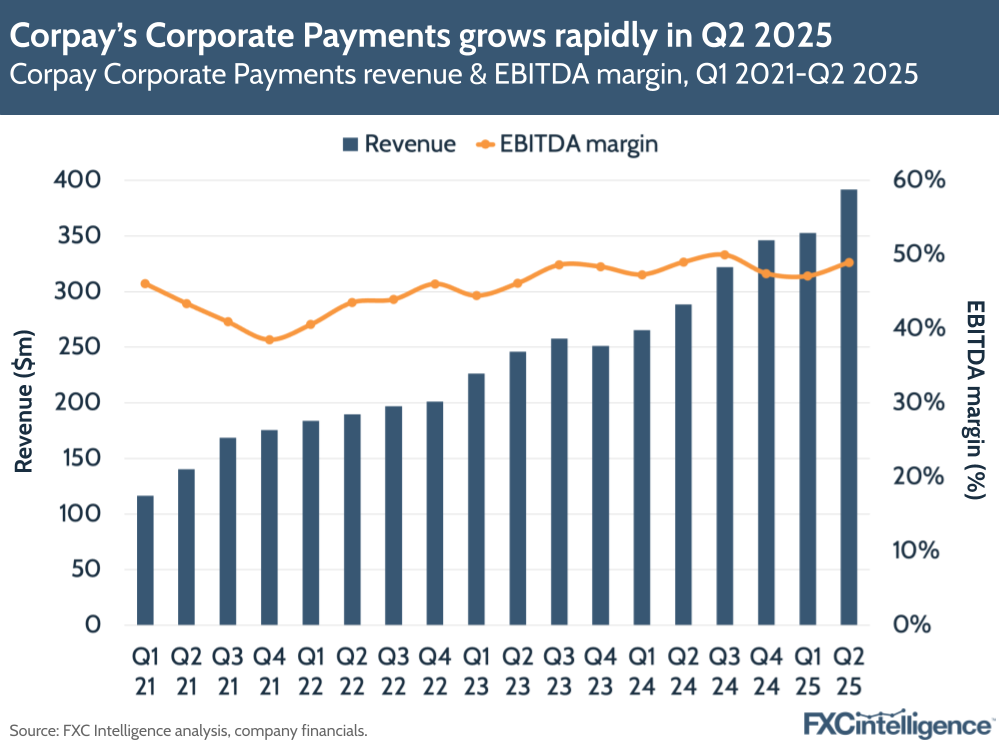

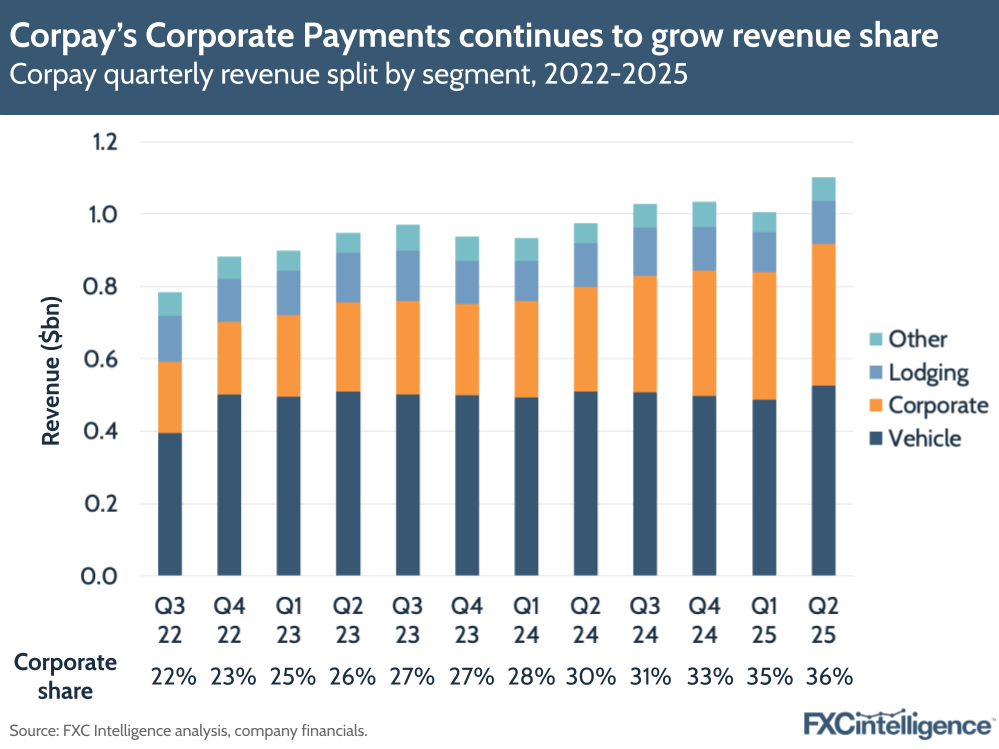

Corporate Payments continues to be the primary driver of revenue for Corpay, with revenue growing 36% overall to $392m and organically 18% to $389m, which excludes acquisitions and “changes in the macroeconomic environment”. Key growth factors include Corpay’s broad geographic coverage, increasing spend volume across its clients and record cross-border sales.

As a result of strong growth, Corporate Payments revenue continues to account for a larger and larger share of Corpay’s overall revenue, taking a 36% share against 30% in the same period last year. Vehicle Payments continues to account for the highest share at 48%, though it grew just 3% in the quarter.

Corporate Payments’ EBITDA rose 36% to give a margin of 49%, flat on last year and just lower than Corpay’s overall EBITDA margin of 52%.

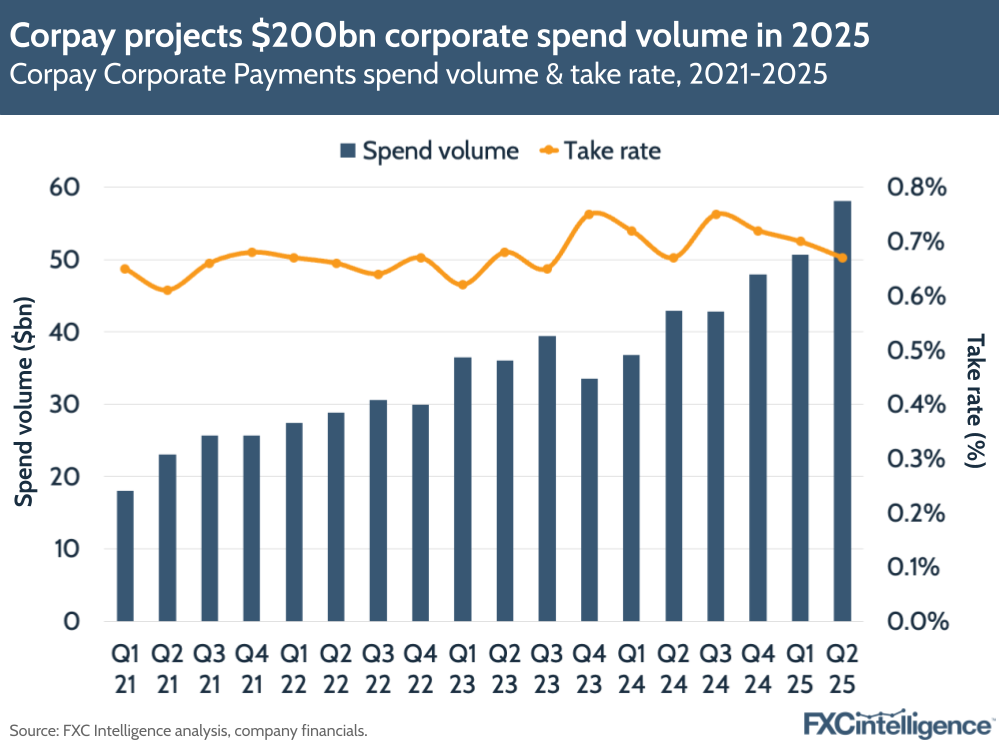

The main driver for Corporate Payments was spend volume, which grew 36% on a reported basis to over $58bn (up 19% organically) and the company expects this figure to be more than $200bn over the course of the full year. In addition, Corpay continues to drive its Payables business, through which it has implemented a new enterprise client that reached $1bn in total spending through the company in July. It is also looking to expand its Corpay Complete payables tech platform, recently launched in the UK, internationally.

Corpay said it expects ‘high teens growth’ for Corporate Payments in the full year, in line with its full-year guidance for group revenue. Next year, with the addition of AvidXchange and Alpha Group alongside Corpay’s other acquisitions, the company expects the Corporate Payments segment to reach $2bn in revenue and represent over 40% of the company’s revenue.

Corpay’s growing multicurrency account product

Daniel Webber:

What’s really resonating with your multicurrency accounts product and driving uptake there?

Mark Frey:

Our focus for the multicurrency account product has been on two key segments: the mid-size corporate customer that is multinational and the investment funds or the private markets business. So it’s the asset manager, the special purpose vehicle (SPV), the funds administrator who ultimately is setting up a new fund and needs to establish a transactional account to provide service, act as a store of value to support the operations of that business and to collect funds from investors and capital calls.

That has been a very successful product launch. We’ve already been very active in that institutional private market space from an FX perspective. This rounds out our product offering for that segment, and we’ve successfully been selling into our existing names, but it’s also been an anchor product to introduce us to new networks and customers.

In the corporate space, we want to be the global financial institution of choice for our customers when they operate outside of their domestic markets. Think of a US corporate that might have a relationship with Bank of America or J.P. Morgan, for example, but increasingly when they do business in Europe, the UK or Australia, we don’t want them to necessarily have to go to three different financial institutions to open up bank accounts in those jurisdictions. They can leverage their overall KYC status with us and we can provide them access to transactional accounts globally through our banking partners around the world and our virtual account products.

We put a lot of time and focus on this going back over a number of years to build this product and make sure that it’s purpose-built for these two customer segments, and it’s been very pleasing to see how it’s gone. We think this is going to be a driver of growth for us going forward.

Leveraging stablecoins for 24/7 money movement

Daniel Webber:

Let’s talk about stablecoins and blockchains. Talk us through how you’re embracing that part of the world and how you’re working with companies in that ecosystem.

Mark Frey:

I’d say there’s two parts. One is enabling capability on our network to be able to move money ubiquitously and in an always-on, 24/7 environment. Whether that’s leveraging stablecoins or blockchain networks to message between financial institutions and digital accounts, we’re looking for ways to move money beyond traditional banking hours, whether it be US dollars or other currencies, and certainly leveraging stablecoins is a big part of that.

We’re also enabling the capability for customers to settle to us via stablecoins, for us to push payments out via stablecoins, and for us to hold value in stablecoins as well. The generation of capability to move money ubiquitously is a key part of our focus and a big part of our business.

The second thing we’re really focused on in the digital currency world is providing on-ramp/off-ramp fiat currency payments, collection and remittance capability for the stablecoin providers, crypto exchanges and financial institutions that operate in this space. This has been an area we’ve been focused on for a number of quarters.

We’ve now onboarded some significant accounts and blue-chip names in this category, and we see this as a very high growth sector for us given the attention in the stablecoin world and the volume build we continue to see in digital currencies. We see this as another customer segment we can focus on that has been very successful for us in terms of new sales and is beginning to ramp up to some material volumes in terms of how we go forward as well.

Corpay expands cross-border focus to include stablecoins

Corpay’s cross-border revenue saw growth in the “very high teens” in Q2, despite some aforementioned weakness in North America. Corpay CFO Peter Walker said that there was “no shortage of opportunity in cross-border, regardless of the macro backdrop.”

Corpay has continued to evolve the cross-border segments it is targeting with the addition of digital asset and stablecoin firms. This includes Circle, which Corpay has partnered with to add USDC across Corpay’s pay-in and pay-out rails for businesses. Through the deal, businesses will be able to manage and store USDC in Corpay-branded digital wallets powered by Circle, as well as fund transactions to more than 80 countries (with payouts enabled in local fiat currencies).

Similar to other players’ recent announcements in the space, Corpay is emphasising the potential of stablecoins in supporting on/off ramping, sending payments across blockchain networks, and also launching multicurrency accounts that support fiat and stablecoins. It sees stablecoins as being another tool for money movement, with CEO Ron Clarke saying the biggest edge for stablecoins is their 24/7 payment capability and not necessarily cost savings, since 90% of Corpay’s value creation comes from FX conversion.

Inside Corpay’s Alpha acquisition

Daniel Webber:

How does the Alpha acquisition fit into your strategy, and what does it add to the Corporate Payments business?

Mark Frey:

We’re very excited about the Alpha transaction. It fits squarely into two of our four customer segments – the corporate space in the UK and Europe primarily, and the private markets institutional customer category.

It really strengthens our value proposition, especially in that private markets vertical, with the virtual account capability that Alpha has been focused on and the FX brand that it has built in that space.

We see this as an opportunity to add some high-quality headcount and sales acumen in the front office and some back-office capability – especially with their global service centre in Malta, where we are already operating and see as a key strategic hub for us building a business across Europe.

We bring a lot to Alpha as well in terms of how we can truly make that a global business, given our licensing footprint in Asia-Pacific and North America, some of the enhanced payment capabilities that we bring to the equation and the technology that we can begin to sell into that customer base as well.

Corpay continues acquisition strategy

Corpay noted in its acquisition materials that Alpha has seen consistent growth over the last few years, with annual revenues of $298m in 2024 driven by a CAGR of 42% over 2021-2024. It has also seen its EBITDA grow by around four times over the past three years, giving an impressive margin of 62% for 2024.

Aside from Alpha, Corpay has successfully incorporated GPS, acquired last December, to bolster its corporate segment for mid-market and enterprise clients, as well as AP automation Paymerang, acquired last July, to expand its cross-border solutions to several new markets, including education, healthcare, hospitality and manufacturing.

In May 2025, Corpay also announced it would acquire a 33% equity stake in AvidXchange, another AP automation provider, in a take-private deal alongside private equity firm TPG. This deal is tipped to close in Q4, with AvidXchange expected to contribute to Corpay’s 2026 earnings.

Separately, Corpay gave an update on a recent partnership with Mastercard, through which the company is becoming an exclusive provider of integrated large-ticket cross-border payments solutions to Mastercard’s financial institution customers. This deal is also moving towards being closed in Q4, and is part of Corpay’s strategy to more “aggressively” target banks and fintechs.

Daniel Webber:

Mark, thank you.

Mark Frey:

Thanks very much.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.