Standard Chartered has published its Q2 2025 earnings, which saw growth in both the company’s overall and cross-border Corporate & Investment Banking (CIB) income, despite some headwinds for the division.

Overall, Standard Chartered reported a 14% YoY rise in operating income on a constant currency basis to $5.5bn in Q2 2025. Meanwhile its CIB division, which accounts for around 60% of the company’s operating income, saw a 9% increase to $3.3bn.

Within this, Global Markets was a particularly key driver of growth, with a 47% rise in income to $1.2bn in Q2 2025. This was aided by growing demand in the bank’s Asia markets, as well as improvements in both flow (recurring) and episodic (non-recurring) income.

Flow income saw a 22% rise attributed to FX income and higher rates, while episodic income saw particular gains as a result of tariff-related volatility at the start of Q2. Standard Chartered also reported that elevated client flows are continuing into Q3. This improved performance has translated into a greater share of CIB income for Global Markets; while it has historically seen a share of 25-30%, its share rose to 36% in both Q1 and Q2 2025.

Global Banking, meanwhile, saw a 12% increase in income as a result of increased origination volumes versus Q2 2024, as well as growth in corporate lending. However, Transaction Services, the division’s largest segment, saw an 8% YoY decline as a result of lower income in its payments and liquidity product line – something that Standard Chartered attributed to lower interest rates and resulting margin compression. As a result, Transaction Services has seen its share drop to 45% of CIB income in Q2 2025, compared to 53% a year ago, while Global Banking saw a 17% share, slightly up on the 16% it had in Q2 2024.

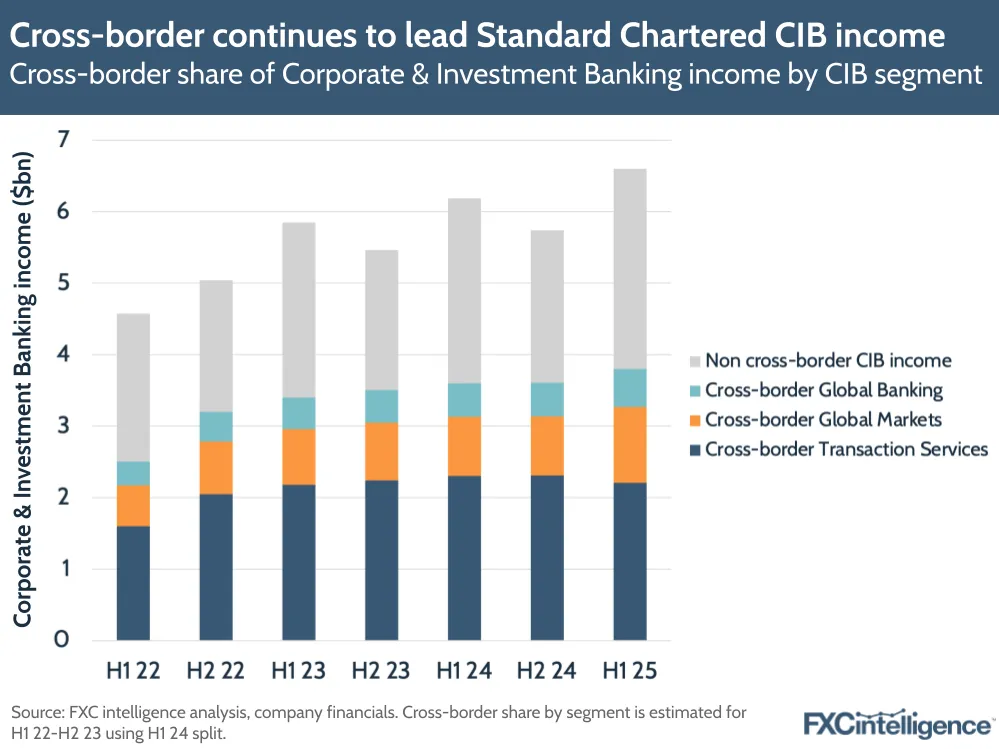

Standard Chartered only reports its cross-border (network) income for CIB on a half-yearly basis, which in H1 2025 reached $3.8bn, a 4% YoY increase, or 9% excluding interest rate impact. This represents a 58% share of CIB income, the same as H1 2024 although slightly down on H2 2024, with share historically being higher in the second half of the year. However, in a recent CIB investor day the bank said it was targeting 70% of CIB income to come from cross-border, meaning it still has some way to go to achieve this goal.

Cross-border income has traditionally been dominated by Transaction Services, which provided the main headwinds this quarter, although Standard Chartered’s reported split by segment has changed for the first time since it began sharing this metric. Transaction Services share has dropped from 64% to 58%, while Global Markets has risen from 23% to 28% and Global Banking from 13% to 14%, with Group Chief Executive Bill Winters highlighting the “highly diversified” nature of the bank’s network income.

This shift is largely attributable to the headwinds and tailwinds that have emerged as a result of the US tariffs, with squeezed margins being offset by greater demand for solutions to counter the volatile environment, particularly in Asia. CIB in particular saw a 17% increase in intra-ASEAN corridor income as a result of shifting supply chains and resulting increased FX and commodity trading, while the bank also reports greater demand for additional financing solutions, in particular hedging and risk management products, from corporate clients.

Beyond CIB, the CEO also highlighted the company’s digital asset strategy, including serving as a bridge for traditional finance clients to utilise stablecoins. He in particular highlighted that the company, which has already launched a number of digital asset-related initiatives, is “seeing interest in the use of stablecoins by logistics operators to provide real-time payments for their customers and suppliers”.

How can I incorporate stablecoins into my payments strategy?