Standard Chartered’s recent Corporate & Investment Banking (CIB) investor day provided an unprecedented view into its cross-border payments-led Transaction Banking offering. We dig into the details.

Last week, Standard Chartered hosted its CIB Investor Seminar, a one-off investor day specifically focused on its Corporate & Investment Banking business. Providing an update on the division, including previously unshared financials and wider performance gains, this gives a rare view of a section of the bank’s business that is dominated by cross-border payments.

Accounting for around 60% of Standard Chartered’s operating income, the CIB segment is made up of three divisions, Transaction Services, Global Banking and Global Markets, all of which include cross-border payments income. However, as Standard Chartered has previously stated, Transaction Services accounts for the majority of this, at around 64% of CIB cross-border income in 2024, while Global Banking and Global Markets account for 23% and 13% respectively.

Within Transaction Services, cross-border is predominantly generated by the Transaction Banking unit, with a small amount generated by Financing & Securities Services, however few metrics for this segment are normally broken out in Standard Chartered’s quarterly or annual reporting.

This investor day has changed that, providing unparalleled insight into the performance of the CIB segment and Transaction Banking in particular, including a breakout of cross-border payments. In this report, we dig into the numbers, primarily focusing on Standard Chartered’s Transaction Banking unit, to consider the role cross-border payments is playing in the unit’s evolving strategy.

Standard Chartered’s growing Transaction Banking unit

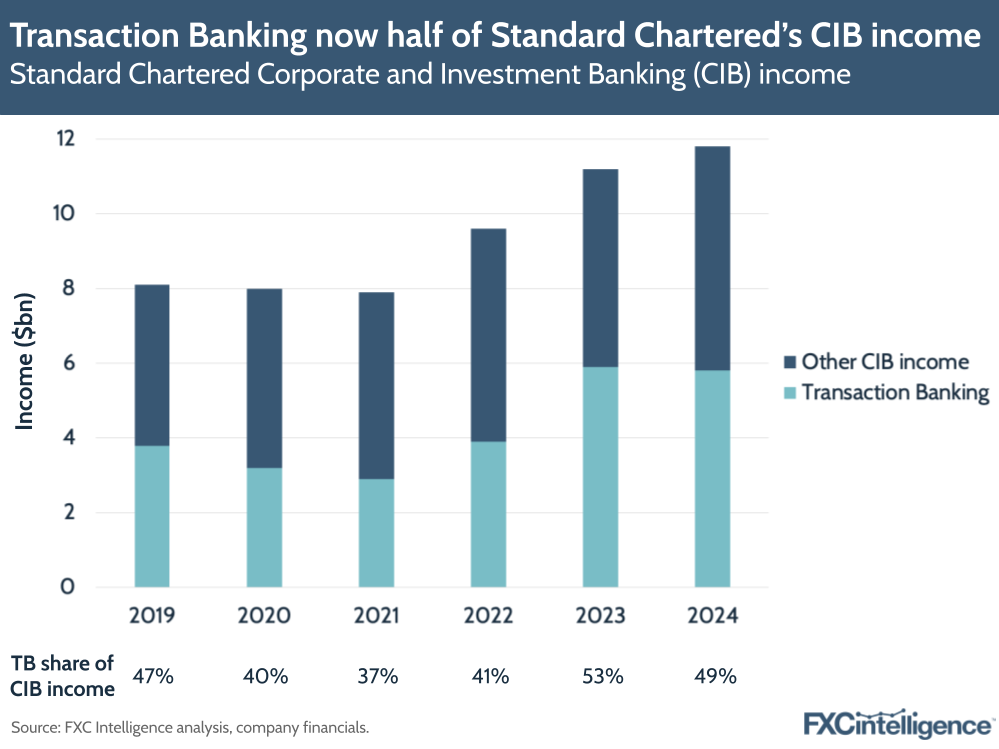

Accounting for 90% of CIB’s Transaction Services segment in 2024, Transaction Banking’s share of the wider division has varied somewhat over the past few years, but accounted for 49% of CIB’s income in 2024, at $5.8bn.

Between 2019 and 2024, Transaction Banking climbed at a CAGR of 9%, or 4% excluding rates impact, although there has been significant variation within this. 2024 saw a YoY contraction of -2%, compared to CIB’s 5% increase, while in 2023 Transaction Banking income increased by 51% YoY compared to CIB’s 17% growth.

This variation is in part due to the Covid-19 pandemic, as well as more recent geopolitical headwinds and the changing interest rate environment. However, it is worth noting that while cross-border drove Transaction Banking’s 2022 and 2023’s overall surges in growth, in 2024 it performed against the wider unit, seeing positive growth, with Transaction Banking’s contraction coming from non-cross-border parts of the business.

Key Transaction Banking segments

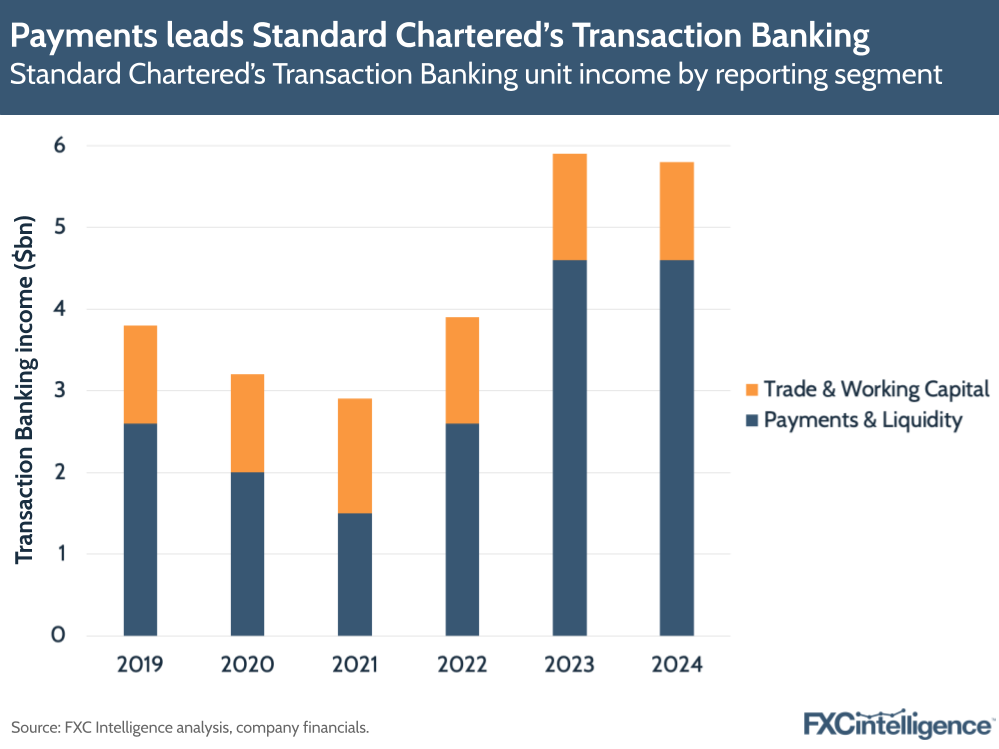

Although Standard Chartered does not usually report Transaction Banking income directly, it does report its key segments as part of its Transaction Services reporting. These are Payments & Liquidity Management and Trade & Working Capital. While the former covers areas including clearing, payments, collections, account services and liquidity management, the latter includes supply chain management, documentary trade and trade lending.

Within payments, Standard Chartered has what Michael Spiegel, Global Head of Transaction Banking, describes as “a sizeable clearing business”, alongside “a holistic suite of solutions ranging from traditional domestic payments, fast payment schemes, QR code-enabled payments and collections to cross-border payments on traditional as well as new rails”.

The segment also provides transactional foreign exchange for both working capital and trade, a service it offers alongside the CIB’s Global Markets division.

In terms of share of income, Payments & Liquidity has consistently accounted for at least twice the Transaction Banking income of Trade & Working Capital, and in fact it has grown this share from 68% in 2019 to 79% in 2024.

This has been aided by significant variation in growth between the two. Trade & Working Capital has seen some YoY growth over the past few years, but has also seen declines, with its income contracting by -8% YoY in 2024. Between 2019 and 2024 it has seen a CAGR of 0%. By contrast, Payments & Liquidity saw flat YoY growth in 2024, but has seen significant gains in previous years to produce a CAGR of 12% over the same period.

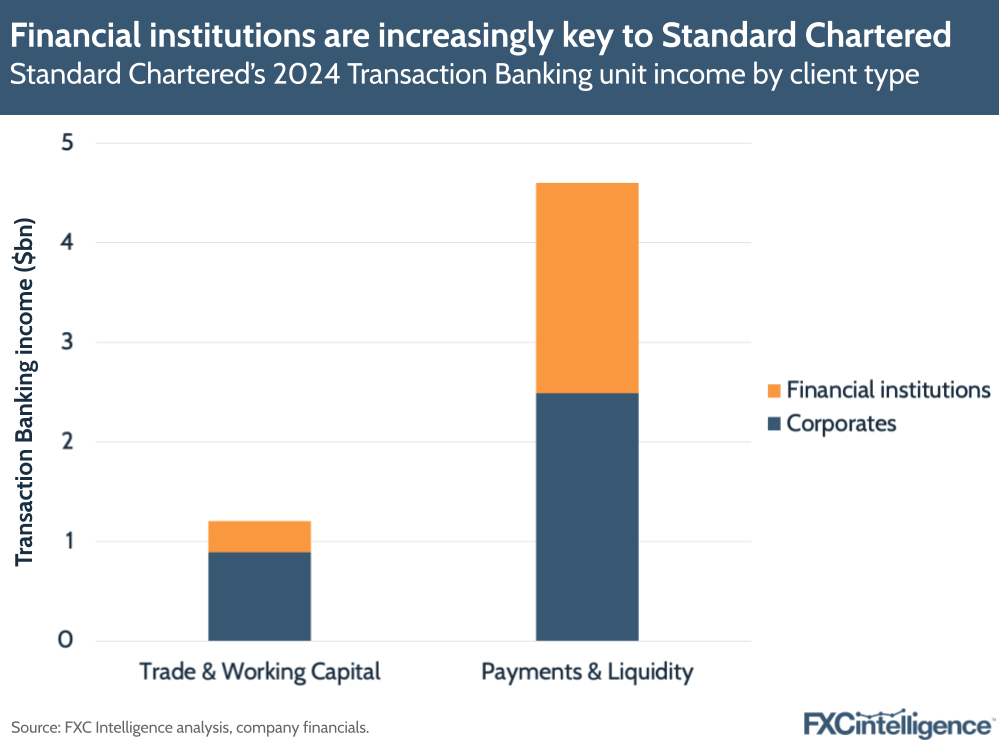

Such increases have in particular been aided by growth in financial institution clients, which in 2024 accounted for 46% of Payments & Liquidity income and 26% of Trade & Working Capital income.

Standard Chartered has sought to further strengthen its digital offering to support larger clients, including through API-led bespoke payment solutions, with Transaction Banking reporting growing numbers of payments processed via API. While in 2022 it saw 60 million transactions processed via API, this has climbed to 72 million in 2024.

It has also continued to build out SCPay, its faster payment system offering, which is available in 28 markets and now handles around 75% of client payment volumes, at a rate of around 2,500 transactions per second.

Cross-border payments’ increasing importance

Cross-border payments has long been a focus for Standard Chartered’s Corporate & Investment Bank, but has seen growing attention as the company both looks to grow cross-border income and increasingly cross-sell its services to increase income per client.

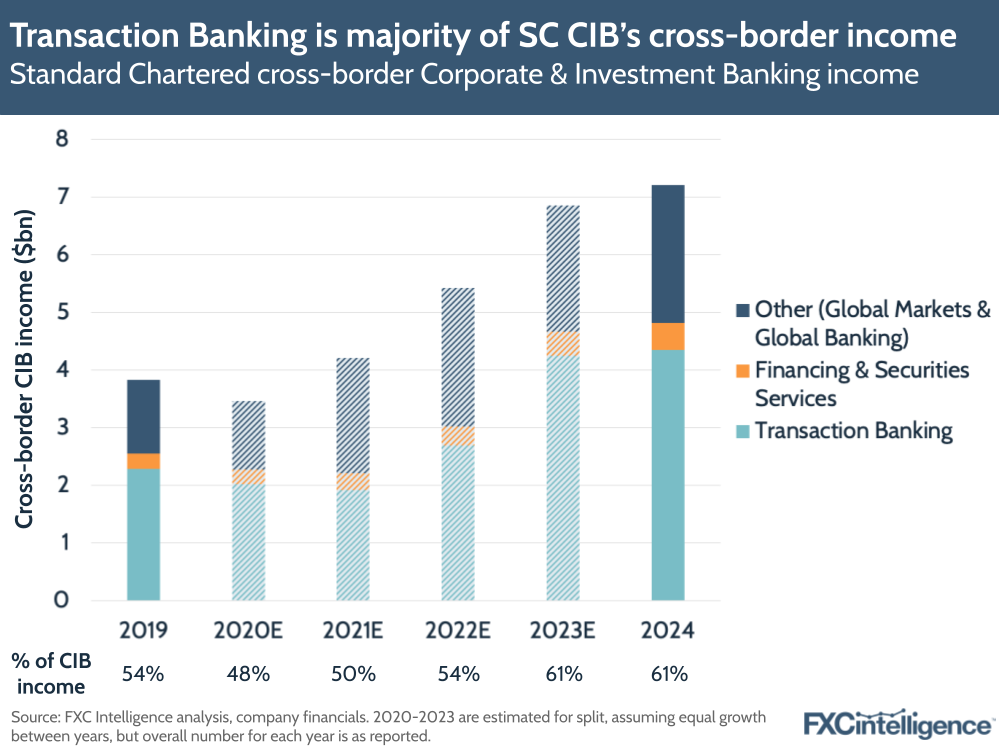

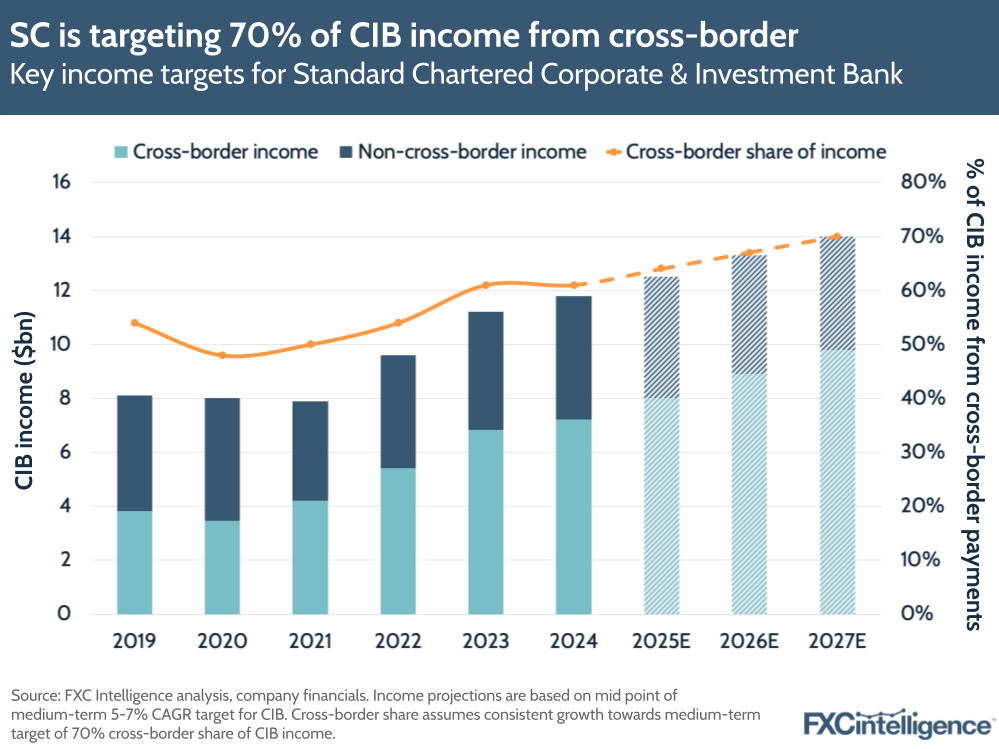

Between 2019 and 2024, Standard Chartered reports that CIB cross-border income has seen an 11% CAGR, or 9% excluding rates, compared to 8% for CIB as a whole. During the investor day, the company contrasted this with several markers for the broader market, including Swift’s payment volume, which it said saw a 3% CAGR over the same period, and global trade volume, which it reported as having a 6% CAGR.

Over this period, cross-border payments has taken a growing share of Standard Chartered’s CIB income, rising from 54% in 2019 to 61% in 2024. This has been aided by a growing share of such income coming from financial institutions, with cross-border income from this group seeing a 12% CAGR since 2019. The bank has also increasingly looked to grow the number of products and markets it is serving each client with, with around 90% of CIB income now generated from clients with at least three products or markets, as well shifting to higher volume per client.

While cross-border payments income is contributed to by all areas of the CIB division, Transaction Services is the biggest reporting line contributor. Within this, Transaction Banking is the biggest single source, accounting for 60% of CIB cross-border income in 2024. Meanwhile, Financing & Securities Services (FSS), the other part of Transaction Services that is typically reported as Securities & Prime Services in quarterly earnings, accounted for a further 6%.

It has also taken a growing share of the unit’s overall income. Transaction Banking cross-border income accounted for 75% of all Transaction Banking income in 2024, up from 60% in 2019, and has seen a CAGR of 14% over the five-year period. FSS, meanwhile, has seen the cross-border share of its income grow from 72% to 75% over the same period.

For Transaction Banking, this has been aided by the growth of cross-border current and savings account (CASA) average deposits, which saw a 10% CAGR over the five-year period, compared to a 6% CAGR for CASA average deposits overall to $194bn.

With self-clearing capabilities in 29 currencies, domestic payments capabilities in 43 markets and support for 130 currencies through its omnichannel digital payables and receivables SC Prism FX product, the unit has also seen growth in a number of other key metrics. While clearing income has seen a 3% CAGR since 2019, income from SC Prism FX has seen a 14% CAGR.

Geographical reach and growth

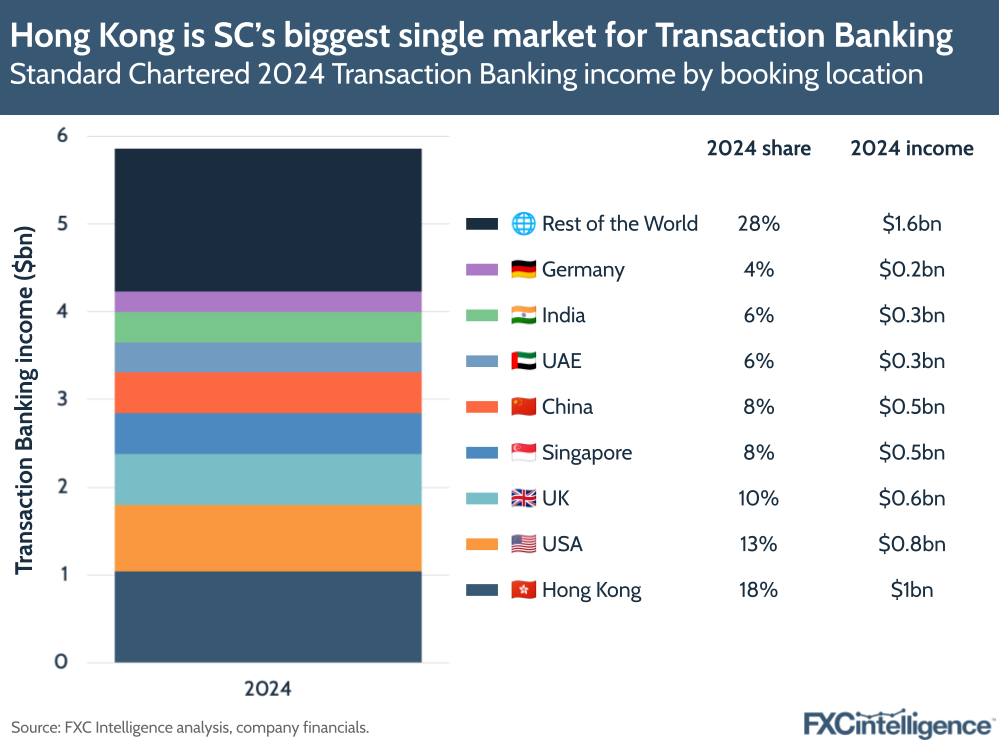

Transaction Banking overall is highly diversified geographically, with Hong Kong leading as the single biggest source of income by client booking location, at 18%. This is followed by the US (13%), the UK (10%), Singapore (8%) and China (8%).

While the unit is already a full-service global transaction bank in every market it operates in – as well as being a major clearing bank in multiple currencies, including US dollars, euro and British pounds – it has also made significant investment in building out its RMB-denominated trade and clearing capabilities to meeting growing demand in and out of China. This includes a licence for the China Cross-Border Interbank Payment System, which Standard Chartered was the first foreign bank to secure, enabling it to clear offshore RMB.

As it continues to grow, it is also meeting growing demand for regional treasury centres, particular from Asian multinational clients. These enable such clients to manage multicurrency and multijurisdictional cash and payment flows on a regional basis, and include the creation of subsidiary accounts under each regional treasury centre master account.

Trade evolution, exposure and tariff concerns

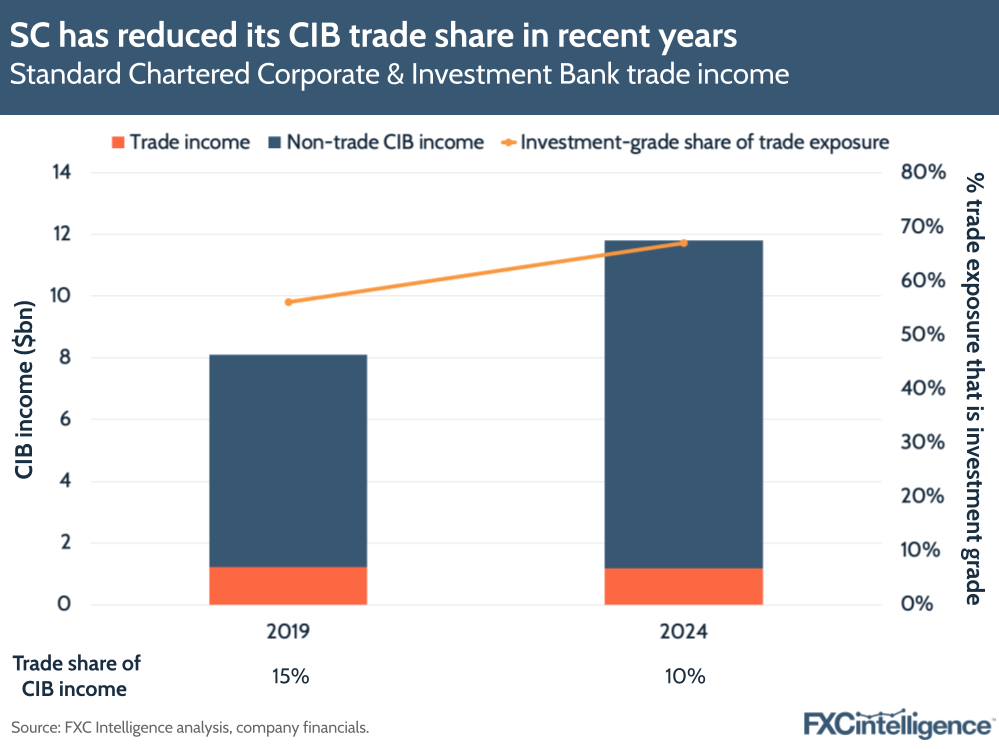

Trade is inevitably a key area for a business such as Standard Chartered’s CIB, however it has actively shifted strategy in this area over the last few years to move away from trade-only clients and, where relevant, shift them to become multi-product clients. This has seen the 11% of clients who were trade-only in 2019 shift significantly. While 91% of the original 11% had exited by 2024, only 4% of the remainder are still trade-only, with the other 5% now being multi-product clients.

This has seen trade income reduce from 15% of CIB income in 2019 to 10% in 2024, while the client profile mix has changed, with investment-grade’s share of trade exposure rising from 56% in 2019 to 67% in 2024.

However, the focus on shifting to multiple products has seen trade in Transaction Banking specifically increase, with cross-border average trade exposure seeing a 7% CAGR between 2019 and 2024.

In its Q1 2025 earnings, the company shared that less than 10% of CIB income was from payments exposed to the US tariffs, and the investor day also enabled it to further discuss challenges and opportunities in this area. Spiegel in particular addressed ongoing diversification in global trade flows, which he said had already begun and which was likely to “continue to happen”.

On this, the bank stressed that its Transaction Banking offering was “well-positioned to support clients as [the] supply chain continues to be reconfigured”, although Spiegel did stress that tariffs alone were unlikely to prompt dramatic changes in client activity, particularly in sectors with local skill needs.

Targeting 70% cross-border income

Standard Chartered has set a target of 70% of its CIB income to come from cross-border payments in the medium term, up from its current high of 61%, while growing the division at a 5-7% CAGR over the same period.

As the largest contributor of cross-border income, Transaction Banking is set to be critical to this goal and Standard Chartered is aiming to “become the bank of choice for cross-border Transaction Banking solutions”.

If CIB reaches its 70% target by 2027, this could see overall CIB cross-border income nearing $10bn, with Transaction Banking approaching $6bn cross-border income if it retains its current share of Transaction Banking overall income.

Continued increase in digital support is set to be key to this, with the unit looking to continue to improve its digitisation efforts. This includes AI, where the bank has been using the technology for some time, particularly in areas such as risk management and fraud, although Spiegel expects more automation to come when local legislation enables the acceptance of electronic bills of lading – critical documentation for cargo.

Beyond this, it is also looking to continue to develop its network, further increase cross-selling and grow operational deposits.

“We have truly transformed our business through targeted investments in our platforms and solution capabilities and now have a leading transaction banking franchise,” said Spiegel.

“The nature of transaction banking puts the business at the heart of the bank’s cross-border revenue aspiration.”