Standard Chartered’s Q1 2025 results saw the company post solid top-line results and centre its cross-border and network presence as it seeks to reassure investors about its ability to withstand tariff-related headwinds.

Reporting a 5% YoY increase in operating income to $5.4bn, or 7% on a constant currency basis, the bank’s top-line revenue was driven in part by gains in key parts of its transaction banking-focused Corporate & Investment Banking (CIB) division, which makes up the majority of its cross-border payments offering.

Global Banking saw 17% growth while Global Markets increased by 14%, both on a constant currency basis, driven by higher origination volumes for the former and volatility-related gains for the latter. However, Transaction Services saw a -4% decline YoY as a result of margin compression from rates, although this was offset by growth in the bank’s Trade & Securities Services segment.

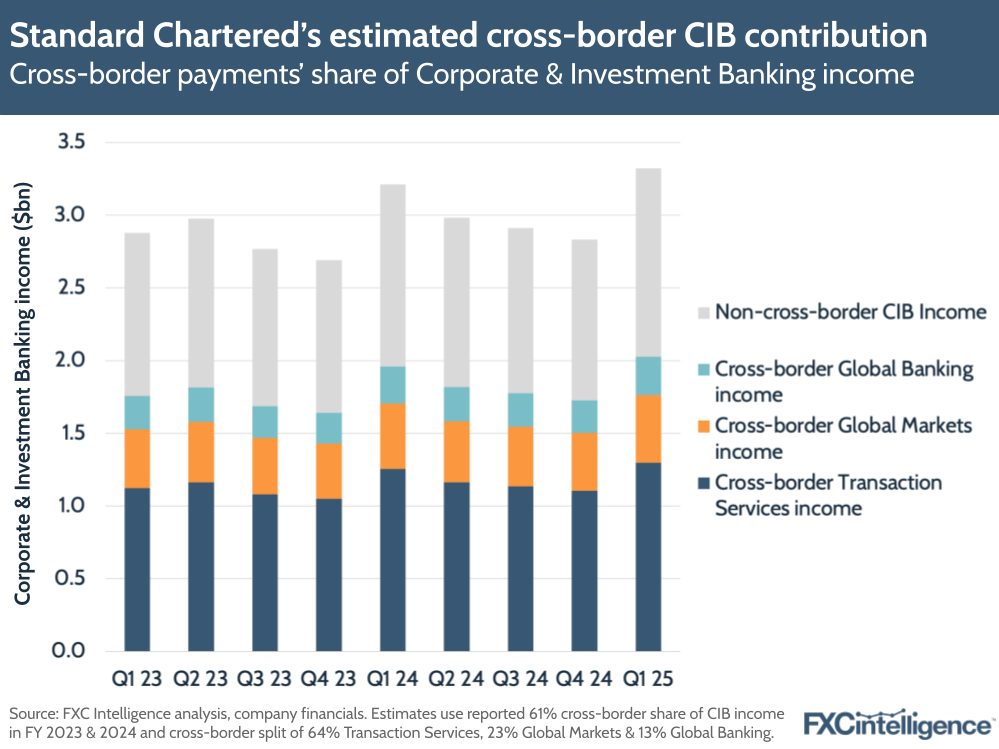

Standard Chartered did position its cross-border payments network as “a distinctive advantage in an uncertain environment”, re-highlighting both its full-year 2024 cross-border network income of $7.3bn and its split across Transaction Services (64%), Global Markets (23%) and Global Banking (13%).

Based on this and the 61% share of CIB income from cross-border in FY 2024, Q1 2025 is likely to have seen around $2bn income from cross-border, around $1.3bn of which is attributable to Transaction Services, approximately $0.5bn to Global Markets and $0.3bn to Global Banking.

The bank highlighted ongoing efforts to diversify its supply chain for corporates, including onboarding 10 regional treasury centres, as well as increasing its presence in international capital and FX markets for financial institutions, where it has invested in digital capabilities for FX trading.

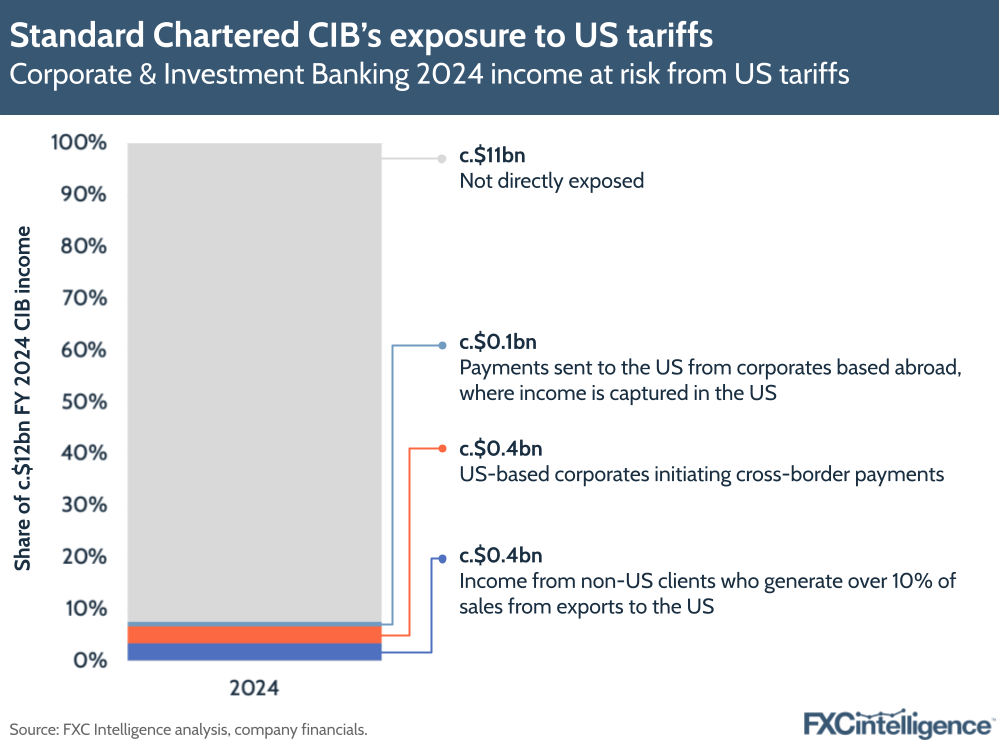

Standard Chartered in particular stressed its geographic diversification as a cause for resilience to the current tariffs and macroeconomic conditions, saying that only seven market corridors generate over $100m network income annually.

The bank also went into detail about its CIB exposure from US-related corporates, which generated 7% ($0.9bn) of CIB income in FY 2024, with around $0.4bn from US corporates sending outbound and $0.1bn from payments income captured in the US sent from non-US corporates. Approximately $0.4bn was attributed to income from non-US clients who generate over a tenth of their sales from exports to the US.

We’ll have more on Standard Chartered CIB’s tariff exposure and its future strategy when it holds its CIB investor day later this month.

How are cross-border payments providers competing on price in key corridors?