Remitly’s Q2 2025 earnings saw another strong quarter for the company alongside the unveiling of key new product lines to significantly increase the company’s TAM. We caught up with CEO Matt Oppenheimer to find out more.

Remitly’s Q2 2025 earnings were, once again, very strong, with the company comfortably exceeding its revenue and adjusted EBITDA expectations, as well as increasing its projections for the year. This was aided not only by greater customer numbers, but also by an increase in both its revenue and volume per customer.

Q2 also saw the remittance major enter new product categories, with the launch of Remitly Business, which the company sees producing a tenfold expansion of its total addressable market, and its subscription product Remitly One, which combines send now, pay later product Remitly Flex and Remitly Wallet. Meanwhile, Remitly also shared moves in the stablecoin space, including the ability for customers to hold and send stablecoins via a partnership with Stripe’s Bridge, as well as providing an update on its AI-focused initiatives.

We caught up with CEO Matt Oppenheimer to find out more about how the company is approaching this next step in its evolution, as well as the key drivers of its growth this quarter.

Topics covered:

- Remitly’s Q2 2025 growth drivers

- Driving business efficiencies

- Remitly Business: Broadening reach to small businesses

- Remitly One: Adding membership solutions

- The role of stablecoins in Remitly’s strategy

- Remittance tax impact

- AI as a growth driver

Remitly’s Q2 2025 growth drivers

Daniel Webber:

Your numbers are at all-time highs across many metrics, and you’re continuing to grow much faster than the market. Talk us through it.

Matt Oppenheimer:

Q2 was incredibly exciting and a really defining quarter for Remitly. We once again delivered GAAP profitability. We reached the Rule of 50, and that means more specifically that revenue grew 34% year-on-year off of a larger and larger base.

We delivered $411.9m in revenue and we delivered adjusted EBITDA of $64m, which exceeded expectations. Most importantly, that is indicative of the fact that we served over 8.5 million customers just last quarter, and we continue to deliver a service to them that enables them to rely on Remitly to move their money around the globe. So we’re incredibly excited about our Q2 performance.

That growth is really diverse. We now operate in 170 countries. Rest of world continues to grow really nicely, which are our origination countries outside of North America, so we’re pleased with that. But it was across the board to deliver that kind of growth number.

One example is Mexico. The Mexico market data that we’ve seen at an industry level shrank in Q2, whereas our Mexico receive market grew faster than the 34% average that the company grew.

We’re seeing growth across the board and I think that’s indicative of the fact that with 8.5 million customers, being the digital-first player at scale, this business comes down to trust. Especially in Latin American markets, but across the board, we’re seeing this flywheel effect where people are loving our product, using our product and saying, “You got to try this out. It’s more affordable, it’s faster, it’s more convenient, you can trust it”. That’s fueling a lot of our growth.

Remitly sees climbing revenue, continuing profitability in Q2 2025

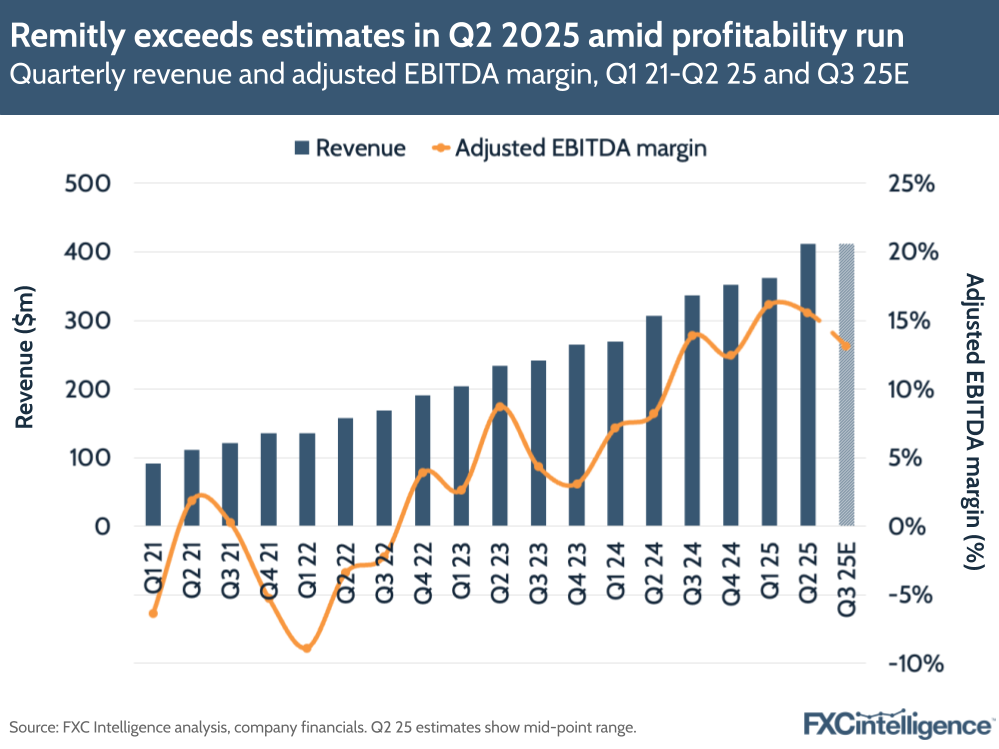

Q2 2025 saw Remitly report a 34% YoY increase in revenue to $411.9m, matching its revenue growth for Q1 2025 and three percentage points above its growth the previous year. This was 7% higher than the top end of Remitly’s projected range for the quarter, which in Q1 2025 it had forecast at $383m-385m of revenue.

The company also saw similar improvements on its adjusted EBITDA, which reached $64m in the quarter despite a previous projected range of $45m-47m. This means that the company has achieved an adjusted EBITDA margin of 16%, around four percentage points higher than its Q1 projections suggested it would reach.

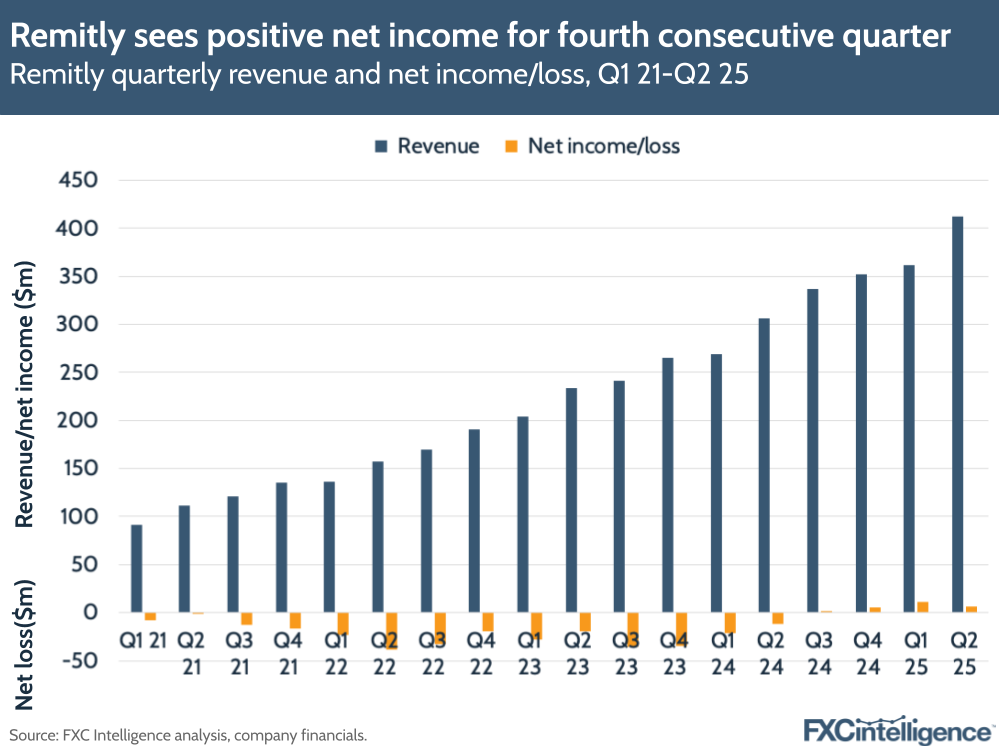

The company also reported its fourth quarter in a row of positive net income, with $6.5m net income for Q2 2025. This is the first time it has achieved this duration of positive income, giving it its first continuous 12-month period of profitability. Notably, it is also despite Remitly projecting that it would see a net loss this quarter when it gave guidance in Q1.

Driving business efficiencies

Daniel Webber:

How are you continuing to improve and develop on the cost of acquisition and marketing and the efficiencies of the business?

Matt Oppenheimer:

A lot of it is the flywheel that we’re mentioning. We continue to get leverage on our marketing spend overall and when it comes to new customers, given that trust is hard to build, the most valuable and efficient way to build that trust is via the word of mouth that is coming from our product.

To put it in perspective, we have 8.5 million quarterly active users. We have more than three million iOS and App Store reviews with a review of 4.8 and 4.9 stars respectively on Android and iOS. If you take a step back and think about that, those are customers that are proactively reviewing our app. So you’ve got customers that are really loving our service, loving our product and continuing to say, “You’ve got to try this out. It is the way to send money internationally”. That’s fueling a lot of our growth.

What’s especially exciting about Q2 is that Remitly is evolving from a cross-border payments provider and leveraging the trust, leveraging the relationship, leveraging the data that we have on our customers to become a broad financial partner.

We introduced some really new and innovative products to support our customers with their financial lives. We launched Remitly Business, we announced Remitly One and we also talked a lot about some of the stablecoin elements.

Remitly continues operational efficiencies

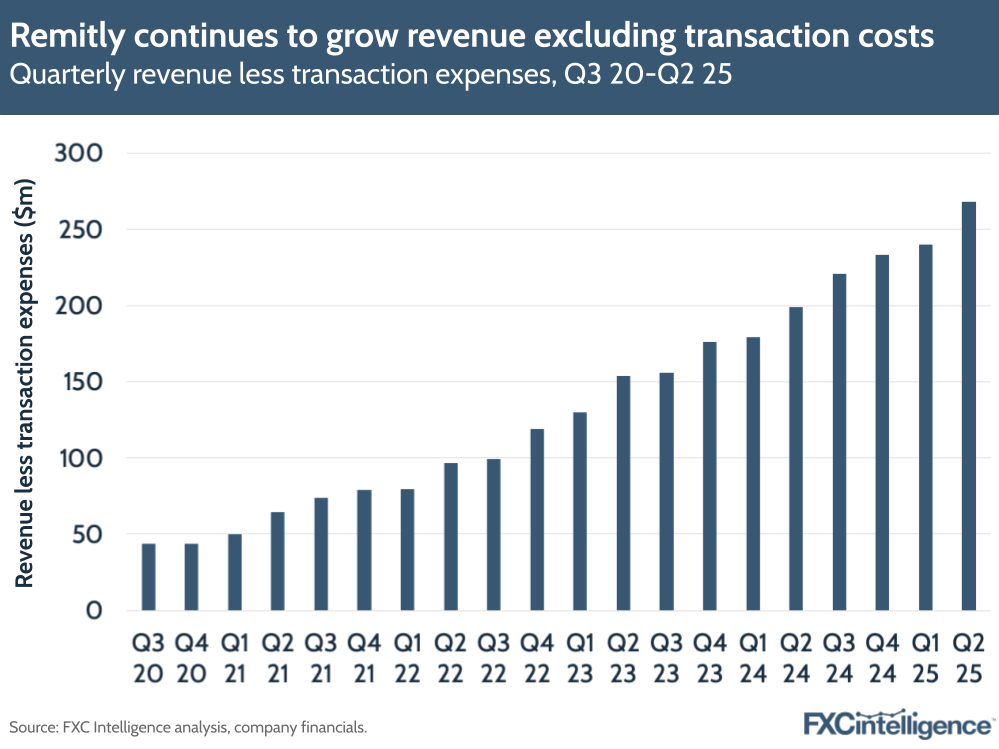

Remitly’s increased profitability has been aided by efforts to combat inefficiencies within its operations, and crucial to achieving this has been a slower growth rate for costs and transaction expenses. This quarter saw total costs and expenses grow 23% YoY, while transaction expenses alone grew by 33%, however revenue less transaction expenses climbed at a faster rate, increasing 35% YoY to $268m.

Remitly Business: Broadening reach to small businesses

Daniel Webber:

Let’s talk about Remitly Business. What markets are you focusing on and how are you planning to build that business piece out?

Matt Oppenheimer:

A bold vision combined with short-term focus is one key to success. Remitly Business, first of all, is for small businesses paying international vendors, and what we saw on our platform without even marketing or doing a lot of product customisation is businesses were already coming to us. These are small businesses that are trying to send money back to freelancers, to vendors that might have five or 10 folks that they’re sending money to.

The reason they were coming to our platform is because from a unit economic standpoint, because we started with low dollar transactions, we had to get the speed, efficiency and cost to serve in a really solid place. For a lot of businesses, they don’t need a lot of the bells and whistles that, when we talk about SMB, the medium and large businesses need right now.

When I think over the long term, we could potentially serve those customers. But where we’re starting is providing a really reliable, affordable and seamless service to small businesses that have, I think, historically been underserved and we have the unique ability to serve them.

We announced that being launched in Q1, we’re seeing nice growth in Q2 and we’re really excited about what’s to come in Remitly Business.

If you look at our growth right now, there’s adding additional segments of customers, Remitly Business being one example, and we can continue to move up market there. Expanding our TAM by the way, from $2tn to 10X more than that, over $20tn, so incredibly excited there.

Daniel Webber:

How will your go-to-market differ for Remitly Business versus how you go to market on the consumer side?

Matt Oppenheimer:

It’s a similar playbook. Oftentimes, when we talk about some of the customers, these are small and micro businesses, so they’re often looking at similar marketing channels that we’re already marketing to, so opportunities to specialise.

The team is thinking about, “How do we ramp up marketing spend specifically in channels that reach Remitly Business customers?”. There’s a lot of channels we’re already marketing on that Remitly Business customers are already finding out about us through.

Remitly reports growth in customers and volume

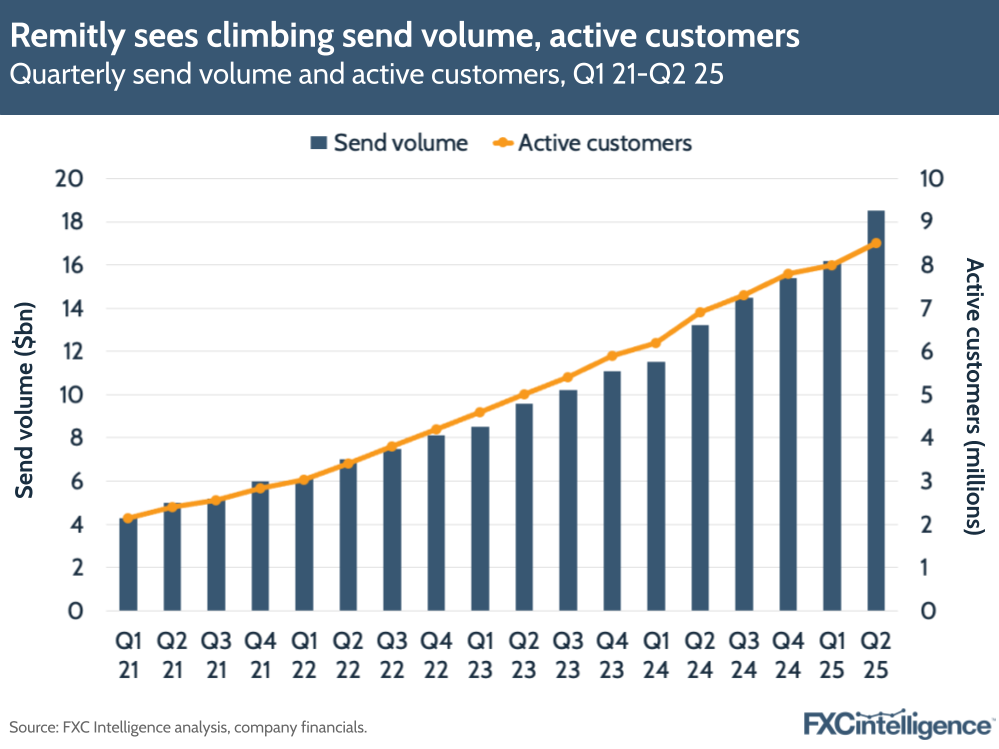

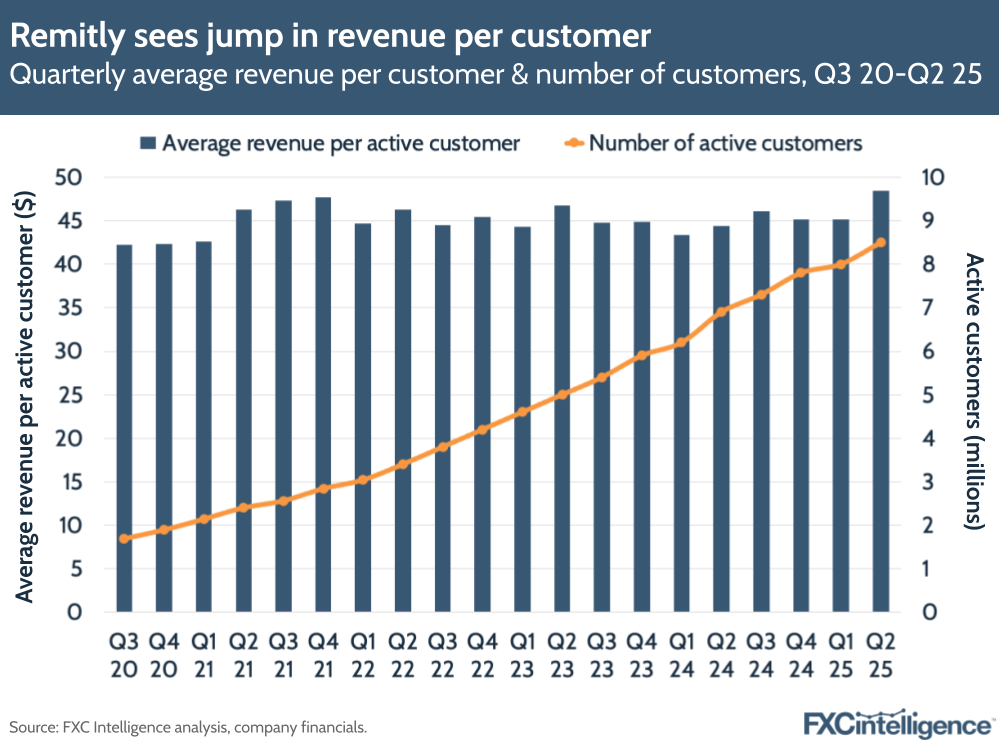

Q2 2025 also saw Remitly’s active customers reach a record 8.5 million, a 23% YoY increase that while strong is slower than in previous quarters. However, the company’s volume growth far outstripped this, climbing 40% YoY to $18.5bn for the quarter.

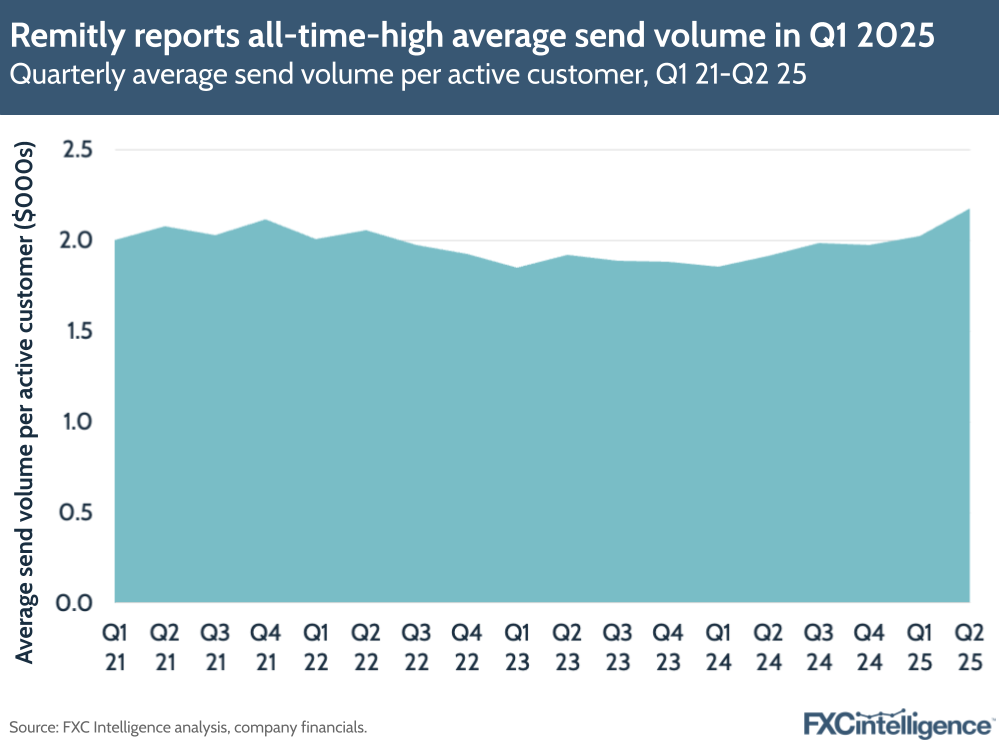

This disparity in growth rates reflects the fact that, after dropping slightly from late 2022 through to mid 2024, average send volume per active customer has been steadily climbing since Q3 2024 and has now reached an all-time high for the company of $2,176. This latest quarter also the YoY growth rate of average volume per customer reach 14%. This is the first time it has seen double-digit growth in almost four years, and the highest rate of growth to-date.

This increase in volume has inevitably also impacted average revenue per active customer, which climbed 9% YoY to $48.45. This is also its fastest growth in around four years, and is the highest average revenue per customer Remitly has reported to-date.

Remitly One: Adding membership solutions

Daniel Webber:

You also announced Remitly One. Talk us through the product.

Matt Oppenheimer:

Remitly One is our first ever membership and it brings together products like Remitly Flex – which is a send now, pay later product – and Remitly Wallet. Remitly One members get additional benefits on top of their Flex and Wallet products – there’s a lot embedded into that.

Over the long term, having a membership relationship with our customers is the way to go. We can add many benefits over time and it’s incredibly exciting to have two real exciting benefits within Flex and Wallet at launch.

Daniel Webber:

How are you thinking about approaching a loyalty scheme and membership, given that it’s a market that’s been around for a long time but hasn’t really developed?

Matt Oppenheimer:

It starts with our vision, which is to transform lives, how mission-driven we are. I met a customer this morning randomly at the gym and it made my morning. He’s been a customer for years.

He walked up to me and said, “Are you the CEO of Remitly?” And I said, “Yeah”. And then we had this great conversation. He’s from the Philippines, he’s here with his wife, but his son is still back in the Philippines and he sends money to his son. He’s from Manila.

He, like the 8.5 million customers we served in Q2, has made huge sacrifices. He’s in a different country than his son. One of the main reasons he’s here is so he can support his family back home.

I think that transforming lives is critical and always will be critical with trusted financial services that transcend borders. So trust, as we mentioned, is critical in any financial services; we’ve uniquely built that trust. Then financial services that transcend borders is where the membership component comes in, because that’s where we’re expanding the set of services that we’re offering.

That’s what is different between a membership programme as opposed to a loyalty programme. Great membership programmes, Costco or Amazon Prime are examples like that. Loyalty programmes tend to just be the same set of services that then you get benefits and points for using. Those are things like airlines, or some of our competitors have done that.

For us, it’s about expanding the service offering that we uniquely can do. If you take Remitly Flex, there is an inefficiency when it comes to the matching of credit access and credit worthiness for the 250 million individuals that live and work outside the country that are born. We have unique remittance data and other things where we can offer things like Remitly Flex and then we can make it even better for Remitly One members, meaning if you’re a Flex customer, you can get funds in three business days, where if you’re a Remitly One member, you get those funds instantly.

Remitly Wallet is a good segue to stablecoins because customers have demands to hold multiple currencies across the globe because they’re global citizens. They are also increasingly interested in being able to hold things like stablecoins.

We can talk about stablecoins separately in a minute, but Remitly Wallet is the ability to hold both fiat and stablecoins in an account that serves global citizens in a really effective way. Then, as a Remitly One member, you can get things like interest, like rewards, you can earn different components by storing balances with us.

I’m incredibly excited about the Remitly One framework in terms of membership, and the specific benefits.

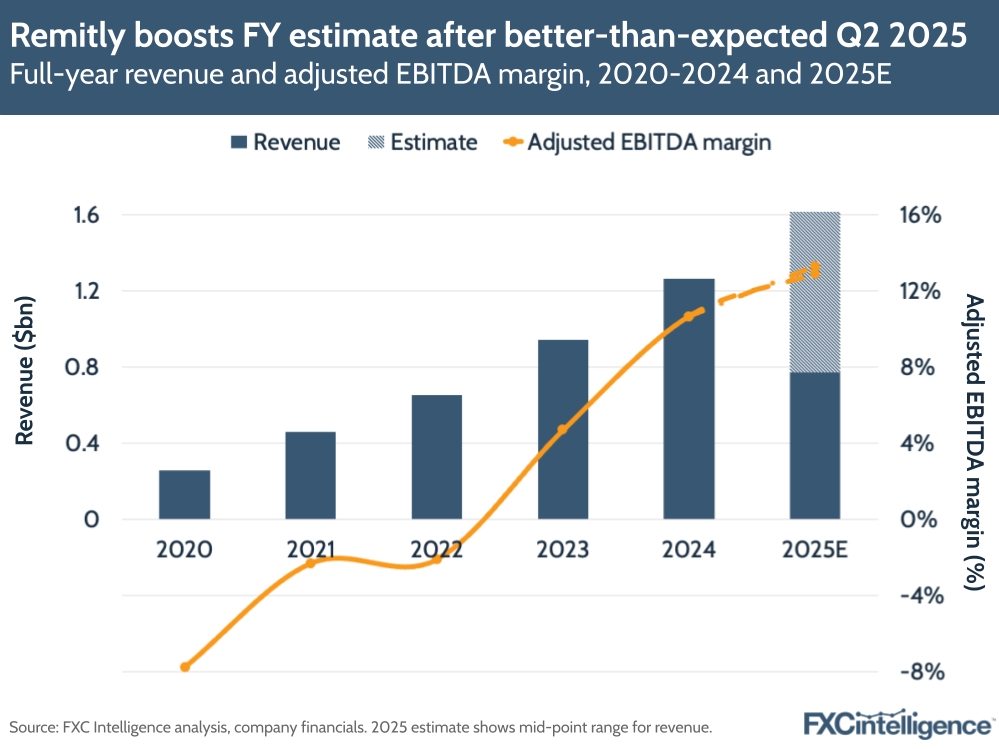

Remitly increases projections for FY 2025

Remitly is expecting to see Q3 2025 continue its run of growth, although at a potentially slower rate, with guidance that projects revenue of between $411m and $413m. This represents projected growth of 22-23% versus Q3 2024, which would be the first time Remitly reported revenue growth below 30% since it became a public company. Meanwhile it is projecting adjusted EBITDA of $53m-55m, which would result in an adjusted EBITDA margin of around 13%. However, given that Remitly has repeatedly outperformed its own projections, it may well do the same in this coming quarter.

Despite the slightly more muted projections for Q3, Remitly has increased its FY 2025 revenue projections for the second time on the back of its latest results and is now projecting revenue of between $1.61bn and $1.62bn, up from its Q1 projection of $1.57bn-1.59bn. The company’s adjusted EBITDA projection has also been boosted from the previous projection of $195m-210m to the current $225m-230m. As a result, Remitly now expects to see an adjusted EBITDA margin of around 14%.

The role of stablecoins in Remitly’s strategy

Daniel Webber:

Lets segue into stablecoins. What’s your five to 10-year vision for how you’re thinking about them?

Matt Oppenheimer:

It’s incredibly exciting. I always try to look at how the technology solves specific customer pain points, and I see there being two pain points that stablecoins can solve in a five to 10-year timeframe. They’re applicable to us. One is that customers around the globe have a desire to hold more stable currencies that are less volatile, especially in a lot of emerging markets.

Two things that we announced today [address that]. One is that we’re launching the ability I just mentioned, to hold stablecoins in a Remitly Wallet, which will give them the ability to do that.

The second is we have one of the best distribution networks on the planet, and we can send to four billion bank accounts and mobile wallets, we can send to over 470,000 cash pickup locations. We can even send a door-to-door delivery in some markets like the Dominican Republic where it’s popular.

We can do that 93% of the time in less than an hour, 24 hours a day, seven days a week.The reason that applies to stablecoins is because we’re also going to be launching the ability to send money into stablecoins, just like other disbursement methods across the globe, and we’re doing that in partnership with Bridge, which is part of Stripe.

That solves that pain point of customers wanting to hold stable currencies in emerging markets.

The second pain point is treasury FX cash management and having that be more real-time and more effective than some of the legacy systems. Our treasury team has launched the ability to leverage stablecoins to be able to improve some of those processes. The volume right now is modest, as I’d expect it to be, but we’re not investing in the next quarter or two. We’re investing in the next, as you said, five to 10 years. And I think there’s some exciting things that are going to happen in the stablecoin space.

Remittance tax impact

Daniel Webber:

Turning to the US remittance tax, how are you thinking about its potential impact?

Matt Oppenheimer:

It’s a 1% tax, but it’s a 1% tax on cash. Because our customers are linked to a bank account, a debit card, etc., it doesn’t apply to Remitly transactions.

As I look towards 26 January, it could be partially a forcing function to have folks shift away from cash to digital alternatives because it becomes, relatively speaking, more compelling to send with a digital alternative, an area we’re obviously tracking very closely, an area that’s very important. But that’s the punchline in terms of what it means to our business.

AI as a growth driver

Daniel Webber:

People always say, “you can talk about stablecoins, but AI is having more impact in a lot of businesses faster”, so let’s update on the impact of AI at Remitly.

Matt Oppenheimer:

Over the last 14 years of building this business, I’ve seen a lot of technologies come and go that don’t solve real customer problems. AI and stablecoins, I’m so excited because they actually do.

Obviously, there’s a lot of hype out there related to certain technologies that are solving problems, but in a very tangible sense, there are two things with AI. One is we have built a virtual AI agent that we’ve been using for customer support and we’re adding additional use cases onto that. We then took that and we said, “Let’s platformise that and let’s enable it to be plugged into other platforms like WhatsApp”, which we talked about in Q1 and we talked about again in Q2.

We’re excited about that being a great way to connect with customers that are using WhatsApp, billions of customers around the globe, especially in markets like Latin America that are using it daily. It’s an easy way to actually build that conversational engagement and trust at the top of the funnel.

We’re excited about our integration into WhatsApp with our virtual AI agent, but now that we’ve platformised it, we can integrate it into other messaging platforms over time.

That’s number one: the conversational nature of how remittances are done, and we’re helping lead the way on that front. Then second, as so many companies talk about but what I can see every day very authentically, is we are using AI to really improve the efficiency and velocity of how we deliver for customers.

Our marketing team, the creatives that they are producing, which matters a lot when it’s across 170 countries in countless languages. I can see our engineering teams using it to deploy code more effectively, I can see our CS teams using it to serve customers more effectively, our customer support teams.

It’s incredibly exciting. I wrote a LinkedIn post a few weeks ago on the potential of AI and how excited I am about it, but wow, it is really exciting and I’m excited about what it’s going to do ultimately for our customers.

Daniel Webber:

Is there anything else you’d like to cover that we didn’t get a chance to discuss?

Matt Oppenheimer:

We already talked about a customer, and I’ll just circle back to that customer this morning since we already talked about him and that’s why we’re here. That’s why we do what we do and it’s incredibly impactful.

The exciting thing is we’re expanding the types of customers that we now serve. To Remitly Business, to, we say, global citizens because our largest transaction in Q1 that we talked about was from Canada to the US.

The impact we’re making on our vision to transform lives with trusted financial services that transcend borders starts and ends with the customer impact. That’s what excites us every day, and that’s why we’re going to continue to grow and do amazing things.

Daniel Webber:

Matt, thank you.

Matt Oppenheimer:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.