Despite an economic slowdown in 2022, several leading providers of consumer money transfers saw sustained (if slower) growth this year, driven by increased digital consumer revenues and ongoing recovery from the Covid-19 pandemic. In this piece, we explore key trends across the money transfer space in 2022.

Remittance players see slower overall growth

In Q1, Q2 and Q3 of 2022, several leading remittance players saw consumer money transfer revenues grow at a slower rate. This was due to a mix of macroeconomic conditions, including a slump in the payments market; the Russia/Ukraine war; rising inflation; supply chain issues; and Covid-19 restrictions. However, these factors did have some positive effects for some companies, as we noted in our full analysis of the economic downturn.

While there have been knock-on effects of a stalling global economy (e.g. cost of living), Intermex CEO Bob Lisy and Remitly CEO Matt Oppenheimer both argued that remittances have weathered the storm and will continue to do so, as migrants tend to be resilient and find new jobs in periods of economic uncertainty.

The Russia/Ukraine war caused some providers to withdraw business from Russia and Belarus, and also may also have affected inbound remittances to Ukraine. Preliminary figures from the National Bank of Ukraine show that there was a 3.8% YoY decrease in personal remittances sent to Ukraine in the period between January to October 2022. This could be explained by an increase in Ukrainian migrants receiving money in a different country. The amount of money sent through informal channels increased from $4.9bn to $5.3bn last year, compared to bank account transfers which declined from $3.4bn to $3.2bn, showing an interesting contrast to many regions around the world that are increasingly moving remittances online.

Digitilisation continues to grow

Digital remittances are continuing to see a post-Covid boom, even as retail returns after the Covid-19 pandemic. Digitalisation is driving greater financial inclusion in many LMICs, and many consumers benefit from the added convenience, speed and often reduced cost of sending via digital methods. An abundance of new entrants is driving digitisation and competition, which in turn will drive lower prices and better experiences, as we learned at our panel at this year’s IAMTN conference.

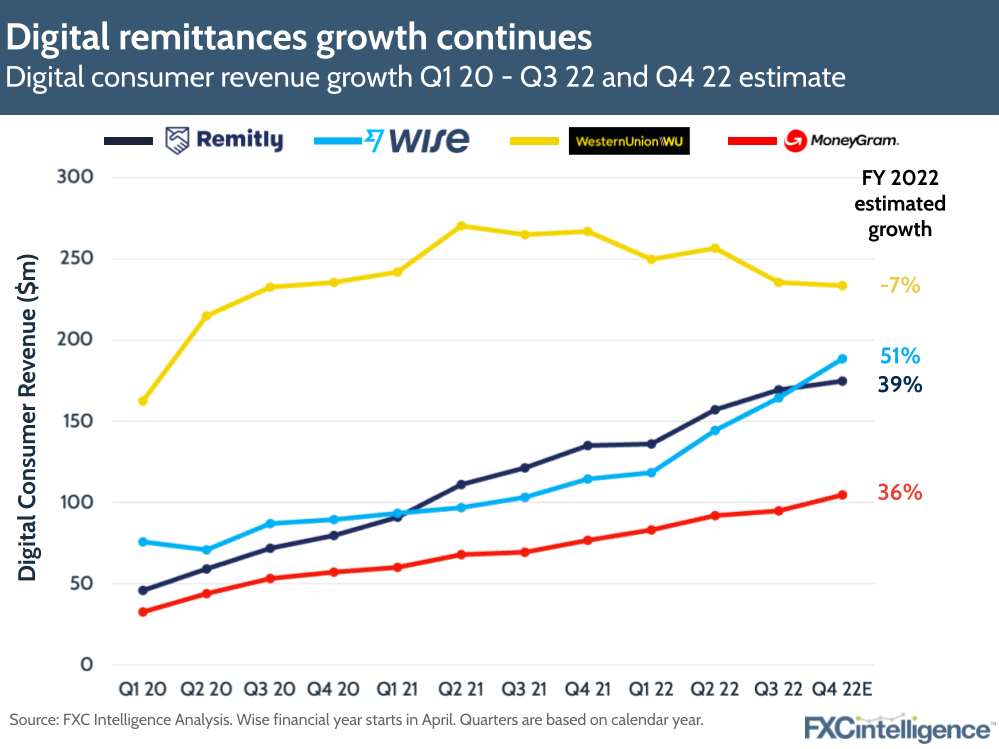

Digitalisation has driven the success of money transfer challengers this year, with Wise and Remitly both posting consistent double-digit revenue growth throughout the year. On the other hand, incumbent Western Union has seen a decline in digital and is now ramping up its digital customer acquisition.

Established digital challengers are looking to increase their payout methods to facilitate more money transfers to and from bank accounts and mobile wallets worldwide. Remitly, for example, has expanded its collaboration with Visa Direct to Canada, meaning Remitly customers can now send money from 18 countries to bank accounts in more than 100 countries. A number of money transfer companies have launched or upgraded their app offerings or integrated with others (e.g. Monzo implementing Wise), while aspiring ‘super apps’ such as Revolut are expanding their remittance offerings worldwide.

Having said this, retail money transfers have still been a key focus for some providers. Despite pursuing an ‘omnichannel’ strategy, Intermex has been driving revenues by increasing its in-store agents in specific regions with high LatAm migrant populations in the US. Meanwhile, Western Union signed a deal that will enable customers to make cross-border money transfers from 4,000 post offices in the UK.

Money transfer companies are tapping into emerging markets

Remittance players have been expanding their global reach through acquisitions and partnerships this year. Intermex aims to break Europe through its ongoing acquisition of La Nacional, while Remitly bought Rewire to expand into Israel (it has since announced it is also expanding into New Zealand and Japan). Western Union also acquired Brazilian e-wallet Te Enviei so that it can launch new products in Latin America, which has seen a great deal of payments activity this year.

A key theme this year has been money transfer providers targeting largely unbanked, cash-using regions with easier, more convenient and accessible payment methods. This is particularly true in Africa, Southeast Asia and Latin America, which have seen some of the biggest funding rounds. See, for example, African fintech Flutterwave’s $250m raise in February, one of many payments stories to come out of West Africa as the region becomes a growing hotbed for fintechs.

The main challenge in emerging markets will be bringing the cost of sending money in line with the UN’s Sustainable Development Goal of 3%. According to the World Bank, although sending remittances via mobile operators is significantly cheaper, digital channels still account for less than 1% of total transaction volume in LMICs, partly because AML and KYC regulations continue to restrict the access of new service providers to correspondent banks.

Crypto’s role in remittances

Crypto and the blockchain have both seen greater integration in remittances this year. MoneyGram partnered with Stellar to provide a new global on/off-ramp service for digital wallets, while blockchain-focused Ripple is partnering with companies such as SBI Remit and MFS Africa to enable faster cross-border payments worldwide. Crypto exchanges are continuing to explore the space, with Coinbase and Bitso launching new crypto remittances to Mexico.

However, some money transfer firms haven’t entered the arena, as the hype around crypto receded amidst the ongoing bear market. From our discussion of crypto’s place in money transfers at Money 20/20, it seems digital currencies are unlikely to disrupt remittances anytime soon due to a number of challenges, mainly due to a lack of trust from customers and fixed costs around crypto. However, if regulators and remittance players overcome these challenges, crypto could play a greater role in the future money transfer landscape.

How are money transfer players competing on pricing worldwide?