This week, the US Senate narrowly passed the latest proposed version of the One Big Beautiful Bill Act, which is now with the House of Representatives for final approval before President Trump can sign it into law. A key part of the bill for the money transfer industry was the introduction of a new tax on remittances sent from the US, which has seen some important updates in this new proposal.

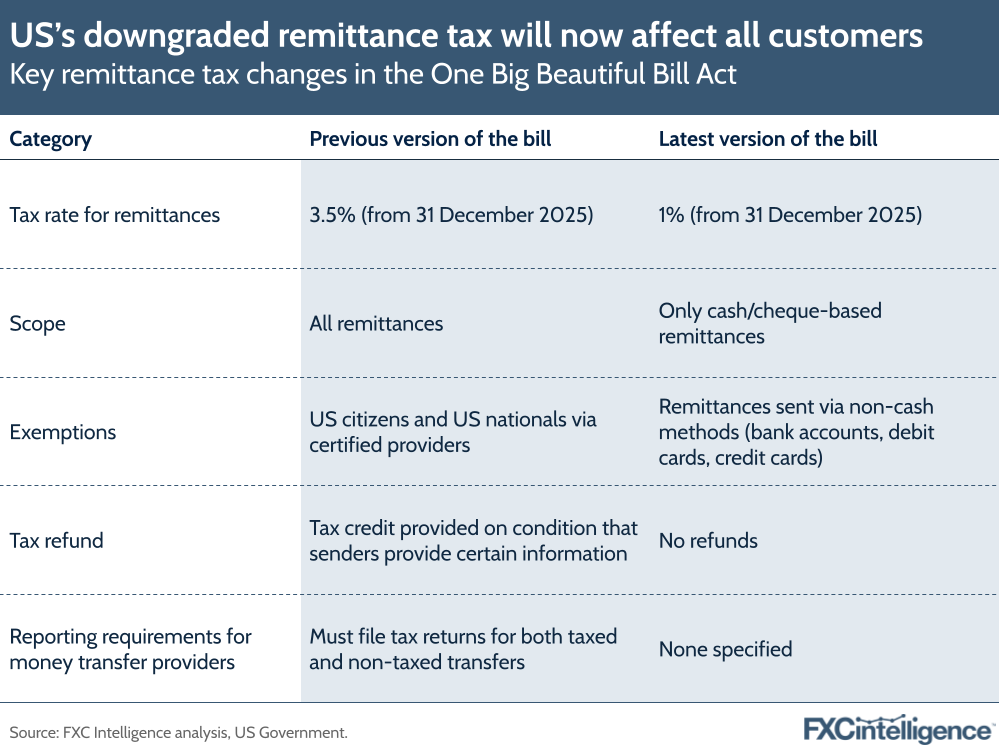

The Senate-approved version has reduced the proposed remittance tax rate from 3.5% down to 1% (though it had been as high as 5% when first proposed in the House). Additionally, certain sections of the bill have been reworded or removed, which could allay some industry concerns about the bill while possibly driving a greater industry shift to digital remittances.

Previously, all remittances sent from the US had been covered by the bill, regardless of the method by which they were funded. In this version, the remittance tax only applies to those funded by cash, cheques or “any other similar physical instrument”. It also does not apply to any transfers funded from a US-regulated financial account or a US-issued debit or credit card.

Another crucial change is the removal of a section that exempted US nationals sending through a “qualified” transfer provider. Under the amended bill, no exemption is specified, meaning that the tax would apply to anyone sending non-digital remittances, even if they are a US citizen or other US national. A section that previously allowed remittance senders to claim back refunds for taxes paid towards remittances has also been removed.

Meanwhile, the previous House-approved version of the bill would have required money transfer providers to verify that senders are US citizens or other US nationals and to report specific detailed information about them. This could have placed a significant KYC burden on transmitters, adding new costs and ambiguities around privacy. The new Senate version removes this requirement.

The changes are important for several reasons. Firstly, it will significantly reduce the amount that non-US citizens would have otherwise had to pay to send money back home, providing they fund the payment via a card or bank account. However, those who fund remittances in cash will be impacted more significantly.

While the move appears to be specifically targeting undocumented migrants who are often paid cash-in-hand, it is also likely to disproportionately impact other groups who are US nationals, including some minority groups and the elderly.

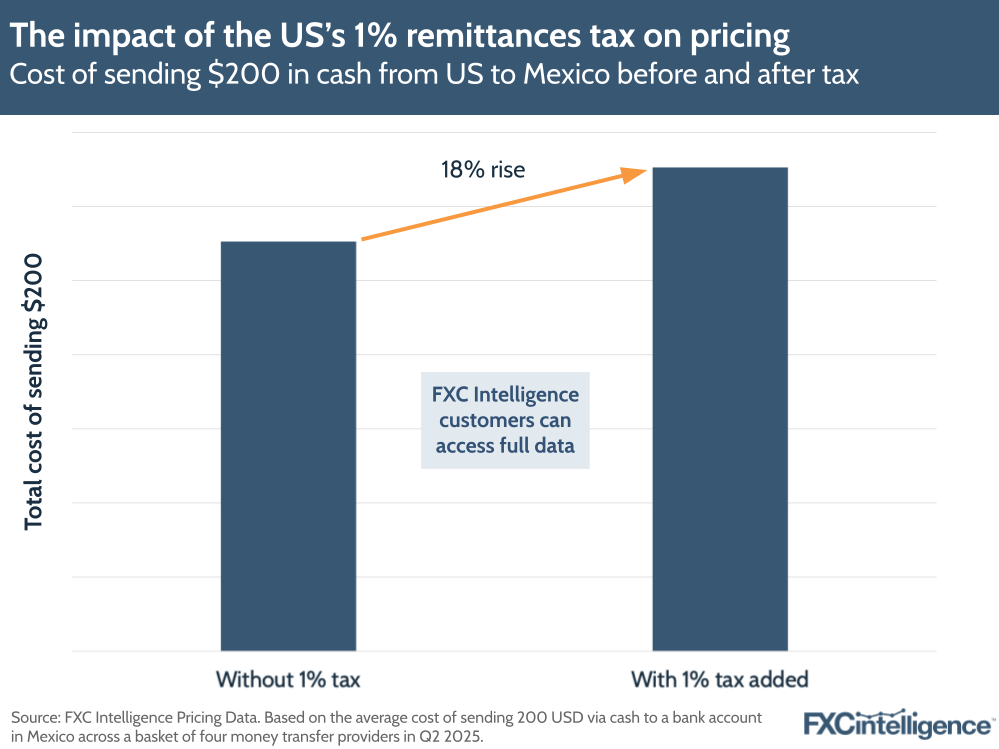

Some reports have speculated that the amount raised by the 1% tax could be higher than when the margin was set at 5%, as it has now moved to cover all remittances with no specifically defined tax refunds. It is likely to translate into a significant extra cost, with our data showing that the cost to send $200 to Mexico using cash will see an average rise of 18%.

The bill appears to have been rewritten to dodge potential issues around the need for money transfer providers to collect significant amounts of data on customers residing in the US. However, the decision to target cash remittances specifically could also speed up a move towards digitalisation that we’re already seeing in the industry from traditional money transfer players Western Union and Ria. These providers have invested heavily in improving their digital apps and customer storefronts online as digital challengers such as Remitly and Revolut have grown their share of the market.

President Trump had originally given the US Congress a deadline of 4 July to send him the final version of the bill to sign into law, though he himself admitted earlier this week it would be “very hard” to achieve this goal. The bill first needs to be reapproved by the House of Representatives, where the Republicans only have a narrow majority, and can only afford to lose three votes. However, with some concerned about wider issues such as Medicaid, the now-downgraded remittances tax is unlikely to be a sticking point for the bill. Nevertheless, if it does pass, we will be tracking its impact across major US corridors.