Uruguay-based payment processor dLocal has once again seen record revenues in Q1 2025, driven largely by rapid growth in its cross-border volumes. We spoke to dLocal CEO Pedro Arnt to find out more about the company’s key drivers and future strategies.

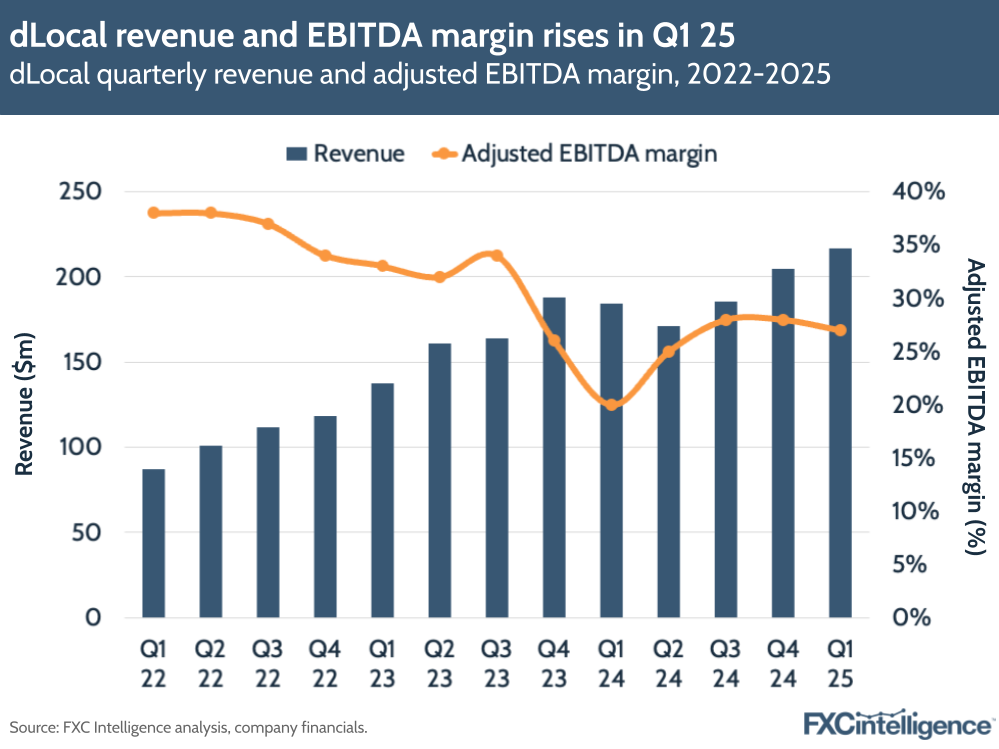

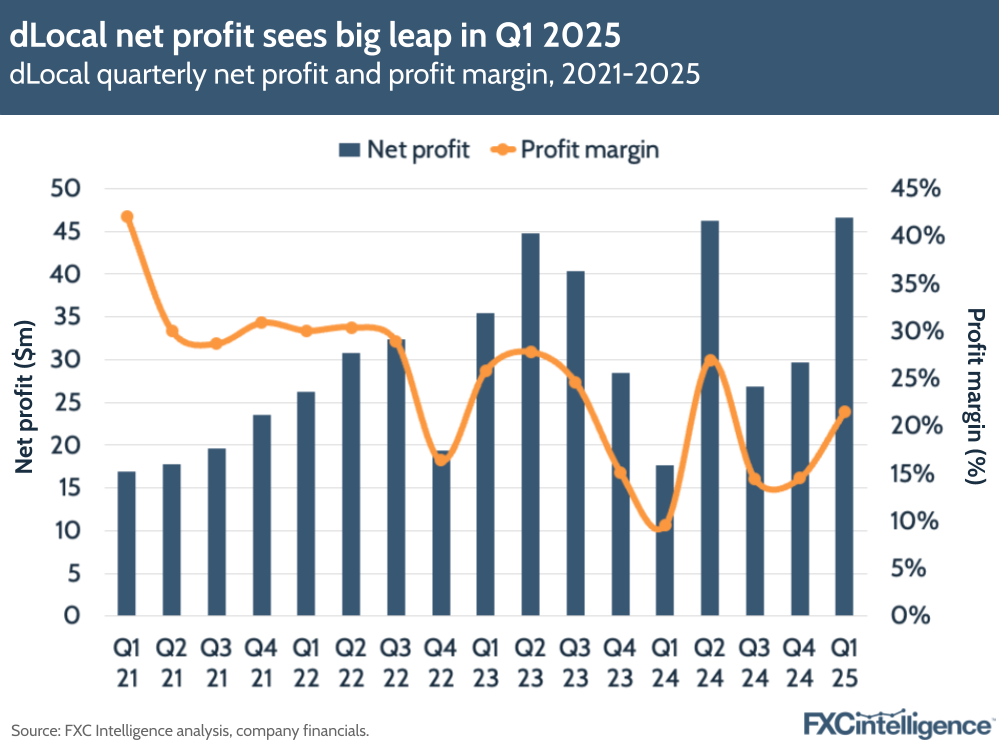

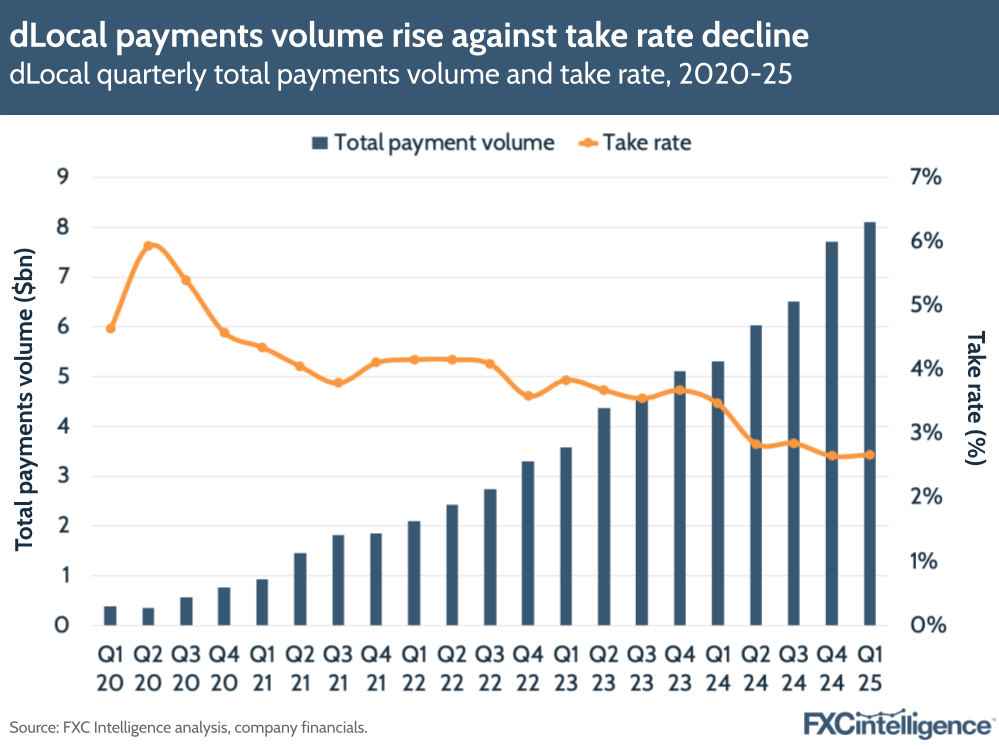

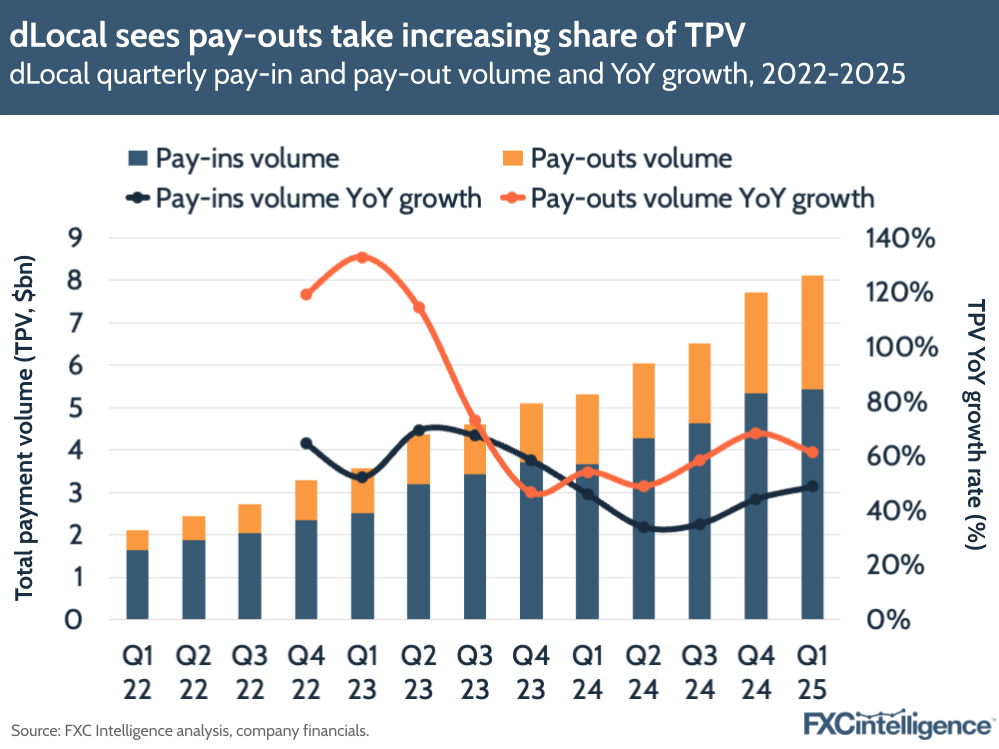

dLocal delivered strong Q1 results, with record revenue of $217m (up 18% YoY, or 36% in constant currency) on the back of 53% total payments volume (TPV) growth to $8.1bn. Despite seeing a lower take rate, profit metrics improved across the board, with adjusted EBITDA up 57% while net income surged 163% YoY to $47m.

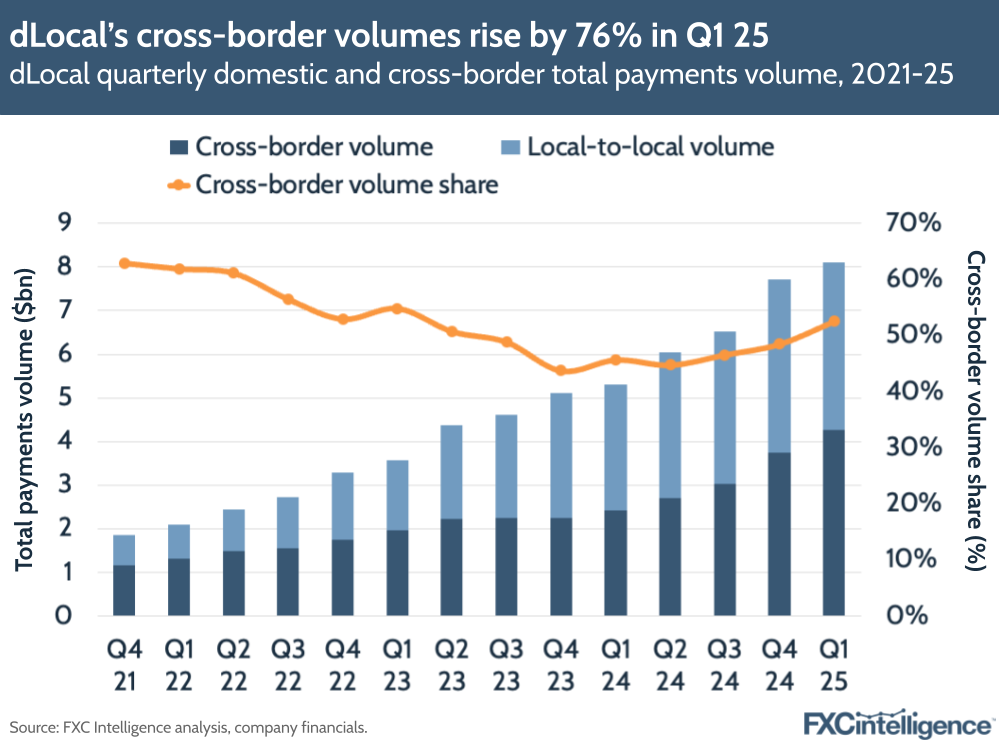

Continuing a trend from Q1, cross-border volumes continued to accelerate for the company, outpacing local volumes to rise 76% to $4.3bn. Key markets such as Chile, Nigeria, Pakistan and Turkey helped to drive this expansion, particularly in high-growth verticals like remittances, financial services and streaming. However, the company did note some softness in two of its core markets, Brazil and Mexico.

The company reaffirmed its annual guidance from last year, in which it aims to see FY revenue rise between 25% and 35% to $932m-$1bn, with adjusted EBITDA growing 20-30% to give a 24% margin. Investors responded positively, with the company’s share price rising on the back of its results.

As the company’s revenue mix continues to shift, it sees long-term potential for emerging markets and localisation in its results, with global trade shifts and ongoing tariff discussions potentially leading to more opportunities for the business.

We caught up with dLocal CEO Pedro Arnt to explore dLocal’s strategy for scaling cross-border payments in underpenetrated regions and how it’s preparing for the next wave of global trade transformation.

Key cross-border drivers in Q1 2025

Daniel Webber:

Pedro, a very strong set of results well received by the markets, which is great to see. What’s been driving the latest growth, particularly in cross-border?

Pedro Arnt:

Record payments volume, both overall and in our cross-border business – the cross-border business has outpaced the local-to-local business in four of the last five quarters. Clearly, dLocal has been delivering on what has always been its strength, which is helping global merchants move money from the Global South to the Global North.

We’ve seen an interesting phenomenon this quarter, which is that we’re really beginning to see the rise of many of the frontier markets that we offer our merchants.

Quarterly strength (despite seasonal “weakness” because Q1 typically comes in below Q4, which wasn’t the case now) was really aided by Chile, Colombia, Ecuador, Costa Rica, Bolivia – markets that are still smaller but beginning to hit scale.

It proves the thesis that once merchants experience our product and service in some of the larger emerging markets, they then start expanding and asking us for more payment methods and more markets where they wish to localise their payment capabilities through dLocal.

dLocal’s strong cross-border volumes drive higher revenues in Q1 2025

Revenue grew 18% to a record $217m, driven by strength in Latin America and frontier markets (constant currency revenue growth was 36% YoY), while TPV rose 53% to $8.1bn. The company saw its highest revenue growth rate since Q1 2024 last year.

Adjusted EBITDA grew 57%, driving a margin of 27%, up seven percentage points compared to Q1 2024 – last year, the company had reported significant slowdowns across several of its core LatAm markets.

Cross-border has been crucial to dLocal’s overall growth in Q1 2025, driving 53% of the company’s TPV. Cross-border flows grew by 76% – the fastest growth rate in this metric the company has reported – and surpassed $4bn for the first time. This was primarily driven by remittances, commerce, financial services and streaming across different markets.

By comparison, the company’s local-to-local TPV increased by 33% YoY. Q1 2025 was therefore the second quarter in a row where cross-border has outpaced local-to-local, representing a continuing shift from last year (in Q1 2024, cross-border volume grew 24% vs 79% for local-to-local payments).

Capturing cross-border opportunities in frontier markets

Daniel Webber:

What are the challenges in frontier markets and how do you help some of these big players address those challenges?

Pedro Arnt:

You need to look at this market by market but, by and large, there are some [shared] characteristics. The adoption of credit cards, fully banked percentage of the population and digitalisation are characteristically somewhat behind – not in the case of Chile, but certainly the other markets I mentioned. This means that you have a more fragmented payment ecosystem with more cash and fewer international credit cards, which enhances the value proposition of a dLocal.

It’s also usually true that the payments infrastructure in many of these frontier markets is still less consolidated, more fragmented and potentially running on more legacy technology, which requires feet on the ground and deep local know-how to actually drive reasonable amounts of conversion and low levels of fraud. They really play to our strengths and what our core value proposition is all about.

dLocal driven by strong return in some LatAm markets

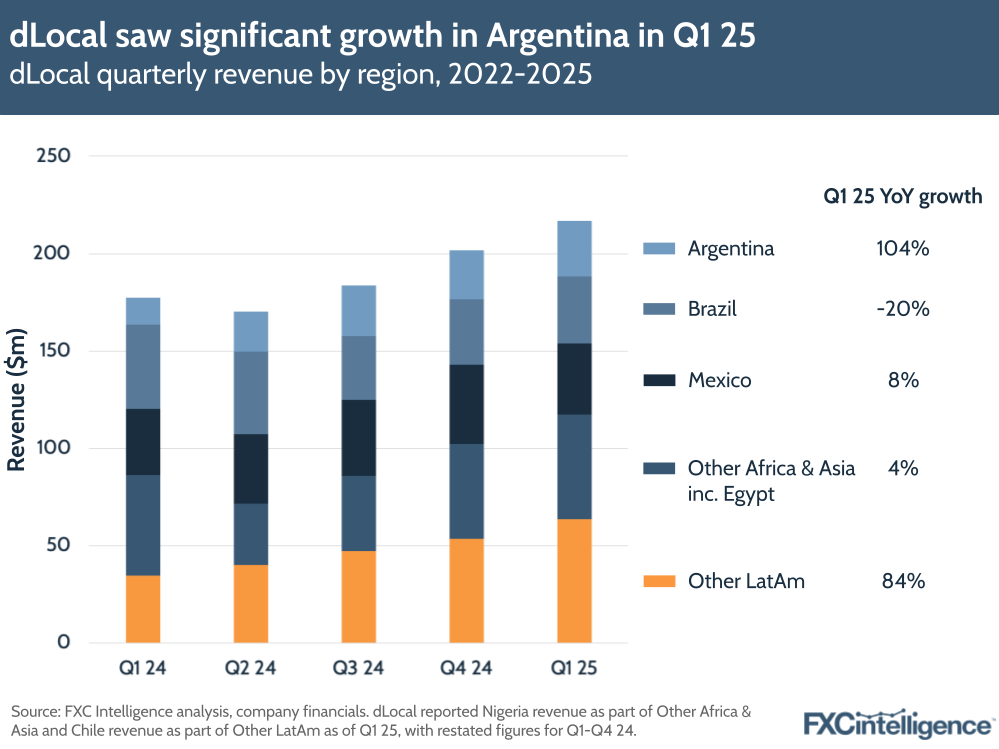

dLocal has shifted its regional reporting slightly in Q1 2025. Instead of splitting out Nigeria and Chile specifically, it has reported results for core markets of Argentina, Brazil and Mexico alongside Other Africa and Asia including Egypt and Other LatAm markets.

Argentina has come back significantly from a difficult period last year, with 104% revenue growth and a 106% rise in gross profit on the back of increasing advancement volumes (which are higher take rate) and higher FX spreads driven by a wider gap between official and parallel rates in Q1 2025 versus Q4 2024.

Meanwhile, Brazil saw revenues decline -20%, which dLocal put down to a shift in its Payment Orchestration model and lower take rates. Mexico revenue rose 8%, slower than the previous year, with decreased volumes from commerce players given seasonality and partial volume loss with a large merchant.

Other Africa & Asia revenue growth also slowed this year to 4%, down from 325% the previous year, though gross profit was up 121% YoY. The company saw strength across various countries such as Pakistan and Turkey, but is seeing higher processing costs in Nigeria and South Africa, prompting a -20% decline in QoQ gross profit.

With Other LatAm revenue rising 84%, Latin America revenue overall rose 30% YoY, though Africa and Asia revenue was down -9% – prompted by FX devaluation in Egypt and Nigeria. Overall, LatAm made up three quarters of dLocal’s revenue versus 25% for Africa and Asia.

Behind dLocal’s surging remittances volumes

Daniel Webber:

Let’s talk about remittances, which has seen strong growth – higher than the growth rate of the market. What’s driving this?

Pedro Arnt:

If you think of what the global remittances companies are looking for in what’s become a highly competitive, yet fast-growing market, it’s cost and speed; instantaneous settlement at the lowest possible cost, so that they can transfer as little cost as possible to their end users.

Because dLocal has an increasingly balanced pay-in to pay-out flow of money, we have all this liquidity from global merchants charging consumers in the Global South, and wanting to repatriate that money north, and we now have a growing portfolio of remittance companies pushing money south.

That local liquidity that we have allows us to offer competitive pricing. There are no broker intermediaries in the cases where we are netting. Because the liquidity is in the the market and many of these emerging markets have developed either real-time networks, or fairly efficient clearing houses and bank transfer networks, we can also offer that immediacy of delivery.

Take Brazil as a great example; on Pix, we can carry out an instantaneous transaction at extremely low cost on behalf of the remittance company with the liquidity that we’ve accumulated in-market from the pay-in merchants that we service there.

I think we’ve done a good job at hitting that combination of effective pricing, immediate settlement and a good level of service. Brazil was a big grower for us, and we’re beginning to see this grow beyond Africa, which is where the initial explosion in our remittance business began.

Daniel Webber:

You’re also seeing strong growth across other sectors, including commerce, financial services and streaming. What other key growth factors can you pick out from there?

Pedro Arnt:

Commerce continues to be a very strong performer. We have begun to see something I can’t help but attribute to the uncertain terms of trade that the world is entering into. We have started seeing many cross-border ecommerce players look to Latin America, to Africa and to the Middle East as perhaps more neutral trading blocks, where there won’t be changes in tariff structures or import tariffs.

We’ve seen many global ecommerce players adding markets in the Global South, and that’s driven some of the strength in ecommerce, despite Q1 being seasonally weak, typically.

We’re seeing interesting growth in last mile and food delivery. These competitive battles between Uber, Rappi, iFood, DiDi and some of the new entrants is creating a very contested space, in part because consumer demand for last-mile services in LatAm is really growing. That’s also driven some interesting growth for us, and ride hailing continues to perform very well.

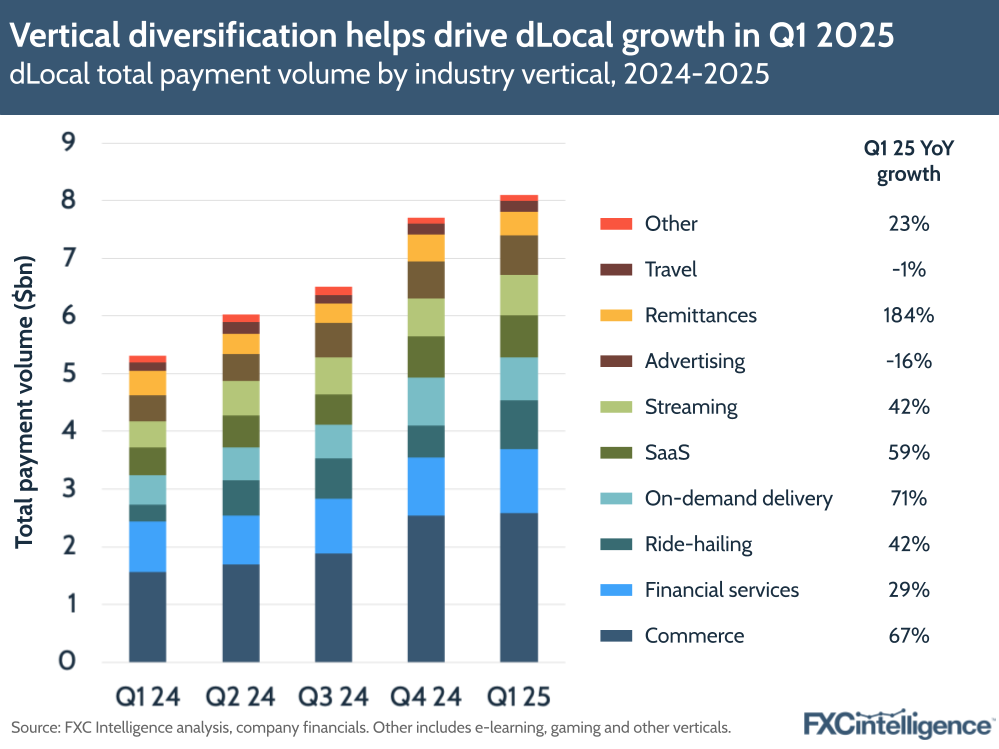

dLocal’s rapid growth in remittances and other sectors

dLocal continues to see solid performance across a variety of sectors. Remittances led the charge with 184% growth, followed by 71% growth in on-demand delivery services, 67% in commerce and 59% growth in its software-as-a-service segment. Not all sectors grew, with advertising and travel seeing -16% and -1% declines, respectively.

While commerce and financial services remain the biggest segments for the company, rapid growth in other areas appears to be switching up dLocal’s mix as it becomes increasingly diversified.

How profitability and scale are driving the business

Daniel Webber:

You have profitability, which not everyone in the cross-border payment sector has. Talk us through the different dynamics between the take rate and profitability.

Pedro Arnt:

I would say we had very solid profitability, with $47m of net income and $40m of free cash generation, so a healthy financial model. Take rates, as we anticipated, contracted by another four basis points. That’s driven by a few relevant items, but structurally, the pay-outs do have a lower take rate.

All this success in remittances we were talking about does drive incremental volume at a lower take rate. They also benefit margin, because we’re getting this highly competitive FX and where we can net, we are keeping all of the FX fee to ourselves, so it comes at a lower take rate but at a higher margin, and accreted in terms of dollars.

Take rates were also compressed by incremental costs that we had in a few markets on the processing side that we’ve said are non-recurring, but that did compress take rates this quarter. On the plus side, we did benefit from our cross-border business growing faster than our local-to-local business. That’s a higher take rate business.

Also, as mentioned before, the higher mix coming from frontier markets and newer markets that typically have higher take rates also helped to offset some of the pressure from increased costs and increased pay-outs. Though all in all, there is a secular trend. [The contraction of] four basis points sequentially is very much within what we had guided towards.

Daniel Webber:

Where are you seeing scale benefit the business?

Pedro Arnt:

Primarily where we didn’t deliver results this quarter, which is on the cost of processing, and that’s the principle benefit as we scale out. That’s why we’ve said this is not a structural cost increase. There were particularities this quarter that led to this. We’ve consistently said that by and large, going forward, we should continue to be able to drive our cost of processing down.

We will then have to monitor country mix and payment method mix, but if you were to isolate each individual pipe as our TPV grows, there’s still quite a lot of room to continue to drive down the cost of processing.

dLocal boosts profits against take rate decline

dLocal also bounced back on net profit, which more than doubled compared to Q1 2024, driven by a positive non-cash mark to market effect related to Argentine bond investments, as well as lower finance costs.

dLocal called out the strength of diversification across its business, with its top 10 merchants in Q1 2025 accounting for 60% of total revenue, down from 65% the previous year.

As dLocal has seen a rapid boost to TPV, it has seen take rates decline. Against total revenue, the company’s take rate was 2.67% , down from 3.47% in Q1 2024. The company shared its net take rate declined four bps from 1.09% in Q4 24 to 1.05%, which it said was driven by weakness in a major merchant for its advertising sector and a one-off cost increase in Brazil.

These headwinds were partially compensated for by higher shares of cross-border volumes (which are higher take rate) and growth in frontier markets.

Potential benefits and challenges from the changing trade environment

Daniel Webber:

Let’s talk about the broader macro environment. What are you seeing as the opportunities and challenges?

Pedro Arnt:

It’s a particular moment in time. Uncertainty in general is not beneficial to consumption. If consumers don’t really know what’s ahead, you may see a pullback in the kinds of cross-border commerce or digital services that are the core of the merchant base we serve.

As I said earlier, what we’ve seen is an offset from an increasing service offering being made available to these Global South consumers, as trading blocks begin to prepare for a mid-term and long-term future, where maybe there are increased barriers for them to access each other’s markets.

We haven’t really seen any change in cadence from our global European or US merchants. We have seen a significant pickup in interest from Chinese merchants through the Global South. If you think about it, the European and American merchants, to a large degree, had never really had that much access to China. I think China has been more restrictive about digital from non-Chinese players, whereas the Chinese players did have thriving businesses in both the US and Europe.

If those businesses may come under risk, it makes sense that we’ve seen many of our Chinese merchants picking up their interest in markets in the Middle East, Africa and smaller markets throughout LatAm.

When we weigh those two things, we’ve been more beneficiaries of that global expansion into the south of the world, versus if consumers are a little bit more cautious on their spend. The consequence of that has been this consistent sequential growth in TPV for many, many quarters now.

dLocal sees rising pay-out volume

dLocal’s pay-ins volume grew 49% YoY, with the company noting the impact of on-demand delivery, commerce and streaming despite an offset from weakness in advertising. However, its pay-outs business continued to grow at a faster pace for the fifth quarter in a row, with YoY volume growing 61% on the back of remittances and financial services.

Where dLocal is taking share in the market

Daniel Webber:

The total addressable markets we’re talking about are giant, and the opportunity to grow is still large. Where are you typically taking share from?

Pedro Arnt:

First and foremost, it’s about the adoption curves of digital services and cross-border goods. These are transactions that weren’t occurring in the past, and now a consumer is deciding to upgrade to the paid version of an AI model, or he’s decided that he now wants to pay for a productivity suite. He’s decided that his small business is going to start advertising digitally for the first time ever. We have this consistent tailwind of an expanding market of digital adoption throughout the Global South.

Even if it were an absolute market dominant player, it’s unlikely that dLocal could be growing at 150% year-on-year, because the market isn’t growing at 100% year-on-year. There are still adoption barriers to that kind of growth. On the flip side, you probably have decades of sustainable high growth in that market as digital consumption moves up those adoption curves. They used to be S-curves, we now don’t think they’re S-curves anymore. They’re probably steeper curves, faster because of mobile phones and the like. That’s where most of the growth comes from.

From a share perspective, it’s not a zero-sum game. It’s not either dLocal has it or some smaller cross-border processor has it. A lot of this is stealing share from international credit card usage. Typically, when a merchant goes to market initially, he may do so with the simplest solution, which is just international credit cards. That has many disadvantages for the merchant. At some point, he decides to localise through dLocal, where he can now offer local credit cards, debit cards, APMs and cash transactions, and he has better conversion rates. At that point, you begin to see the shift from international acquiring to local payment, and that’s who we’re stealing share from.

How stablecoins could generate revenue for dLocal

Daniel Webber:

How are you thinking about stablecoins and where do you think they may have value?

Pedro Arnt:

This is an area that we’re quite enthused about and spending a lot of time in, and I would separate it. First of all, what are the revenue-generating opportunities for us? You may have seen we’re a participant in the launch of Circle’s global network. dLocal is a significant provider of fiat liquidity in emerging market currencies because of our pay-in business, so we are positioned to be a very successful off-ramp into fiat in local currencies.

Because of our pay-in capabilities, we’re also well positioned to be an on-ramp from fiat to stable, serving exchanges or other providers of stablecoins or crypto. If someone wants to buy their USDP in Nigerian naira or Brazilian reals, they can do that through us. Also, for someone who wants to get settled in fiat from a stablecoin in any of these currencies, we can be very competitive there, partnering with exchanges and global money movers that are using stablecoins.

Then there’s how we can also use stablecoins to improve our operations. We’re already piloting with a few remittance partners that, rather than send us fiat, which is a cumbersome and slow wire process, they settle to us in stablecoin. We have immediate settlement and, along with that immediate settlement, they give us the pay-out instructions, and we can use the local fiat liquidity we have to carry out those pay-outs for them in T+0. That improves our working capital cycle within our infrastructure for remittance and pay-out players.

It’s early days. We’re seeing some encouraging use cases, and we’ll continue to monitor this and see where we can add value to clients.

Daniel Webber:

We had a previous cycle with other digital assets that weren’t stable and that didn’t quite take up. Why are stablecoins seeing adoption and traction now when five years ago, trying to do it with Bitcoin or something else, it didn’t get traction?

Pedro Arnt:

A couple of things. The first one is that a lot of the volume we’re seeing aren’t really end users, although you’re beginning to see a lot of treasuries. Even SMB treasuries are actually using this, probably because the smaller you are and the less sophisticated your banking relationship is, the more of a nightmare it was to pay your providers in China or things like that. The fact that stablecoin has much less volatility is an obvious part of that answer.

I also think you’ve seen the emergence of larger, more compliant, more regulated providers of these kinds of services. When a treasury does minimal counterparty risk sort of management or KYC, they’re a lot more likely and comfortable using these crypto providers or stablecoin providers for cross-border payments. I like to use the analogy that if initially the crypto world was Dodge City in the Wild West, we’re now seeing the emergence of New York City in the crypto space, and that really helps, for this time around, to be more serious.

Daniel Webber:

Great. Pedro, excellent set of results and well done to you and the team. Anything else that you want to mention?

Pedro Arnt:

We’ve been fairly consistent. The last four quarters of results have piled on a consistency of compounding growth, cash generation and increasing EBITDA. This is exactly what we’ve always said dLocal can deliver, which is consistent compounding of growth over long periods of time, which is always a good thing for shareholders, merchants and end users.

Daniel Webber:

Pedro, thank you very much.

Pedro Arnt:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.