Since going private in 2023, MoneyGram has undergone a digital transformation that has seen it go from omnichannel money transfers player to a fintech with a global digital and cash network. We speak to its new leadership team to learn how the company’s refounding is transforming its place in the market.

Money transfers major MoneyGram is arguably one of the most recognisable brands in remittances, with a long history in the retail space and a network that spans the globe. However, while that is how many know the company, that may not be the case forever.

Having gone private in 2023 and seen a leadership overhaul in the past year, MoneyGram is now on a refounding journey that sees it transformed from a purely remittances-focused player to a fintech building on its long-established payments network.

“Remittances was the old way to think about the business, now the network is our business,” explains Chairman and CEO Anthony Soohoo.

“You have really limitless possibilities for how you think about it and you just go after the biggest opportunity that fits.”

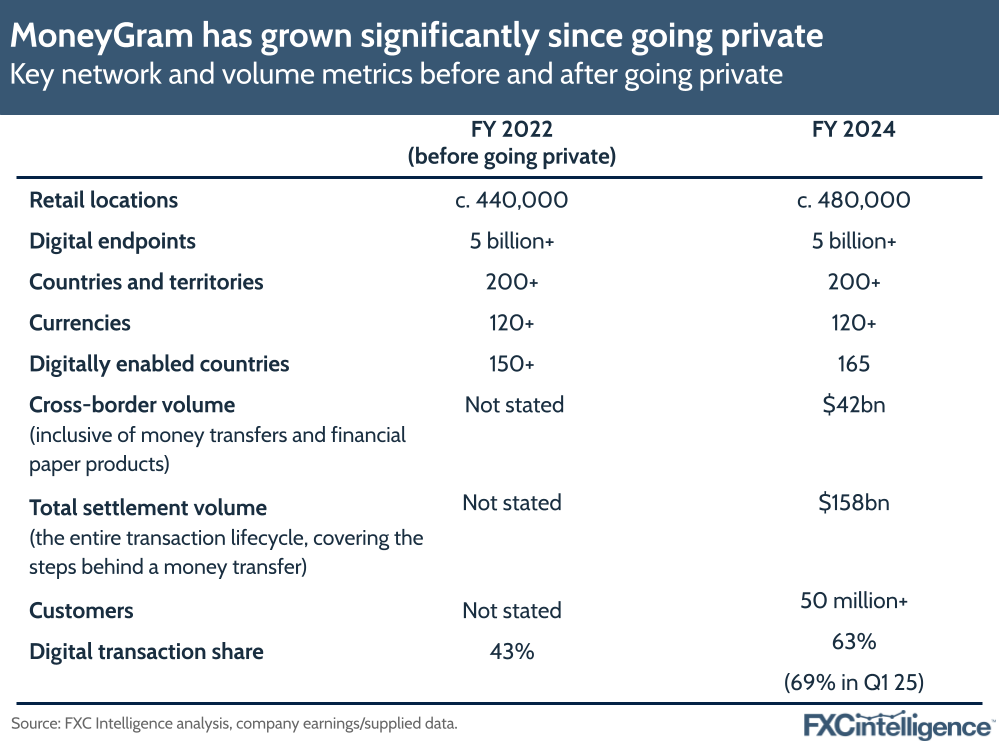

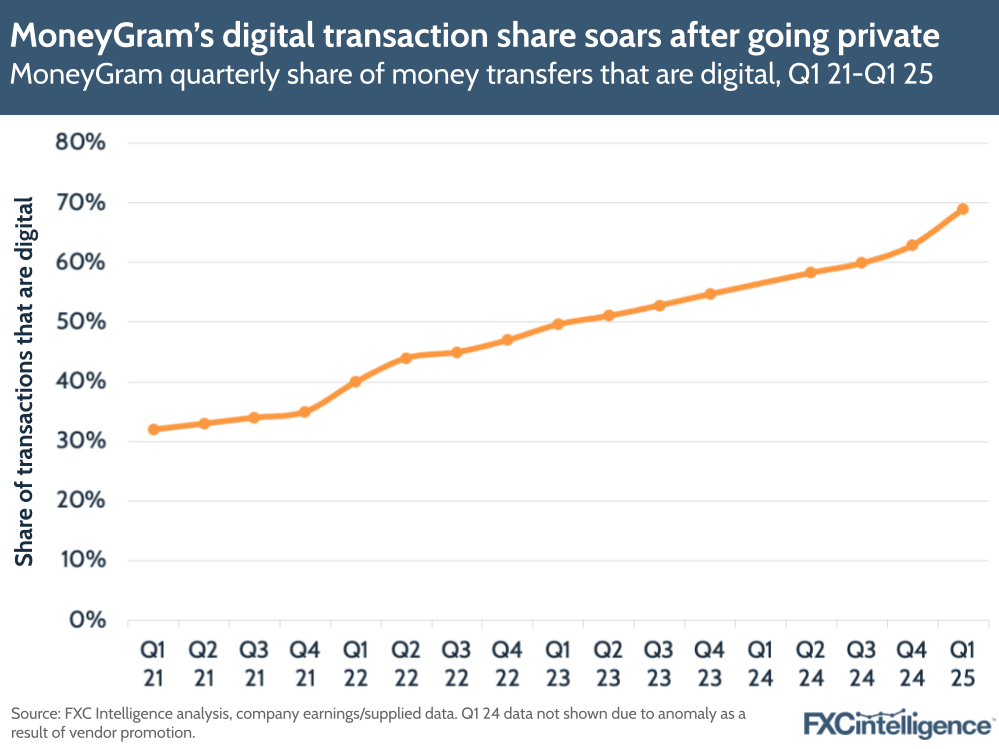

This refounding comes as the business has made significant strides as a private company. Cross-border volume has grown by around 8% since the company went private, while its digital efforts have been particularly pronounced, with the share of its transactions that are digital having increased by more than 20 percentage points over the same period. In 2022, less than half of MoneyGram’s transactions were digital, while today one in three are.

With the company embarking on its refounding journey, FXC Intelligence CEO Daniel Webber caught up with key figures from MoneyGram’s senior leadership – CEO Anthony Soohoo, CPTO Luke Tuttle, CMO Lamia Pardo and EVP and GM, MoneyGram Online, Josh Gordon-Blake – to find out more about the company’s plans, and where it sees its future opportunities.

Changing of the guard: MoneyGram transformed

MoneyGram today is a very different company than it was a year ago. Soohoo was appointed in November 2024, following a stint leading Walmart’s Home Division, and took the helm at MoneyGram with a mandate to enact digital transformation and deliver growth.

For Soohoo, the appeal of the company lay across several areas. While he cites the ability to provide financial inclusion as a key appeal, he also saw the brand and its Formula 1 title sponsorship as key.

“It seemed like it could do more than what it was, especially having their name plastered on F1 cars,” he says. “What else can you do with that type of brand?”

However, beyond this, he also saw potential in reframing the nature of MoneyGram as a company.

“Instead of looking at it as a remittance company, I really saw it as a global payments network,” Soohoo explains. “What are other products you can build on top of that?”

While MoneyGram sits across both the digital and physical worlds, Soohoo saw potential for digital transformation and therefore improvement in unit economics on both the cash and digital sides of the business.

“The core product you’re moving here can become digital even if you’re handing out cash,” he says, adding that he “saw a huge opportunity” to digitalise the business’ back office operations in order to improve its customer-facing delivery.

“Looking at stablecoin to drive treasury; thinking about how we can do AP; how we can rethink how we run our whole back office to give us that flexibility to go digital. And having that type of data helps us to run our business a lot more intelligently than we’ve ever done in the past.”

In service of this transformation, Soohoo has also overhauled MoneyGram’s leadership team. In February of this year, Luke Tuttle joined as Chief Technology Officer, before seeing his role expanded to Chief Product and Technology Officer in June, an appointment the CEO said he was “so excited about” due to the central importance of technology in the company’s reshaping. This is something that Tuttle also echoes.

“I’ve been at organisations that were able to implement technology in a way that was really adaptable to the needs of the customer,” says Luke Tuttle, Chief Product and Technology Officer, MoneyGram. “That’s ultimately the aim of what I would like to do here: have a service offering powered by technology that delivers solutions to problems our customer has in as efficient a manner as possible. What makes my job fun is putting that together.”

Alongside Tuttle, Lamia Pardo was brought onboard as Chief Marketing Officer a few weeks later, having previously led growth and strategy at Pangea Money Transfer, and who says the appeal of the company lay in “the refounding journey and the brand”. Meanwhile Justine Van Buren, a former colleague of Soohoo’s at Walmart, joins as Executive Vice President, Growth and Partnerships.

There have also been some promotions from within the company. Former Chief Digital Officer Josh Gordon-Blake is now Executive Vice President and General Manager of MoneyGram Online, while his former responsibilities are no longer siloed into a single role, with Soohoo saying “everyone is a chief digital officer” at the company.

Finally, Brinda Bhattacharjee, who previously was responsible for MoneyGram’s Treasury organisation, is now Interim Chief Financial Officer.

“Everyone is inherently focused around the customer and has a lot of empathy towards our customers,” says Soohoo of the leadership team.

“When you look at us, you’ll find an org that is very much new age from the standpoint of being digitally-native, and has run these things at scale at many other large companies, but also has a very much of an entrepreneurial spirit.

“My goal is that this company is the world’s largest fintech startup.”

The vision behind MoneyGram’s refounding

Central to Soohoo’s transformation of MoneyGram has been the idea of “refounding” the business. Rather than being built from the ground up, this sees established companies undergoing significant transformation in their offering and positioning while maintaining foundational elements.

“You take the good things that came from your founders or how the company was built; you keep the things that are working that make you strong, where you have moats and competitive advantages; but you really reimagine and rethink things that need to be modernised,” Soohoo explains. “You’re basically keeping part of the house and keeping a lot of the bones, but you are rethinking how the company needs to compete.”

Examples of existing refounding CEOs cited by Soohoo include Satya Nadella, who shifted Microsoft’s focus to cloud and AI when he took over from Steve Ballmer. Others include Andy Jassy, who moved Amazon’s AI focus to efficiency rather than invention, and Tim Cook, who moved Apple “much more towards services”.

For MoneyGram, however, the refounding journey is beginning to unfold, and instead focuses on the company’s vast global network. Covering around 480,000 retail locations and five billion digital endpoints, Soohoo sees the opening up of this network to applications beyond remittances as the core of the company’s refounding journey.

“That’s how we’re thinking about our business as we expand to different layers where we’re going to have products,” he says. “We’re going to build ourselves, there’re going to be third-party products and people are going to build on top of our network or our platform.”

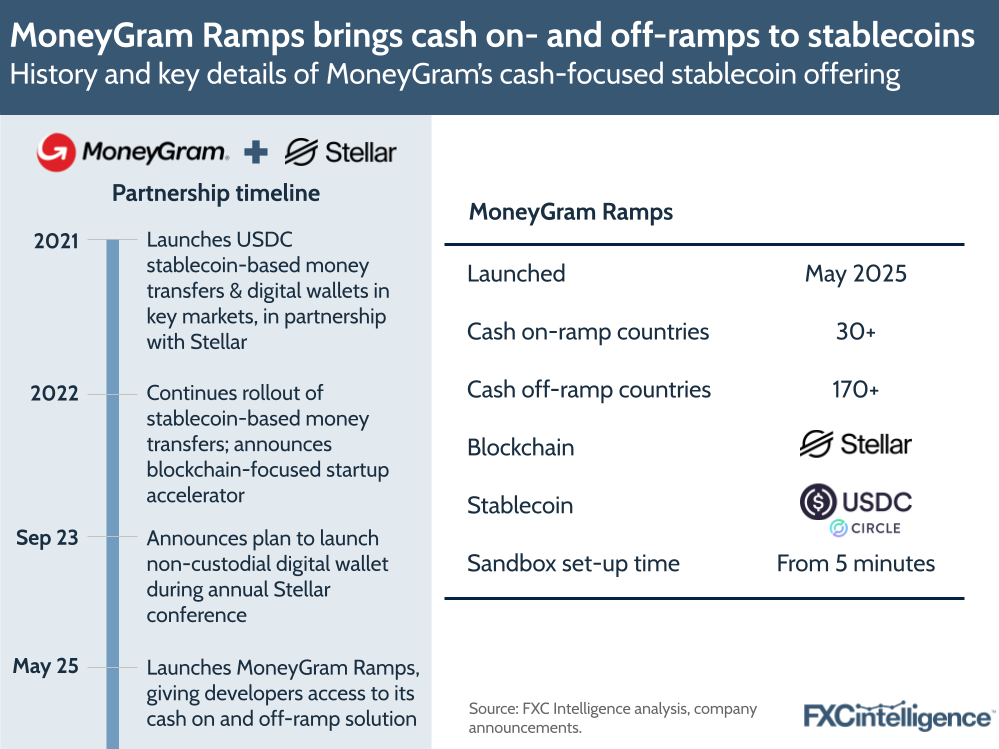

He cites MoneyGram Ramps, the service launched in May that allows developers to harness MoneyGram’s network for cash on- and off-ramps for crypto and stablecoin products, as a sign of what’s to come.

“That’s the first glimpse of all the things that we plan to do on our network,” Soohoo says.

“When you think about the fact that the network is a platform, your ideas are not limited by what is within the MoneyGram walls, especially as you open up with an API for other people to build on top of.”

As MoneyGram’s refounding journey gains steam, Lamia Pardo, MoneyGram’s CMO, is keen to stress that it is “not a PR story” but is instead a deep-rooted initiative to build on the “incredible asset” that is the company’s brand.

“It’s really how we’re operating, it’s everywhere in the company and we are bringing so many elements of that into evolving the brand,” she says.

“We would never lose that asset: we would never not be called MoneyGram or not have the red arrow. It’s one of our biggest strengths and why we still have good conversion rates. But it’s time to evolve it in a direction that feels that we’re relevant for consumers of today.”

MoneyGram’s network: The core of its evolution

Spanning more than 200 countries and 20,000 corridors, MoneyGram’s network has been built out over decades and has been critical to its ability to compete within the consumer money transfers space. However, with the company’s shift in focus, it has become even more central to its positioning.

“The more products and the more things you do within that network, the more valuable it becomes,” says Soohoo.

“Your biggest incremental cost is the fixed cost of building out each of those networks and then other than that, the variable cost is much smaller.”

This network focus is already seeing MoneyGram increasingly take on clients beyond its core remittance customers, in the form of digital partners such as Saudi Arabian player Barq.

“They’re providing a new fintech solution in their market with a variety of services in their application. One of them is cross-border money transfer, and we’re able to provide them a network solution for that,” explains Tuttle, adding that such partnerships help grow MoneyGram’s “network of networks” and ultimately strengthens its offering in terms of volume, cost and reach.

“When we work with a customer like Barq, they’re going to be demanding from us because of demands from their consumer. It’s great to get the forcing function from one side or the other to expand your network.”

Beyond these customers, MoneyGram also has a variety of strategic partnerships with network players including Visa, Mastercard and Plaid, whose capabilities serve as “a key enabler” for MoneyGram, according to Tuttle.

“Plaid’s done a very good job solving how to do authentication into bank accounts in several major markets,” he says, adding that customer preference has driven much use of the company, while Visa and Mastercard broaden the ways MoneyGram can send digitally across different markets to enable it to “provide a service that’s ubiquitous”.

“Through one API to us, a partner is able to provide many different receive options for their customers because we partner with so many other companies. But then they themselves don’t have to try to figure out how to integrate all these different solutions. We’re doing all that hard work of stitching together the network because there’s no one single provider that is able to serve these different functions globally.”

While MoneyGram’s network is already strong, it is likely to continue to grow as the company broadens who it is serving as a customer.

“What I imagine with the network growth over time is that there will be existing business that we keep establishing in every one of these markets, but we will add more and more products on,” says Soohoo.

Stablecoin strategy: MoneyGram Ramps and beyond

MoneyGram has long embraced digital currency, and in particular stablecoins – the fiat currency-backed version of cryptocurrencies. This has largely centred around a partnership with blockchain provider Stellar since 2021, which has seen MoneyGram deliver consumer money transfers via Circle’s stablecoin USDC as well as allow customers to purchase or redeem the digital currency using cash via its retail network.

“We have had a strong relationship with Stellar for many years,” says Tuttle.

“We’ve been working in partnership with them to manage these digital assets, particularly when it comes to our wallet product that enables consumers to hold USD in the form of stablecoin, which is a great value proposition in countries where there’s inflationary growth or other challenges with the local currency.”

The company has been providing consumer-focused stablecoin solutions for some time, with Gordon-Blake seeing the use case as a key differentiator for its consumer remittances offering.

“Enabling folks to hold non-local fiat currencies, worldwide, actually surfacing within the MoneyGram app, holding USDC both in the US and abroad, means it’s a different product than just a remittance product,” he says.

However, Tuttle also sees use cases on the agent side.

“There are businesses that themselves can be challenged to get banking products where we could provide them a B2B-type wallet and then settle with them with stablecoin,” he explains, adding that the company is also increasingly using stablecoin for treasury, particularly in key markets or scenarios where the company can trade in and out “more quickly with stablecoin”.

“We do a lot of money movement where we have to predict the amount of currencies we need in a particular market for a particular period of time that might be over weekends where the banking routes aren’t open. Stablecoins can enable us to work on a 24/7 basis, settle more often, trade in and out of currencies more often.”

However, the launch of MoneyGram Ramps earlier this year also brings its stablecoin capabilities into its wider network play, with the company’s ability to enable on- and off-ramping from stablecoins in cash being relatively unique within the rapidly proliferating market. In this way, the technology feeds into Soohoo’s wider refounding approach for MoneyGram.

“I saw the power and the potential of stablecoin early,” says Soohoo, adding that before the technology emerged he saw cryptocurrencies as “a technology chasing a market”.

He likens stablecoins to the early spreadsheet programs that drove early adoption of PCs, describing the fiat-backed digital currency as the “killer app” of crypto. And crucially, this extends to how he sees it impacting MoneyGram itself.

“It will impact and touch every part of our business, from how we think about treasury to how we think about building our new products – they’re all going to be based on stablecoin,” he says, citing the combination of stored value, low costs at scale and high transparency as key reasons for stablecoins’ appeal.

“By moving it all digital, there’s a lot more data that we will understand around our customers and the use cases around the stablecoins too.”

While MoneyGram is not the only remittance player exploring the technology, it has embraced it far more fully than its immediate competitors, and Soohoo sees it becoming increasingly central, albeit with fiat currency always remaining key.

“Stablecoin will allow us to run our business differently and help us rethink our whole supply chain of how we deliver services to our customer all the way to the products and the services we can deliver for our customers, and it is because we’re moving the digital currency,” he says, adding that there is particular value in making it easier for customers to move in and out of digital currencies.

“Right now in digital currency, there’s no ability to get out: it’s almost like Hotel California. MoneyGram can serve a very important role there in terms of allowing people to come in and out of Hotel California.”

Shifting to digital: Remittances in focus

While the refounded MoneyGram’s focus is beyond just its remittance offering, the core business remains key, and here there has been a significant evolution in terms of its digitisation over the past few years. While MoneyGram’s last quarter as a public company, Q1 2023, saw the company report a 50% share of transactions that were digital, up from around a third two years earlier, this has climbed to just below 70% as of Q1 2025.

Central to this has been the growth of MoneyGram Online, which now accounts for around 25-30% of MoneyGram’s revenue, according to Josh Gordon-Blake, Executive Vice President and General Manager of MoneyGram Online.

“We fully believe the cash business is solid and here to stay, and there’s growth in the cash business. But not like the digital business: that’s the thing that can really take us to that next level,” he says, adding that omnichannel customers who switch between the two are the highest-value customers for the business.

This omnichannel approach continues to be particularly key to MoneyGram’s marketing initiatives, with Pardo seeing both digital and walk-in retail remaining key.

“It’s responding to trends in consumer behavior,” she says. “The fact that we are everywhere, digitally and physically, needs to be an advantage and part of the value proposition.”

While a core driver of growth for MoneyGram Online is pricing, with Gordon-Blake characterising this as “so much of what you think of as the product offering”, he also sees user experience playing a “huge” role.

“Actual ease of use, sending a transaction each time, and keeping track of it, and the money actually arriving, and all those things that go to a good service,” explains Gordon-Blake, adding that when it comes to enhancing the platform, much of MoneyGram’s shift to being a fintech has focused on building out capabilities in this area.

“Up until recently, no one here had ever worked in a tech company, and they were trying to build one, which means using data to make decisions; doing A-B testing with customers; knowing how to do direct-to-consumer marketing, which channels are performing and what is the LTV [lifetime value] on the customers looking through these channels,” he says.

“There’s so much of that foundation that we have now; I wouldn’t say it’s done, but that we’re now leveraging and building better every day. We’re far along in business, we’re nascent in technology, but we’re actually in this AI age now.”

A shift to artificial intelligence?

While MoneyGram has seen a significant shift to digital, its next stage of development is likely to see a far greater use of artificial intelligence, something that Tuttle expects to prompt a transformation in how the company solves the needs of customers – even if they “remain the same”.

“The solutions will begin to change dramatically, particularly around the conversational way that one can interact with an application,” he says, adding that it could get to the stage where “you may not actually need an application anymore” and instead the entire interaction is “conversational”.

Gordon-Blake expects that the technology will also “make it easier for customers to shop”, increasing the need to compete on price, however he believes that it will also make acquisition easier, increasing the importance of user experience.

“The way we compete in the age of AI is we need a great price, and we’ve got to have a great user experience if people want to keep sending with us,” he says, adding that this “isn’t totally different from today”.

MoneyGram is also exploring how the technology can bring efficiencies across the organisation, an approach that may ultimately impact how much it can compete on pricing.

“We’re trying to get to a world where we can streamline our operations and then after that, putting AI on top to make our services faster, smarter, better and more cost-effective,” says Soohoo.

“AI is going to play a very big role there for us on the digital side, from how we think about orchestration, how we think about pricing, how we think about fraud to how we think about regulation and compliance.”

In the long run, it may also unlock significant possibilities in terms of customer service.

“It’s so much cheaper now to predict what the consumer might want, and it can be much more open-ended with less kind of deterministic attempts at understanding what they’re trying to do,” says Tuttle, adding that he expects use of the technology to be “extremely fascinating”.

“The applications that might come out of this are extremely varied, but we’re very heavily invested in building the system and enabling our developers and our staff to work with AI as efficiently as possible.”

Growing the new MoneyGram

As the new MoneyGram evolves, the refounding focus has seen the company shift to a more agile approach that adjusts course in response to relevant data.

“We are building a performance-driven culture that is not just about reporting, reporting and reporting on things, but actually making decisions based on that,” explains Pardo, giving a recent example of a meeting where they were reviewing a migration plan created eight months earlier that wasn’t yielding the desired results.

“The team didn’t really understand that they could just change that course, and it’s a fundamental part of this refounding journey. Those kinds of decisions can actually happen within 24 hours and then we can be live by the following day. That’s the core of the decision-making culture, and it has to be empowered to move the needle.”

With this approach underpinning how MoneyGram operates, the focus is now on efficiency and delivery.

“We are focused on driving much more velocity in our product initiatives, allowing our customers to do more by paying less,” explains Soohoo.

“We are going to lower the cost of how we operate these businesses, which will allow us to lower the price of the services that we offer our customers, while increasing or improving the services that we actually deliver in the process as well. The way we do that is with better technology.”

Market positioning and future prospects

As MoneyGram continues to evolve, it does so as a brand that continues to compete with its established competitors, but which is also increasingly entering the platform side of the market. And while its presence here is less well-established, its brand recognition is likely to serve it well.

“It’s very rare you see a brand that is so established, but still relevant, still with so many of the positive associations, with a distribution that we have around the world. It’s very hard to replicate, with all the digital innovation that we’re bringing into it, and then our key relationships,” says Pardo, adding that the company’s partners will be particularly vital to its ongoing growth.

“I don’t think MoneyGram gets to the next level without every single business and agent and every city around the world that’s actually championing us. That synergy is going to be quite important, and not just obsessing over digital. It’s bringing both together.”

Although MoneyGram has not published earnings since Q1 2023, and has no plans to return to the public markets imminently, it is very likely that this will eventually change.

“One of the appeals of why I joined was to take this company public again,” says Soohoo.

In the meantime, the focus is on completing the transformation of MoneyGram so that it can return to the public markets at a considerable premium versus the $1.8bn deal with private equity player Madison Dearborn Partners that saw the company exit the Nasdaq in mid 2023.

“Companies that are going through refounding, sometimes that’s best done away from public view, where you’re managing the thing on a quarterly basis, and you have a little bit more of a vantage point of fixing it, getting it right with a longer-term view,” says Soohoo.

“Our focus has been really to get the business in a place where it’s very competitive, where it’s strong and with a strong focus on top-line growth and free cash flow growth.”