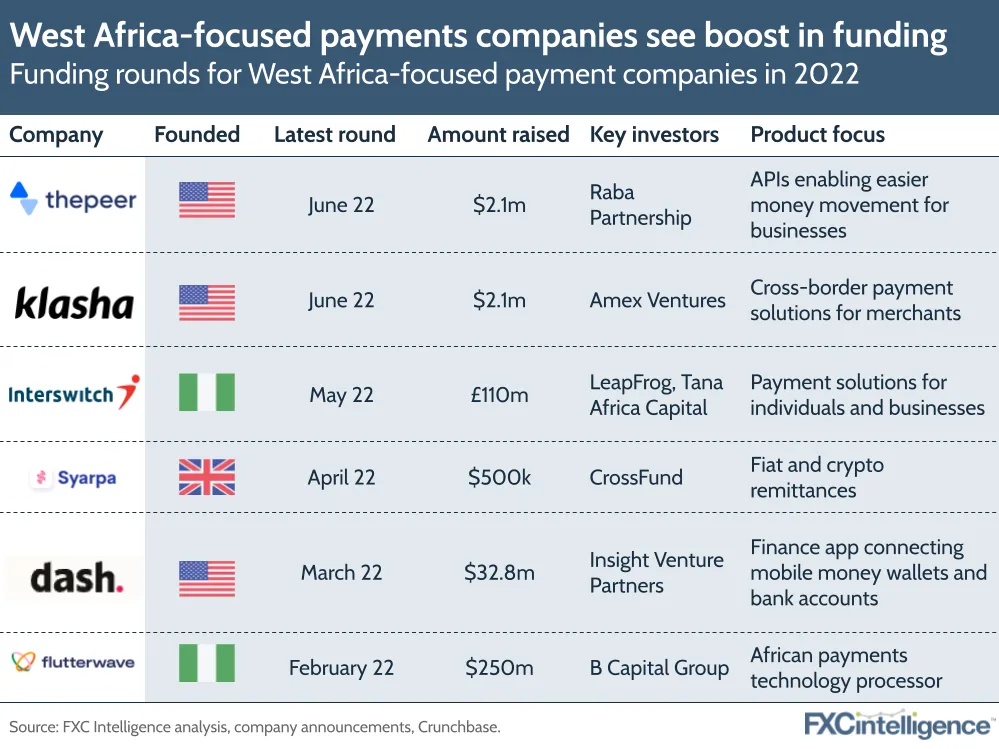

West Africa has been a hotbed for fintechs and payments innovation. Startups are working to bring digitised, streamlined payments to a largely unbanked, cash-using population in several countries in the region, such as Ghana, Nigeria and Senegal. Here, we’ve rounded up some of the key funding rounds and developments for West Africa-focused payments so far this year.

US-based companies such as Insight Venture Partners, B Capital Group and American Express are investing more in West African payments. Amex made its first investment in an Africa-focused company in June, namely ecommerce enabler Klasha.

Although African retail payments are still cash-heavy, Amex joining Visa and Mastercard in Africa suggests an expected increase in card transactions as neobanks and digital wallets make it easier to spend through non-cash methods.

Earlier this year, payment tech processor Flutterwave became the fourth African unicorn, with its $250m funding round landing it a $3bn valuation. Despite raising less than mobile payment service OPay’s $400m round last year, Flutterwave is now Africa’s most highly valued startup. It is one of many payments startups with a base in Nigeria, one of the largest remittance markets on the continent and a focal region for digital payments, mobile money and ecommerce companies.

Key drivers for payments growth in West Africa are a young, tech-savvy generation, a largely unbanked population and high smartphone penetration, which is encouraging mobile digital payments solutions to fill in the gaps. For example, Senegal’s leading mobile money payments company Wave recently became the first company that isn’t a bank or telco to receive an e-money licence, allowing it to offer a range of financial services, including remittances, without having to use third-party banks.

Major remittance companies such as Mukuru, Chipper Cash and MFS Africa have also all taken steps to expand their activity in West Africa in recent years. Meanwhile, digital wallet Centbee launched a new digital service allowing UK customers to send digital cash to mobile money wallets and bank accounts in West Africa via the BSV blockchain.

Moving forward, it will be interesting to see how upcoming developments play a role in changing the remittances scene in West Africa.

How have African neobanks changed financial services on the continent?