In a new addition to our Post-Earnings Call series, we speak to Matt Briers, CFO of Wise, about the company’s continuing success in its H1 2023 results.

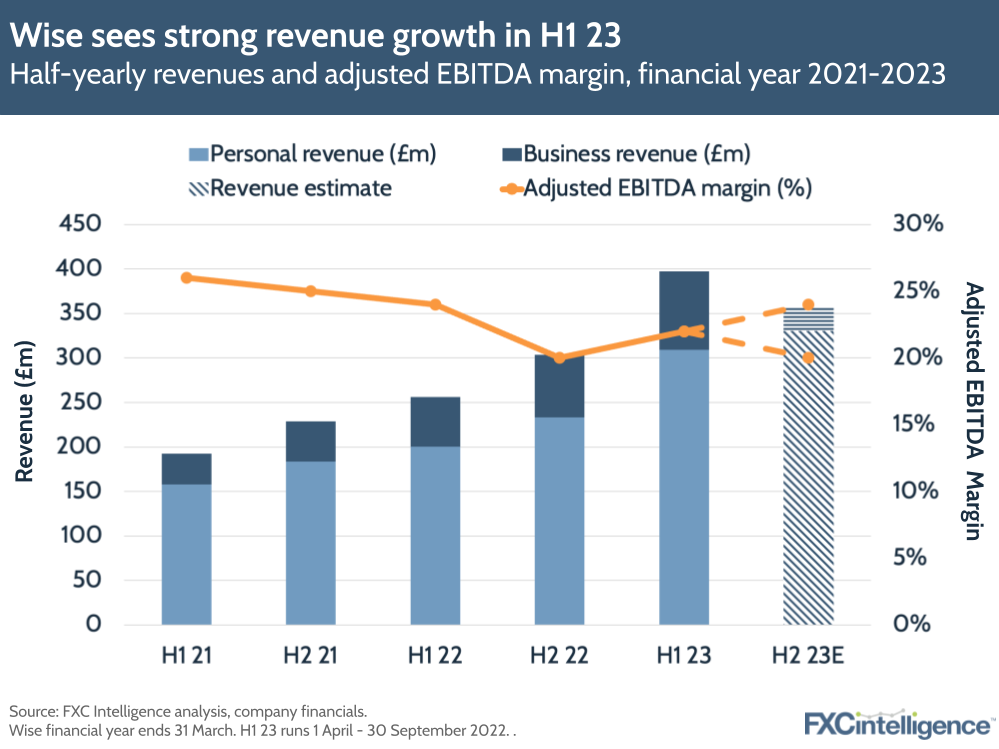

Wise has released its H1 2023 results, covering the six months ending 30 September 2022, or calendar quarters Q2 and Q3 2022, with the company continuing to see growth across its business and personal products.

H1 2023 saw Wise hit 50% instant transfers for the first time, with 71% of transfers now arriving within one hour and 90% within 24 hours. However, the company did see its average price rise to 0.64% – up from a low of 0.6% – as a result of increased FX volatility and servicing costs. Wise did manage to partially offset rises with price reductions in key corridors.

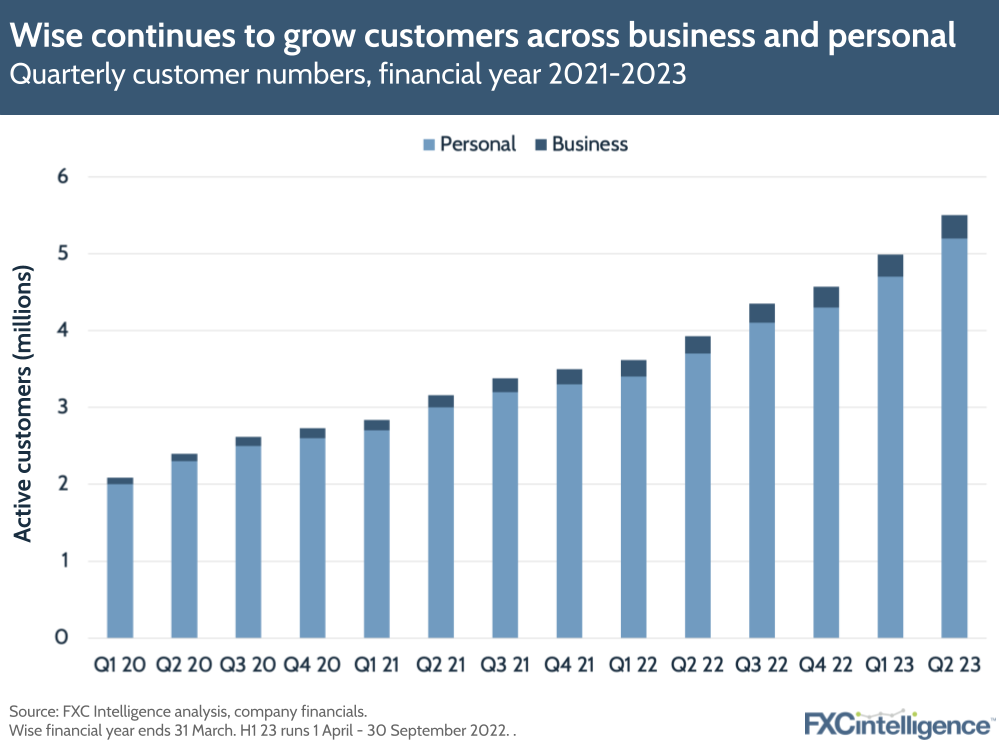

The company also saw a 40% year-on-year increase in active customers in Q2 2023, to 5.5 million, with a 40% increase in personal customers and a 31% increase in business customers.

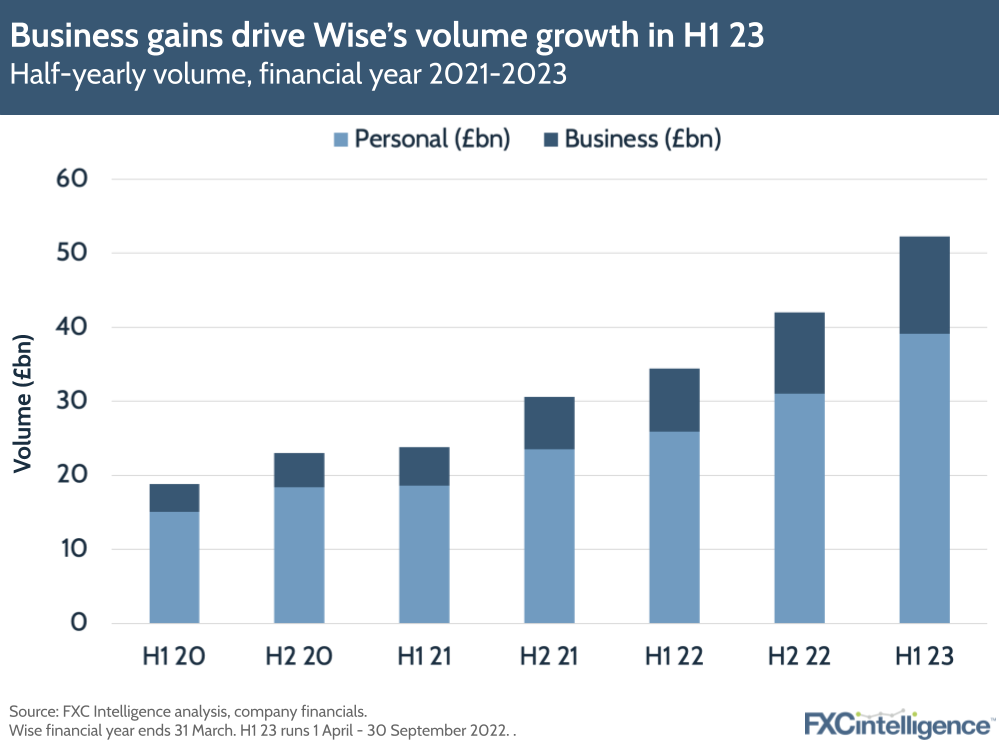

However, when it comes to amounts sent, business is growing faster, rising 56% YoY to £13.2bn while personal grew 47% to £38.1bn. Overall, Wise processed £51.3bn of cross-border payments in H1 23, a 49% YoY rise.

But how does Wise plan to continue its run of growth? We caught up with CFO Matt Briers to find out more.

Key drivers of Wise’s revenue growth in H1 23

Daniel Webber:

Matt, an excellent set of numbers and growth that is perplexing some people. What’s continuing to drive your growth across consumer, SME and your platform product?

Matt Briers:

We talk about personal and business, and the platform business is intermingled in both. If you’re a Monzo customer that comes through the platform but you go into the personal, and if you’re a Novo customer in the US, you come through the platform and you go into the business. We don’t split that out. It’s a small share. The platform business is doing well. It’s growing fast, but it’s small.

What’s driving the growth is personal and business. Within that, there’s a few things. One is we’re onboarding a lot of customers, so there’s a lot of people wanting to join up and use Wise. Over a million people are joining us and making cross-currency payments on a quarterly basis.

That’s between four or five million a year; it’s quite a lot of people to onboard. These are not people that come and look at the website or even sign our T&Cs. They don’t even make a domestic payment. These are people that sign up, go all the way through that and make a cross-currency payment. So it’s quite an honest measure. That’s pretty amazing.

Why is that? Our product is obviously resonating. There’s an element of the world opening up a little bit again post-Covid, but we’re seeing pretty great market fit for our product at the minute.

The second thing that’s driving growth is that underneath that, we’re seeing pretty healthy adoption of this Wise account. So instead of just being a money transfer company, I think we’re far beyond that now. A third of our customers are using us for much more than just sending money. They’re holding money, receiving money, spending money. Then 51% of the businesses are now doing this as well, so the Wise business product.

This means people move more money with us. They transact more frequently with us. So this just gives you a stronger foundation from your cohort off of which to grow.

Figure 1

Wise’s multi-use customer profile

Daniel Webber:

What’s the typical path for your multi-use customers? Do they start using both products straight away or do they start with a core product and go down that journey?

Matt Briers:

It’s actually both. When we were TransferWise, you only came in through the send product. You’d come in and say, “I want to transfer from one bank to another”. There were a lot of customers that didn’t use us and said, “Well, I want to hold money”, or, “I want to receive money”, or, “I want to spend money”. And they just didn’t join us. They might’ve stayed with their bank or maybe joined somebody else.

Now we have both people that just want to send money joining us and we have the people that might want to spend on their card, but also send money and hold money between accounts. A typical multicurrency account holder, like a HSBC customer, might now say, “Right, I’m just going to move all of that now to Wise because I can do all of that on Wise”, or a Chase customer might be like, “Right. Multicurrency didn’t really work there. So I’m going to start doing all of that now on Wise. I’m going to get my pound and dollar”.

Then you also have some customers that would be send customers, but they also had that use case somewhere else. They might be converting from just sending money to doing all this other stuff with us as well.

So it’s both parts. If you go to our website or our app, you’ll see that the welcome screen’s changed. It’s no longer just, “Use TransferWise. Save money versus your bank. Here’s the currency converter. Check us out”. It’s very much, “The Wise account. Get a card. Get an account. Send money. Save money. Hold money, etc”. Through design and UI, this is making a change now.

Figure 2

Customer churn and net revenue retention

Daniel Webber:

You’re adding a lot of customers, but how does the churn sit underneath? What role are existing customers playing in your growth?

Matt Briers:

We haven’t disclosed the net revenue retention before, so I’m not going to do that now. If you look in the various filing documents we’ve done in the past, you’ll see that our cohorts are very stable. In a product like ours, there’s always going to be customers that use you once.

The first month is always the highest: you get 100 from a cohort. Then you see a phenomenon – two things: some customers don’t come back, but then there’s some customers that only come back once or twice a year. They come back on different frequencies. Maybe their use case is annual or every three terms a year or something like this.

You have a bit of both. In every quarter after the first quarter, you’ll have less customers using you. Partly that’s because the frequency’s different. It’s not that they’ve gone away.

For businesses, it’s slightly different. Once they start, businesses tend to use you more frequently. If you look at the cohorts, even the 2014 cohort, it’s sending the same amount this year as they sent last year and the year before. The cohorts are very stable.

You see some customers churn. Inevitably, the use case goes away. Maybe they moved back home to their family or they’ve sold their house. They’re probably grateful that they no longer have this complication in their life. So that’s inevitable. Also, some customers grow with us, particularly small businesses. Some of them grow. Some of them die.

The question is what happens to this net revenue retention. We’ve seen that when you give customers a Wise account, it definitely helps them stay around, or rather it attracts customers that might stick around longer.

It’s probably a cause and effect, but it’s definitely a deeper relationship that we have with the customer. If you imagine a small business one day transacting spot with us every now and again versus running all of their international accounts on Wise, we’ve become quite important to them. So we’ve got to do a good job. It’s very important for us to stay part of their business space.

The source of Wise’s customers

Daniel Webber:

You’re growing much faster than all the segments of the market. Where are you winning those customers from?

Matt Briers:

It’s mainly other banks, to be honest. It just has to be: we grew volumes more than the other fintechs. Year-over-year, we’ve put £9bn of volume on. If you add up the volume that goes through the other fintechs, it probably adds up to £9bn. So it’s got to come from the banks.

There’s this hidden market that you’ve probably got better insight on than me. Every time I think we’re getting to a 20% market share in the UK because we don’t really have great numbers, we find ourselves growing 40% year-over-year. I’m like, “I’m not sure this makes sense. Maybe the market’s bigger than we think, right?”.

Figure 3

Wise’s business product strategy

Daniel Webber:

To win a business customer, it needs to be a more sophisticated product than the consumer product. How is the business product changing to become less similar to the consumer version?

Matt Briers:

Exactly right. They care about price just as much, and they get ripped off by price just as much. They care about speed just as much. They want reliability because they need people to get paid like their staff or their suppliers.

Their convenience features as we think about them is where it differs. You need authorities and controls. You need the ability to pay all your invoices together like batch files. You need to issue cards so that you can manage spend and expense management. You need to be able to invoice your customers easily, integrate with your accounting platform.

We launched the ability to accept payments through different approaches of bank-to-bank payments, but now we’re demoing with a small group of customers the ability for businesses to accept payments with cards from their customers as well.

This is definitely evolving into the need to offer a really good transaction account for these customers. They’re probably still going to have a bank that they have a loan with or a trade finance deal with. But fundamentally, this international treasury infrastructure that they could use through us is going to be really useful.

The more features we add, the further up the business size we go. We started because we built a personal product, and businesses were knocking on the door. We realised, “Oh, well, we need to KYC them differently”, but they still only did one paper at the time, and it was pretty bad.

They persevered. It’s taken us a long time because these things are hard to build. We’re doing things that are still quite basic. In the US, embarrassingly, we’ve only just been able to give businesses cards.

We take for granted how good Wise is in the UK. The US is growing really well. The US is probably the biggest individual market country now, and it’s growing really quickly. So it’s very exciting.

The importance of profitable growth

Daniel Webber:

Is there anything else you want to mention that we haven’t covered?

Matt Briers:

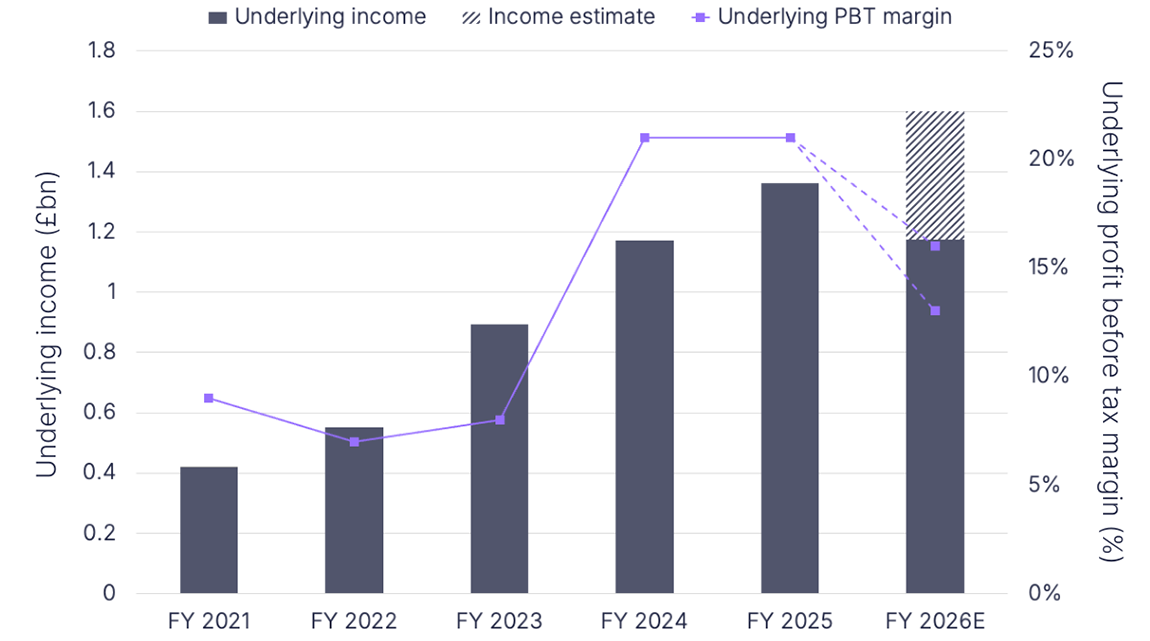

We’re really proud of the rates at which we’re growing. But the thing to understand is there’s lots of noise in tech at the minute around companies that have been growing fast, burning money. What we’re revealing now is that we’ve got a really sustainable, resilient model to offer the product that we’ve got profitably, but also continue to be able to grow and invest in our growth. Whether it’s through our product investments or our marketing investments, at such a good return and a lean cost we can still be a profitable, cash-generative business.

This is pretty important to us, but there’s not many businesses growing 55%, 60% year-over-year running at 20% EBITDA margin at the same time. There’s 1,500 companies in the world with a market cap greater than $3bn. There’s maybe 40 that fit into that greater than 20% growth, greater than 20% EBITDA margins, and there’s not many payments companies.

Daniel Webber:

Matt, thank you for the time.

Matt Briers:

Thanks.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.