Wise saw another market-beating year of growth in FY 2025 and is now moving its primary listing to the US. We spoke to CFO Emmanuel Thomassin to dig into the company’s core drivers as it continues its shift to becoming a global money movement platform.

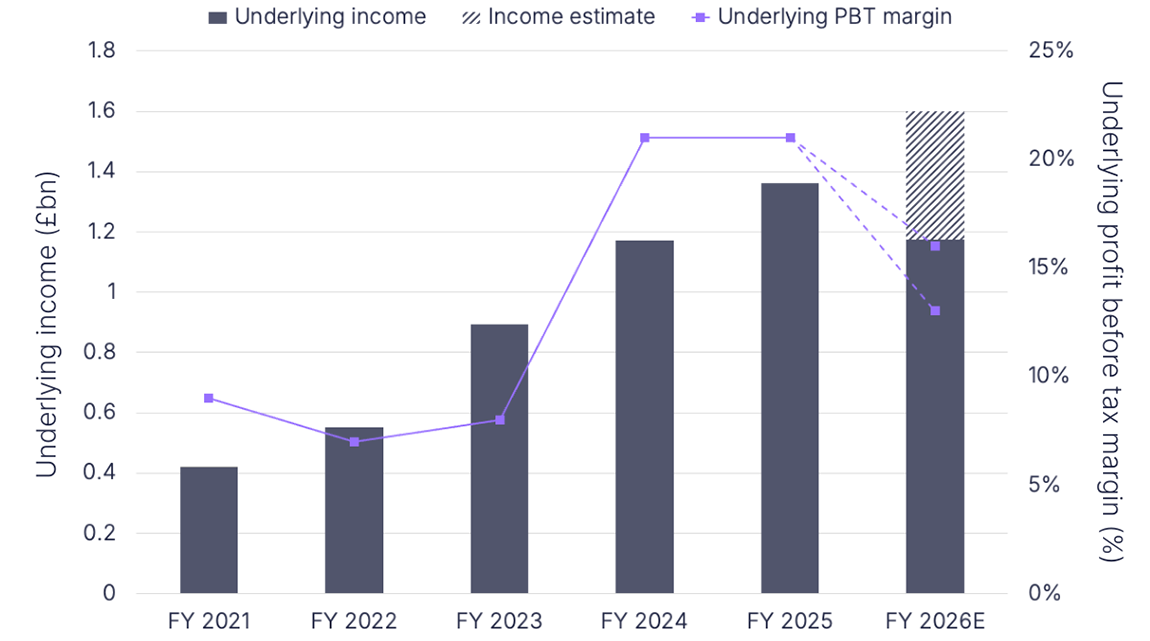

Earlier this month, Wise reported strong growth in FY 2025 (ending in March 2025), in which it saw underlying income jump 16% to £1.36bn on the back of continued customer growth.

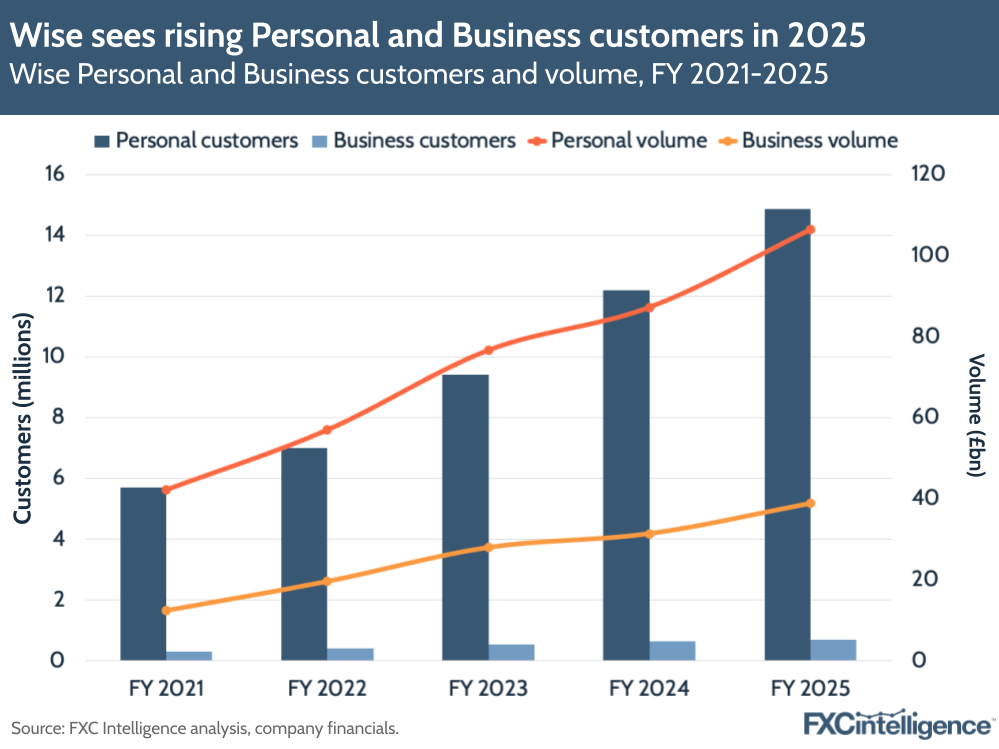

The money transfer provider served 15.6 million active customers in FY 2025, up 21% YoY, with Personal customers growing by 22% and Business customers increasing by 11%. Despite cutting its pricing for customers, the company’s underlying profit before tax increased 17% to £282m, giving a 21% margin that is well above its 13-16% mid-term target.

During its earnings, Wise announced that it would dual-list its shares in the US and the UK in a bid to build out its capital and bring Wise Platform – the company’s payment infrastructure for financial institutions – to a wide base of US banks (numbering over 4,000). This marks a key pillar of the company’s global vision to enable money movement for some of the biggest cross-border volume carriers in the world, helping it expand further into Wise’s estimated cross-border TAM of £32tn.

Cross-border volume surged 23% YoY to £145.2bn in FY 2025, driving 6% cross-border revenue growth, though the company has also continued to significantly lower prices and drive up its transaction speeds. It has also seen significant growth across many of the non-cross-border elements of its business, namely its account, card and assets-based products.

On the London Stock Exchange, Wise saw its share price jump to new heights on the day of its earnings results, rising 7% to a closing price of £1,160 – the company’s highest daily closing share price since it first went public.

We spoke to Wise CFO Emmanuel Thomassin to find out more about the company’s key drivers in FY 2025, its potential to tackle a massive untapped business opportunity as well as its US listing.

Wise key revenue figures and drivers for FY 2025

Daniel Webber:

Wise has seen lots of growth across the board. According to our total market size numbers, you are growing faster than the market. Take us through what really drove the company’s continued growth in FY 2025.

Emmanuel Thomassin:

We grew cross-border volume by 23% year-on-year last year. This is quite exceptional, and our active customers grew by 22%, so our customers are active. We’re moving £145bn of funds now, so it’s very impressive to see this growth rate.

In general, it’s related to three main currencies. The US dollar to euros, US dollar to GBP and so on and so forth. That’s the main three currencies. The success comes basically from what we call infrastructure. It’s the service, the platform, which is extremely fast, and the direct integration that we are building over the time. We have six direct integrations today, with two coming on top [of that] during this year, Brazil and Japan, which we estimate will also foster volume over the years.

The price adjustments that we’ve done are probably one of the drivers of what we’ve seen during the year. The adjustment last year was making a large transfer more attractive. We were reducing the take rate and giving some discounts for large transfers, so if you are a customer that is transferring a large amount of money per month, the take rate or the fees that you’re going to pay to Wise are essentially different from what you paid a year before and that was driving volumes.

Daniel Webber:

What’s your definition of a ‘large’ transfer, and how do you define this across different customer bases?

Emmanuel Thomassin:

We consider a large transfer to be over £10,000 but also over £50,000. We are clustering our customers in certain categories, but at over £10,000 per month on cross-border volume, you start to be a customer that is sizeable in terms of transaction volume. We use this definition across both business and consumer customers, though obviously businesses will have a larger volume than a private consumer.

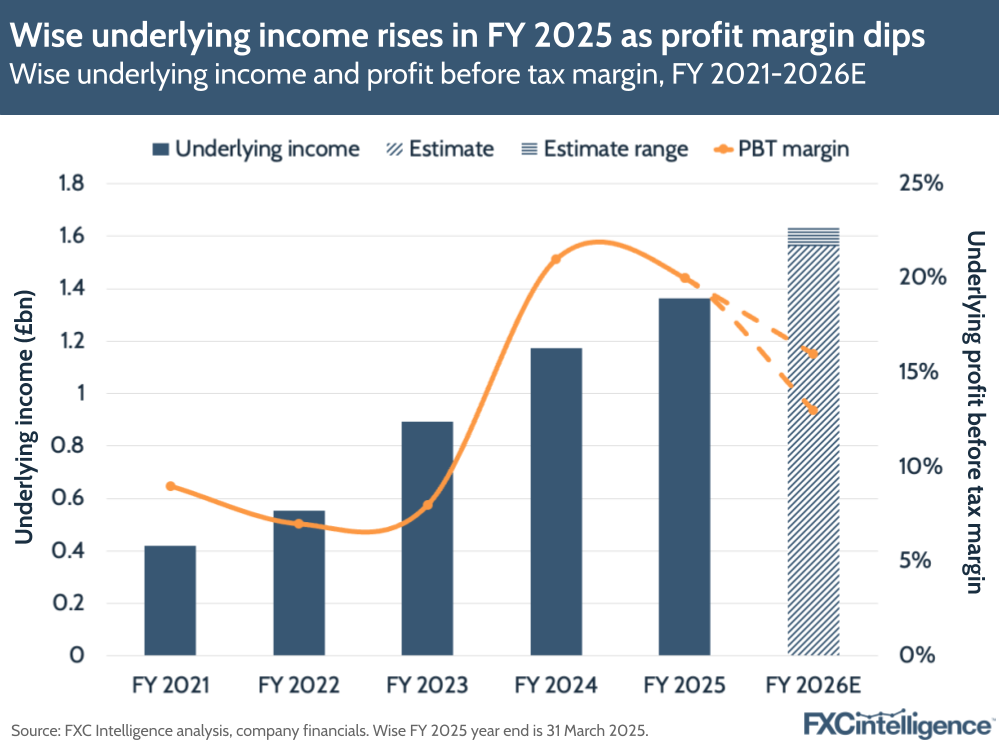

Wise’s underlying income and profits driven by customer growth

Wise’s revenue (including cross-border, card and other revenues) grew 15% to £1.2bn in FY 2025. Overall, underlying income (including the first 1% of gross yield of interest income on customer balances) rose 16% to £1.36bn.

Driving income growth was a boost in customers, rising usage across its various products – including Wise’s multicurrency card product and Wise Platform – and growing interest income. Wise’s active customers grew by 21% YoY, helping drive a 23% increase in cross-border volumes to £145.2bn.

Underlying profit before tax increased 17% to £282m, with a 21% margin, which was above Wise’s 13-16% mid-term target. On the back of the results, the company expects to deliver on 15-20% growth in the midterm, driven by continued growth across its customers and products.

How Wise is reducing pricing while staying profitable

Daniel Webber:

How are you continuing to make sure the business is profitable while reducing the take rate and pricing?

Emmanuel Thomassin:

We keep this logic of cost-plus [pricing]. We have the cost base – per route, per country, per product, you name it – and then we apply the margin that we want to generate all of this revenue. For this we are agnostic, so it doesn’t matter if you’re a private customer, company or even for Platform, we want to generate the same margin no matter how the revenue stream is created.

Based on that, we will then set up pricing. If we get an efficiency gain in terms of cost due to the volume that we generate or due to new negotiation with partners, that will allow us to revisit our take rate per route or per currency.

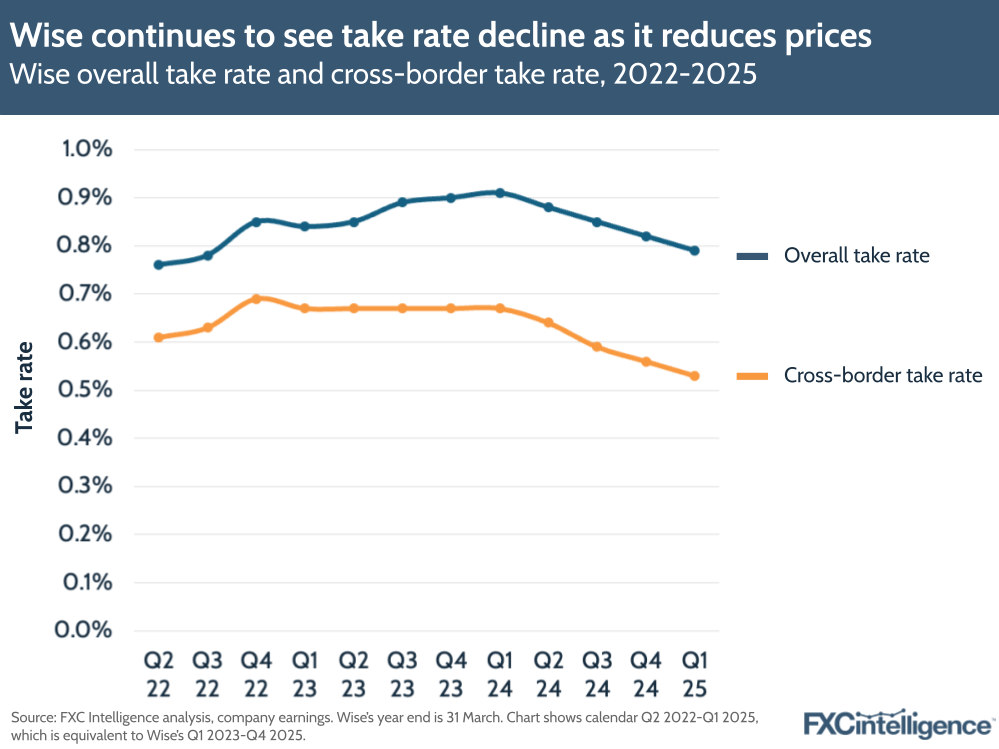

Take rate declines as Wise brings down pricing

Wise has continued to see its cross-border take rate decline over time as it moves to reduce pricing for transfers. In Q4 2025, the company reported a rate of 53 basis points (bps), a reduction of 14 bps compared to the same period last year. For the full year, the company’s cross-border take rate was about 58 bps.

This reflects price adjustments Wise had made from Q2 2025 onwards, as well as the “impact of current mix and an increase of high-volume customers”, Wise said during the earnings call. The company is looking to continue to make gradual and sustainable price reductions as a draw for customers, as well as working on speed.

Wise also claimed that 65% of all cross-border transactions are now arriving with the receiver in less than 20 seconds.

Daniel Webber:

If some cost was to go up outside of your control, then that’s a justification to put the price up, correct?

Emmanuel Thomassin:

Absolutely right. When we talk about price adjustments, last year the take rate decreased by 14 bps from 67 bps to 53 bps at the end, so it is quite significant. Nine bps were due to our decision i.e. price adjustments, and the difference was based on market mix, but certain prices have been increased as well.

Certain routes and certain categories have been increased. It was not only one direction. Overall we have quite a significant decrease of the take rate, but we also increased certain prices when we were not satisfied or where we didn’t meet the margin that we wanted to meet. From the 15.6 million customers that have been active last year with us, some of them would’ve seen certain prices increasing.

Daniel Webber:

It’s likely there are of course many more customers than that 15.6 million, because you’re not counting low-frequency people and someone making transactions using the Wise card, correct?

Emmanuel Thomassin:

Correct. Active customers for us are people that have been transferring last month’s money across borders. We don’t count people that are only card holders, even if they made a transaction with a card in that past month. It’s really based on our cross-border volume related to that and you have to have one transaction in a given month, in a given quarter or in a given year.

Driving consumer growth through Wise Account adoption

Daniel Webber:

On the consumer side, what are the dynamics that are allowing you to grow faster than the natural growth of the cross-border payments market?

Emmanuel Thomassin:

Wise Account/card adoption is driving more and more customers towards Wise. It’s not only for transfers as we were supposed to be in the past. Now it’s really becoming the account that people will use every day for the cards. And that’s why you see clearly the percentage of revenue from cards and other revenues now at almost 40% the last year. This is the fastest growing part of our revenue because of the account adoption that we see at Wise, and that’s why we see not only private customers but also businesses using our card.

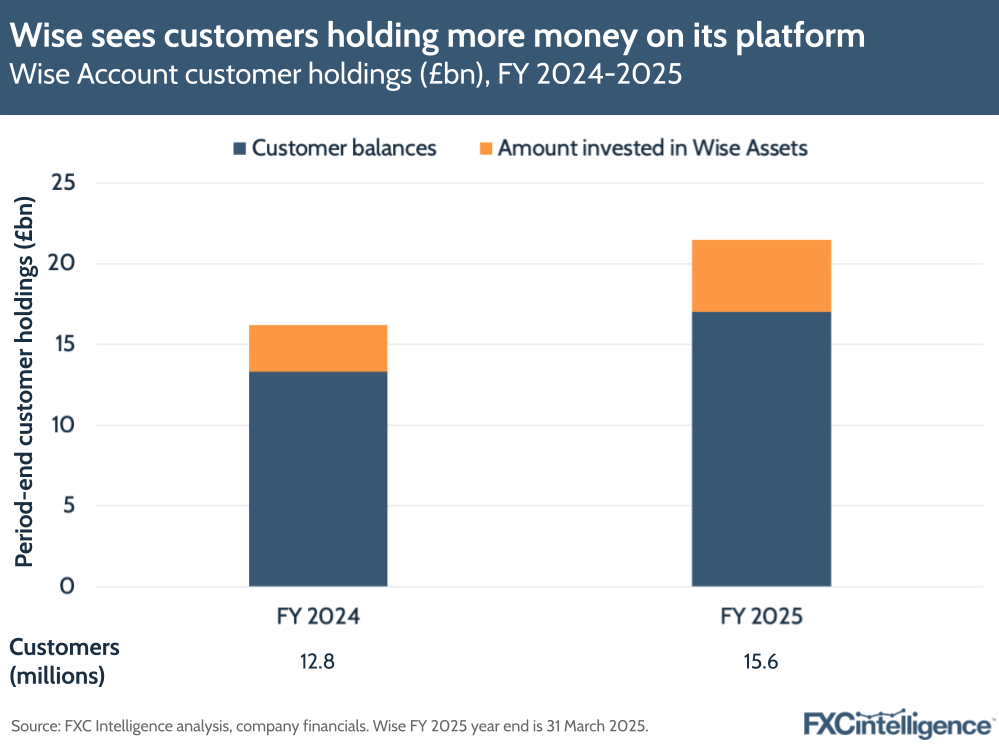

From our customer base, 50% of personal customers are using the card and 60% of business customers and this is growing. As you can imagine, not only are they opening an account and using the card but they increase the holding balance. We ended up last year with £21bn of holding balance for our customers, which has multiplied by seven times since we listed, so it’s quite impressive.

Wise Account spurs income growth

Wise said that in FY 2025, more than 3.5 million people have started to use Wise Account. Not only this, but around 50% of Personal and 60% of Business customers have adopted multiple features within the Account product, once again showing the company’s diversification strategy is paying off.

Customer holdings at the end of the FY 2025 period rose 33% to £21.5bn, with £17.1bn comprising customer balances held on Wise’s platform. The other portion is ascribed to the amount customers invested in Wise’s Assets, which allows them to earn a return on their balances by allocating funds to investment funds.

Wise’s business growth and future opportunity

Daniel Webber:

On the business side, that’s a much bigger total addressable market for the world. Where are you gaining traction there?

Emmanuel Thomassin:

If you consider the SMEs or the business world as you said, we are talking about a £32tn TAM overall [including £3tn moved by consumers, £14tn moved by SMBs and £15tn moved by large enterprises]. This is by far the largest market, and this is also an area where we only serve 1% of the customers according to our estimates. So this is a very attractive part of the business.

Wise Platform is a separate animal but it requires a long time until you acquire businesses because they will have to trust you. But then when you look at the cohorts, they’re extremely sticky. This is the people that once they choose Wise, they stay with us for a very long time.

The services that you provide besides the ones that are obvious for private customers include, for example, invoicing. This is an integration to the accounting system and something that will basically facilitate the daily life of these businesses. If you’re a freelancer or you have a small company or a company with 10 employees, you can invoice in different currencies and get the payment in different currencies.

If I am, for example, a freelancer based in the Philippines and I serve customers in the US, Europe or another country, I can invoice in that country’s currency. Sometimes, CFOs don’t want to deal with different currencies in the P&L, and they don’t want to take the risk of FX. They say, “Well, I’m happy to pay this freelancer, but they have to invoice us in my currency.” Then you facilitate these kinds of businesses and you can hold the money in the wallet in the local currency or foreign currency that you’re invoicing. This kind of service is very important.

Invoicing, integration, accounting systems, digital cards for employees – that’s the services that we are developing and once you get adoption from the businesses, as I said, they’re very sticky.

Wise volumes surge after Business onboarding resumes

Of 15.6 million customers, Wise’s Personal customers grew by 22% to 14.9 million, while Business customers grew to nearly 700,000. This drove a 22% rise in Personal cross-border volumes to £106.4bn, while Business rose slightly faster – by 24% to £38.8bn.

Businesses continue to drive a higher volume per customer (around £56k) versus Personal customers (£7k). The company noted that it saw sequential growth in business customers in financial Q4 25 as it resumed the onboarding of business customers in the US and UK after a pause in H2 24.

Wise’s growing role as the main account for SMBs

Daniel Webber:

Are those businesses typically still banking with a traditional bank and Wise? What proportion of them have you as the dominant account?

Emmanuel Thomassin:

The businesses that are with us are mainly with Wise. Where they would use another bank is if they need external financing that is not done by shareholders. If you are a single entrepreneur or you have a small company, you probably do not have the capital with different shareholders and you will potentially require a loan for your investments. This is where you contact another bank.

Daniel Webber:

What’s been the demand for risk management? Is Wise offering any forwards or even more sophisticated risk management piece as part of the package?

Emmanuel Thomassin:

This is where we have to revisit the appetite if we want to enter this kind of sphere. Today, the potential is so large with the products that we can already offer that to go down a new path or to go to new revenue streams, we’ll have to think: what are the investments that we have to do and what is the risk that we have to accept with this new revenue stream?

Today, it’s fair to say that we have features that are now rolled out everywhere. For example, Wise Assets is available in the UK, Europe and just rolled out in Australia and that’s a driver for growth or new customer growth. If I look at the portfolio of Wise, there are still a lot of countries where we will be able to roll out a lot of features for quite some time and before adding a new one, we have to balance our level of investment versus our capacity and resources to deploy the products that are already available but not in that specific country.

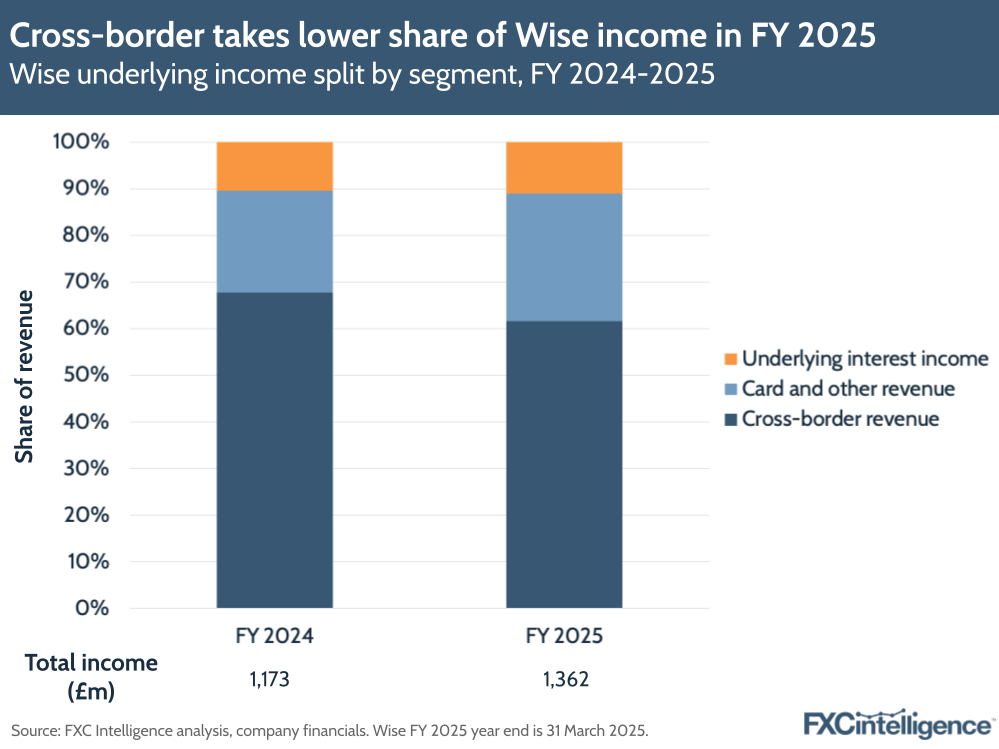

Wise’s diversifying income streams

Breaking down the different income streams across Wise shows that the company has continued to diversify towards being a broader financial services platform in FY 2025. Overall, cross-border accounted for 62% of Wise’s underlying income in 2025, with the remaining 38% coming from streams such as Card and Other Revenue and interest income.

This mix has shifted significantly over time. Cross-border made up 91% of Wise’s underlying income in its FY 2021 results, dropping to 62% in FY 2025, driven primarily by the strong growth of its Account product.

Cross-border revenue grew 6% in FY 2025 to £840m, with the company’s Personal segment making up the majority of this at £669.6m versus £170.8m for Business. Although cross-border revenue’s growth slowed from the 17% of FY 2024, Wise said that this reflected the company’s continued price reduction strategy.

By comparison, Wise’s card and other revenue segment continued to grow faster, with a 45% rise to £371.5m. Of this, cards revenue (mainly interchange) grew 31% to £219.8m, while other revenue (business customer account set-up fees, Wise Assets revenue and fees for replacement cards) grew 71% to £151.7m. These revenues were driven by growing adoption of Wise Account, which drove higher retention across a broad use of the company’s products.

Increasing Wise Platform’s revenue share

Daniel Webber:

Let’s talk a little bit about Wise Platform. Why do you want to make Wise Platform a substantial share of the business?

Emmanuel Thomassin:

On Owner’s Day (3 April 2025) we announced that Platform today is 4% of our cross-border revenue and we have midterm [projections] to come to 10%. Long-term, we think that it could be 50%. The reason why Platform makes sense for us is that a lot of customers will come from larger banks or Tier 1 banks – Standard Chartered and Itau, for example – that are not satisfied either with the product itself or the offering, meaning the conditions that they have to pay when they want to transfer money.

When we talk with these partners, we share with them transparently how many customers we are receiving per month from them and the progression in terms of volumes, customers and transactions. Ideally, we partner with them so that customers are not coming to us.

When we partner with Nubank and Itau, for example, we can then serve both an excellent product. The customers are all of a sudden receiving the capacity to do instant payments below 20 seconds and there’s no reason for them to move away from Nubank to Wise completely. Nubank still has a satisfied customer and we are partnering with them, so we make a good business out of it. We are charging the take rate that I mentioned before, which is producing the margin that we want to see, and Nubank, Itau or any other partner can still invoice the fee that they think the customer should pay for that.

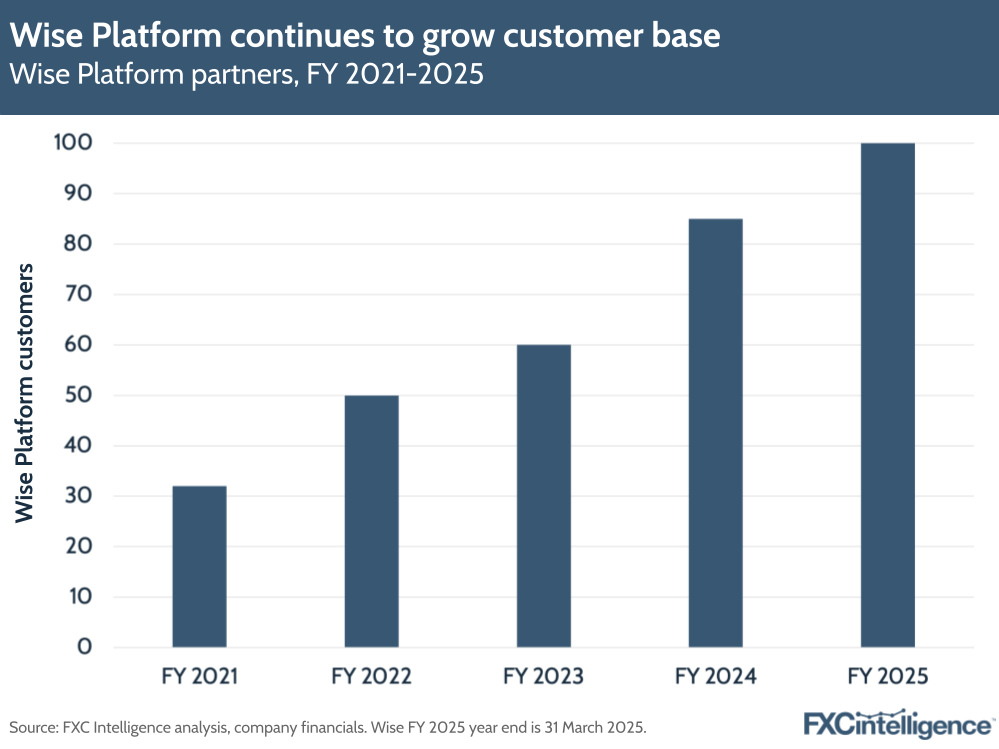

Wise Platform’s continued growth

Since its Owner’s Day earlier this year, Wise has continued to focus on building out Wise Platform – its infrastructure product that allows banks and large enterprises to embed Wise’s cross-border network into their own product. Notable partnerships for FY 2025 include major Latin American banking providers Nubank and Itaú Unibanco, as well as global banks including Morgan Stanley and Standard Chartered.

Wise continues to claim Wise Platform could one day be the driving force of its business and key to it tapping into the company’s self-calculated trillion-pound network opportunity. Wise Platform accounted for 4% of the company’s revenue in FY 2025, though the company says it could take 10% in the mid-term and 50% of revenue in the long term.

Part of the driving force of Wise’s US listing is enhancing the company’s profile among the US’s 4,000 banks, which include several of the world’s largest. In the meantime, the company continues to build out its network, connecting to domestic payment systems in the Philippines, Brazil and Japan and also using a new licence acquired in India to remove transfer caps and unlock more outward transfers from the country.

The strategy behind Wise’s US listing

Daniel Webber:

Wise is moving to a primary listing in the US – what’s the strategy behind this?

Emmanuel Thomassin:

The US listing or dual listing was triggered a bit by the new rules that were coming into play in July last year on the London Stock Exchange. The fact that certain rules were changing and will allow a step-up and potentially puts the inclusion indexes off of Wise. For this, we have to change our article of association as a company. It’s quite a significant change that you have to do.

Doing this, we were consulting first within the board, but also we were listening to what shareholders were telling us. Shareholders in the US but also on other funds in Europe told us all the time that the liquidity of the stock was an issue.

You have to pass a certain threshold or certain fund to be considered as an investment target and clearly that was a blocker. It’s a blocker for our funds. It could be a sizeable investment that you would consider to do in Wise, but they don’t do it today because liquidity is too low.

The US is by far the larger market in terms of liquidity in the world and it will remain like this. We took this decision because we’re looking at the long term. We think if we have to fundamentally change a lot of things within the article of association and the company, why not do a dual listing?

We will stay listed in the UK, because we’re also very thankful. A lot of things were done to make sure that Wise would have a very good outcome in the UK listing, but we think that long-term the US has a big liquidity advantage. It’ll also broaden our owner base because more people will be able to access our stock.

Thirdly, we think that strategically we will have more visibility in the US, where there are more than 4,000 banks. Being listed should have an impact in terms of brand awareness, and that could play a big role for us in terms of gaining banks as platform partners.

Wise’s focus on long-term decision-making

Daniel Webber:

Anything else you’d like to cover?

Emmanuel Thomassin:

We’re on a mission. We had very good numbers, but we want to move trillions. That’s what’s motivating us. We want to be the network of world money and this US listing is one step, but we think about these decisions long term, so what will happen in the next 10 years, 20 years or next decades.

We’ve been asked if the US listing is due to our current situation or political changes. When you make a decision like this, you can’t consider the next two or three years. You have to have a vision of what is right from our point of view today for shareholders and the company for the next 10 or 20 years.

Daniel Webber:

Emmanuel, thank you.

Emmanuel Thomassin:

Thanks very much.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.