Money transfers and remittances continued to weather macroeconomic headwinds in 2023, with Q4 and FY earnings generally strong. We explore the key trends in the space from publicly traded companies’ FY and Q4 performances.

For most publicly traded remittances and money transfers companies, the FY and Q4 2023 earnings season has been strong, providing an opportunity not only to showcase growth, but discuss new strategies as the industry continues to evolve.

In this, the latest in our series of reports, we compare the performance of five of the biggest publicly traded companies in this sector to determine how the industry is growing, which companies are taking outsized share and how the industry’s wider digitisation is being reflected in the activities of its biggest players.

This sees us cover the calendar equivalents of FY and Q4 2023 for Western Union, Intermex and Remitly, as well as Euronet’s Money Transfers division, which covers Ria and Xe, as well as the personal business of Wise. By comparing key metrics across the last few years’ earnings seasons, as well as the frequency of keywords in the companies’ respective earnings calls, we gain a picture of how the industry is developing and where key trends are taking it.

Revenue growth in Q4 2023 remittances

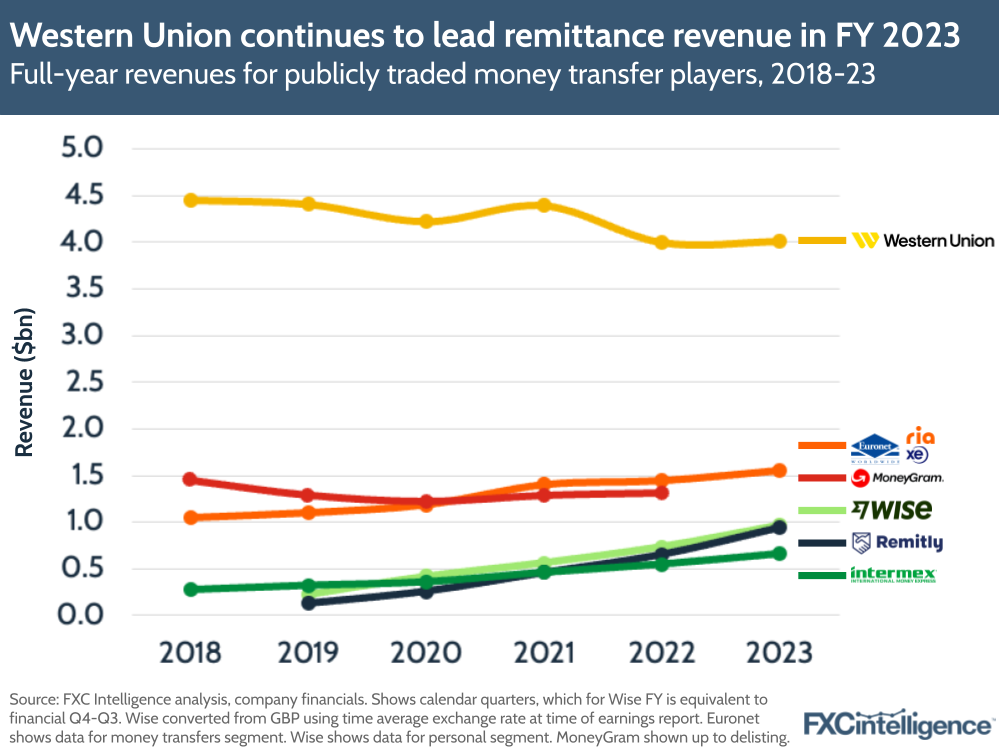

For FY 2023, Western Union continues to lead by some distance, although the gap between it and the next player – Euronet Money Transfers – has narrowed notably from 2021. As a private player, MoneyGram no longer reports its yearly or quarterly revenue numbers but may also be closing the gap.

Among other players, Remitly has noticeably climbed over the past few years. Having pulled ahead of Intermex for the first time in 2022, it reported revenues that were 43% higher than the traditional remittances player in 2023, and is now only marginally below Wise’s personal revenues.

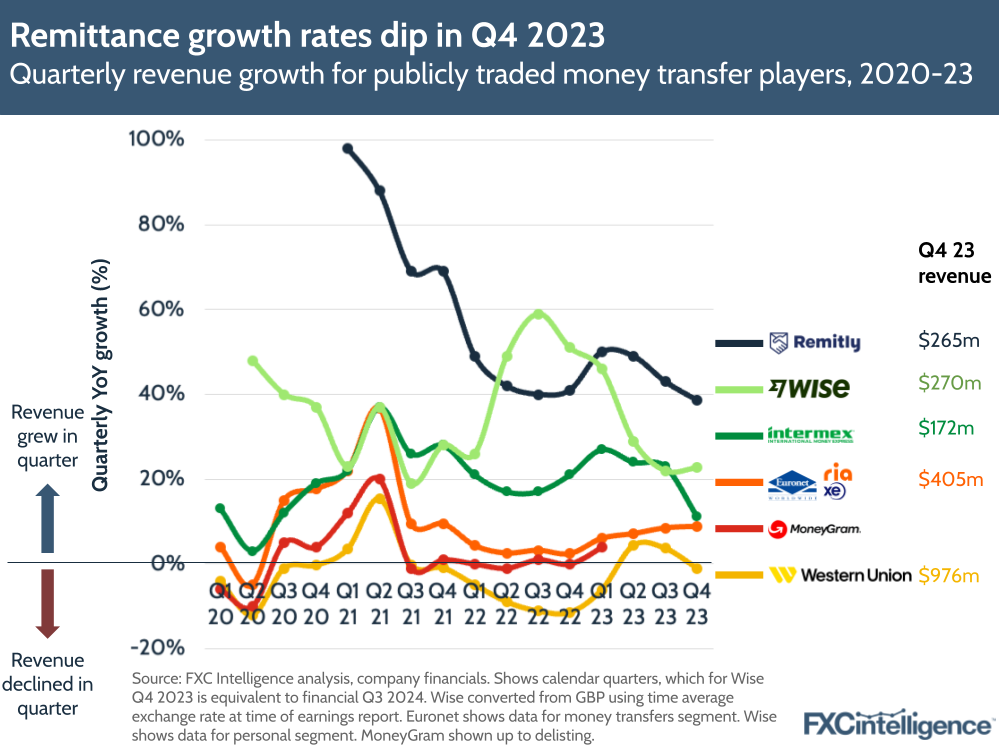

On growth rates, meanwhile, Q4 2023 saw all but Western Union maintain positive levels. Ria and Xe pulled slightly ahead of their Q3 rate with YoY growth of 8.9%, while Intermex saw an increase of 11% – its lowest revenue growth rate since Q4 2019, although still in double-digits.

Newer market entrants Wise and Remitly continued on a high-growth trajectory of 23% and 39% respectively.

Meanwhile, WU saw revenues contract by 1% year-on-year, ending a two-quarter run of growth that had followed an extensive period of contraction.

For Western Union, this Q4 2023 performance rounded off a year where overall revenues declined by 3% and it is projected that revenues will continue to decline in 2024 as it increases marketing spend in order to boost customer and transaction numbers.

Intermex saw FY revenues increase by 20%, although is expecting lower growth in 2024 of between 3% and 7% as it focuses on expanding both into new markets and its digital business. Ria and Xe, meanwhile, saw Euronet Money Transfer’s FY revenues increase by 10%, with a similar increase in earnings.

By contrast, Remitly saw FY revenues increase by 44% and is now expecting to see its first $1bn+ year in 2024, with growth of 30-32%. However, different reporting years for Wise saw calendar Q4 2023 reported as Q3 2024, although for calendar FY 2023 the company did see personal revenue increase by 29%. For its reported FY 2024, which runs from calendar Q2 2023 to calendar Q1 2024, Wise now expects overall YoY growth of 42-44%.

How are remittance companies’ pricing strategies shaping their growth?

Money transfers ARPU in Q4 2023

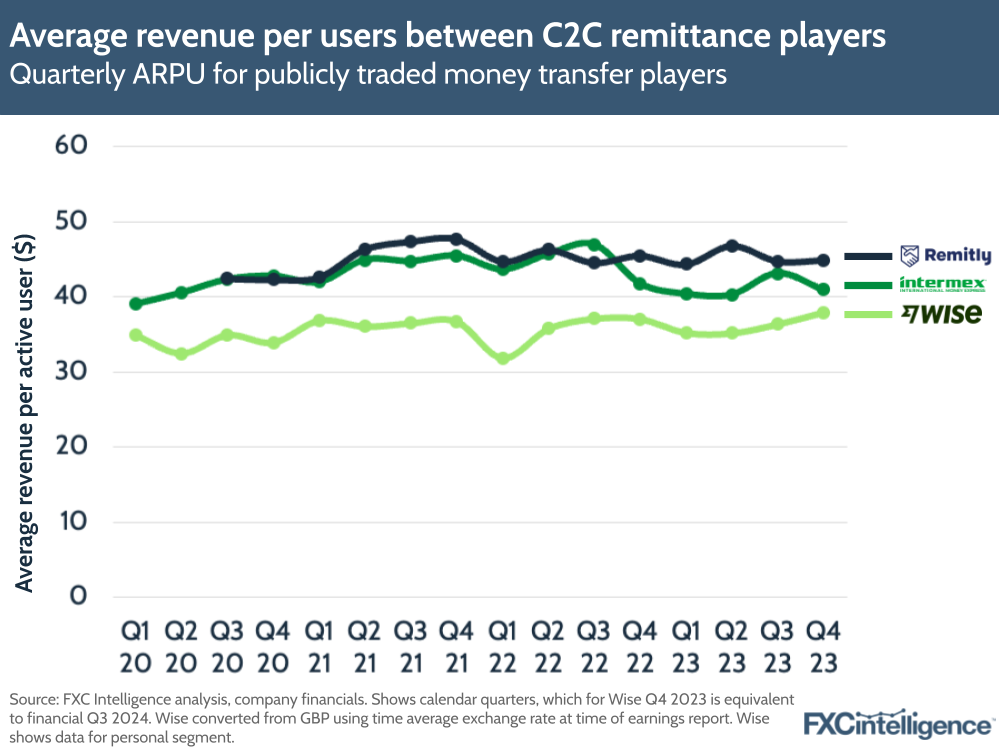

Comparing the average revenue per user for the three companies that report sufficient data to calculate this – Remitly, Intermex and Wise’s personal division – shows increases in calendar Q4 23 for both Remitly and Wise, while Intermex saw a decline. While Wise largely caters to an expat money transfers customer base, Remitly and Intermex both serve traditional remittances customers, albeit a digital-only focus from Remitly versus Intermex’s traditionally retail-led approach.

Intermex is making some moves into the digital arena, but the greater ARPU gap this quarter suggests Remitly’s approach is yielding greater returns at present.

FY 2023 volume for money transfers players

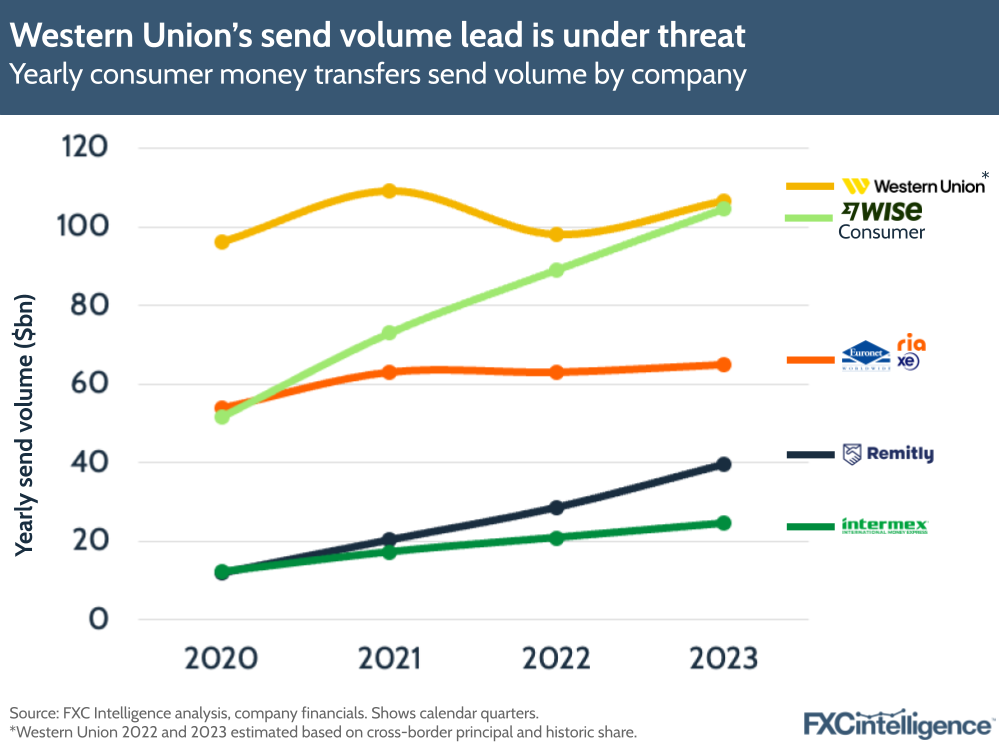

Full-year numbers also provide a comparatively rare opportunity to see how changes in volume are reflecting relative sizes of different players in the market. Western Union remains the leader in the space, although Wise’s significant growth trajectory is bringing it increasingly close to the incumbent.

Meanwhile, Remitly has pulled away from Intermex, and although it is still some way off Euronet Money Transfer, when it comes to Ria as a remittances brand on its own, rather than combined with money transfers-focused, online-only Xe, it is likely to be much closer. Euronet has not broken out its send volumes by brand in some time, although in 2021 when the company last published such information, Xe accounted for 23% versus Ria’s 77% share. Since then, Xe has consistently seen higher transaction growth than Ria, suggesting it is likely to now have a greater slice of volume. With this in mind, Ria’s 2023 volume is likely to be somewhere in the region of $42bn-49bn, considerably closer to Remitly’s $39bn than Euronet Money Transfer overall.

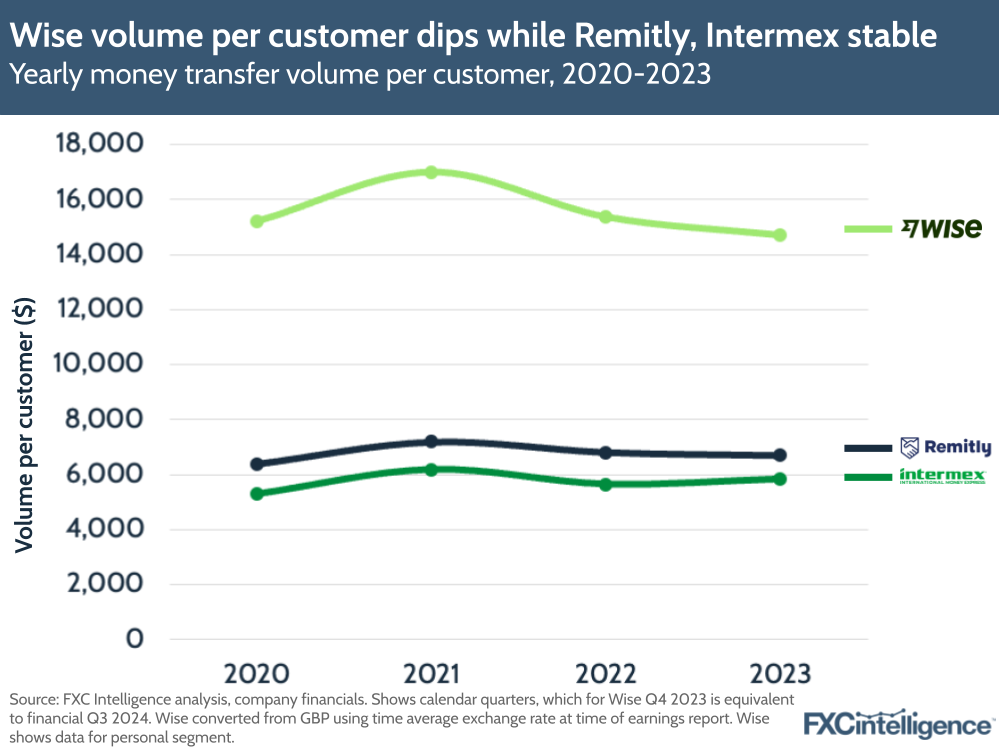

For those where volume per customer can be calculated – Wise personal, Remitly and Intermex – the differences in customer profiles between Wise’s money transfer customers and Remitly and Intermex’s remittances customers is again clear. While Wise’s customers have always had higher send volumes, there has been a notable drop in 2022 and 2023 – likely a reflection of the economically tougher macroeconomic environment over the last few years.

However, Remitly and Intermex’s average send volumes have remained far more robust, with both dropping only slightly in 2022 and Intermex seeing an increase in 2023, while Remitly has seen only a narrow contraction.

This reflects comments made in particular by Remitly’s CEO Matt Oppenheimer about the resilience of this type of spend versus other forms of financial expenditure due to the importance it has for recipients’ livelihoods, with senders likely to make cuts to other costs before they notably reduce the money they remit.

Transaction rates

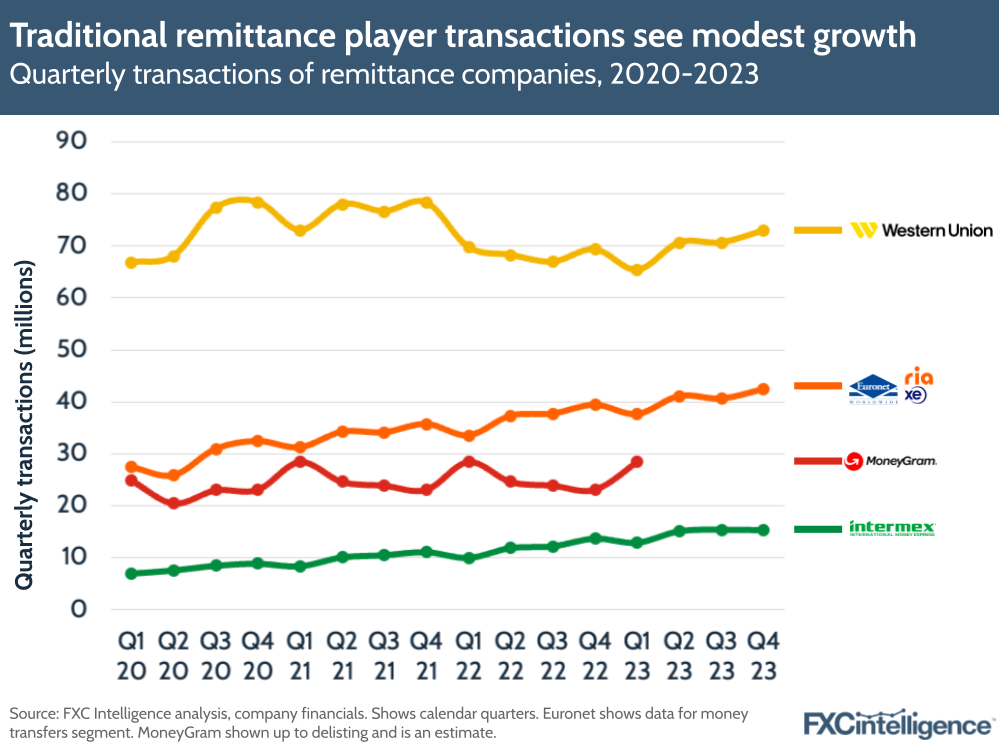

Among those who report numbers of transactions – Western Union, Euronet Money Transfers and Intermex – the trend has generally been positive. While Western Union saw a 5.2% increase in C2C transactions in Q4 2023 compared to the same period in 2022, Euronet Money Transfer saw a 7.6% increase over the same period. Intermex had the strongest growth rate for the quarter, however, at 11.7%.

Notably, while for Western Union Q4 was its second strongest quarter in terms of YoY transaction growth in 2023 after Q3, for both Euronet Money Transfer and Intermex Q4 saw the lowest rate of transaction growth in 2023. Euronet saw growth rates of 12.2% (Q1), 10.2% (Q2) and 7.7% (Q3), while Intermex reported transaction growth of 29.0% (Q1), 27.0% (Q2) and 26.2% (Q3).

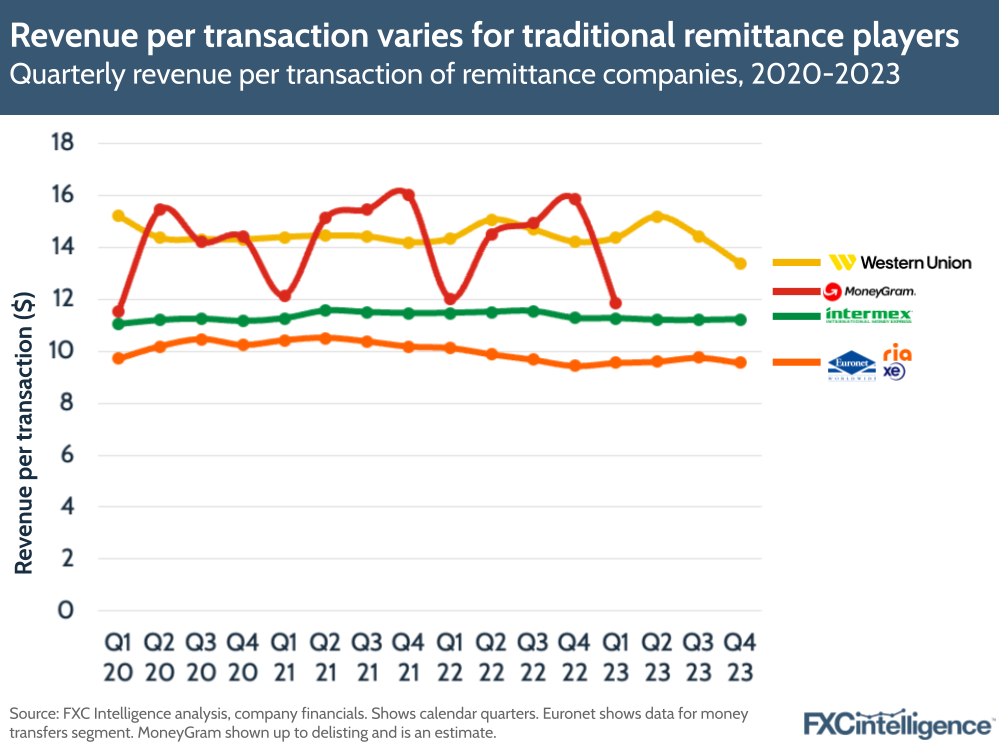

However, when it comes to revenue per transaction, the picture is quite different. While Euronet Money Transfer saw a 1.2% increase YoY for Q4 2023, both Western Union and Intermex saw declines of 5.9% and 0.4% respectively.

For FY 2023, revenue per transaction declined for all three players, at -1.5% (Euronet), -1.6% (Western Union) and -1.9% (Intermex). This reflects a more challenging operating environment, with many companies reporting both a reduction in send amounts and higher costs.

How do remittance players compete on speed?

Digital’s continuing rise in remittances

The slow growth of digital remittances has been a strong and persistent narrative in the space for some time, and in 2023 we saw this gain notable momentum.

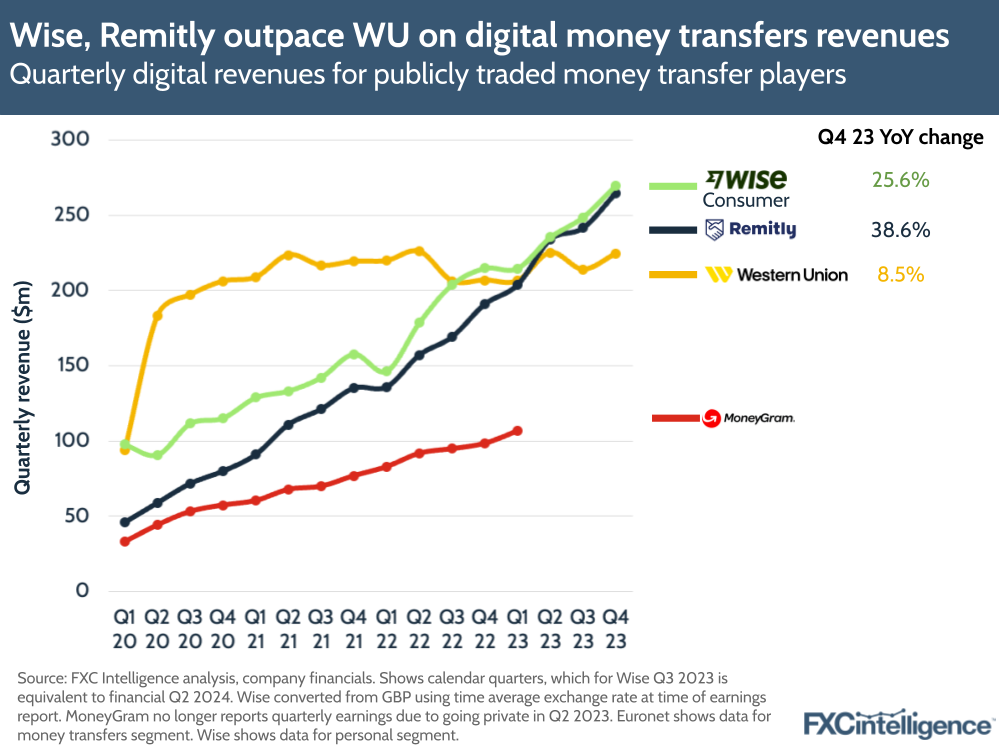

On digital revenues, not all players report sufficient information to accurately chart these, however those that do show the impact of different growth rates. Wise and Remitly both offer digital-only services to different consumer money transfers market segments, but Remitly’s slightly higher growth rates have seen the two companies converge around the same C2C revenues, all of which is digital.

However, in the last few quarters both have now passed Western Union’s digital remittances revenue, which has seen inconsistent levels of growth, although did see an 8.5% YoY increase in Q4 23. This now puts Remitly and Wise’s C2C revenues at a notably higher level than Western Union’s.

However, WU is beginning to see some digital growth. Having seen its branded digital revenues sit at 21-22% of all C2C revenues for the last two years, in Q4 this rose to 23%.

While neither Euronet Money Transfer or Intermex report digital revenues, there are signs that their digital businesses are growing.

Euronet is reporting faster double-digit growth in its digital business compared to its retail business. It also credits its digital success to its digital payout capabilities, where its network now includes connections to four billion bank accounts and two billion wallets.

Meanwhile, Intermex has reported a 41.6% increase in digitally originated transactions, with digital send or receive transactions seeing a 17.9% YoY increase in share.

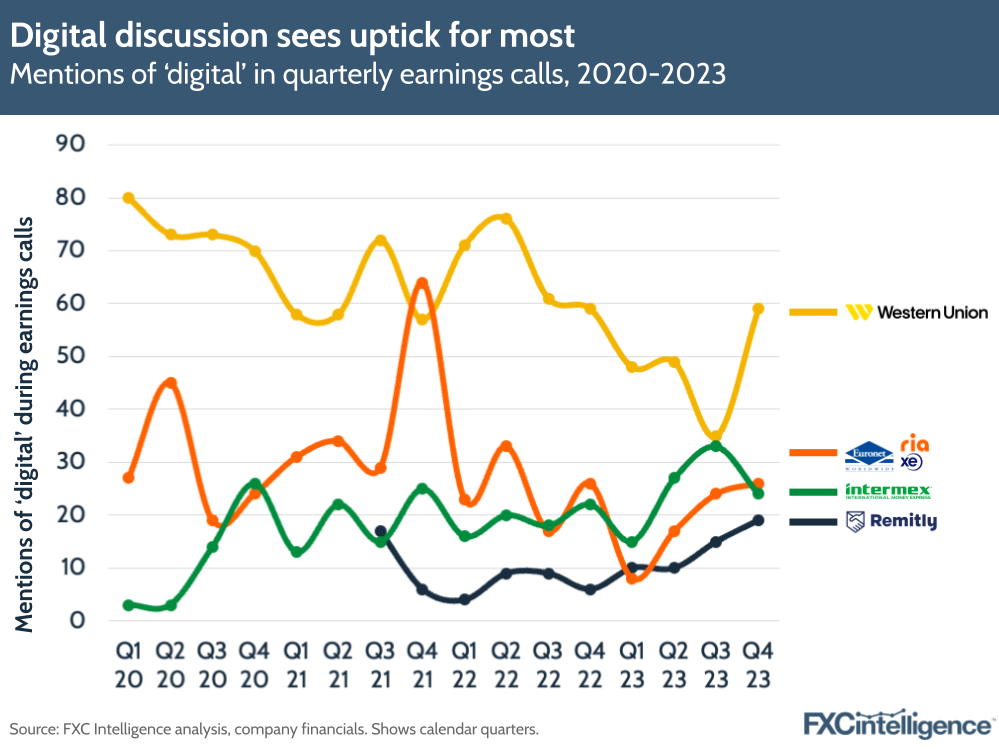

For all companies, discussion of digital was elevated in Q4 2023 earnings calls. Western Union saw a notable upswing in discussion after several quarters of decline, while Intermex discussion was slightly below the previous quarter but still above historic averages. Euronet and Remitly, meanwhile, both saw an increase.

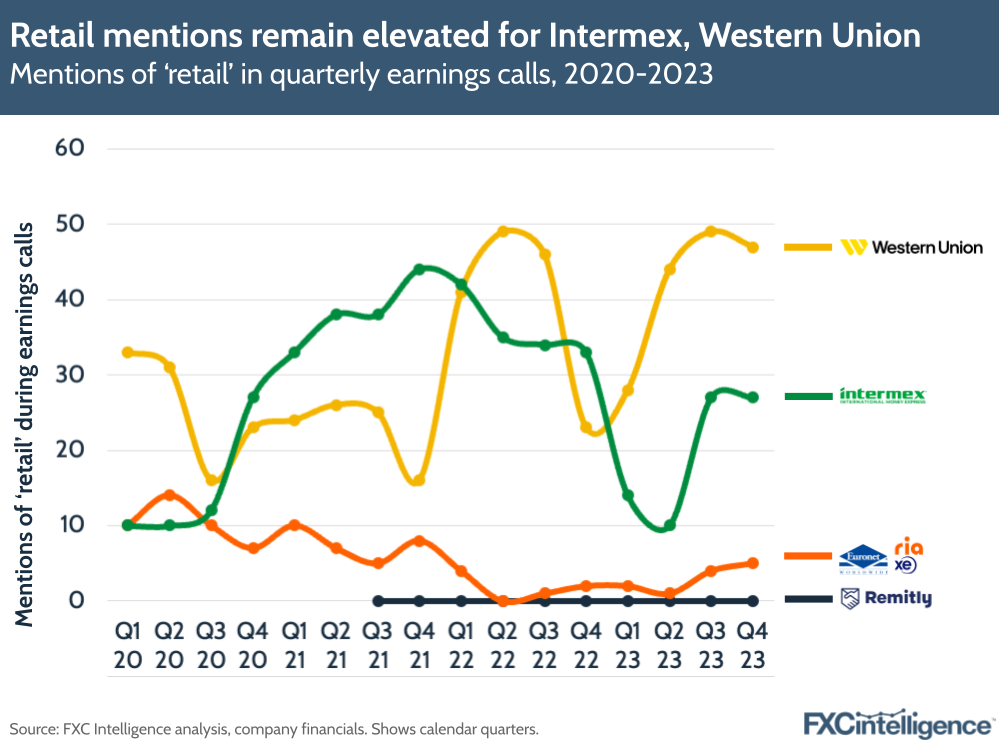

However, there was also an uptick in the discussion of retail for all but digital-only Remitly, reflecting the fact that while digital remains the key source of long-term growth, for traditional players the retail business still holds significant sway.

Western Union and Intermex both saw elevated discussion slightly below the recent highs of Q3, while Euronet increased mentions after a period where discussion of the retail business had all but vanished. Here, the company placed retail at the heart of its money transfers business discussion, including highlighting an 11% YoY increase in network locations.

How do remittance companies compete on send and receive capabilities?

A focus on opportunity

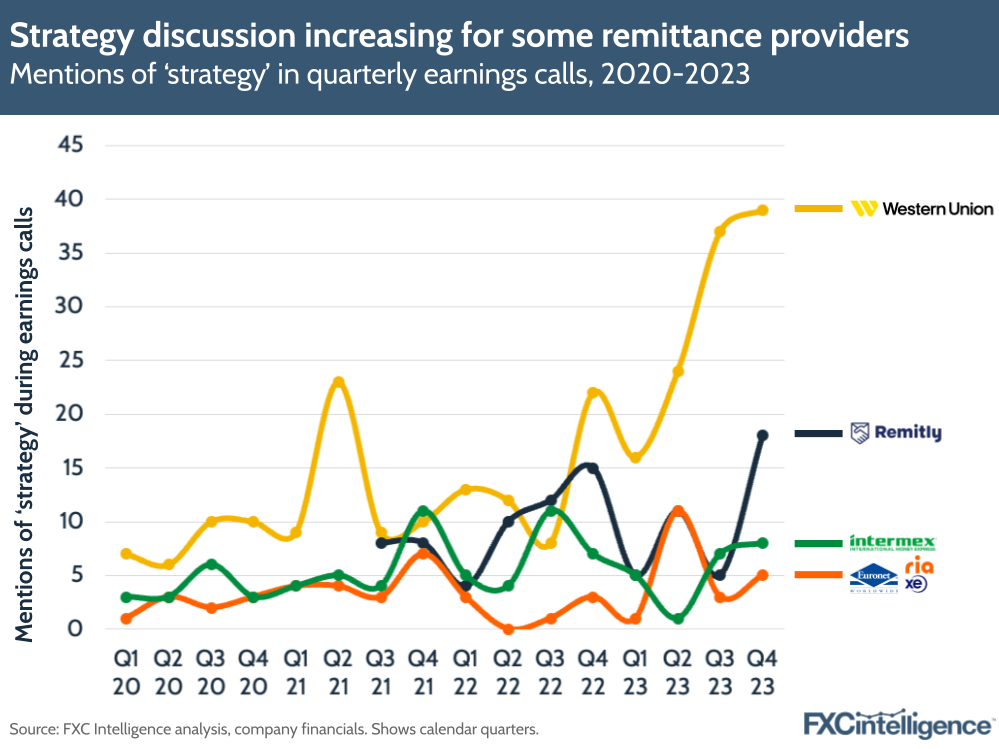

As companies look to 2024 and beyond, there was a notable upswing in mentions of both growth and strategy in earnings calls, with both Remitly and Western Union seeing a significant increase in their mentions of the latter term.

Q4 calls often see increased discussion of strategic plays and other longer-term approaches to delivering growth, but the level of increase this quarter speaks to a longer-term focus that reflects a new economic period for the space.

With the pandemic-era economy now behind us and the new more constrained economic reality now upon us, companies are now facing the reality of an operating environment that is not expected to radically change any time soon. As a result, they are increasingly looking to build approaches that can help them develop within this environment.

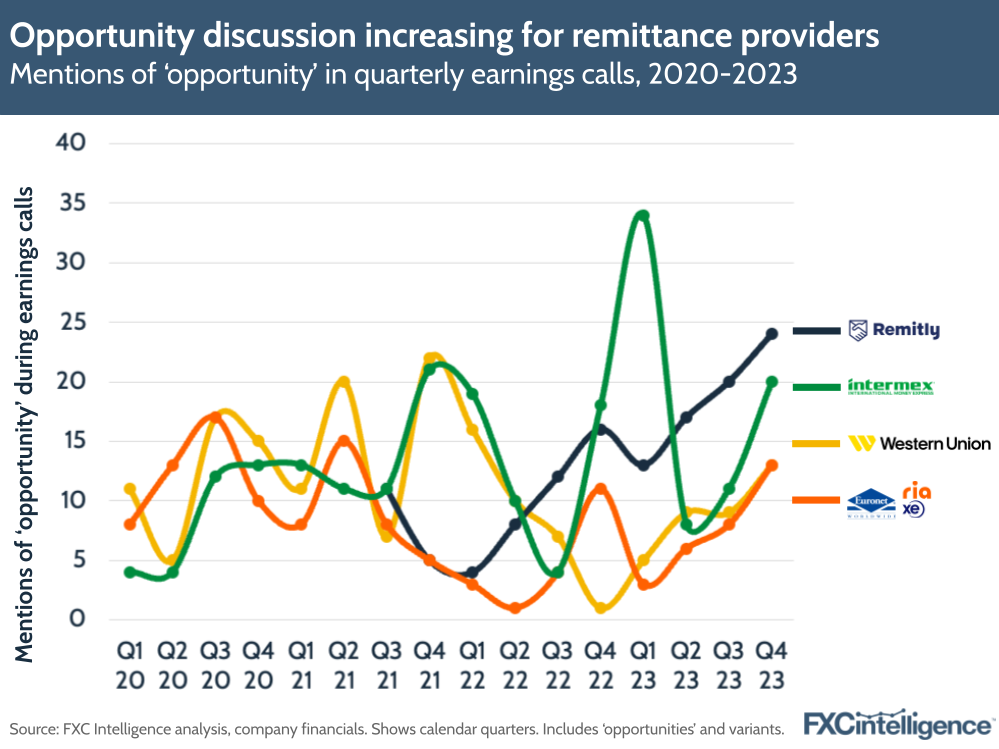

For many, this presents new opportunities, which was reflected in an increased mention of the term opportunity by all four players. Remitly in particular is seeing consistent growth in use of the term as it maps out its next stages of development.

Notably, this quarter also saw the first signs of a potentially longer term embrace of artificial intelligence. While Euronet and Intermex continued to have no mentions of the term, with no instance in any of either of the players’ earnings calls, Western Union and Remitly both saw elevated mentions.

Having only briefly mentioned the term in two previous quarters each, this quarter saw multiple mentions for both players, with Remitly discussing its use to improve customer support while Western Union outlined broader early exploratory work with generative AI.

As we look to 2024, expect to see growing clarity over whether AI truly presents an opportunity for the remittances space – and how the key players are set to grow further in the future.