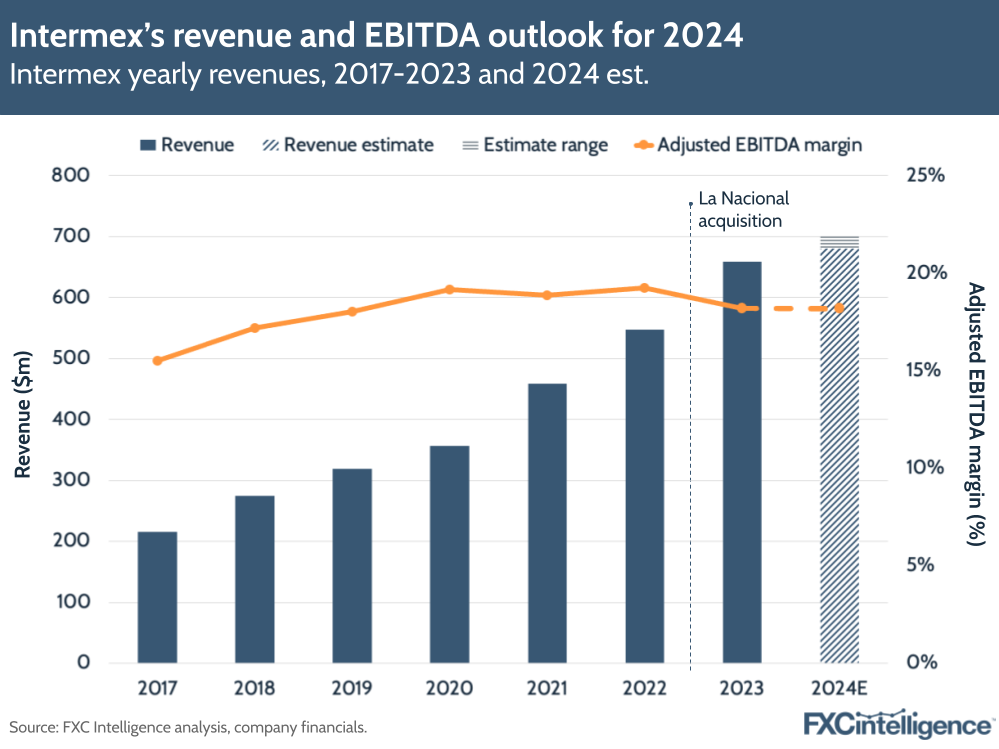

Intermex has reported another record year in terms of total revenues, which rose 20% to $658.7m in 2023. Despite meeting the lower end of its revenue guidance for Q4 2023, the company’s stock price fell after it forecast slower revenue growth in 2024, as well as declining market activity in Mexico.

Intermex’s revenues rose by 11% to $171.8m in Q4 2023. Meanwhile, adjusted EBITDA rose by 14.5% to $33.3m in Q4, giving an EBITDA margin of 19.4%, while for the full year, adjusted EBITDA rose by 14% to $120m, giving a margin of 18.2%.

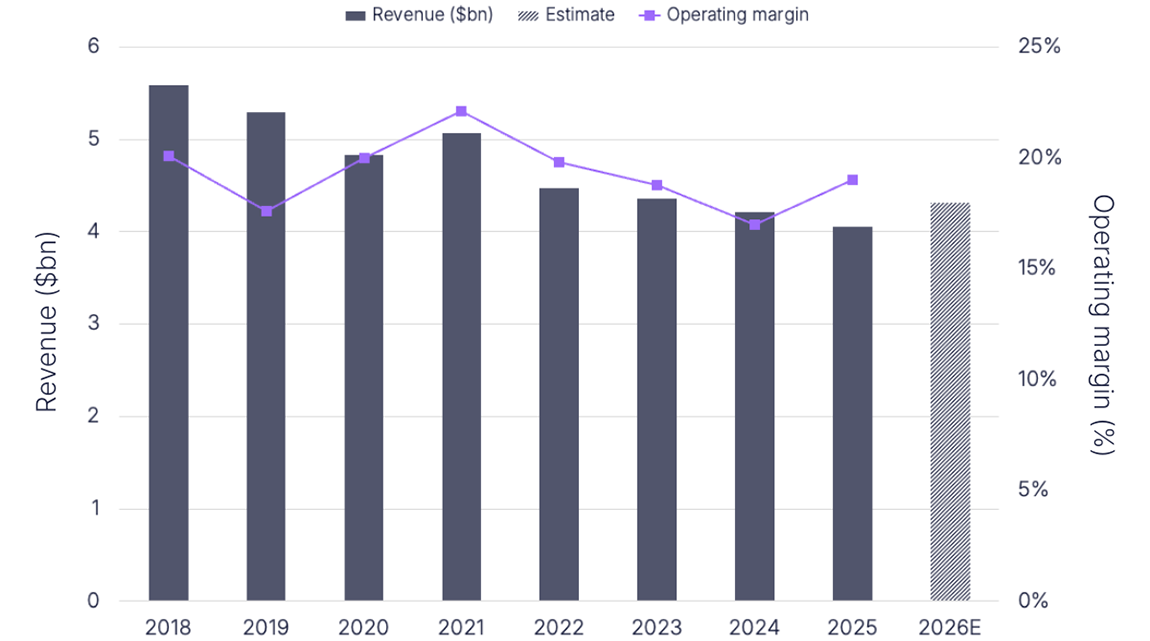

The company also gave its guidance for 2024, which was more conservative than in previous years. The company is expecting a 3-7% revenue rise in 2024, to between $681m and $702m, driven initially by a 3-7% rise in revenues for Q1 2024 to $150m-155m.

Intermex key revenue growth drivers

Intermex continues to be driven by expansions to its core business, as well as La Nacional and i-Transfer, which it acquired recently to move into new markets.

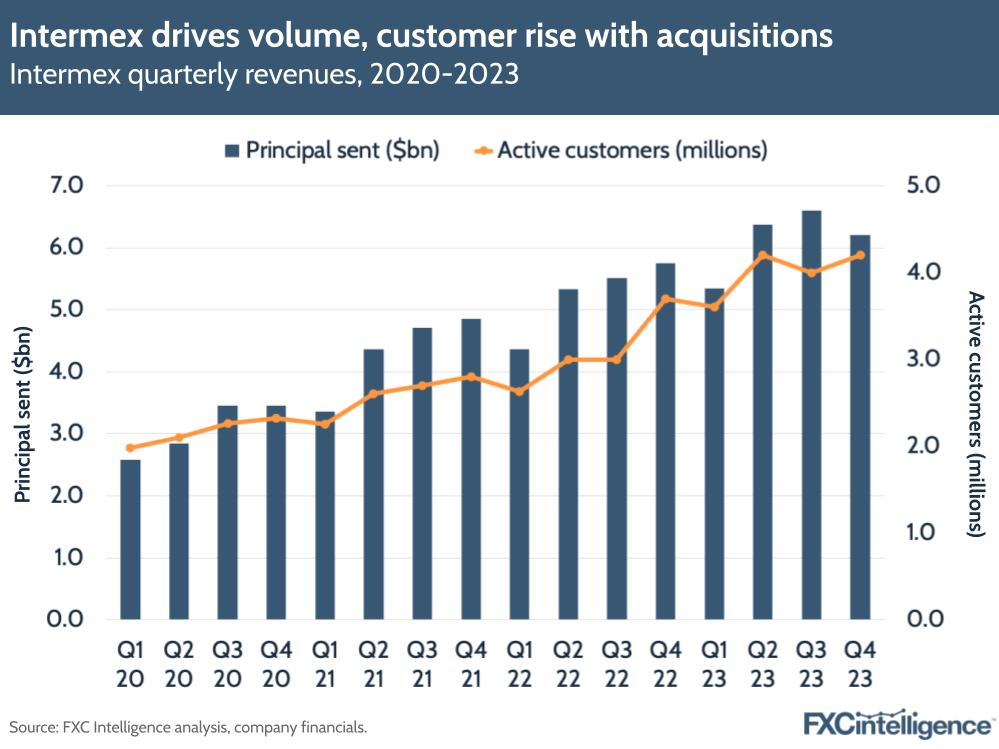

Overall, remittance transactions grew by 11.7% to 15.3 million in Q4, which contributed to a 23% growth in transactions in 2023. Meanwhile, the number of active customers on Intermex’s platform increased by 13.5% to 4.2 million for the quarter, which the company put down to its increased marketing efforts and targeted agent strategy in the US.

Overall, customer and transaction rises contributed to a 6.9% increase in principal sent to $6.2bn in Q4 2023.

The company reported that i-Transfer business in Europe grew by 17% in Q4, while La Nacional in the US was “more powerful” than a year ago. In the earnings call, executives said that La Nacional accounted for about $18m in revenue in Q4, while i-Transfer contributed around $5m.

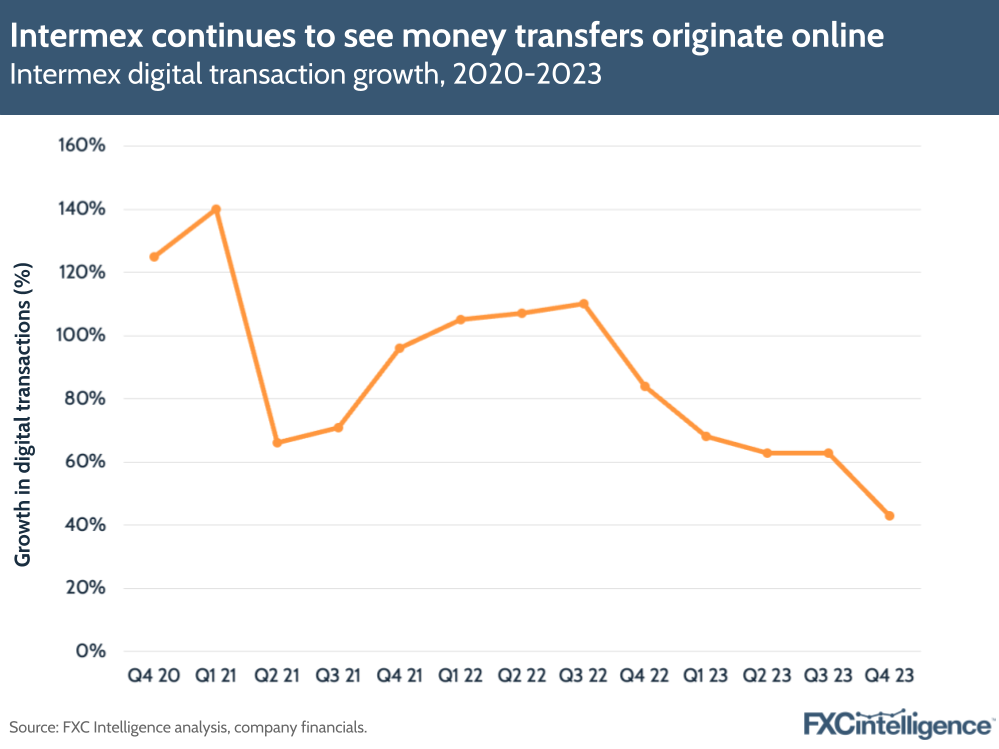

Growing digital transactions

Though Intermex has often spoken about the importance of retail to its core customers, digital transfers are continuing to make an impact for the company. Digital transactions grew by 43% in Q4 2023, and 59% over 2023 as a whole.

The company also continues to see growth in transactions being sent and received digitally, which were up 17.9% in Q4 2023 compared to last year.

In the earnings call, Intermex CEO Bob Lisy said that the strategy is to “carefully cultivate and grow [Intermex’s] digital business with the same efficiency that we have demonstrated while building our retail network”.

Intermex continues its expansion strategy

Intermex completed its acquisition of La Nacional’s US-based assets in November 2022 and its non-US based assets in April 2023, which also included i-Transfer. The acquisition more than doubled the number of markets Intermex has access to, allowing it to provide outbound remittances across several European countries for the first time.

A partnership with Visa Direct, signed in Q4, has also extended Intermex money transfers to eligible cards and bank accounts across 20 countries it wasn’t previously serving.

The company noted that a rise in operating expenses from La Nacional and i-Transfer had an impact on net income, which grew 3.8% to $59.5m for full year 2023 and by 33.9% to $17.5m in Q4 2023.

Higher service charges from agents and banks also had an impact, though these rose at a lower rate than revenues, showing that the company has some resilience against macro effects.

A major headwind, however, has been Mexico, which alongside Guatemala, the Dominican Republic, Honduras and El Salvador, made up 82% of all money sent to Latin America and the Caribbean in 2022 (the most recent figure provided by Intermex). The company says it had 21.4% market share of these markets in 2023.

In Q3 2023, Intermex had spoken about how the changing value of the peso led to pricing pressures from other services in the region, which in turn affected the number of transfers being sent across the US-Mexico corridor – the largest remittance corridor in the world.

Intermex CEO Bob Lisy noted that despite market headwinds and operating costs rising as a result of acquisitions, it managed to maintain profitability and double-digit revenue growth in Q4 2023, and will invest to accelerate growth in the year ahead.