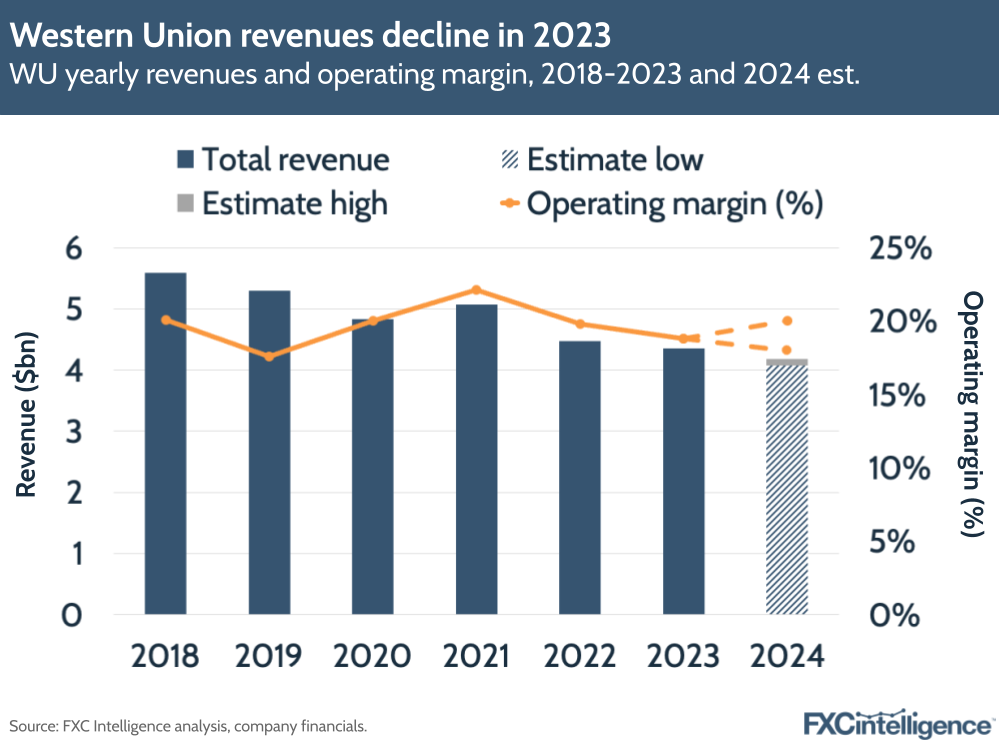

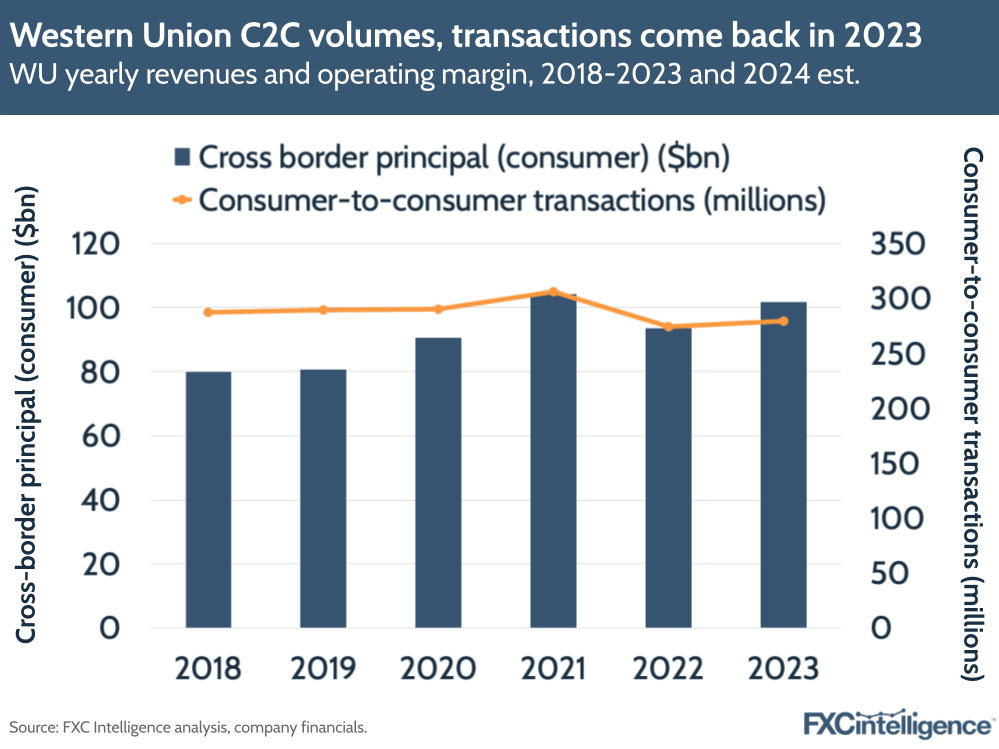

Western Union revenues declined by 4% in Q4 2023, which drove a 3% full-year decline to $4.36bn. The company has projected revenues to fall again in its 2024 guidance, but also saw a turnaround on consumer volumes. This was driven by a rising number of customers and higher transactions, in turn fuelled by its marketing efforts.

The company reported its EBITDA was slightly lower this year at $1.03bn compared to 2022’s $1.06bn, while its EBITDA margin dropped slightly to 23.6%, down from 24.7% in FY 2022. Meanwhile, its operating margin for the year was 18.8%, down from 19.8% last year.

Macroeconomics and customer growth drive growth in Q4 2023

Western Union’s consumer money transfer segment (previously reported as its C2C segment) revenue declined by 1% in Q4 2023, but was flat on an annual basis. This was an improvement on 2022, however, when it reported a 9% decline.

With the completion of the sale of Western Union Business Solutions in July 2023, the company reported no business revenues for the second half of the year and a minimal contribution to its FY revenues. However, its other revenues stem from its Consumer Services segment (previously referred to as Other in its reporting), which represents around 7% of total company revenues. This segment saw double-digit growth in 2023 and the company believes this will extend into 2024.

Western Union continued to see the impact of global macroeconomics and customer retention on its revenues last year. In particular, inflation in Argentina benefitted revenue by approximately three percentage points. Growth was also driven by higher-than-expected revenues in Iraq due to changing central bank policies in the country.

Western Union is making progress when it comes to retaining and gaining new customers. It noted that retail retention had improved by 70 basis points versus 2022, while for branded digital – which refers to Western Union’s digital services – retention saw a 120 basis point improvement.

The company also said it has grown new digital customers by 13% while lowering customer acquisition costs by over 15% through its new marketing strategy. Alongside this, transactions also grew by more than 5% for the second consecutive quarter for the first time in nearly a decade.

This translated to cross-border principal growth of 8% in Q4 2023 to $25.2bn, which drove 9% growth for the full year. This is compared to a -12% decline in Q4 2022 and a -10% decline across 2022 as a whole.

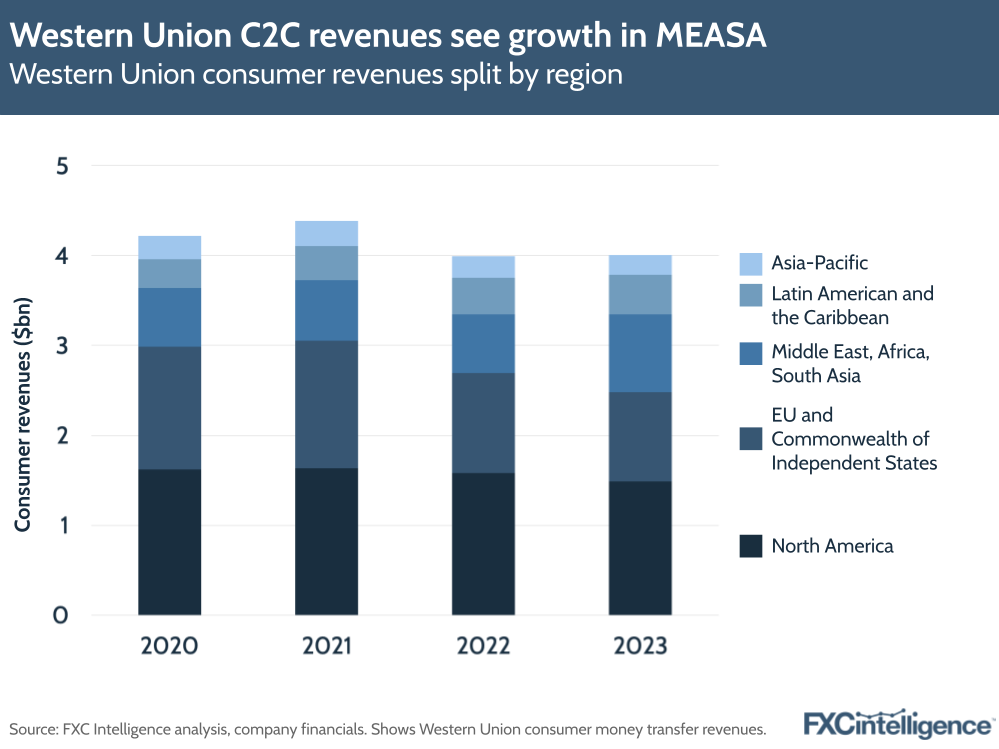

Middle East and LACA drive consumer revenues

Though Western Union noted a 1% decline for CMT revenues for Q4, the 5% transaction rise was propped up by Iraq and its MEASA segment. Looking geographically, the company continued to see softness in Europe, the Commonwealth of Independent States and North America (though revenues for these all improved quarter-on-quarter).

Transactions grew across several key corridors, such as the US to Mexico. Increased migration from other countries (in particular to the US) is contributing to this growth.

North America continued to make up the main share of consumer revenues in Q4 (39%), followed by EU and CIS (25%), MEASA (18%), LACA (12%) and APAC (6%). Looking at the regional breakdown for 2023 against previous years, it’s clear to see the growth of MEASA against the declining share of EU & CIS.

On Iraq, Western Union did note regulatory uncertainty was ongoing, and the suspension of one of its largest agents in the country could result in volumes returning to levels closer to 2022. Paired with impacts from Russia and Belarus, it is another example of macroeconomic instability having a notable effect on Western Union’s revenues.

The company also noted an expansion with Visa Direct, which it said will enable further collaboration across 40 countries and five regions.

Driving digital customer acquisition

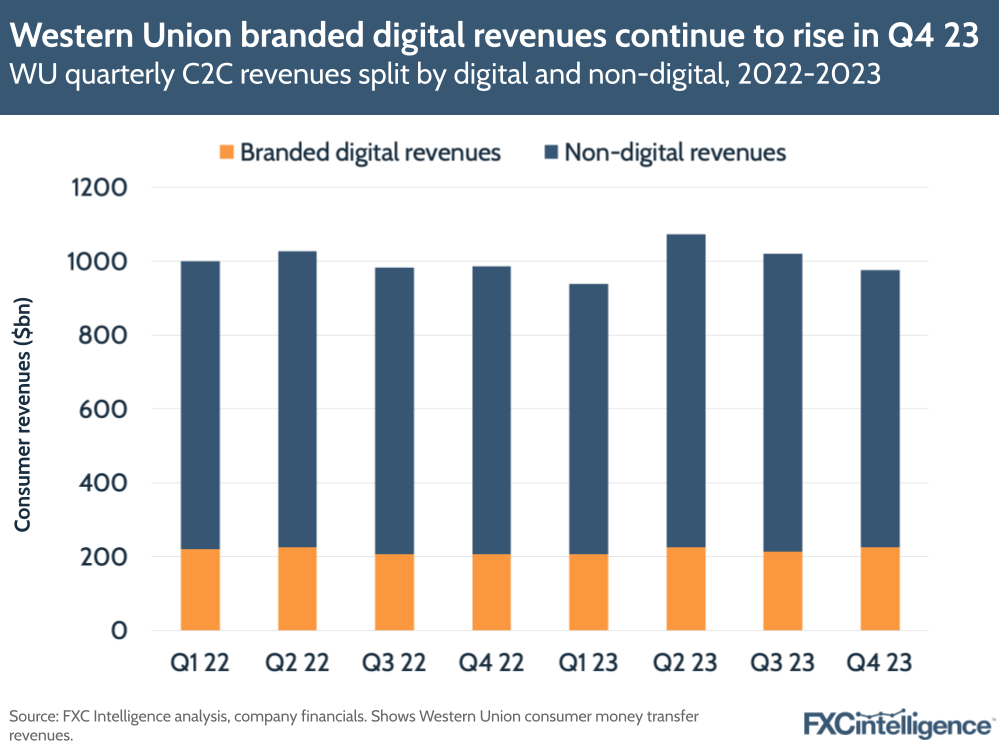

Branded digital revenues continued to rise in Q4, increasing by 4% in Q4, while transactions grew by 13% in Q4. Overall, branded digital represented 23% and 29% of total CMT revenues and transactions respectively. While not a seismic shift in share, it continues the comeback for digital revenues that Western Union started last quarter.

A key part of Western Union’s ‘digital go-to-market’ strategy has been expanding the use of its app and digital wallet worldwide, a move that seemingly looks to the success of digital challengers such as Remitly or Wise.

The company has now launched its app in 12 countries, with a digital wallet in four European countries, as well as one LatAm nation. Driving the aforementioned digital customer growth, over 200,000 customers onboarded to the digital wallet in Europe over the quarter, alongside 50,000 in Argentina.

Interestingly, the company is shifting its focus with regards to omnichannel customers (i.e. customers using both retail and digital parts of the service). This is because only 30% of omnichannel customers stayed that way at the end of 2023, while customers that moved from retail to digital accounted for 5% of branded digital customers by the end of the year.

CEO Devin McGranahan said in the call that digital customers that were previously retail customers had better retention than new digital customers; the company will therefore look more at how to move customers from retail into digital, as opposed to growing omnichannel customers directly.

Investments in Western Union’s future

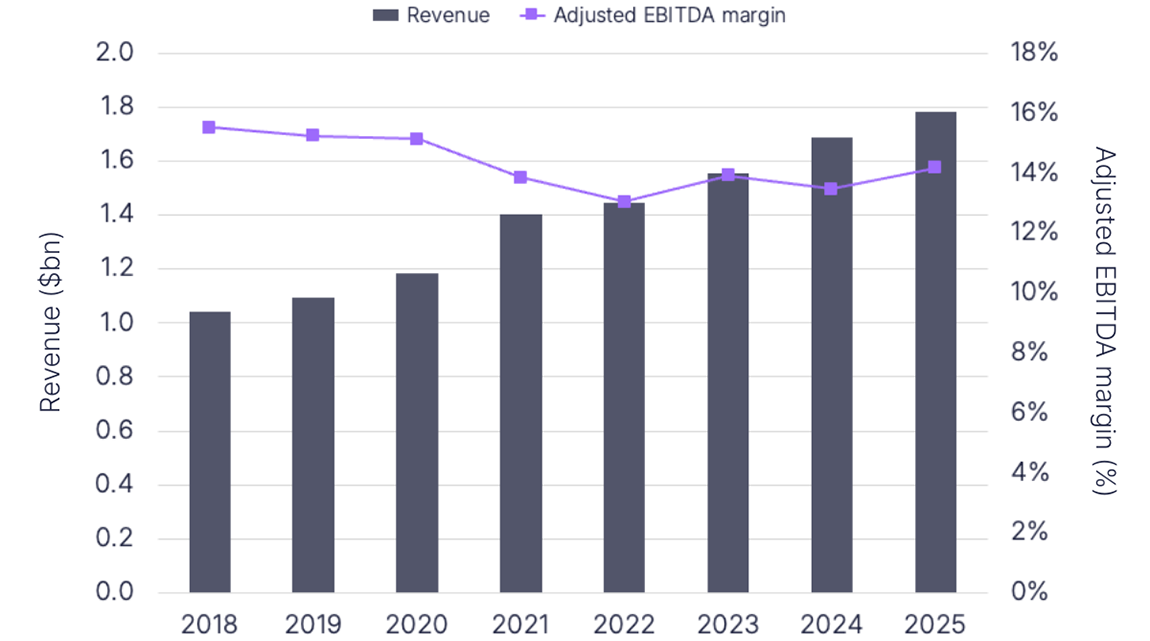

Western Union is seeing positive results from its moves to grow customer transactions and volumes. The question will be how it will translate this to revenue and profitability. The company has projected that revenues will once again decline in 2024 to a range between $4.1bn-4.2bn on a GAAP basis, and expected operating margin of 18-20%.

This is amongst Western Union’s continued investment in Evolve 2025 – its ongoing strategy to revitalise growth, improve its products and close the gap between transactions and revenue. As part of this, it has observed higher costs – selling, general and administrative costs for Q4 were $237m, which is around 23% of the company’s revenue for that quarter.

That being said, Western Union noted that it had seen over $50m of savings in 2023 from a cost-cutting programme, under which it aims to “redeploy” approximately $150m in expenses for the company over the next five years (it was first unveiled in 2022). Western Union also noted the potential of generative AI to drive further cost savings for the company – this is after it noted robotic processing automation is already being used in areas like agent collection and customer refunds.

Going forward, Western Union wants to grow its digital wallet and retention with customers, but McGranahan also repeatedly mentioned building more of an ‘account-based relationship’ with customers, driving them towards services like retail money orders, bill payments and prepaid cards, which don’t serve its CMT segment. This was part of a strategy to grow its Consumer Services segment by double digits annually.

While, Western Union did note a shift in focus away from neobank customers to “high-quality cross-border remittance customers”, it has expressed a desire to expand its total addressable market beyond the remittances market, which could lead to some interesting developments this year.

How does Western Union’s pricing compare to other money transfer providers?