Adyen has announced its H1 2025 results, and while the European payments processor has continued to see growth, headwinds from the US tariffs and a weak dollar have seen it post lower-than-expected results and reduce its projections for FY 2025, prompting shares to tumble.

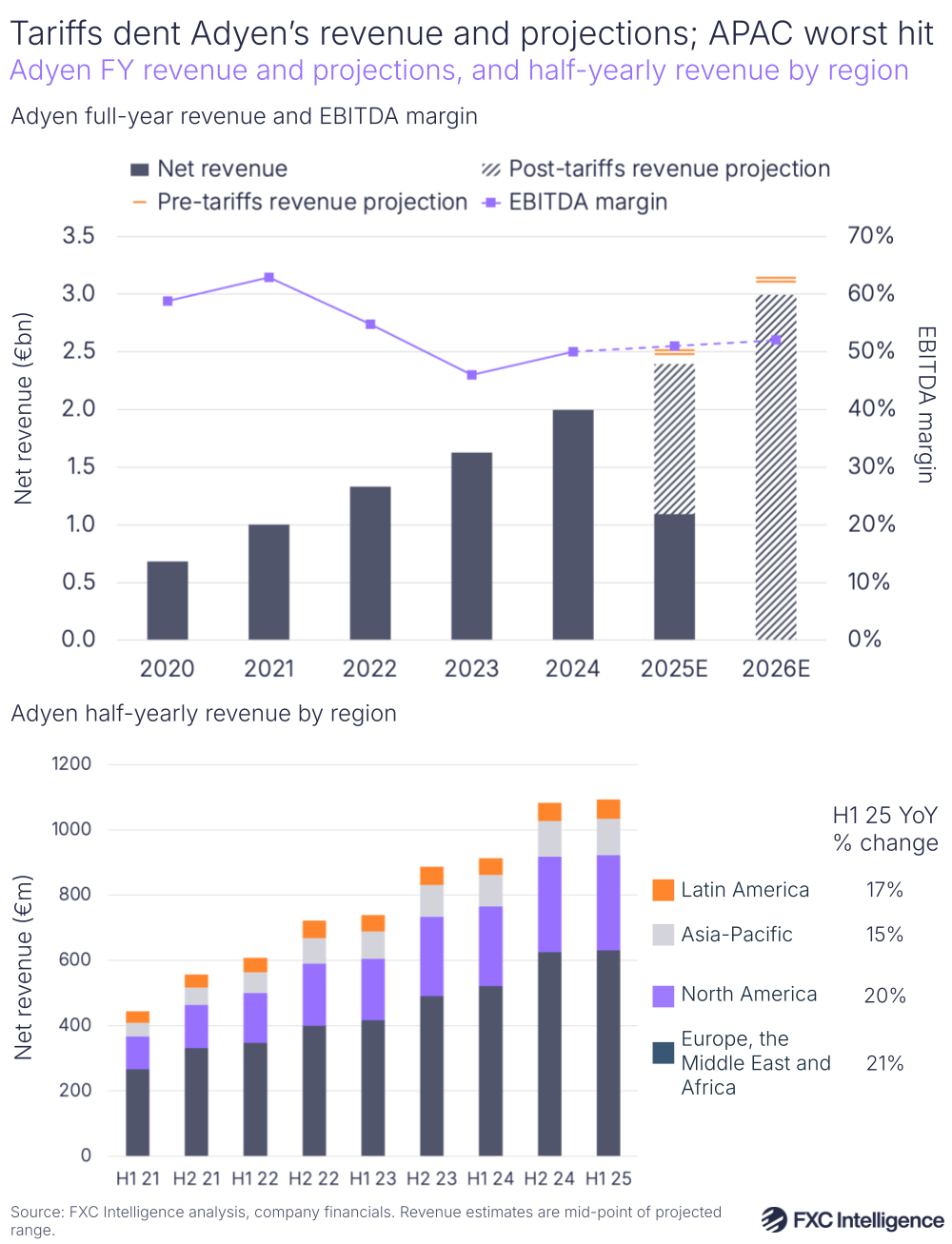

The company saw net revenue climb 20% YoY (or 21% on a constant currency basis) to €1.1bn, below its previously stated projection of a “slight acceleration” in 2025 net revenue growth, as it is its lowest rate of half-yearly YoY revenue growth to-date. This has also prompted the company to reduce its projections for the second half of the year to growth roughly in-line with H1, describing the “previously anticipated acceleration [as] unlikely”, meaning its FY 2025 projections are now below the previous low end of its estimates.

This is largely the result of the US tariffs, as well as the strong euro versus the dollar, with Adyen Co-CEO Ingo Uytdehaage highlighting that the company’s customers based in Asia-Pacific who are trading into the US were having a particularly strong impact on the company’s numbers. This was something Adyen saw more in Q2 as the tariffs began to bite, with the company anticipating it to continue across the rest of the year.

Asia-Pacific did see the lowest rate of growth for Adyen this quarter, at 15%, although EMEA and North America’s 21% and 20% respectively were lower than previous periods. Latin America, the company’s smallest region, saw 17% YoY growth, which was its strongest growth rate since 2022.

By contrast, the company saw EBITDA growth of 29% to €544m, a slightly slower growth rate than the last two periods but remaining solid relative to some earlier points, which produced an EBITDA margin of 50%. Despite planning to continue hiring to support ongoing growth, Adyen has made efforts to tighten its operational expenditure and now expects a slight increase in EBITDA margin in H2.

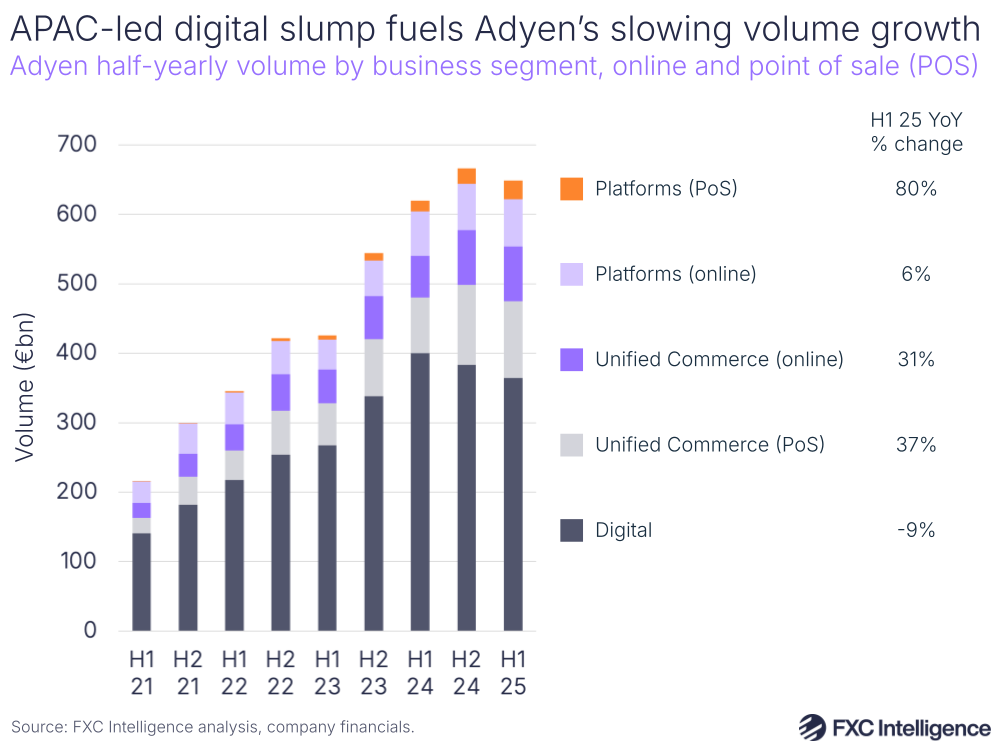

While it had an impact on revenue growth, the tariffs’ hit to volume growth was more pronounced, with processed volume climbing just 5% YoY to €649bn. This is the only time Adyen has reported single-digit growth in this metric in its seven years as a publicly traded company, and is around 17 percentage points below the next lowest half-year period of growth for processed volume during that time.

Digital, the company’s largest segment for both volume and revenue, was the biggest driver of this, with its volume dropping 9% YoY – its first reported YoY decline. This was largely attributed to Asia-based retailers.

Despite the headwinds, Adyen stressed that it expected to return to its previously expected growth trajectory in 2026 and highlighted key areas where the company is investing in innovation to support this. The company is aiming to take “full control” over its payments infrastructure, aided by ongoing acquisition of banking licences, according to Uytdehaage, and now sees stablecoins playing a role in this area. While Adyen has not yet added any stablecoin solutions, the co-CEO said that the company “would look into” pay-outs if there is customer demand, but currently sees the use of stablecoins as a payment method as “very unlikely” at this stage.

How can ecommerce players benchmark their multicurrency pricing?