Payment processors grew again in the first quarter of 2024, though in some cases revenue growth hasn’t been as fast as in previous years. We explore some of the key trends from the first quarter of the year for publicly traded payment processors.

Publicly traded payment processors continued to see positive growth in Q1 2024, though in some cases revenue growth hasn’t been as fast as previous years.

In this new report, we’ve once again reviewed both the latest and historical earnings for some of the biggest publicly traded payment processors to find out how the industry is evolving, highlighting key trends and who is coming out on top across different metrics.

We’ve compared a range of payment processors with different focuses, as well as those that are directly competing with each other. These include Adyen, dLocal, Fiserv, Global Payments, PayPal, Paysafe, Worldline and Square. We’ve also included historical earnings for Worldpay as a point of comparison, though in February a majority share of Worldpay was sold by parent company FIS to private equity firm GTCR, meaning it is no longer publicly traded and as a result Q1 2024 figures are not available.

Please note that companies have been compared on each metric for which there is comparable data. We’ve also identified how often certain keywords are cropping up in available earnings calls to get a sense of important trends in the space.

Revenue growth among payment processors in Q1 2024

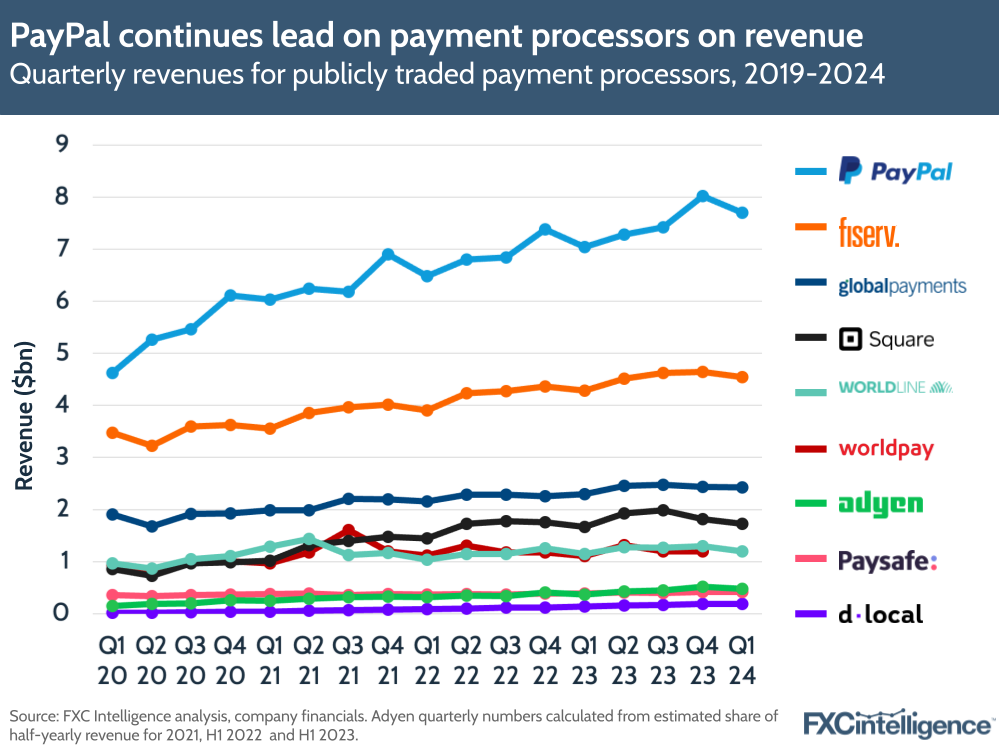

PayPal continues to lead payment processors on revenue in Q1 2024, with revenues continuing to remain higher than the next two processors in the ranking – Fiserv and Global Payments – combined.

Looking further down, companies are largely maintaining their positions. Adyen continued to see higher quarterly revenues than Paysafe (when converting from EUR to USD), having initially pulled ahead of the company in Q4 2022.

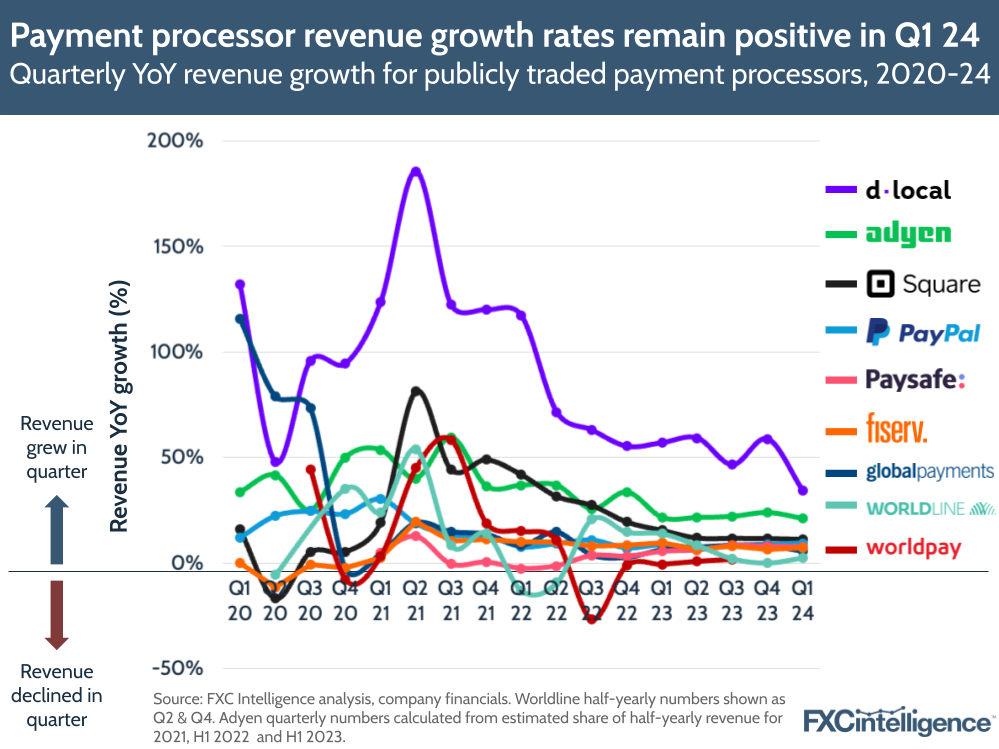

The story is different when it comes to growth rates, with emerging markets player dLocal once again seeing the strongest quarterly revenue growth at 34%. However, this was the lowest YoY revenue growth for the company since it went public, prompted by headwinds in two of its core markets (for more on the company’s long-term strategy, see our interview with dLocal CEO Pedro Arnt earlier this year).

The next highest growth rate was Adyen, which saw revenues grow by 27% in Q1 2024, followed by Square with 11%. The other companies all saw single-digit growth, with PayPal at 9%, Paysafe at 8%, Fiserv and Global Payments at 6% and Worldline seeing 3% growth during the quarter.

Though growth for several of these companies is significantly lower than it was during the Covid-19 pandemic, this was the fourth consecutive quarter that all of the companies tracked here saw YoY quarterly growth, which is a positive sign of ongoing strength in the industry.

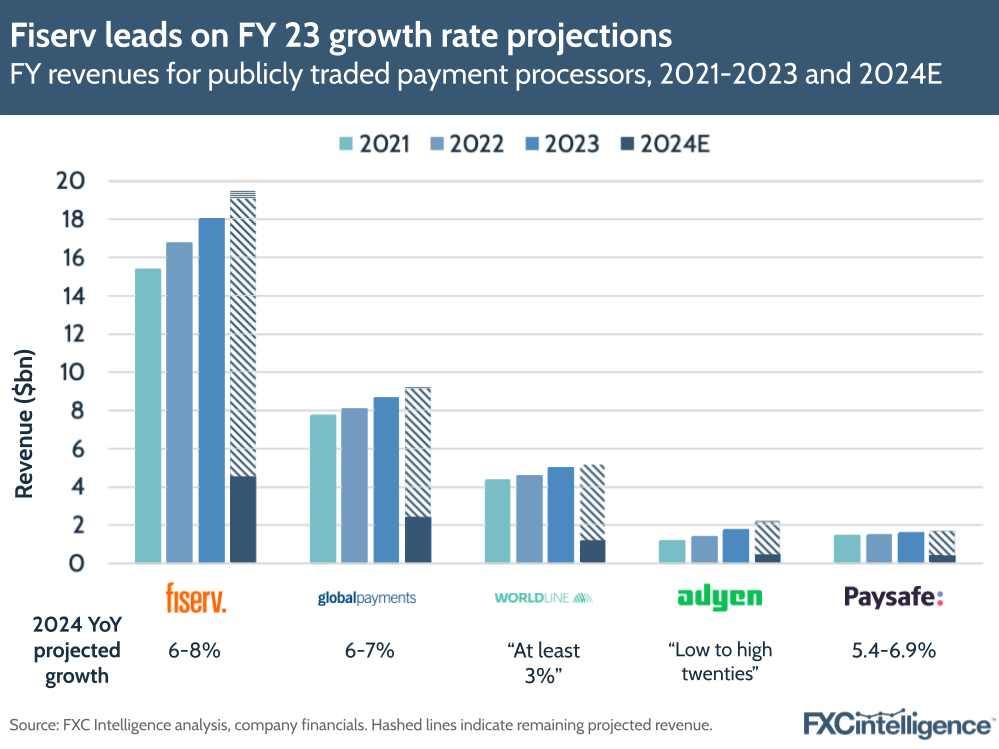

When it comes to forecasting, fewer companies have offered up a projection for their full year results in 2024. For Worldpay, this is because the company is no longer publicly sharing its figures, while for PayPal it opted to only share forecasts for Q2 2024 (6.5% growth on a spot basis, 7% on an FX-neutral basis) rather than the full year.

Despite its solid (if declining) growth rate, dLocal did not give revenue guidance for 2024. However, the company did say it was tracking towards delivering on its 2024 guidance, in which it was expecting total payment volumes to grow by 40-50%, but that there was a greater likelihood of coming in towards the lower end of issued ranges.

Adyen and Worldline reaffirmed their revenue projections for the year, with Adyen forecasting continued solid growth between the low and high twenties, up to and including 2026, while Worldline expects growth to be at least 3%, in line with its recent results.

Meanwhile, Fiserv, Global Payments and Paysafe all expect similar growth, with Fiserv expecting 6-8% FY revenue growth; Global Payments expecting between 6% and 7%; and Paysafe expecting between 5.4% and 6.9% growth (based on our calculations from its projected revenue figures).

Investors reacted positively to the Q1 2024 earnings results of PayPal, Paysafe, Block, Fiserv and Worldline. However, dLocal saw a significant share price drop in response to its declining EBITDA and aforementioned headwinds.

Global Payments and Adyen also saw their share prices fall in the wake of their results, despite reporting growth. The latter’s share price had previously seen a major slump last year after a share sell-off in light of failure to meet revenue expectations, concerns over the company’s hiring spree amid interest rate rises and economic slowdown, though it has partially recovered since then.

Profitability varies amongst payment processors

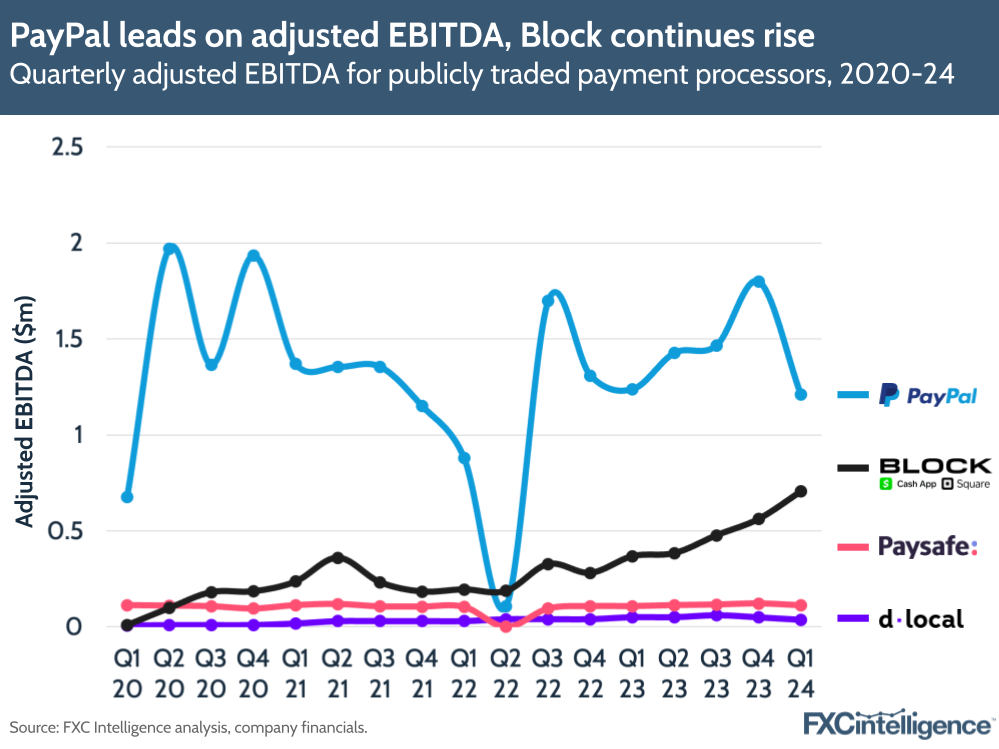

Examining companies’ EBITDA highlights how they have been able to profit over time. PayPal’s EBITDA declined by 2% in Q1 2024, but it is still leading the pack with EBITDA amounting to more than $1.2bn in this quarter.

Block, meanwhile, saw EBITDA rise by 92% – its fifth consecutive quarterly rise – on the back of the continued strength of both Cash App and Square, as well as streamlining operating expenses.

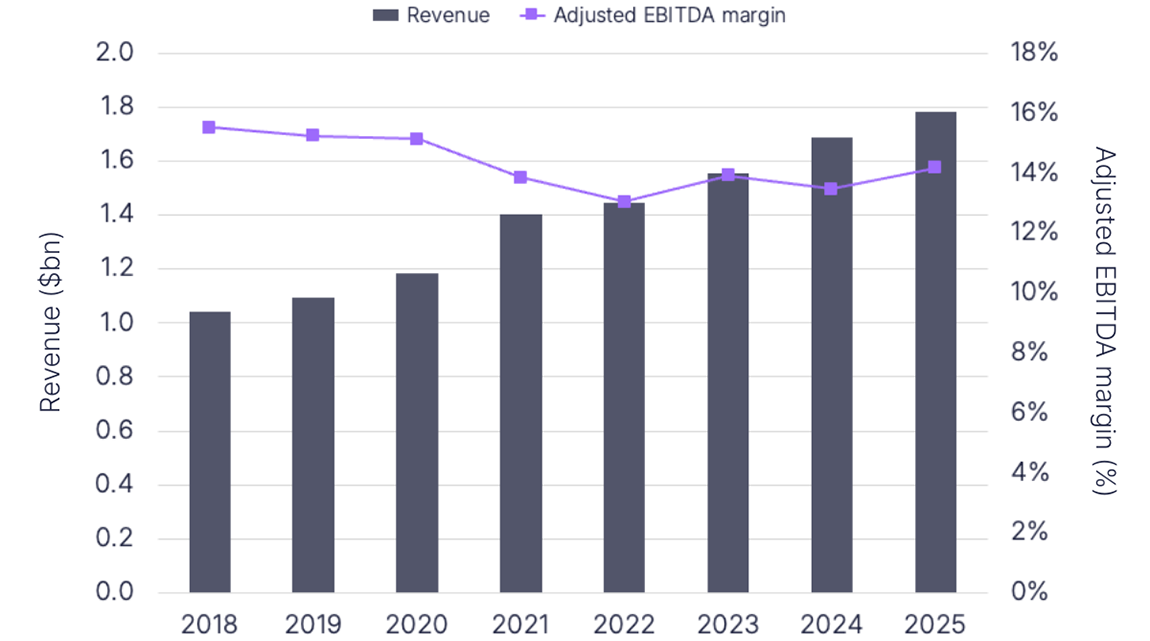

Paysafe and dLocal are smaller companies, with smaller EBITDAs. dLocal’s adjusted EBITDA dropped by 19%, the result of higher operating expenses against gross profit losses in some core markets (particularly Argentina). Meanwhile, Paysafe managed to achieve a 4% rise in EBITDA despite increasing its investment in new hires to grow its SMB division.

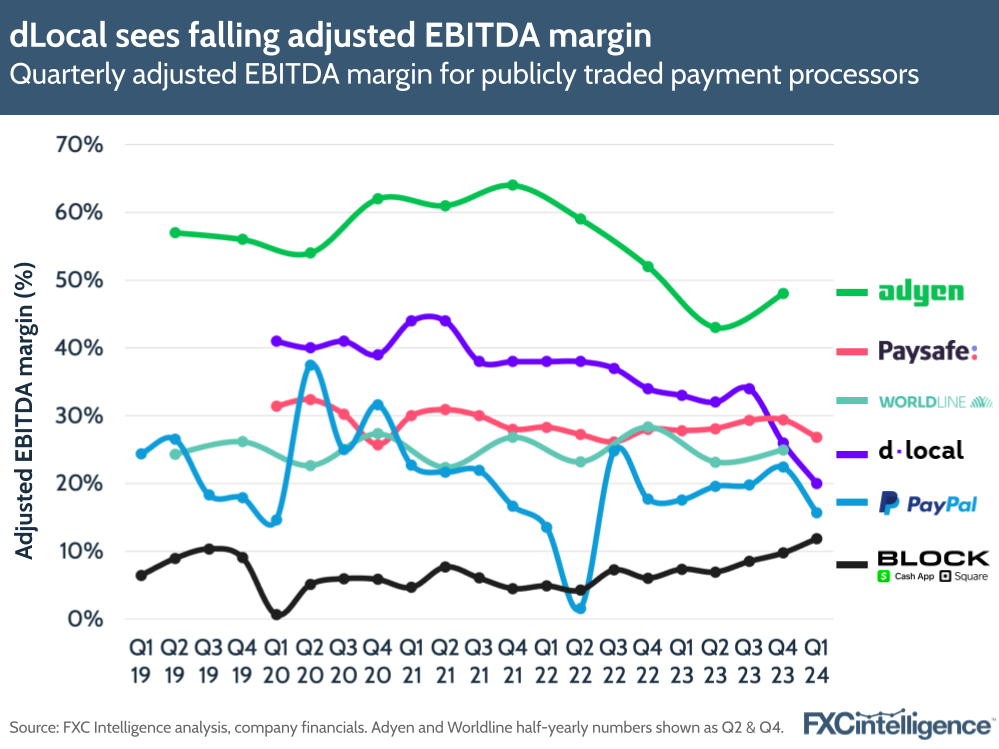

However, looking at adjusted EBITDA margins puts things in perspective. Adyen only reports its EBITDA on a half-yearly basis (shown in the image below as its Q4 23 figure), but it is consistently higher than competitors and was 48% in H2 23, the last available figure.

With regards to margin, Block and PayPal remain at the bottom of the pack in Q1 2024, though PayPal has seen its EBITDA margin fall by around two percentage points compared to Q1 2023, while Block’s has grown by around five percentage points, having grown consistently over the last few quarters.

Mirroring its slowing revenue growth, dLocal has seen the most significant YoY drop in its EBITDA margin, from 33% in Q1 2023 to 20% in Q1 2024. Its margin is now lower than Paysafe, which saw a one percentage point decline to 27% but has one of the most consistent EBITDA margins of the bunch.

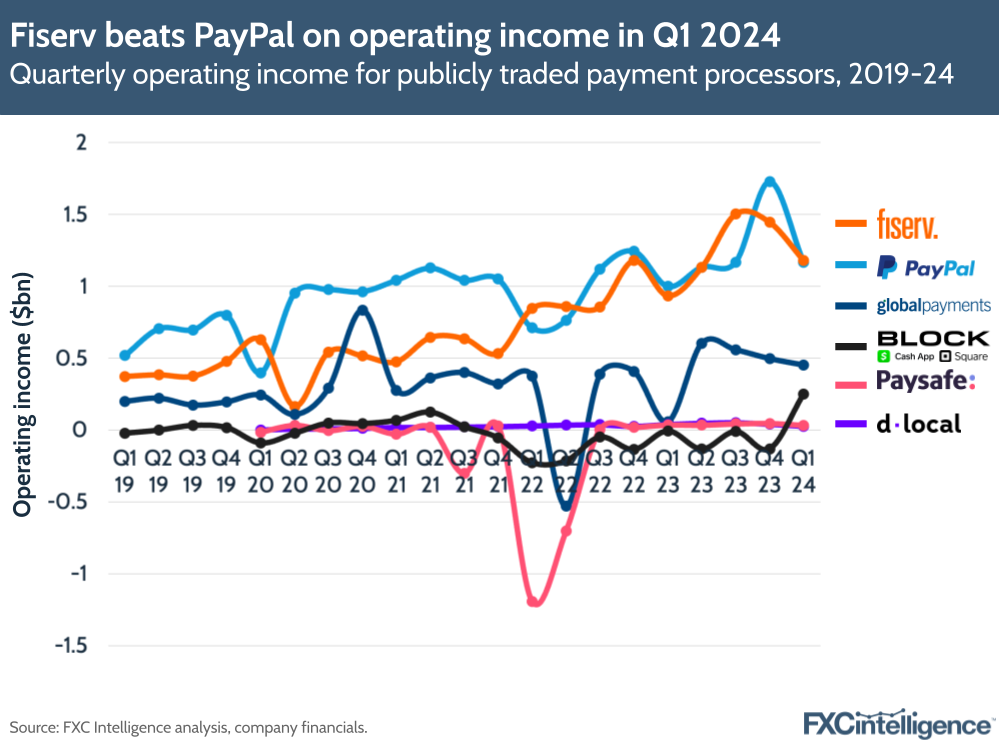

Meanwhile, on operating income, Fiserv has once again edged just ahead of PayPal in Q1 2024, with both companies having operating incomes approaching $1.2bn, substantially higher than the next highest in the ranking, Global Payments, which saw an operating income of $452m.

The biggest shift here is arguably Block, which reported an operating income of $250m – the first positive result for this metric the company has seen since Q3 2021. In its results, the company also said it expects at least $1.3bn in adjusted operating income in 2024. Once again, dLocal and Paysafe saw lower operating incomes than other companies, but these were also positive.

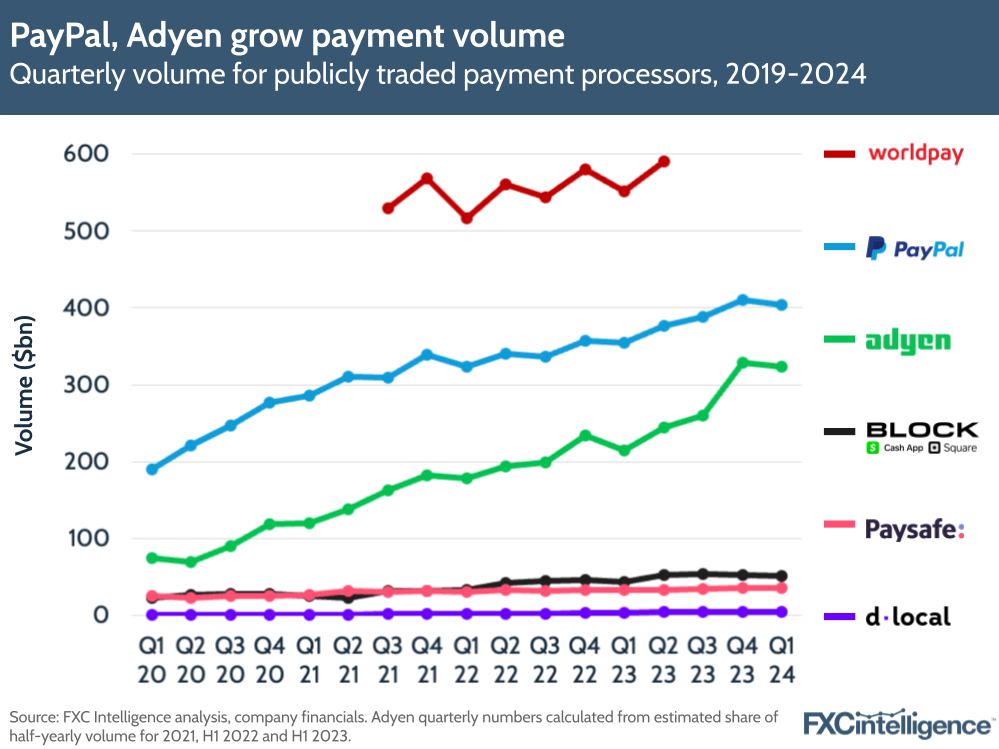

Not all companies report volumes, but those that do have reported rises in Q1. Worldpay has historically seen lower volumes in Q1 versus other quarters, but it is likely that this company has maintained its lead over the other processors in Q1 2024.

Of those companies that have reported, PayPal had the highest quarterly volume in Q1 – this figure rose by 14% to $403.9bn. However, Adyen could continue to catch up, with quarterly volumes rising by 46% to €297.8bn (around $324bn) in Q1.

Though it has significantly lower volumes than the other players, dLocal continues to see relatively high total payments growth, with Q1 volumes rising by 49% YoY. This was the result of volumes from ecommerce nearly tripling, remittances “practically doubling” and other verticals also seeing solid growth.

Combined volumes from Square and Cash App contributed to a 6% rise in gross payment volumes for Block, while Paysafe grew by 7%.

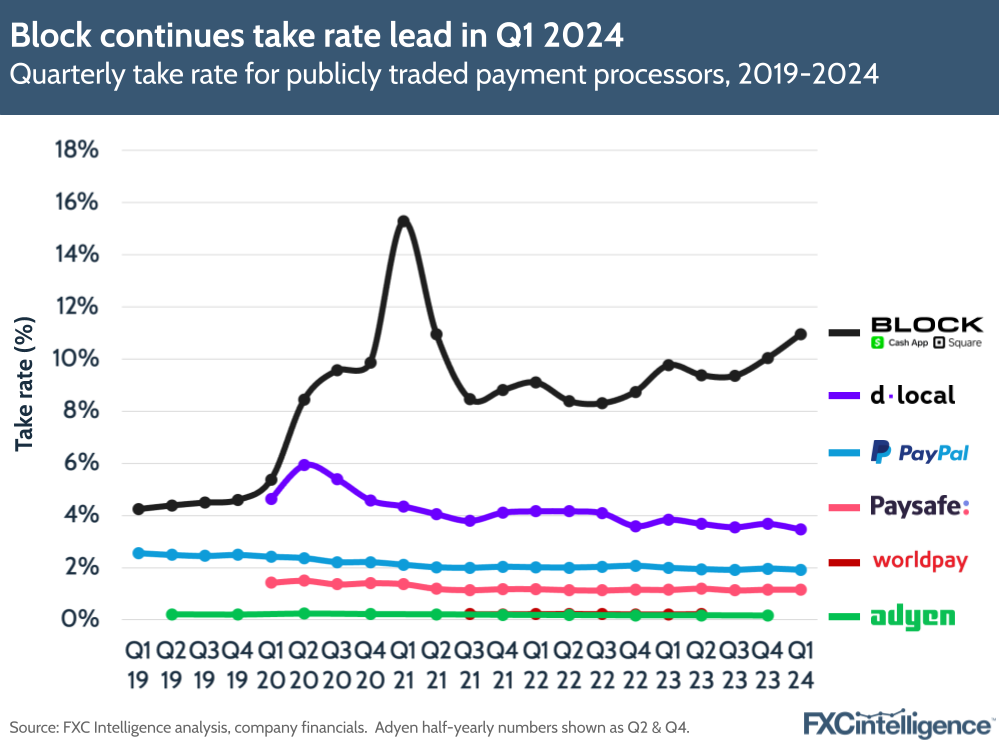

On take rate, Block continues to lead by a significant distance and has also seen the most significant growth in its take rate (YoY) by over one percentage point. Meanwhile, dLocal and PayPal both saw YoY and QoQ declines in their take rate, though dLocal’s take rate still remains relatively high compared to Paysafe and Adyen.

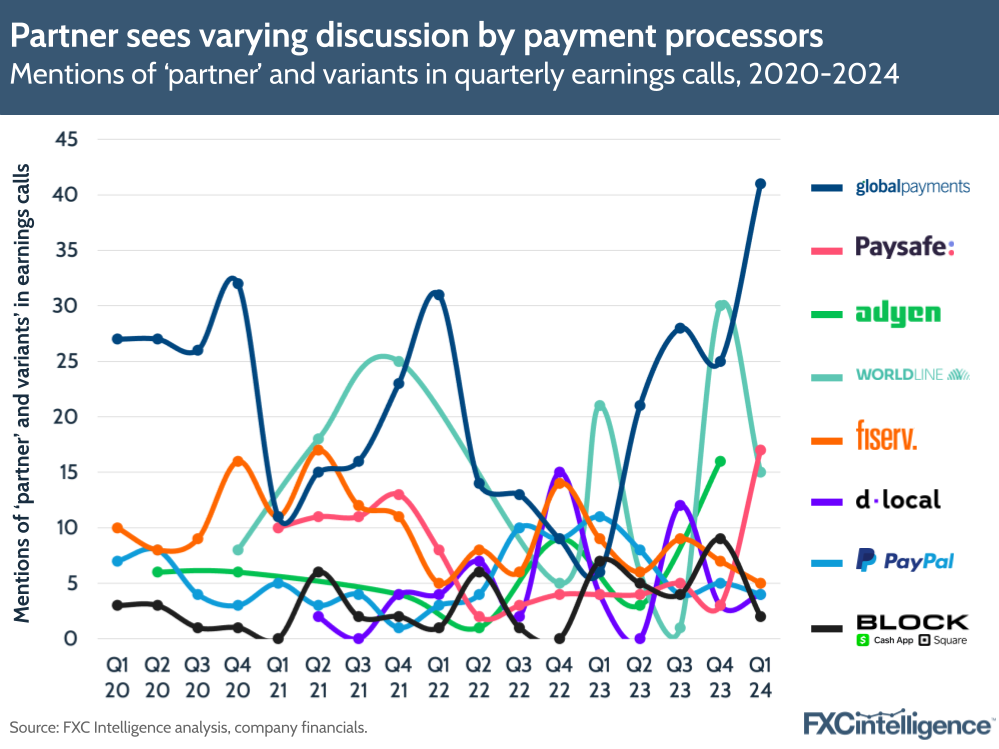

Partnerships sees growing discussion among some players

Aside from revenue and profit figures, looking at how often certain terms are discussed amongst different companies also highlights certain trends for the quarters. One particular term that all players keep discussing is partnerships, which demonstrates the impact that they continue to have on the space.

While some companies saw less discussion of the term compared to Q1 2023 (PayPal, Fiserv and Block), Global Payments and Paysafe saw notable upswings in usage of the term, with the former using the term ‘partner’ or ‘partnerships’ 41 times during the call.

Global Payments often used the term ‘partner’ in reference to its independent software vendor segment, and it mentioned that it had doubled the number of new strategic integrated partners it had signed in Q1 2024 compared to the previous year.

Worldline also saw high usage of the term in Q1 as it made a big step further into the Italian market through a deal with Cassa Centrale Banca, which could generate volumes of around €6bn.

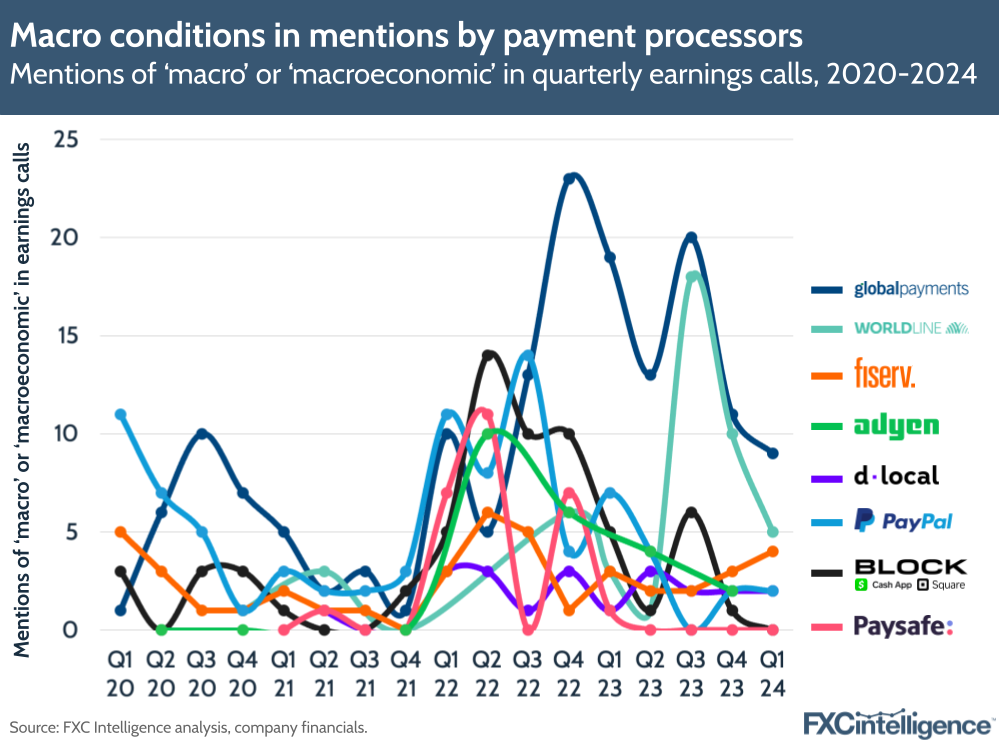

Are macroeconomic conditions still affecting processors?

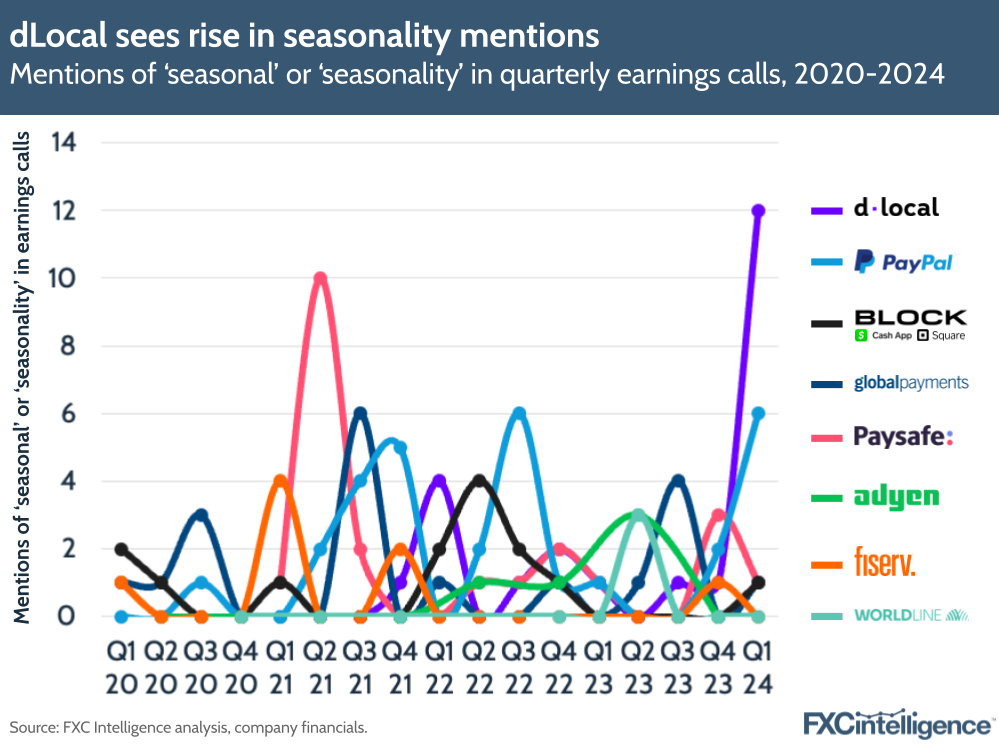

In our FY 2023 report for payment processors, we noted that several companies had not mentioned macroeconomic conditions as much in Q4 2023 compared to previous quarters, which suggested that concerns over the impact of macro conditions could be abating. This was also aligned with declining discussions of seasonality, which can affect consumer spending.

In Q1 2024, macroeconomic conditions have been discussed fewer times compared to Q1 2023 by companies such as Global Payments, Block and PayPal; the same number of times by dLocal and Paysafe (which didn’t use the term); and more times by dLocal and Worldline.

The varying discussion of this term suggests that macro factors are still an influencing factor for the space, but these conditions aren’t necessarily at the front of mind or having such a large impact on some companies that they need to be mentioned frequently to contextualise their progress.

Having said this, the terms ‘seasonal’ and ‘seasonality’ were frequently mentioned across processors this quarter. In PayPal’s case, we included mentions of ‘holiday season’ (which they referred to repeatedly with regards to merchants). dLocal saw mentions of this word shoot up in Q1 as it claimed seasonality had played a role in driving lower volumes in some of its LatAm markets.

Consistent mention of this term shows that processors continue to see spending patterns often affect its revenues at certain times of the year.

How are processors discussing artificial intelligence?

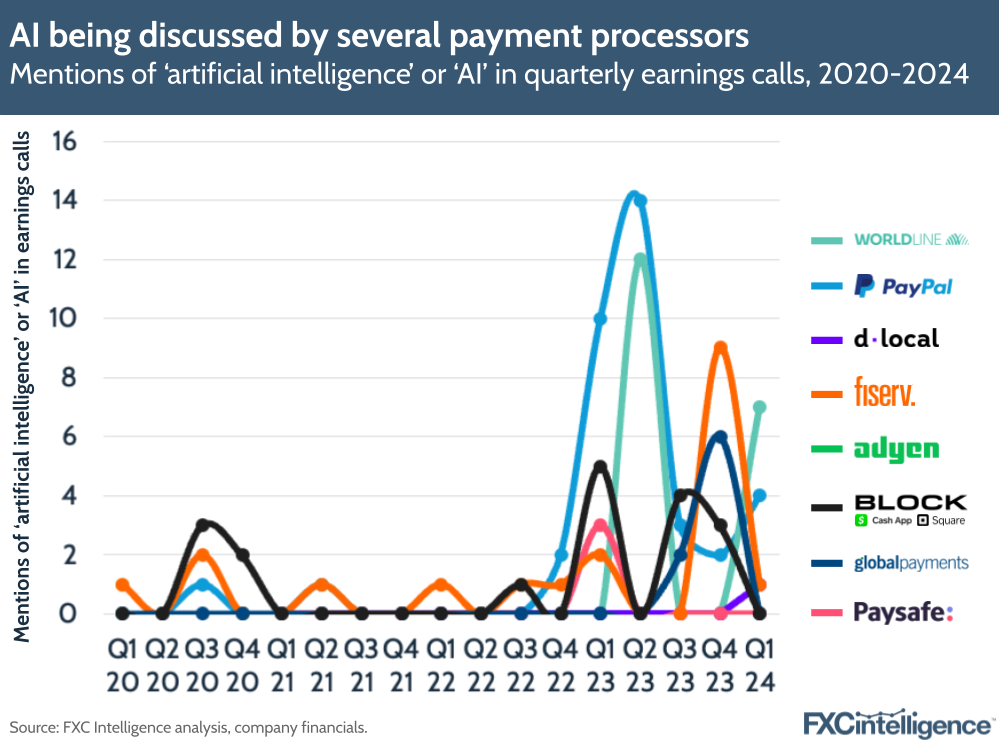

At this year’s Money20/20 Europe event, we noted that artificial intelligence (AI) remains a key topic of discussion but that we may be over the peak of the hype, with companies now looking at realistic discussions of its use in the space.

Looking at mentions of AI across payment processors in Q1, the shape of the graphic somewhat reflects this sentiment, with four companies discussing the technology in Q1 – specifically PayPal, Worldline, dLocal and Fiserv.

Worldline, which mentioned AI the most this quarter, talked about the role generative AI was playing in increasing productivity for developers, as well as in augmenting its customer services. Meanwhile, PayPal CEO Alex Chriss talked about the potential of AI in risk models, while also saying “there are a lot of AI conversations in the market”.

AI has already been a tool used in payments for some time and while the advent of generative AI spurred a wave of new discussion about new technologies and tools, it remains to be seen whether these results will become more tangible for processors in the future.