Moneycorp posted another solid year of growth in its annual results for 2024, in which it achieved conditional approval for a US bank charter. In our latest post-earnings series interview, we caught up with CEO Velizar Tarashev to find out what’s behind the company’s strategy.

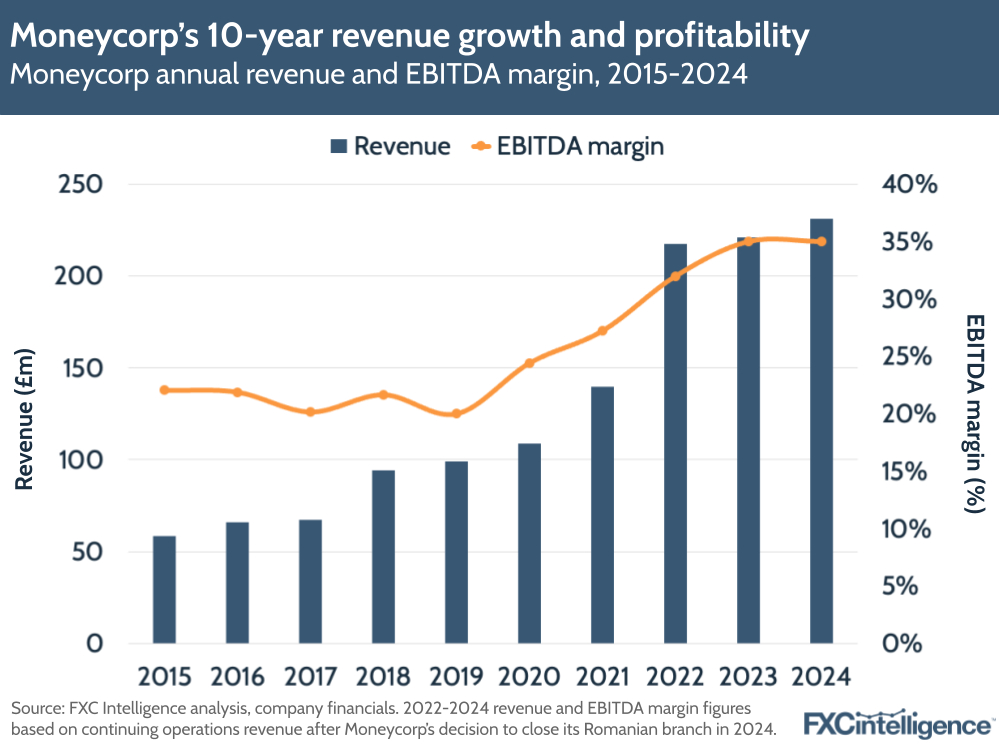

Moneycorp delivered a strong performance in 2024, posting £231.3m in group revenue, up from £220.8m in 2023, while EBITDA rose 5% YoY to £80.4m, giving a margin of 35%.

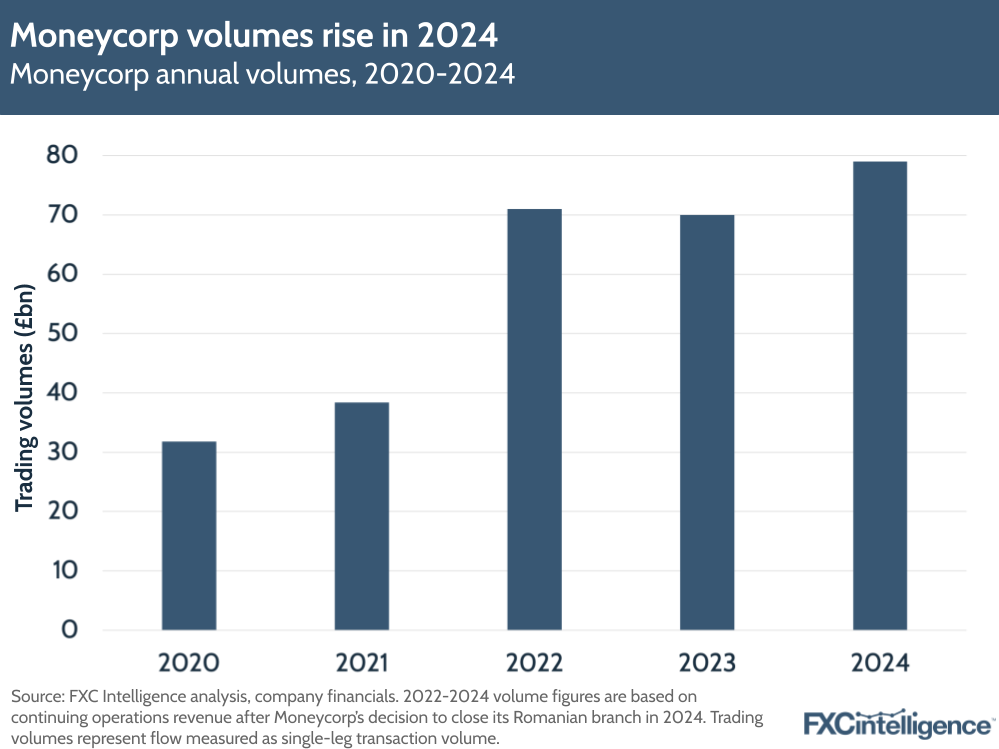

It achieved these figures on the back of trading volumes growing 13% to £79bn, powered by rises across two of Moneycorp’s core business lines, with particularly strong momentum in its Financial Institutions Group (FIG). The company now serves more than 32,000 clients across 100 countries, a network it has built over a 10-year period of transition from serving primarily private individuals to the major banks and corporates it powers today.

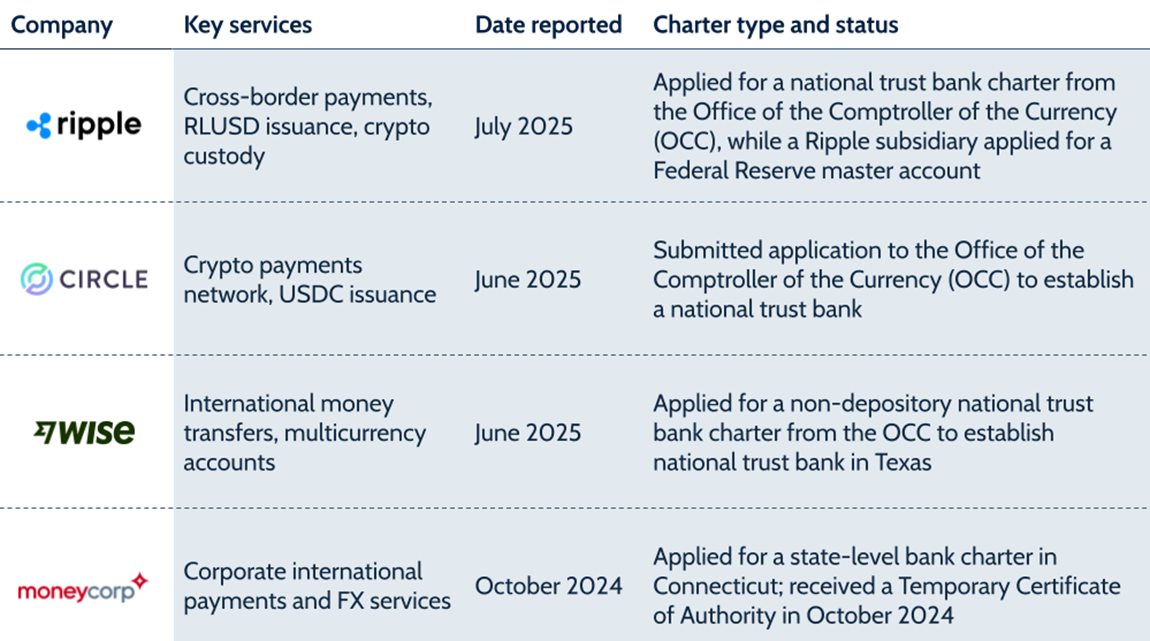

Continuing this trend, Moneycorp has secured a conditional US bank charter from the State of Connecticut, which it hopes will deepen its foothold in the US payments market and give the company direct access to the US dollar clearing system. The company’s continued investment in scalable cloud-based infrastructure, backed by £90m in capital expenditure over the past decade, has helped it position squarely between traditional global banks and agile fintech players.

We caught up with Velizar Tarashev, CEO of Moneycorp, to unpack what’s driving Moneycorp’s performance, explore its US banking strategy and find out how it aims to stay profitable in an increasingly competitive cross-border payments space.

Moneycorp revenue growth and key drivers in 2024

Daniel Webber: You’ve seen solid growth both on revenue and client volumes, year-on-year. What’s been driving this?

Velizar Tarashev:

It’s all about momentum. This is the strategic growth that we have been targeting. We have introduced a renewed focus on clients. We’ve defined our client population into ideal client profiles (ICPs), which is basically identifying where we can serve our clients in the best possible way given the size, liquidity and assets we have. That focus has been in place for the last couple of years and is starting to bear fruit now.

We’ve seen more of a broad-based growth in both flow (volumes for the clients) and revenue, both attracting new clients and seeing amazing client retention in that cohort. Overall I would attribute it to client focus, bringing in this new lens of ICPs, both in the corporate as well as in the financial institution’s business. That’s ensured that we’ve grown across a lot of our areas globally. Also, interest income has helped us, so we have been able to monetise some of the volumes that we have.

Moneycorp’s growth and B2B transition

Moneycorp noted a 5% increase in revenue to £231.3m and EBITDA rising 5% to £80m, giving a 35% margin (flat on the previous year). The company noted that its growth reflected global diversification as well as disciplined cost control, though it had also seen a “challenging macro environment”.

In 2024, the company decided to wind down the regulated activity of its Romanian branch, which is now discontinued, and therefore restated its revenue and EBITDA results for 2022 and 2023 to enable a comparison.

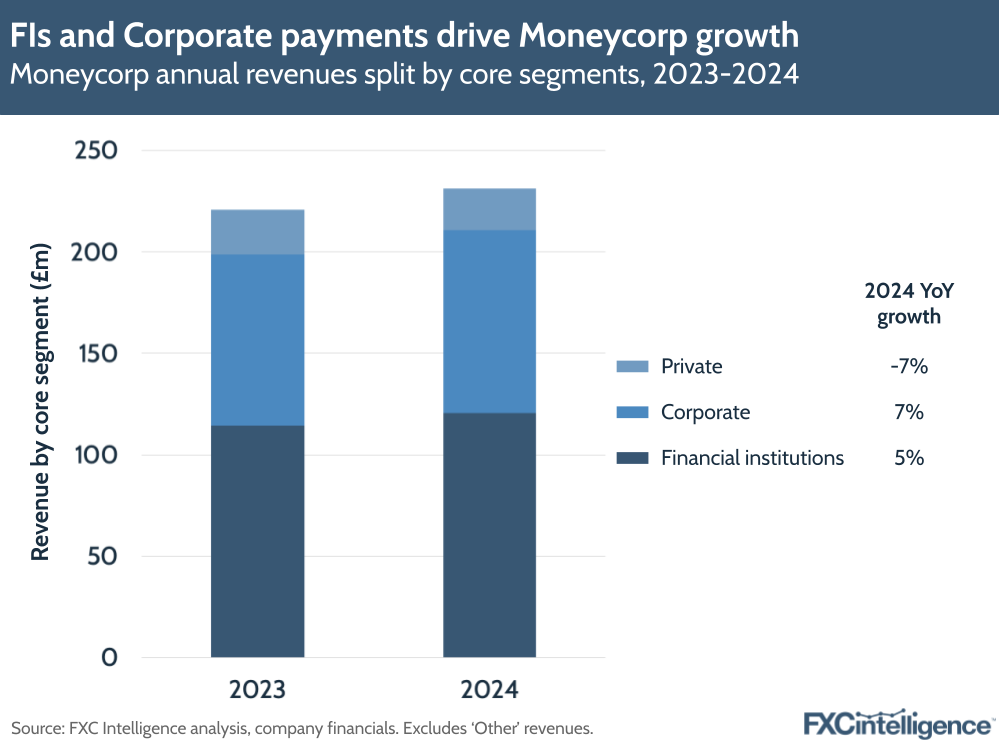

Moneycorp’s FIG continued to drive revenues in 2024, growing 5% to £120m, and carried around 77% of Moneycorp’s total flows. Corporate, meanwhile, saw the fastest revenue growth, rising 7% to £90m, while Private – Moneycorp’s segment targeting high-net worth individuals – declined by -7% and accounted for just 10% of the company’s revenue. With a 50% EBITDA margin, FIG is still the most profitable segment versus Corporate (with a 49% margin) and Private (43%).

These figures highlight Moneycorp’s stark transition compared to 10 years ago, when B2B accounted for 50% of its revenue. Through international expansion and the development of the company’s wholesale payments network, B2B accounted for 91% of Moneycorp’s business in 2024.

Moneycorp’s client mix and product focus

Daniel Webber: Talk us through the ICPs of both corporates and then financial institutions. What are you focusing on? What type of solutions is Moneycorp trying to bring them?

Velizar Tarashev:

Our ideal client is a client in the mid-corporate segment. These are clients that are too big to not worry about their international trade needs, but at the same time they’re too small for the traditional banking sector. And so we focus on identifying clients who have a genuine international trade need. What we’re doing is identifying where and in which industries we can best ensure that we can eliminate the friction in the international payment space. A rough rule of thumb is that we’re looking for clients that are between £2m and £100m revenue a year. That’s a nice spot. It’s quite a range, but depending on the market we play in different spaces.

We are very focused on what would be the liquidity requirement in order to support that trade, so we don’t over-extend ourselves either and we want to make sure that we’re within our risk appetite. It’s traditionally clients that are in the trade, they have accounts payable, accounts receivable that are cross-border. They are fighting with the friction in the industry that is created by payment rails and they are generally unloved by their traditional banks.

What we provide is more of a high-touch model with very competitive pricing that we can give based on our coverage model with liquidity providers, which we have established over the years and we’re very close to them. That focus permeating across the organisation – anywhere from sales all the way through to the operations – has helped us really deliver the best service for these guys.

On the financial institutions, the ideal client is a commercial bank or in some cases also national banks and central banks, but their flow is very periodic. So the ideal client is mostly a commercial bank, which is in Europe, Eastern Europe, Africa, Asia. These are banks that still require hard currency liquidity in order to meet their client needs or their reserve needs. And we provide them with a very good operating model and logistical setup with our partners and for the Federal Reserve, which is also a client of ours to a degree. We provide all of the right compliance and reporting that make them comfortable that we’re doing the right business in the right place, in the right way

Moneycorp boosts volumes in 2024

Trading volumes grew 12% to £79bn, with the company serving more than 32,000 clients (though this is down from 35,000 reported last year). Financial institutions accounted for the majority of flows, followed by Corporate payments and the company’s Private segment.

The company said it had seen a “change in client and product mix”, though it did note strong client retention across both its FIG and Corporate segments. Private, meanwhile, was impacted by higher interest rates and reduced marketing spend, and the company is looking to streamline less profitable channels.

Inside Moneycorp’s strategy for financial institution clients

Daniel Webber: What services are you focusing on for financial institutions? Is it predominantly banknotes or payment services?

Velizar Tarashev:

At the moment, the majority of the services that we’re offering financial institutions are around banknotes. These are clients where we’re looking to expand our product and cross-sell into the rest of the company, and the US bank is going to unlock that even further.

In banknotes, we are a member of the Foreign Bank International Cash Services (FBICS) programme, which allows non-US banks to clear directly and to fulfil hard currency orders by banks, including commercial and central banks. If the central bank of country X decides to bolster its US dollar reserves, they often do that in hard currency as well as electronic. The hard currency component, which is very large volumes, will be something that we can help them handle.

So what do we provide? First, we’re a member of the Federal Reserve Bank programme, but most importantly, there are three components of that journey. One is risk assessment and compliance, the second is fulfilment, and the third one is reporting. We do the first and the third and we have a partner or a series of partners who help us with the fulfilment in the middle.

Where we are distinguishing ourselves is that we have our own proprietary compliance and risk management systems. We have a compliance monitoring system which is called Soteria, which we’ve developed internally. We are able to assess risk and monitor that in a very modern and agile way. We’ve also developed a financial intelligence unit with people who come from a very deep intelligence and data background, who are able to monitor risk on a global macro level and more micro country as well as bank level. We are extremely agile and deep in our understanding of risk. That’s the first part.

The last part of the journey that I described is the reporting, and we pride ourselves that we are an extremely, completely open book with the Federal Reserve. We are able to report and we do report all of the transactions. We report where they go, we report a level of detail that helps the US as well as the Federal Reserve to gain a full picture of where dollars get circulated in the world.

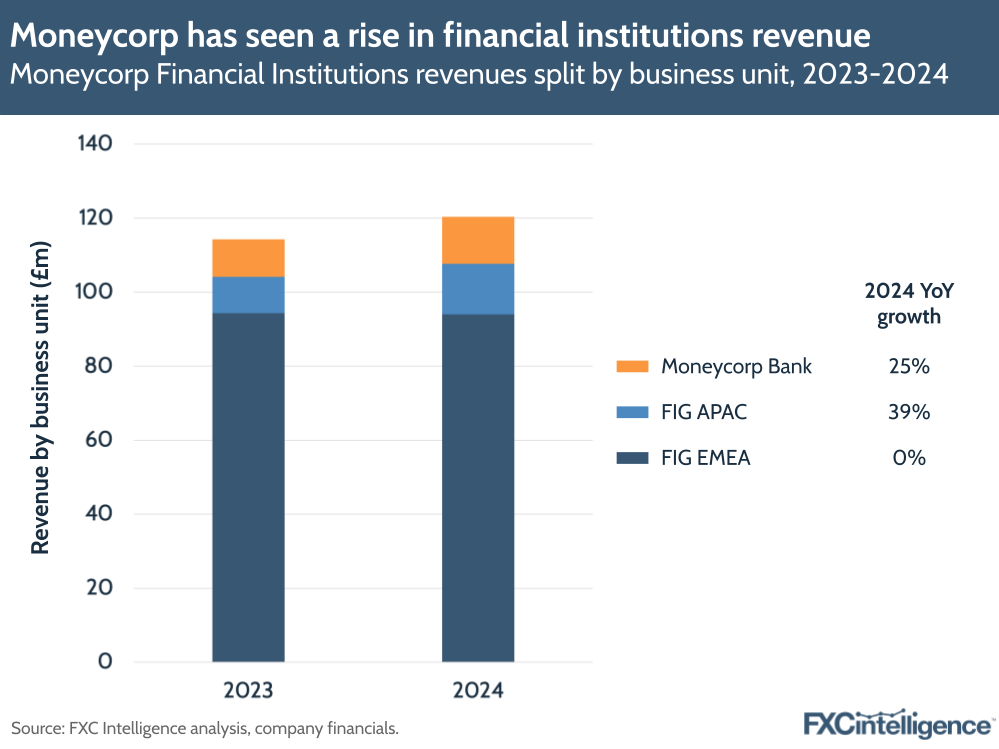

Strong APAC gains power Moneycorp’s FIG segment

Revenue for Moneycorp’s FIG was mainly driven by strong contributions in EMEA, though FIG APAC revenue grew YoY by 39%, with EBITDA growing 54% to over £6m. Moneycorp attributed the rapid rise to growing operations in Asia, aligned with a wider goal of broadening its geographical reach.

The APAC segment is now larger than Moneycorp Bank – which offers multicurrency accounts for businesses – though this grew 25% on the back of interest income. EMEA, meanwhile, saw changes in client mix that resulted in flat revenues with the previous year and a -6% EBITDA decline.

Since the business obtained access to the FBICS programme, USD to USD accounted for 91% of all FIG client trades, with EUR to EUR accounting for 5% and 2% being GBP to GBP.

Moneycorp’s US banking opportunity

Daniel Webber:

Let’s transition from that to the new US bank. Talk us through the opportunities that will potentially open up.

Velizar Tarashev:

The US bank is front and centre of our strategy right now. Our strategy is to become a payments platform business that can help our clients through this friction that we’re talking about in terms of international payments. And the US bank serves a very important part of that. It’s the first area where we are going for direct connectivity to the payment rails.

What are the benefits for that? Firstly, it improves effectiveness and efficiency in the current business. Just think about the payment rails that we’re going to be able to tap directly and all the flow that is in USD. We’ll be able to clear that at basically no cost and with the speed that will benefit everybody, including our clients.

It does open up new client opportunities as well. We have about 250 bank clients at the moment through the financial institutions business that we just talked about. Those clients usually rely on an individual bank provider to be able to give them access to dollar clearing, which is the major clearing that they typically use. We’ll be able to give them an alternative and that diversification is extremely important for them.

These are clients that we know and love, and we are very advanced in the conversations and the demand for that as a product. As you know, the US dollar is a major part of global trade. So we’ll be able to also offer that to more clients in the corporate space, to other financial institutions and potentially fintechs, so people like ourselves who rely on banking partners.

Besides new clients, there’s new products around direct clearing, correspondent banking, deposits – these are all areas that we will open up. To your earlier question about whether [the service to] financial institutions is predominantly notes, yes, but that’s a captive client audience and we are looking to be able to cross-sell more traditional bank products and more traditional payment products into those companies. The US bank opens that for us.

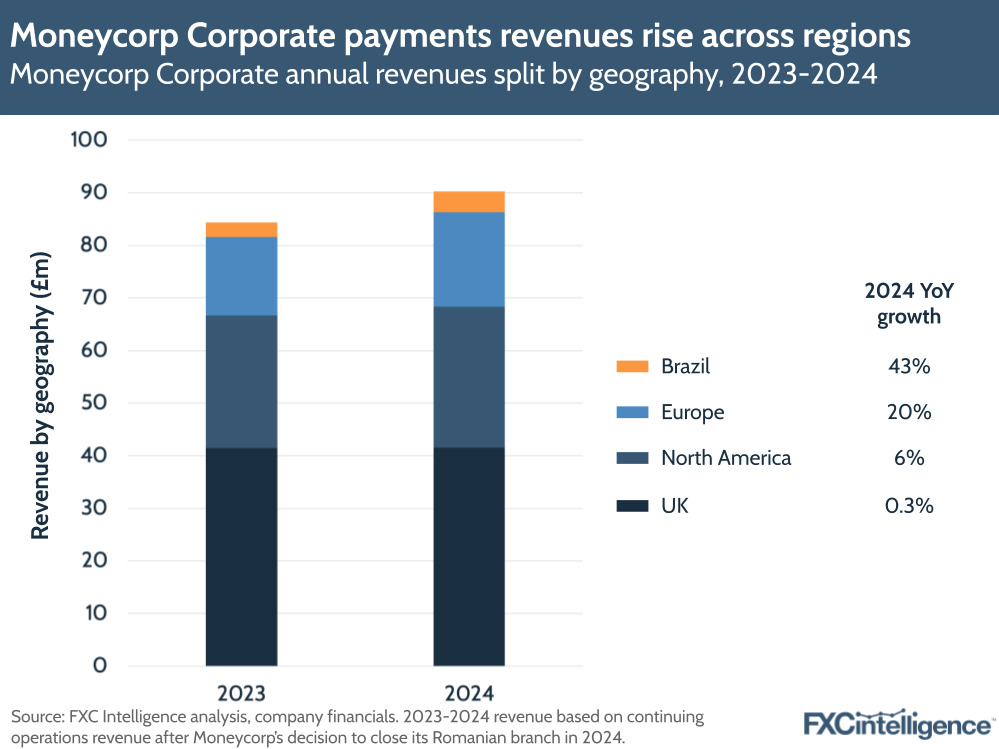

Brazil and Europe lead Corporate payments growth

Moneycorp’s Corporate Payments division – its other main segment serving cross-border payment needs for corporates across four geographical hubs – registered strong revenue and EBITDA growth, with the largest contributions coming from the UK and North America.

The division saw its fastest growth in Brazil, where it has a smaller client base, and which saw its EBITDA turn positive for the first time, again signalling progress in its regional expansion. Europe also saw 20% growth driven by strength from Ireland, Spain and France. Moneycorp noted the impact of general elections in several key economies, including the US, UK, China, India and Brazil, which have driven volatility in global markets.

The flows across Moneycorp’s Corporate Payments segment comprise a mix of different currency corridors compared to FIG, though major currencies (USD-EUR, GBP-EUR and GBP-USD) accounted for 75% of flows.

Why Moneycorp is more profitable than its peers

Daniel Webber:

You are a highly profitable business related to your peers, some of which may be of similar or larger scale. How are you approaching maintaining your profit margins moving forward?

Velizar Tarashev:

I often bring up Moneycorp’s history, which is in retrospect a very interesting evolution. Through that period we have accumulated some amazing assets across the organisation. We are now putting all of that together into a coherent product and go-to-market proposition to leverage operating efficiencies on the back of investments that we have made in the past.

This includes investments in our system, which is a proprietary system that can scale, and investment in our ability to price. We have 16 liquidity providers who can bid on currency payers live, and we create a market for that. You can’t do this easily, but that’s an asset that we already have. For me, the biggest thing is basically leveraging all the assets that we have.

Of course, we now have a big investment ahead of us in the case of the bank, but we are highly cash-generative as well, so we can invest in that from our own cash. We don’t have the pressures of having to go and raise funds. So we are quite unique and fortunate to be in this position.

The financial institution business benefits from good scalability and operating leverage and it’s a substantial business. So when you put it all together, we have assets that we are able to now properly run at scale and have invested in. We have a highly cash-generative business and one of our businesses, which is the financial institutions, is structurally driving a lot of operating leverage

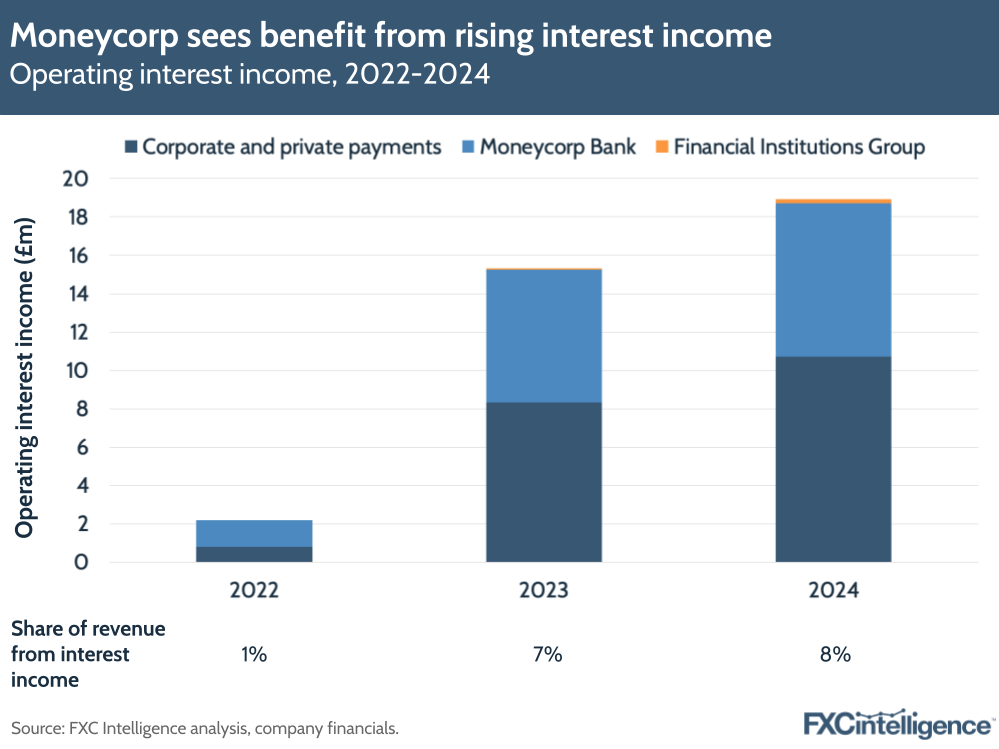

Interest income backs Moneycorp growth

Interest income was a recurring theme across Moneycorp’s results, accounting for 8% of its revenues in 2024, despite the company noting a downward trend in global interest rates in the second half of the year due to continued “optimisation of balances throughout the year”. Last year, we noted interest rates having similar growth surges across multicurrency offerings from other cross-border payments providers.

This revenue stream was lifted by Moneycorp’s Corporate segment, which saw interest income rise across all geographies other than Brazil. FIG saw its interest income rise by 157% YoY in 2024, while Moneycorp Bank saw this figure rise by 15%. Overall, Moneycorp’s total interest income rise in 2024 (23%) wasn’t as steep as the previous year (603%).

Daniel Webber:

What are your thoughts on stablecoins? Where might they have an impact, if any, within the context of Moneycorp?

Velizar Tarashev:

Of course we’re thinking about it. It’s definitely where the world is going and it has some amazing long-term value creation opportunities for it. Where we get very excited is the ability for that type of technology and setup to improve the speed and reduce the cost of payments and basically the way it disintermediate payment rails altogether. That is an extremely interesting development.

This infrastructure and technology has the capacity to do that, but we are very early in the journey as an industry and the regulations as well. We are developing all of our new investments, especially in technology, with an eye to being able to participate in this disruption in the future. We’re developing the use cases and making sure that the technology is able to cater for it. We will most likely not be the first mover in this space, but we are preparing to be a fast follower.

Daniel Webber:

Anything else you’d like to mention?

Velizar Tarashev:

The company’s on a great trajectory. For me, momentum is extremely important. The focus on clients is super important and we have a very exciting agenda ahead of us. The US bank is going to open up some really interesting times for us. We have a captive client audience, which is unique, and we need to be able to do the right thing there.

Daniel Webber:

Velizar, thank you.

Velizar Tarashev:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.