We enjoyed meeting many of you at Money20/20 this week in what was the biggest event yet for both the show and those of us at FXC Intelligence (shown by some of the team’s smiling faces below!). Covering three sprawling halls as well as numerous fringe events, the show was the biggest it has ever been this year – a positive sign for all.

This was a show where the focus was on serious deal-making and connection building. While many people we spoke to reported having packed and extremely positive schedules, multiple stands said they had seen less casual footfall than in previous years and some players opted not to have a stand. The event itself was excellent, with myriad opportunities for networking alongside the usual high-calibre speaker selection.

Meanwhile, discussion reflected an industry that is excited for and rapidly engaging with its next stage of growth. Here are some of the key trends we saw at the event:

- Artificial intelligence was once again a dominant topic across the show, however there was a weariness to some of the discussion, suggesting we’re over the peak of the hype. The focus now is more on how companies can realistically make use of the technology, with proven areas such as fraud prevention currently winning out over some of the more exciting but experimental areas of focus.

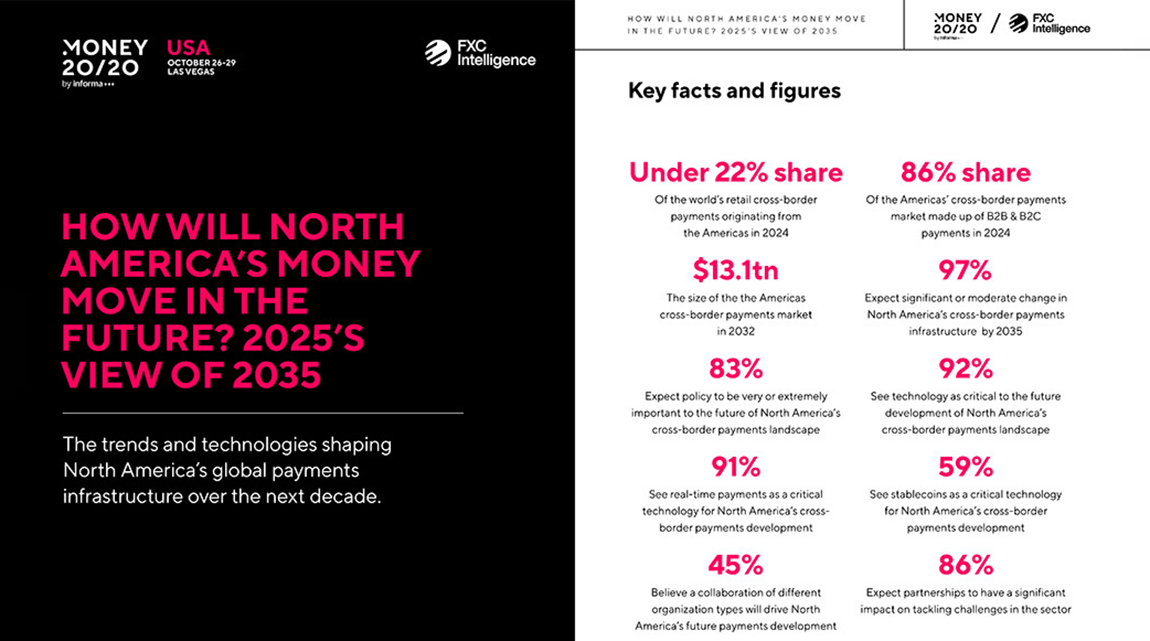

- Tokenisation and blockchain is re-emerging, but crucially often without the cryptocurrencies in tow. While some companies are looking at stablecoins (definitely a growth area), for many the underlying technology is an opportunity to create improved network solutions for fiat.

- There were also signs of growing engagement with the infrastructure side of the industry, with many more companies discussing payment rails, networks and interoperability. This is also driving increased discussion of real-time payment solutions, particularly in markets with traditionally slower rails and for applications such as B2B payments.

- The emerging markets opportunity, meanwhile, continues to be a focus, particularly in Latin America and Asia-Pacific, as well as the Middle East. While some companies are interested in Africa, here much of the discussion is coming from companies in the region, rather than those focusing on expansion into it.

- The many elections internationally this year also provided a backdrop for several trends, with multiple people highlighting expected impacts in key corridors.

- On the B2B side, cards are becoming a growing product focus for many players, while on the consumer side there is increased focus on hyper personalisation, aided by technologies such as open banking and embedded finance.

Missed us at Money20/20? Get in touch to discuss how we can help your business