Payment processors are beginning to find a new post-pandemic normal, but consumer belt-tightening has made for a challenging FY 2023. We look at the key trends among publicly traded players from the latest earnings season.

The last few years have been something of a rollercoaster ride for payments processors. After the giddying highs of the pandemic, consumer spending has not only shifted, but increasingly tough macroeconomic conditions have hit volumes and revenues for many players.

However, this is not to say that FY 2023 has been a bad year for payment processors; while it is a far cry from 2021, results have generally been positive, with signs of growth ahead.

In this latest edition of our report series, we explore both the latest and historic quarterly earnings for major public traded companies in the space, in order to get a sense of how the industry is developing, what key trends are evolving and where some players are pulling ahead.

As always, this report focuses on the earnings of a wide range of payment processors, covering a variety of niches and markets, as well as major players in direct competition. This sees us review the Q4 and FY 2023 results, as well as historic performance, of: Adyen, dLocal, Fiserv, Global Payments, PayPal, Paysafe, Worldline, Worldpay and Square. Due to the nature of these companies, in some areas we use data for FIS rather than Worldpay up until its spin-out in the last quarter, while we also use some metrics for Square’s parent company Block.

Differences in reporting schedules for some European players, as well as a lack of disclosure of some metrics by some companies, means that not every company is included on every chart, but we include every player where possible.

FY 2023 revenue growth for payment processors

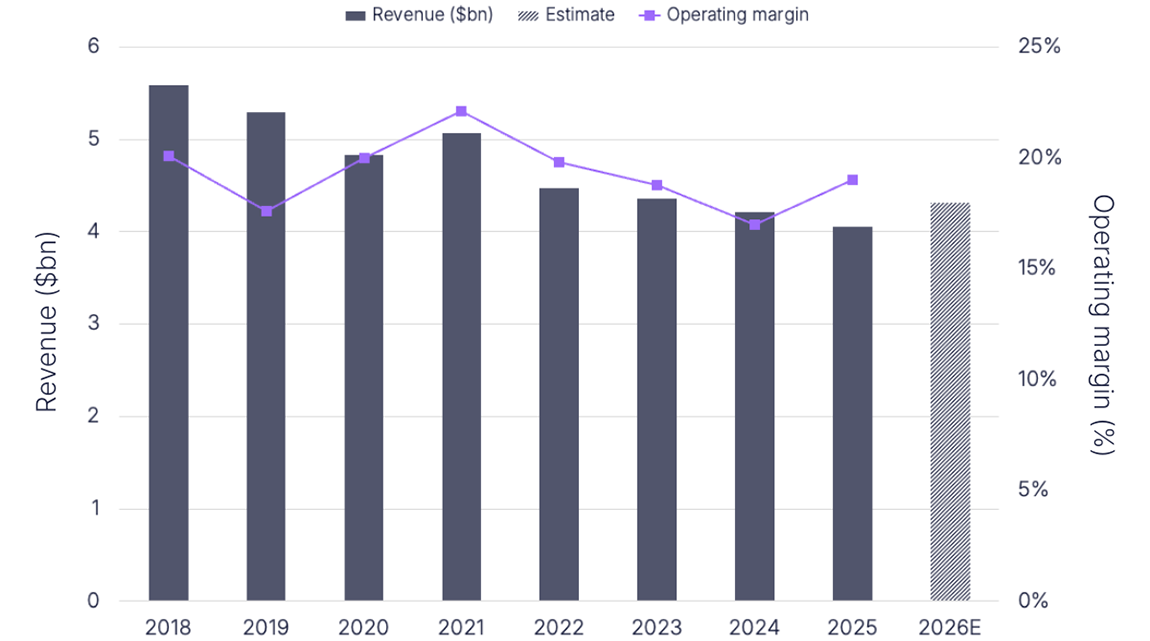

Looking at full-year revenue, PayPal is inevitably in the lead, with almost double the FY 2023 revenue of Fiserv, the next largest player on this metric. Beyond this, however, there are some interesting developments.

While on an extremely similar revenue line to Worldline and Worldpay, Square has pulled ahead for the last two years and is now moving closer to Global Payments, the third-largest player in terms of revenue.

Adyen, meanwhile, is for the first time slightly ahead of Paysafe, while emerging markets-focused dLocal is closing the gap on both players.

On growth rates, every player saw revenue growth in Q4 2023, although Worldline’s was minimal, at 0.1%; this was, however, in part due to one-off losses associated with termination of merchant contracts as a result of implementing a new risk management framework.

While PayPal, Paysafe and Global Payments all saw Q4 growth of between 8% and 9%, Square and Adyen reached double digits, although dLocal remains firmly in the lead at 52%.

Interestingly, while full year growth followed similar trends, most players saw lower growth rates than in 2022, even among those who are on very strong growth trajectories.

For some players, the year was framed as being about change rather than growth, with Adyen announcing it had concluded a period of investment, while PayPal characterised itself as being in an ongoing transitional period that is set to continue into 2024 as it builds a fresh strategy under new CEO Alex Chriss.

PayPal was also the only player to fall short of full-year revenue projections, while Fiserv and dLocal exceeded their own expectations on revenues.

Changing rankings on earnings and profit metrics

Looking to adjusted EBITDA, there has been considerable movement in terms of rankings over the course of the last year, with PayPal once again reclaiming its leading position. Block, however, has been on an interesting growth path, although this may be in part due to the high contribution Bitcoin has to its overall revenues.

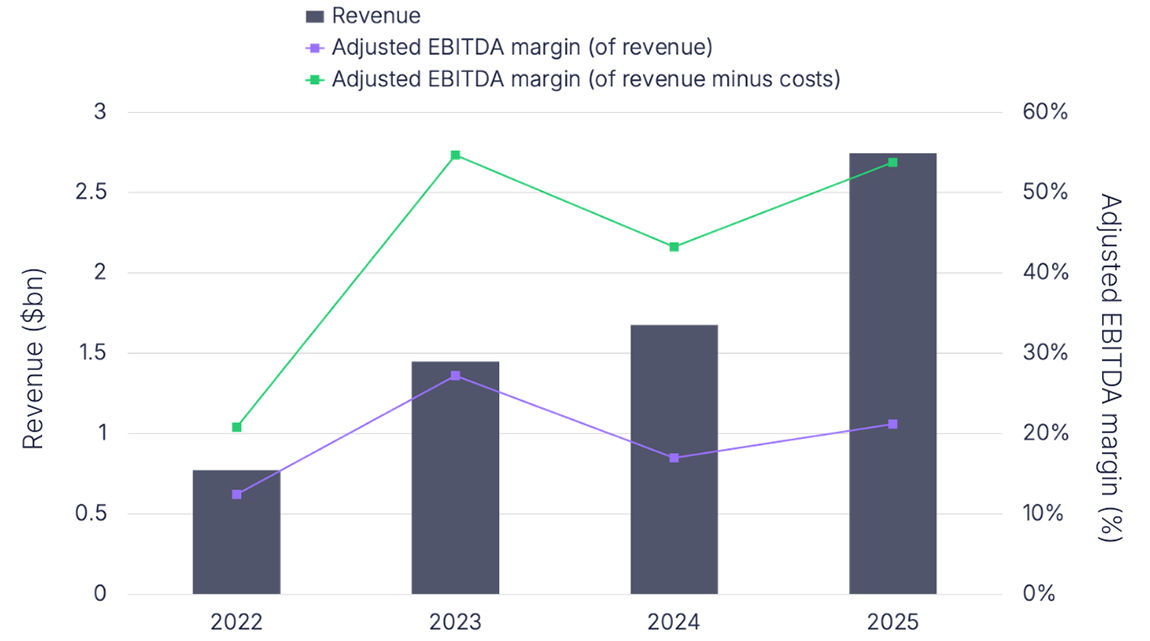

On adjusted EBITDA margin, however, Adyen remains in the lead, having seen something of a rebound after successive quarters of decline. Having prioritised investment this quarter, dLocal has seen its margin dip, while PayPal has seen its own increase with the return of EBITDA in Q4.

On operating income, PayPal has also once again pulled ahead, although this time from Fiserv. Global Payments is in third, echoing overall revenues, while this quarter only Block sat below zero.

Which players lead on volume and take rate?

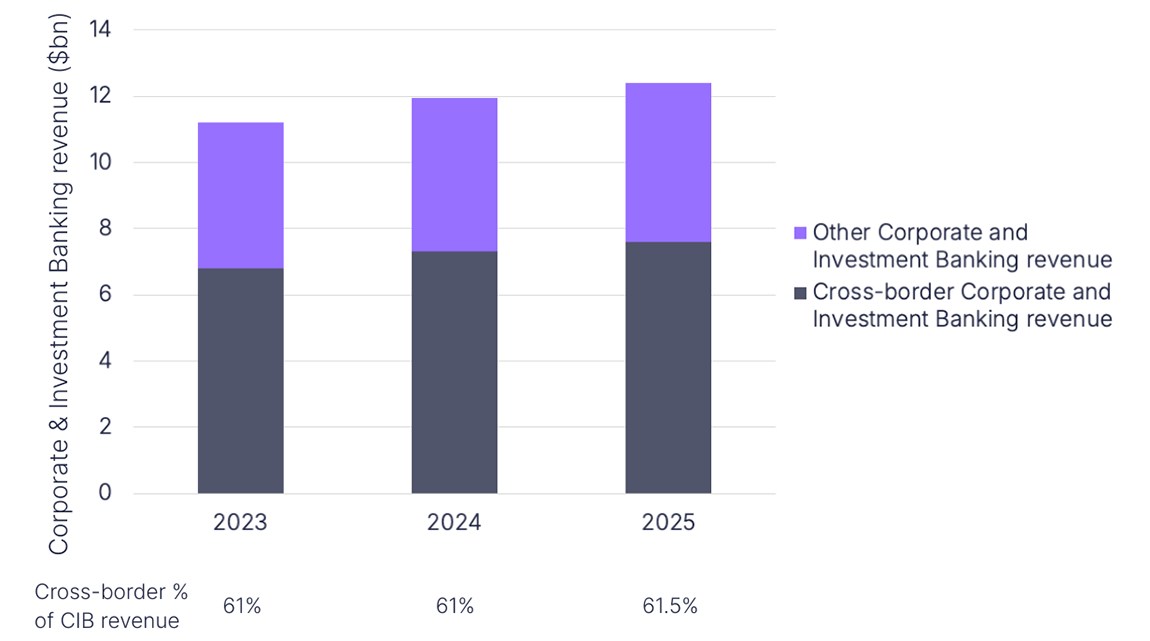

On total payment volume (TPV), the publication of key but private player Stripe’s annual letter provides the opportunity to include it in benchmarking, showing it slightly below Adyen, the third largest player on TPV.

PayPal unsurprisingly retains its second-place position, while Worldpay remains in the lead. While it looks set to hold this place for some time to come, as it is now a standalone private player, we are unlikely to know for certain in 2024.

Further down the line, Block and Paysafe are both currently ahead of dLocal; although dLocal is set for 40-50% growth on TPV in 2024, it is likely to be some years before it overtakes its closest competitor.

On take rate, meanwhile, Block remains comfortably in the lead, although this is again likely a reflection of the broader range of services it offers beyond just payment processing under Square.

However, among companies who largely or completely focus on payment processing, dLocal is in the lead on take rate – a reflection of its focus on emerging markets both in Latin America and, increasingly, Africa and Asia.

Are macroeconomic concerns finally easing?

Looking to earnings calls, we also analysed the frequency of certain terms among different players to determine if there were any standout trends this quarter. Echoing the wider market, there was an uptick in mentions of AI for some players, including Global Payments and Fiserv, as companies increasingly discuss how the technology may play an increasing role in their ongoing strategies.

Beyond this, there was a notable uptick in the discussion of partnerships this quarter. For some players, this reflects a preference to discuss partnerships in FY earnings rather than in other mid-year calls, however for others such as Adyen and Worldline it is an increase that does not have a pronounced historic precedent. As a result, it suggests that the industry is increasingly thinking about partnerships as it turns its attention to 2024.

Interestingly, the widespread discussion of macroeconomic conditions that we have seen dominate earnings over the past year or so finally appears to be declining.

This may have been in part due to the fact that Q4 holiday spending by consumers was not as soft as some had feared, reducing the need to explain poor performance. This was also reflected by less discussion of seasonality than we have seen in some previous years.

However, it also reflects a widespread feeling that we are beginning to turn a corner economically, and that 2024 is not expected to be quite as challenging.

As we move into 2024, it remains to be seen how pronounced this improvement will be, and whether other factors such as AI will ultimately have as much of an impact as some might hope, but with all players seeing growth, it is likely that is more ahead over the next few quarters.