OFX’s latest earnings for financial year 2025 saw disappointing results amid a tough macro environment, but also provided a detailed breakdown of its plan to return to growth via “OFX 2.0”.

Covering calendar Q2 2024 to Q1 2025, OFX’s FY 2025 earnings were a tough set of results for the B2B and high-value consumer cross-border payments-focused company. Missing previous expectations, the company reported YoY declines across several key metrics as it saw headwinds from challenging macroeconomic conditions.

However, the company also included detailed plans on how it would return to growth, built around its multifaceted OFX 2.0 project, which is set to double the company’s TAM while significantly broadening the sources of its revenue.

In this short report, we review the numbers and their drivers, alongside OFX’s plans for growth.

Drivers of OFX’s FY 2025 results

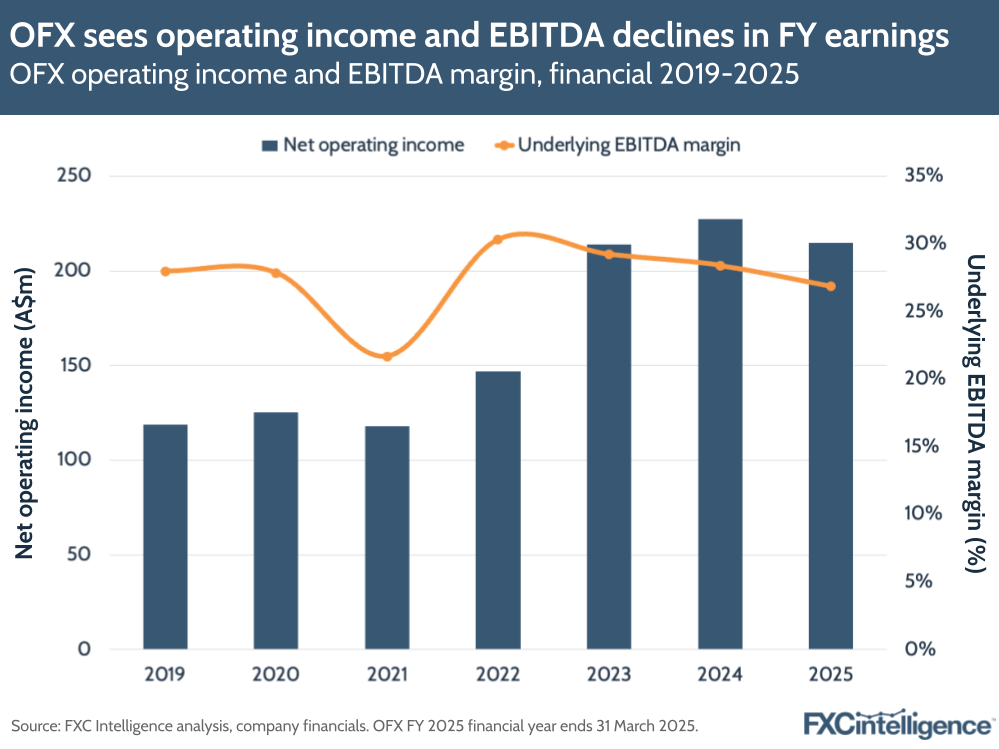

OFX missed its previous targets for FY 2025, with net operating income reducing by -5.5% YoY to A$214.9m and underlying EBITDA dropping -10.7% YoY to A$57.7m. This drove a -155 bps drop in underlying EBITDA margin to 27%.

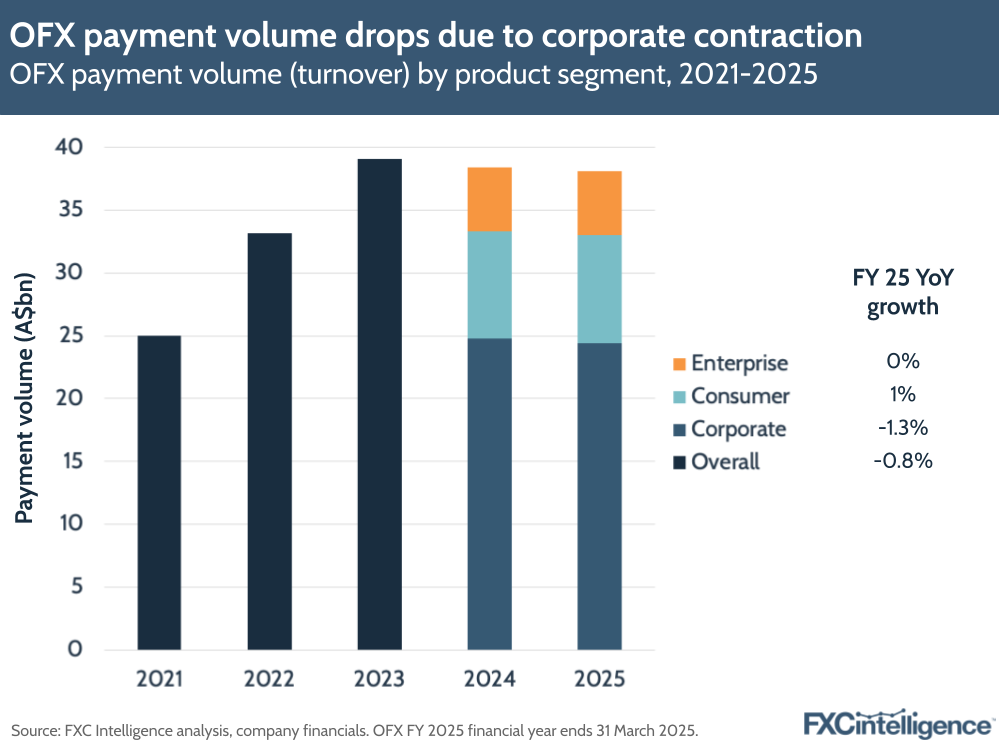

The company’s payments volume – which it refers to as turnover – also reduced by -0.9% to A$38.1bn.

The corporate payments division, OFX’s largest business area, was particularly impacted. It saw revenue decline by -4.2% to A$133m, while turnover dropped by -1.3% overall, with cross-currency turnover reducing by -4.2% YoY.

CEO Skander Malcolm attributed this to “weak business confidence” that started in H1 and continued into H2, with “political instability and the prospect of tariffs later in the period adding to uncertainty”. SME businesses, which OFX has primarily catered to, are in particular seeing a greater decline in confidence in OFX’s major markets, which has translated into both a -5.6% drop in active corporate clients and a -23% reduction in cross-currency average transaction value (ATV) for such clients.

Consumer, meanwhile, was a slightly more mixed picture. Revenue from this division, which provides high-value money transfers to consumers, contracted by -0.6% to A$68m, but both turnover and cross-currency turnover saw a 1% increase. This was aided by the fact that while OFX saw its number of consumer customers decline by -11%, their cross-currency ATV grew by 7.9%.

Meanwhile, the picture was different for OFX’s smallest customer segment, enterprise, where turnover remained flat at A$5.1bn, but revenue climbed by 17%.

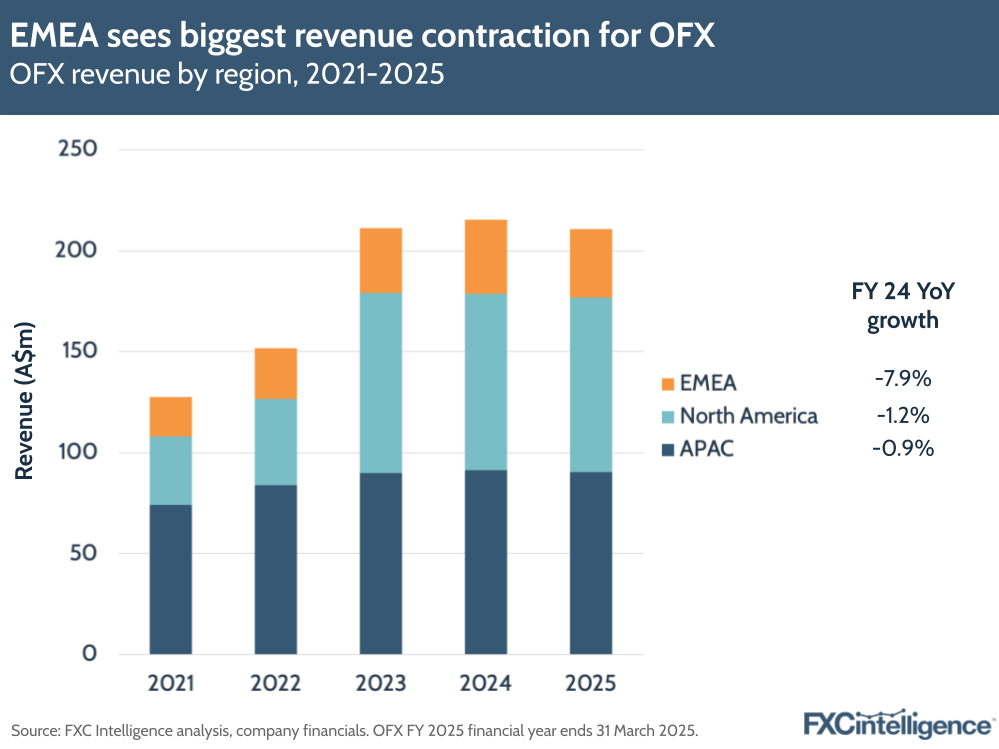

Looking geographically, every region saw reductions in revenue and EBITDA, although OFX’s smallest region, EMEA, which is led by one of its biggest overall markets, the UK, saw the biggest contractions, with revenue dropping -7.9% and EBITDA -43%, resulting in a 4% EBITDA margin.

By contrast, Australia-led APAC, its largest region, saw revenue drop by just -0.9% despite a -9.2% EBITDA reduction. North America, which completes its biggest markets with the US and Canada, saw revenue drop by -1.2% and EBITDA by -5.5%.

Despite the tough conditions, the company did stress its operation efficiency and efforts to streamline the company’s expenditure over the last financial year. It has reduced underlying operating expenses by -3.5% in FY 2025 to A$157m, with reductions across employment costs, promotion costs and technology costs. Crucially, where OFX is spending on promotional activities, it is seeing provable gains, with A$17.4m in promotion costs generating A$34.4m in new revenue.

The company has also made a significant cut in costs from bad and doubtful debts, which dropped by -43% YoY.

OFX 2.0: The plan to return to growth and early signs of success

Despite the challenges, there were also some positive signs at the company, with Malcolm going into further detail about OFX 2.0, the company’s growth-focused reinvention project, which is already underway and showing some early signs of success.

Designed to more or less double OFX’s total addressable market, this project saw some discussion in previous calls, but has now been accelerated, with the company providing greater details about each aspect of the initiative, including key metrics.

At the heart of the plan is a focus on growing revenue beyond its core area of spot FX, allowing the company to make incremental margin gains and increase its pace of new client acquisition.

This sees it increasingly cater to the broader needs of companies with international transactions, including through solutions such as budget and spend controls, employee and company cards, multicurrency accounts, AP automation and integration with accounting platforms, as well as adding support for domestic payments.

OFX is developing its New Client Platform (NCP) to deliver this broader mix of solutions to corporate and enterprise clients. The platform is already live in Australia and Canada, and is set to launch in its key markets of the UK and the US in calendar Q2-Q3 2025 and calendar Q4 2025-Q1 2026 respectively. The company has also been actively introducing enhanced features over the last year and is expected to continue to do so as it scales the platform.

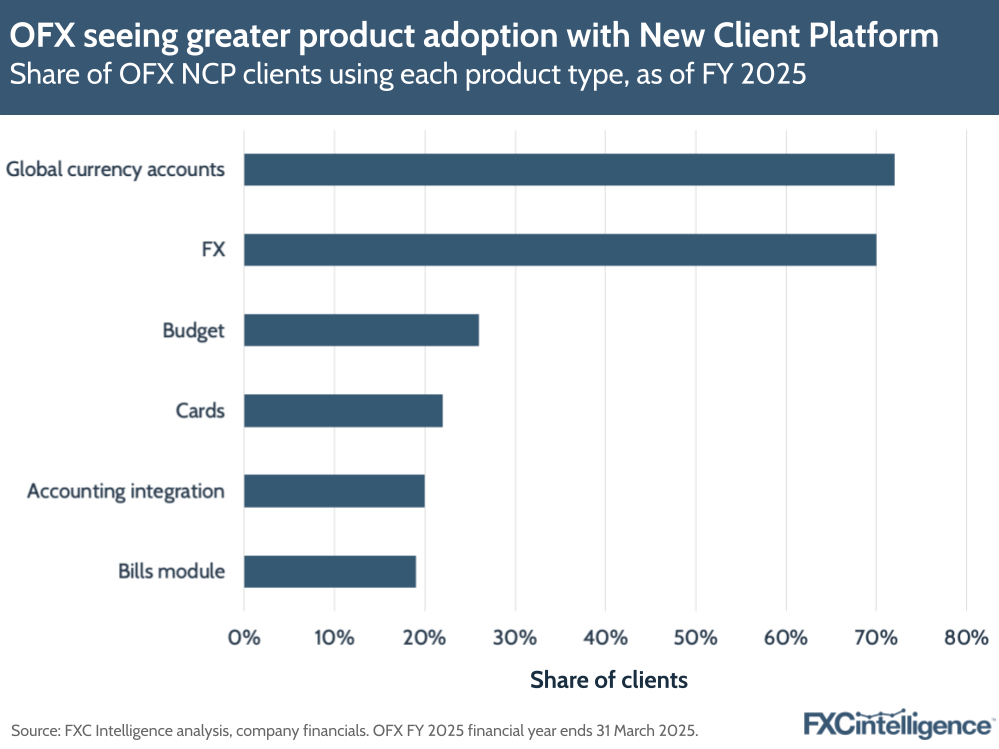

While it had 605 clients on NCP in March 2024, this had grown to 2,544, around 8% of its overall active corporate clients, by March 2025, while the number of cards per client has grown from 6.5 in H1 2025 to 6.8.

There is also evidence that the platform is improving OFX’s revenue mix. Average products per NCP client currently sit at around 2.2, while in the financial year 2025 OFX saw 27% of its revenue from new NCP clients coming from non-FX services. It also expects this to grow further, to around 40% in FY 2026.

Beyond this, OFX is also looking to shift its corporate client mix to increase its revenue per client, and has been actively pivoting to dedicated B2B marketing to attract clients that fit its ideal customer profile (ICP): those with an average revenue per client (ARPC) of over A$4,000.

This has already begun to produce results, with the number of active clients with an A$4,000+ ARPC increased by 0.1%, while those with under A$4,000 ARPC declined by -7.3%. This has also helped OFX increase its ARPC in its corporate segment, which grew 1.4% YoY and by 3% over the last two years, and the company expects this to grow further as it accelerates the rollout of its NCP.

ICP profile clients appear to be those who send more frequently, as opposed to just sending higher amounts in each transaction, with the number of cross-currency transactions for corporate clients increasing by 24%.

This combination of focuses is enabling it to significantly increase its TAM in the developed markets it serves. According to the company, while OFX 1.0 had a TAM of $34bn, the SME opportunity in its core markets of Australia, New Zealand, Canada, the US, Hong Kong, Singapore, the UK and Europe is $66bn.

The company also sees a “huge opportunity to take share from banks” across all regions, with most SMEs (77-87%) still using banks as their primary cross-border partner in OFX’s core markets.

Priorities for FY 2026 and longer-term growth prospects

As it looks to FY 2026 (calendar Q2 2025-Q1 2026), OFX is set to accelerate its NCP rollout, with all major markets set to be live within the year, and continued rollout into further markets planned for 2027.

Alongside this, the company plans to continue to invest in go-to-market and non-FX revenue streams, including increasing its commercial resources, and has set aside A$24m in operational expenditure and A$5m in capital expenditure for FY 2026. The company also plans a “modest” increase in investment in FY 2027, with a return to normal levels in FY 2028.

This is also echoed in its revenue prospects. OFX is currently not providing guidance for FY 2026 and does not plan to do so “until markets normalise”, although did report “strong” April revenue.

The implication, however, is minimal growth in FY 2026 and 2027 while the company invests and develops, and then a return to stronger growth in FY 2028.

From FY 2028, OFX is projecting 15%+ growth in net interest income, with an underlying EBITDA margin of around 30%. With OFX’s FY 2028 beginning in calendar Q2 2027, this means it has less than two years to deliver on this goal, but if it can continue to deliver on its goals, particularly when it comes to its NCP rollout, it is in a position to achieve this as planned.